How to buy, sell and short Kanabo shares

Kanabo, with products designed to offer medical treatment solutions, became the second medical cannabis company to list on the LSE. Find out how you can buy, sell and short Kanabo shares and analyse the company’s share price.

How to buy Kanabo shares: investing or trading

You can buy Kanabo shares by investing in physical shares of the company, or you can take a ‘buy’ position using CFDs if you think that the company’s share price will rise.

Here are the steps of buying Kanabo shares with us.

Investing in Kanabo shares

- Create or log in to your share trading account and go to the platform

- Search for ‘Kanabo’

- Select ‘buy’ in the deal ticket

- Choose the number of shares you want to buy

- Confirm your purchase and monitor your investment

Trading (buying) Kanabo shares

- Create or log in to your trading account and go to our trading platfrom

- Search for ‘Kanabo’

- Select ‘buy’ in the deal ticket

- Choose your position size and take steps to manage your risk

- Open and monitor your trade

Investing in Kanabo shares means that you will have ownership in the company – you’ll be a shareholder, and if given by the company, you’ll qualify to receive dividends and voting rights.

To become a Kanabo shareholder, you need to pay the full value of your position upfront – as leverage is not available on investments.

Learn more about leverage in trading

When investing in any company’s shares, you run the risk of getting back less than your initial outlay, but your maximum risk is capped at the full value of your position.

‘Buying’ Kanabo shares via trading means that you speculate on the price of the company’s shares rising – this is also known as going long. Taking this position doesn’t give you direct ownership of Kanabo shares.

You can take a ‘buy’ position on using leveraged derivatives, such as CFDs, with us.

How to sell Kanabo shares: investing or trading

You can sell physical Kanabo shares via share trading. If Kanabo’s share price has increased since you took a position to buy them, you can make a profit if you sell. Alternatively, you can sell if the share price is below what you paid for the stock – closing your position can mitigate the risk of losing more money. However, you might also miss out on a profit if the share price rises after you have closed your position.

Find out more about how to sell your Kanabo shares in the boxes below

‘Selling’ Kanabo shares via trading means that you are speculating on the company’s share price falling – this is also known as going short. As when buying, you can also ‘sell’ using leveraged derivatives, namely CFDs. Remember, leverage can amplify both your profits and losses.

Learn more about the impact of leverage on your trades

Investing a Kanabo share investment

- Log in to your share trading account and go to the platform

- Search for ‘Kanabo’

- Select ‘sell’ in the deal ticket

- Enter the number of shares you want to sell

- Confirm the sale

Short-selling Kanabo shares

- Create or log in to your trading account and go to our trading platfrom

- Search for ‘Kanabo’

- Select ‘sell’ in the deal ticket

- Choose your position size and take steps to manage your risk

- Open and monitor your trade

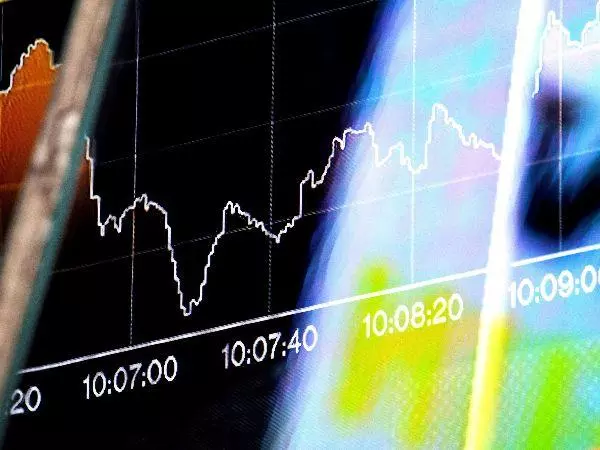

How to analyse the Kanabo share price

You should analyse the Kanabo share price by utilising both a technical analysis and fundamental analysis.

- The technical analysis gives you chart patterns, technical indicators and historic price action

- The fundamental analysis gives you the fundamental information of a company, such as net revenue and loss statements

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get commission from just 0.08% on major global shares

- Trade CFDs straight into order books with direct market access