Market update: Gold tests $2k, GBP/USD, EUR/USD pop, USD sags

US equities soar to multi-month highs, VIX at 2020 lows; global optimism prevails amid challenges.

Optimism prevails: fresh highs in US markets amidst low VIX and global rate sentiment

Markets continue to adopt a risk-on stance, as various US equity markets achieve fresh multi-month highs. The VIX 'fear gauge' is currently at lows not witnessed since the beginning of 2020, having dropped by over 46% from its late-October peak. A prevailing sentiment suggests that global interest rates have reached their zenith, contributing to an optimistic outlook. Anticipated rate cuts by the end of Q2 2024 could potentially extend the upward trend in the coming months.

VIX daily chart

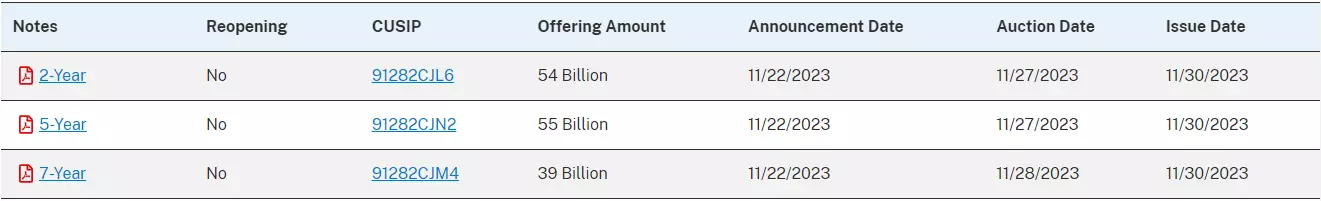

The US dollar remains on the backfoot, and is within touching distance of making a fresh multi-month low, despite US Treasury yields edging higher. Next week there is a large sale of two, five, and seven-year US treasuries and it seems that the market is pushing for higher yields before the $148 billion of paper hits the street.

US treasuries and their sell date

British pound weekly forecast: data and monetary policy align, doubts remain

The British pound is back at highs not seen since early September against the United States dollar. Indeed, it looks perhaps surprisingly comfortable above $.1.25 on its twin pillars of monetary support and, as rarely of late, economic data.

Gold, silver hold the high ground as oil prices eye a recovery

Gold and silver prices enjoyed a positive week as buyers kept both metals supported with a struggling US dollar helping as well. Both gold and silver threatened a selloff this week, but buyers kept prices steady for the majority of what was a shortened trading week. Looking at gold though, and the failure to find acceptance above the $2000/oz mark could leave the precious metal vulnerable heading into next week.

Euro forecast: EUR/USD and EUR/GBP week ahead outlooks

FX markets have been relatively quiet overall in a holiday-shortened week, with the British pound the notable exception. The Euro has edged higher against the US dollar, consolidating its recent gains, while the single currency has struggled against the British pound, and is back at lows last seen over two weeks ago.

US dollar forecast: growth and inflation to extend the USD sell-off?

The dollar has been moving lower, in a similar fashion to US yields and US economic data as the world’s largest economy appears to be feeling the effects of tight financial conditions. Labor data has eased since the October NFP report, retail sales, and CPI data dropped and overall sentiment data has been revised lower too.

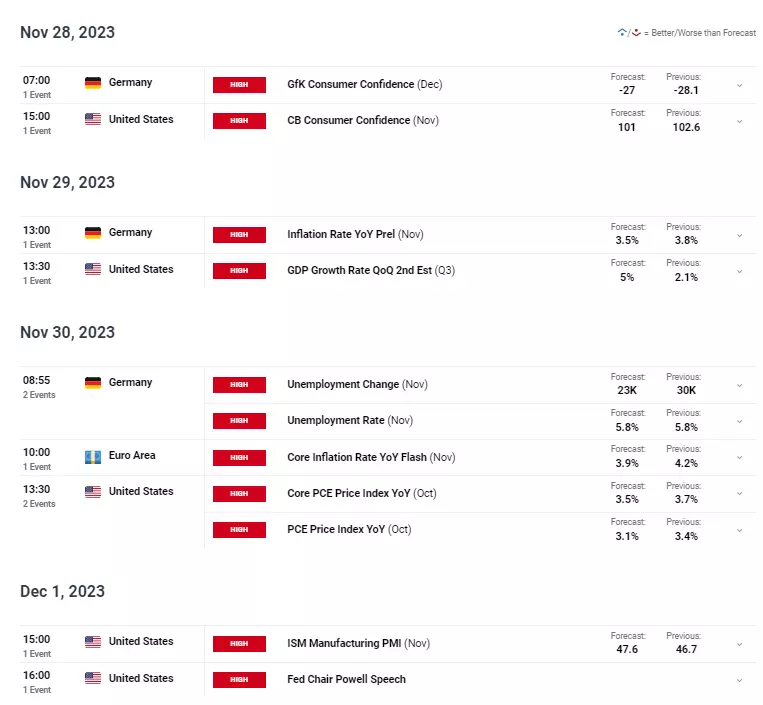

There are a few high-impact economic data releases on the calendar next week with the 2nd look at US GDP and Euro Area and US inflation the standouts. Fed Chair Jerome Powell also speaks at the end of the week.

Economic data releases

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Speculate on commodities

Trade commodity futures, as well as 27 commodity markets with no fixed expiries.

- Wide range of popular and niche metals, energies and softs

- Spreads from 0.3 pts on Spot Gold, 2 pts on Spot Silver and 2.8 pts on Oil

- View continuous charting, backdated for up to five years

Put learning into action

Try out what you’ve learned in this commodities strategy article in your demo account.

Ready to trade commodities?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Deal on our wide range of major and niche commodities

- Protect your capital with risk management tools

- Get some of the best spreads on the market – trade Spot Gold from 0.3 points

Inspired to trade?

Put what you’ve learned in this article into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices