What are hedge funds and how do they work?

Hedge funds are often spoken about in finance, but what exactly are they and what exactly do they get up to? Learn more about hedge funds, including what they are and how they work.

What is a hedge fund?

A hedge fund is an unregulated alternative investment vehicle that uses a wide selection of strategies and financial instruments (unavailable to regulated pooled funds) to achieve strong returns independent of market performance.

A pooled fund collects money from many individual investors with the intention of using the accumulated capital for investment purposes. Investors share the profits, should any be earned.

- Regulated pooled funds, like mutual funds, are open to retail investors – but, owing to this, they must adhere to the rules and restrictions laid out by the relevant regulatory authority

- Unregulated pooled funds, like hedge funds, aren’t constrained to the same degree, and are not available to retail investors. This relative freedom from regulation allows hedge fund managers to engage in high risk tactics like taking short positions and trading with leveraged derivatives

A major advantage of hedge funds comes from their ability to mitigate market risk by diversifying an investment portfolio. Market risk is the risk that the stock market as a whole will experience a downturn. If this happens to a portfolio containing many stocks, the value of the portfolio will likely decrease in step with the market.

As alternative investment vehicles that can look to opportunities outside of the stock market, and by using derivatives to take short positions in the market, hedge funds stand to earn positive results even when the market is falling.

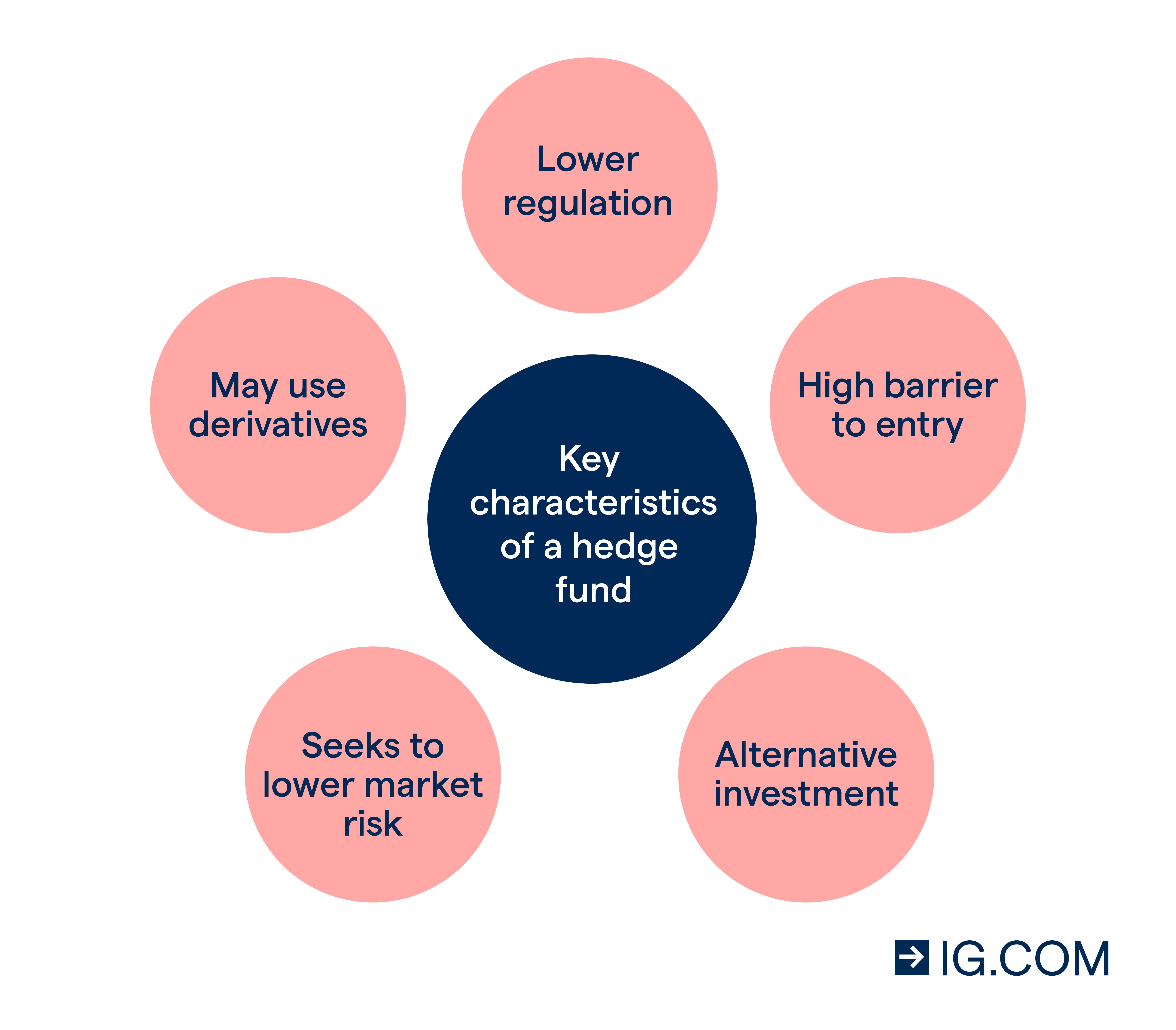

Three key defining characteristics of hedge funds include:

Relative freedom from regulation

Highly regulated traditional investment vehicles like mutual funds typically use pooled funds to invest in shares and fixed-income securities like bonds. In addition to hedge funds, unregulated alternative pooled-fund investment vehicles include private equity and venture capital.

- Private equity funds specialise in buying companies with an aim to increase their value by implementing changes to their structure or operations

- Venture capital is a subcategory of private equity, but it specialises in investing in high-potential start-ups

Several alternative investments face less stringent regulation than traditional funds, which gives them greater latitude in their choice of available instruments and tactics.

For example, a hedge fund manager can borrow shares from an investment bank to short-sell the market and use derivatives like options and futures to hedge positions. Moreover, they can adopt positions that are highly leveraged, and even use ‘activist’ strategies to become a majority shareholder in a listed company. As a majority shareholder, they can then force fundamental changes within the company to increase its value and equity price.

These tactics come with significant risk and are difficult to effectively manage, making them off-limits to highly regulated investment funds (like mutual funds).

Many investors already have exposure to traditional investments, and therefore look to include alternative investments that are uncorrelated to market performance because:

- They lessen the portfolio’s overall exposure to market risk (which securities like equities unavoidably incur)

- They can earn positive returns even if the market is down

- They may return better-than-average results, should some of their riskier investments be successful

Hedge funds – in theory – meet the first two objectives and can produce the results required in point three. For these reasons, they are a relatively popular portfolio addition for those who can afford the hefty minimum-entry criteria.

However, experts suggest that the use of hedge funds could possibly decline substantially in future as their results may not, when measured across a large sample of funds, justify their risks.

The mitigation of market risk

Market risk is a measure of the systemic risk of the aggregate stock market. In a highly diversified portfolio containing a wide selection of stocks, the portfolio’s returns are highly dependent not on the skill or insight of the manager, but rather on the fluctuations of the overall stock market.

Despite incurring significant amounts of other types of risk, and depending on the strategy used, hedge funds seek to remove the market risk element as much as possible, thereby rendering profits or losses a function of a manager’s talent and financial expertise. They often set targets of ‘absolute returns’ (of, for example, 10%) rather than returns benchmarked to a stock index (for example, market return plus 5%).

Risks that hedge funds are exposed to vary with the strategies utilised by the fund manager, but could include:

- Interest risk – the risk posed to the value of an asset, like a bond, by rising interest rates

- Liquidity risk – the risk that an organisation won’t be able to meet its debt obligations owing to the inability to timeously turn assets into money

- Manager risk – the risk that a fund manager may take on extra risk by changing an investment style or strategy in the hope of achieving greater returns

- Valuation risk – the risk incurred when dealing with assets that are difficult to value. These may be overvalued by a fund, meaning that they don’t earn the expected return when sold

- Concentration risk – the risk that too much capital has been concentrated in a narrow investment area or in investments whose returns are highly correlated. It results from a lack of diversification

High minimum-entry criteria

Because hedge funds are unregulated, only investors who meet certain minimum criteria may contribute to the fund. The investors have to be either ‘institutional investors’ or ‘accredited investors’.

- Institutional investors are non-bank companies that invest on behalf of clients (eg pension funds)

- Accredited investors are members of the public who, owing to a high income or high net worth, are deemed knowledgeable enough to understand the risks associated with hedge fund investment practices

Initial required investment amounts for hedge funds are also normally very high.

What does a hedge fund do?

A hedge fund collects money from qualifying investors, creates a pooled fund with the investments, and then utilises the accumulated capital to engage in a variety of unregulated investment and trading activities. These are designed to earn strong returns independent of whether the stock market is rising.

Hedge funds are sometimes said to actively seek out the ‘up-side’ of any:

- Significant events – like company mergers and bankruptcies

- Pricing inefficiencies between similar instruments – like bonds with similar payments and term structures

- Incorrect share valuations – by simultaneously buying undervalued stock and selling overvalued stock

- Macroeconomic events – like interest rate announcements and political actions

- Negative or positive market trends – by trading in a way that profits from rising or falling markets

Moreover, they’re sometimes said to seek out ‘alpha’ returns. Alpha can be calculated using linear regression and a stock index as a relative benchmark. In simpler terms, it could be described as the returns on a portfolio not explained by the risk-adjusted rate of return on the market portfolio.

What types of hedge funds are there and what strategies do they use?

Hedge funds are usually classified in terms of the strategies they use and can be broadly categorised as one (or a mix) of the following:

Relative value funds

The relative value funds rely heavily on arbitrage. An example of pure arbitrage is the simultaneous purchasing and selling of an equivalent asset in two venues when the price received for the asset is higher than the price paid. Pure arbitrage is riskless and always makes a profit – but very rarely exists in the real world.

As a hedge fund strategy, relative value arbitrage follows the same principle, but always incurs risk and never guarantees a profit. In relative value arbitrage, a hedge fund will look for inconsistencies in the pricing of similar assets. We’ll use a simplified example from ‘convertible bond arbitrage’.

For example, a company issuing bonds may find it advantageous to increase the price of a bond relative to its future payments by giving the bond holder the choice to convert the bond into shares at a later date. A bond buyer may find this option to convert attractive, and be willing to pay a premium for it when purchasing the bond.

In a consistently priced market, the convertible bond would be closely tied to the value of the shares it can be changed into. In a nutshell, if the unconverted bond is priced lower than the company’s shares are actually worth, then the shares, and their future cash flows, have been bought at a discount. By hedging, the convertible bond holder can still profit even if the stock is overpriced.

Relative value strategies include:

| Volatility arbitrage | Capital structure arbitrage |

| Convertible arbitrage | Statistical arbitrage |

| Fixed-income arbitrage | Regulatory arbitrage |

| Risk arbitrage | Yield arbitrage |

Directional funds

Directional and tactical investment strategies involve taking positions in the stock markets and are, therefore, exposed to some market risk. However, because hedge funds can ‘go short’, and unlike traditional portfolios that are meant to be a representative sample of the market, directional strategies can profit from falling markets in addition to rising markets, thereby lessening market risk.

Well-known examples of directional trading include ‘fundamental growth’ and ‘fundamental value’ funds. Here, hedge funds analyse stock values and identify stocks that enjoy high earnings relative to the market (fundamental growth), or that are undervalued relative to market earnings (fundamental value).

Another example in the directional and tactical category is the ‘long/short’. Funds using the long/short attempt to capitalise on incorrect stock prices, no matter the direction of the market. Owing to this, the long/short is sometimes called a ‘market-neutral’ tactic. In the long/short, a manager will buy (‘long’) an undervalued stock while selling (‘shorting’) an overvalued stock in equal monetary amounts.

If the market rises and the undervalued stock performs better than the overvalued stock, the profits earned from the long position will be higher than the losses on the short (meaning that profit is made). Conversely, in a bear market, if the short stock falls by more than the long stock, profit will result. The market risk – in this ideal example – has been hedged, and the strategy relies only on an undervalued stock outperforming an overvalued stock rather than on the expectation of a specific market direction.

Event-driven funds

Event driven funds look for investment opportunities in corporate transactional events like mergers and acquisitions, bankruptcies and liquidations. The idea here is to profit from incorrect market valuations in the lead-up to, and aftermath of, such events. Typically, there are three types of general corporate events hedge funds are interested in: distressed securities, risk arbitrage and special situations.

Distressed securities present an opportunity for purchasing debt securities at a significant discount. Hedge funds may have the ability and expertise to aid the distressed company and prevent bank foreclosure. Should the company become viable, the price of the debt will appreciate.

In merger arbitrage, a hedge fund may attempt to take advantage of the effects on the share prices a merger regularly produces for the companies involved. In many instances, the target company’s equity will increase in value after the merger announcement, while the purchasing company’s stock will fall.

If, for example, a hedge fund manager believed the merger will go ahead, they would buy the stock that’s expected to appreciate (the company about to be acquired) and short the stock expected to fall (the company doing the acquiring). If the fund manager believed that the merger would fail to take place, this would be reversed, and the target company’s stock would be shorted while the acquiring company’s stock would be bought.

In an activist strategy, the hedge fund behaves in a similar manner to a private equity fund. After gaining a majority holding of a company, the hedge fund could force fundamental changes to increase the target company’s valuation. The main difference between a hedge fund and private equity in this circumstance is that the hedge fund would only buy listed companies.

Global macro funds

Global macro funds can be classified as a sub-category of directional funds as they attempt to trade with or against general market trends at a macroeconomic or global level.

George Soros made macro funds an object of both scorn and admiration when he took a sizeable short position against the pound sterling in the lead up to the European Union adopting the euro. Known as the ‘man who broke the bank of England’, Soros collected upward of a billion dollars (in the 90s) for correctly predicting that the pound was overvalued.

Macro funds make use of the skills of macroeconomists to model the performance of entire national economies and major sectors within economies. Models analyse variables like currency value, government debt and monetary policy, the balance of trade, unemployment levels and fiscal policy. The aim would be to identify mis-valuations where applicable and to predict the effects of domestic and international events on these variables.

Hedge funds vs other funds: what’s the difference?

Hedge funds enjoy certain similarities with other pooled-fund vehicles like mutual funds and private equity (including venture capital). However, they are distinct entities and the differences can be extensive.

Structure of a hedge fund

Hedge funds are often established as limited partnerships. In this type of partnership, the investors (either institutional or private ‘accredited’ investors) are limited partners that contribute money to the fund.

The fund manager directs and executes the investment activities of the fund, and is called a general partner. If the fund appreciates, limited partners are entitled to profits in proportion to their investment amounts.

Limited partners enjoy a capped risk – the maximum they stand to lose is their initial investment amount. The general partner has unlimited liability, meaning that personal assets can be used to cover the fund’s debts.

General managers invest alongside the limited partners, but as a fund manager, the general partner may charge management and performance fees. A typical fee schedule includes a 2% management fee and 20% of profits – the ‘2 and 20’ as it’s called.

Because hedge funds are unregulated, they cannot market themselves to the public, and investors have to meet minimum criteria. ‘Accredited investors’ must either have a high net worth or earn a substantial annual income. The relative freedom from regulation, however, enables hedge funds to engage in trading strategies and use financial instruments (like leveraged derivatives) that are usually off-limits to regulated funds like mutual funds.

Leveraged derivatives, however, are available to retail traders through platforms like ours.

Learn more about trading CFDs with us

Hedge funds vs mutual funds

Like hedge funds, mutual funds are pooled-investment vehicles, meaning that individual investors all contribute to a fund that is used as capital for investment purposes. Unlike hedge funds, mutual funds are highly regulated.

This means that they are allowed to market themselves to the public, but their investments are constrained to securities like stocks and bonds. Mutual funds regularly earn market portfolio returns – ie returns that reflect the performance of the stock market as a whole.

Mutual funds allocate earnings by dividing their capital into shares. Investors are its shareholders, and when the fund earns positive returns, for example, the share value rises in proportion. There are two types of mutual fund:

- In a ‘closed’ mutual fund, the fund issues no new shares, but existing shares may be traded on an exchange

- In an ‘open’ fund, shares are issued should a new investor want to join. Investors in an open fund may cash out by redeeming their shares from the fund itself at their current value

In both open and closed mutual funds, shares are highly liquid and can be redeemed for cash easily and quickly.

By contrast, hedge funds may require a substantial notice of any intention to withdraw from the fund, and investors are usually only allowed to do so during specific periods – and only after an initial minimum investment duration (‘lock-up period’). This makes money invested in a hedge fund relatively illiquid when compared with mutual funds.

Mutual funds charge management fees, but ordinarily forgo any performance fee. This, many argue, prevents unnecessary risk taking from mutual fund managers because the manager’s earnings aren’t tied to how well the fund performs against the market.

Hedge funds vs private equity

A private equity fund may also be structured as a limited partnership. In this set up, they’d employ the same fee schedule as a hedge fund – a management fee plus a performance fee. The ‘2 and 20’ schedule appears extensively in private equity.

As an unregulated alternative investment vehicle, private equity investors have to meet minimum criteria in the same way as accredited hedge fund investors. This means having a high net worth or high annual income over a specified period.

Private equity specialises in investing directly in companies or gaining a shareholder majority in publicly traded corporations. Tactics available to private equity funds include leveraged buy-outs (LBOs) and investment in high-potential start-ups (venture capital).

A private equity fund may purchase companies in distress with the intention of having the companies’ values increase as successful turnaround strategies are put in place. Hedge funds use an ‘activist’ approach to force necessary changes in a company when intervening, but they tend to keep to exchange-listed companies when doing so.

From an investor’s perspective, perhaps the most notable differences between the two involve the differing investment time horizons, risk profiles and liquidities.

Private equity is a long-term investment – involving a commitment of anywhere between three to ten years as the strategies used by private equity funds require a considerable period to produce a worthwhile results.

By comparison, after the initial lock-up period, hedge fund monies are available for withdrawal at specified intervals. This means that hedge funds are more liquid than private equity investment as investors can retrieve their capital with greater ease.

Although both are risky, hedge funds are regarded as incurring the higher risk of the two alternatives – this despite private equity’s employment of considerable leverage when engaging in buy-outs.

Lastly, generally speaking hedge funds are open – meaning new investors may join by new shares being issued, and shares can be redeemed from the fund itself rather than by having to sell them on an exchange. Private equity funds adopt a closed structure, not allowing new investors to be onboarded after the fund has been established.

Table summary

| Hedge funds | Mutual funds | Private equity | |

| Type | Managed pooled-fund investment | Managed pooled-fund investment | Managed pooled-fund investment |

| Regulation | Unregulated | Regulated | Unregulated |

| Risk | High-risk strategies, can be highly leveraged | Market-related risk, not leveraged | High-risk strategies, can be highly leveraged |

| Investment duration | Initial lock-up period, but withdrawals allowed after (with notice and at specified intervals) | In an open mutual fund, shares can be redeemed every day at close of business. In closed funds, shares are bought and sold at market value | Minimum three years, up to ten years |

| Open or closed | Generally open | Open or closed | Generally closed – no new investors are onboarded after it is established |

| Liquidity | Illiquid | Highly liquid | Highly illiquid |

| Fee structure | Management fee plus performance incentive | Management fee | Management fee plus performance incentive |

| Minimum qualifying criteria | Yes – only open to institutional and accredited private investors, with a large initial investment required | No – open to public at current share price | Yes – only open to qualifying investors, large initial investment required |

How do hedge funds work?

Hedge funds work by identifying and capitalising on investment opportunities resulting from financial asset mis-pricings, expected market trends, corporate transactional events like mergers and acquisitions, and events that impact certain macroeconomic variables.

To profit from the latter, hedge funds employ a range of trading strategies and leveraged derivatives unavailable to traditional pooled-fund vehicles.

Because several hedge fund strategies rely on the fund taking advantage of opportunities before a competitor – called ‘first mover advantage’ – they are often tight-lipped and secretive, even with investors. This has been interpreted as hedge funds wanting to keep unethical dealings away from public scrutiny – a charge that may be unwarranted.

What is a hedge fund manager?

A hedge fund manager directs investment strategy at a hedge fund. They are tasked with protecting and augmenting the wealth of the fund’s investors by achieving results that, over a period of several years, outperform traditional funds and competing alternative investments.

Managers typically invest alongside other investors, and are sometimes required to reinvest a large portion of their performance fee back into the fund. If the fund is set up as a limited partnership, the hedge fund manager is the general partner.

Well-known hedge fund managers include:

- John Meriwether (Long-Term Capital Management)

- Ray Dalio (Bridgewater Associates)

- Jim Simons (Renaissance Technologies)

- Paul Tudor Jones (Tudor Investment Corporation)

- George Soros (Quantum Group of Funds)

- Bill Ackman (Pershing Square Capital Management LP)

- John Paulson (Paulson & Co.)

- Steve Cohen (Point72 Asset Management)

- David Tepper (Appaloosa Management)

- Daniel Och (Och-Ziff Capital Management Group)

How do hedge funds make money?

Hedge funds make money by charging management and performance fees. The funds are usually divided into two components – the pooled-fund component and the company that manages the fund. In the case of a limited partnership, the general partner may charge a management fee of 1% to 2% of the total assets under management (AUM). Performance fees of 20% to 30% are added above this amount.

Many hedge funds use the ‘2 and 20’ structure also common in venture capital and private equity. This is a 2% management fee and a 20% performance incentive. As noted, hedge fund managers are usually required to invest in the fund, and are often mandated to reinvest up to 50% of their performance fees to ensure that their interests align with those of their clients.

Several additional measures to protect the interests of clients are employed. A ‘hurdle rate’ is a return that must be reached before any performance fee can be charged, and a ‘high watermark’ is a benchmark high that, if the fund falls, must be reached again before which no performance fees may be charged.

Example of a hedge fund’s fee schedule

To illustrate a ‘2 and 20’ fee schedule in an example of a modestly sized hedge fund of £100 million, let’s assume that:

- The fund has a £105 million hurdle

- It increases to £130 million after year one

- Falls to £110 million in year two

- And then reaches £145 million in year three

The fee structure would be as follows:

- Year one: (2% x £130 million) + (20% x £25 million profit) = £7.6 million

- Year two: (2% x £110 million) + (0) = £2.2 million

- Year three: (2% x £145 million) + (20% of £15 million profit above previous high watermark) = £5.9 million

- Total fees: £15.7 million

- Return to investors: £129.3 million

Ten largest hedge funds

To rank these hedge funds, we used the most recent 13F filings at the time of writing (20 April 2021) for US firms, and the most recent annual report for UK firms.

| Founder | ADV-reported Assets under management (AUM) | |

| BlackRock Fund Advisors (the largest entity of Black Rock, Inc.) | Larry Fink, Robert S. Kapito, Susan Wagner, Barbara Novick, Ben Golub, Hugh Frater, Ralph Schlosstein, Keith Anderson | $1.9 trillion (December 2020) – note that BlackRock, Inc. has reported over $8.6 trillion in AUM (Jan 2021) |

| Millennium Management | Israel Englander | $276 billion (January 2021) |

| AQR Capital Management | Cliff Asness, John Liew, Robert Krail, David Kabiller | $248 billion (November 2020) |

| Bridgewater Associates | Ray Dalio | $235 billion (January 2021) |

| Citadel Advisors | Kenneth Griffin (at the age 19, from his Harvard dorm room) | $234 billion (January 2021) |

| Renaissance Technologies | Jim Simons | $165 billion (January 2021) |

| Man Group | James Man | $127 billion (March 2021) |

| Elliott Management | Paul Singer | $73 billion (November 2020) |

| Two Sigma Investments | John Overdeck, David Siegel | $66 billion (May 2020) |

| Tiger Global Management | Chase Coleman III | $41 billion (September 2020) |

How to invest or trade like a hedge fund manager

The investment and trading strategies used by hedge funds are complex and difficult to master – especially those that require intimate knowledge of sophisticated financial instruments and volatile markets.

To gain a deeper understanding of the financial markets, our products and the risks involved when trading, we’ve put together a wealth of resources for you to explore. These include:

- IG Academy

- Guidance on risk management

- Guidance on how to maximise trading success

- A collection of articles to aid strategy development

- Regular webinars and seminars

- A comprehensive glossary of terms

Alternatively, practise trading risk free with our demo account.

Hedge funds summed up

- Hedge funds are unregulated, pooled-fund alternative investment vehicles that employ a wide variety of strategies and financial instruments to achieve strong returns even when the market is falling

- They work by capitalising on investment opportunities resulting from financial asset mis-pricings, expected market trends, mergers and acquisitions, and events that impact on macroeconomic variables

- Hedge funds can be classified in terms of the strategies they use

- Because hedge funds are unregulated, investors have to meet minimum criteria. ‘Accredited investors’ must either have a high net worth or earn a substantial annual income

- Hedge fund managers charge management and performance fees. A management fee will equal 1% to 2% of the total assets under management, and a performance incentive of 20% to 30% is added above this amount

- Hedge funds have some similar characteristics to other pooled-funds. However, they are distinct entities and the differences can be extensive

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Explore the markets with our free course

Discover the range of markets and learn how they work - with IG Academy's online course.