Market update: Japan's finance chief Suzuki on alert as yen declines

With the Yen nearing a crucial value, Finance Minister Suzuki assures close monitoring and potential measures to stabilize forex fluctuations as the USD/JPY approaches intervention territory.

Japanese finance minister Suzuki aims to be ‘fully prepared’ regarding FX moves

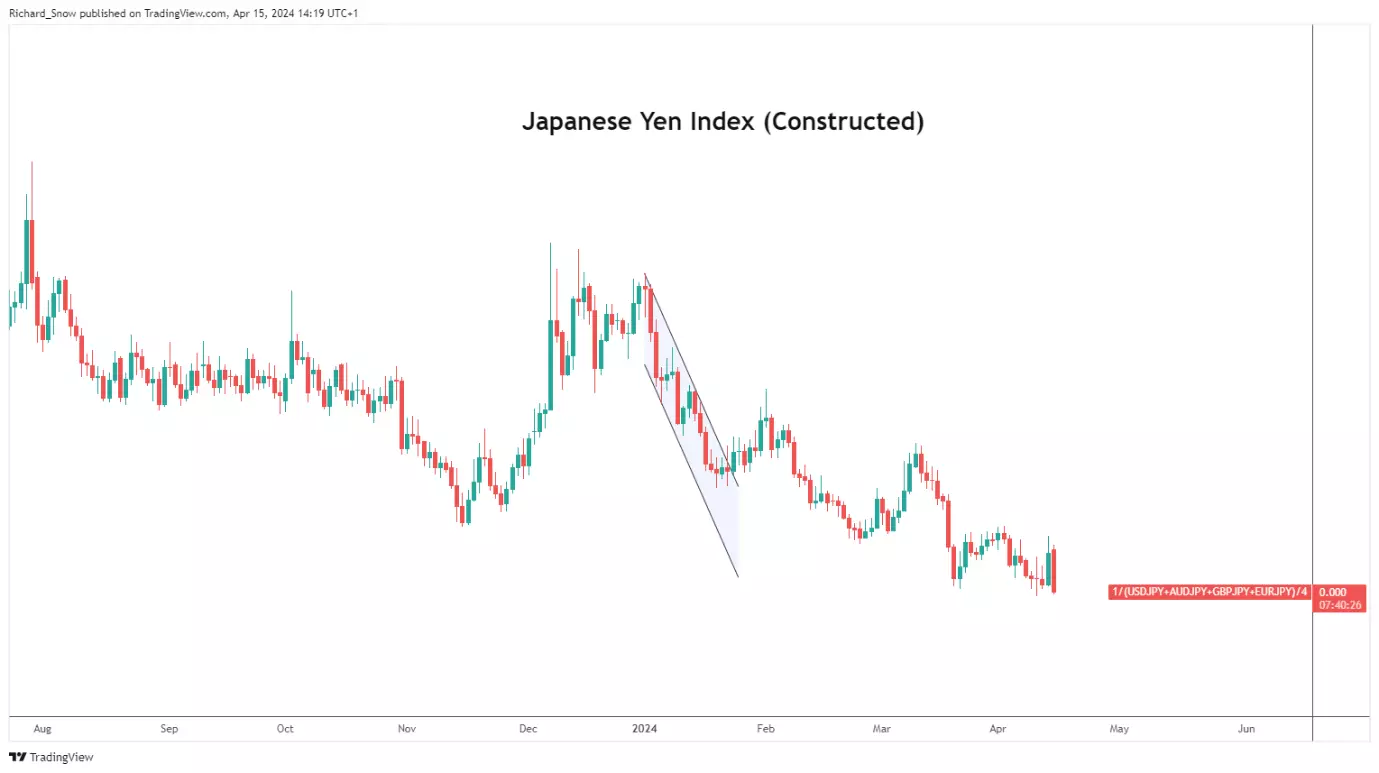

An index tracking the Japanese yen's performance showed a widespread drop against a mix of major currencies, marking a rough start to the week for the currency. This dip prompted a reaction from Japanese Finance Minister Shun'ichi Suzuki, who stated his intention to be "fully prepared" for forex market fluctuations, emphasising the government's vigilant eye on currency movements.

Previously, Japan’s former currency official Watanabe mentioned that authorities are more likely to consider FX intervention at a level of 155.00 on USD/JPY. Officials have mentioned many times that they are not targeting specific levels, but instead monitor undesirable, volatile moves (depreciation).

Japanese yen index (equal weighting of GBP/JPY, USD/JPY, EUR/JPY and AUD/JPY)

USD/JPY continues into the danger zone, approaching crucial 155.00 level

USD/JPY accelerated closer to the 155.00 level at the start of the week as the dollar remains at elevated levels. 152.00 was initially the line that the market dared not cross, but the high-flying greenback pushed the boundary until markets felt comfortable above the 152.00.

Traders appear to have become emboldened by the lack of urgency in communication out of Tokyo and continue to bid the pair higher still. The RSI reveals that the pair trades well within overbought territory and shows few to no signs of moderating.

Long trades from here present an unfavourable risk-to-reward ratio, considering the warning issued by the former currency official Watanabe about 155.00 potentially being the tripwire for a major response (FX intervention). 155.00 appears as stern resistance with 152.00 and 150 representing levels that could come into plat at a moment’s notice if Tokyo feels it is necessary to take action. Thereafter, 146.50 comes into view.

USD/JPY daily chart

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Explore the markets with our free course

Discover the range of markets you can trade CFDs on - and learn how they work - with IG Academy's online course.

Turn knowledge into success

Practice makes perfect. Take what you’ve learned in this shares strategy article, and try it out in your demo account.

Ready to trade shares?

Put the lessons in this article to use in a live account. Upgrading is quick and simple.

- Trade over 11,000 popular global stocks

- Protect your capital with risk management tools

- Trade on 140+ key US stocks out-of-hours, so you can react to news

Inspired to trade?

Put the knowledge you’ve gained from this article into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices