This week in crypto: Prices rebound as macro and micro factors align

Crypto prices rise as systemic risks fall and the macroeconomic backdrop improves.

Crypto assets continue to rise as global markets turn “risk-on” - but can the momentum continue? In this week’s Crypto Verse, we review the week in crypto and take a look at the charts of Bitcoin, Ether, and Litecoin.

Prices rebound as macro and micro factors align

Crypto assets took another leg higher last week, as both macro and micro factors align for a more bullish market backdrop. The volatility sparked by the cascading failures of prominent crypto-businesses, chiefly FTX, has subsided, ostensibly lowering the systemic risks to the crypto industry.

Meanwhile, the broader macroeconomic drivers, high inflation and aggressive monetary policy tightening to dampen inflation, are shifting. There are growing signs that inflation in the US is trending lower and interest rate markets are discounting an imminent end to the rate hiking cycle. Not only that, but rates markets are implying rate cuts by the end of the year, as the US economy confronts a possible recession.

Three cryptos to watch

-

Bitcoin

Bitcoin prices made new highs last week. Price broke through technical resistance at roughly $21,500 and $22,400 as the crypto carves out a short-term uptrend. The RSI is diverging from price, indicating a slowdown in upside momentum. The next key level of resistance is just above $25,000.

Bitcoin daily chart

-

Ether

Ether's price also extended its rally last week, however, there was less upside momentum than what was seen in Bitcoin. Price failed to break through resistance of $1680 but support has held at $1500. If the former breaks, $2000 may be the next level to watch.

Ether daily chart

-

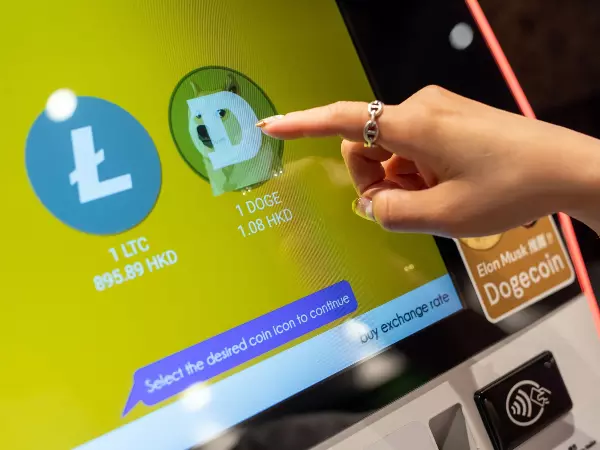

Litecoin

The bullish in the crypto markets hasn’t filtered through to some of the smaller alt-coins.

Litecoin prices have pushed higher with the short-term trend to the upside. However, the upside momentum is weaker. Price is testing resistance at around $91 while support could be found at $81.57.

Litecoin daily chart

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices