1950 - 2003: A battle for control of crude oil production

After the war, governments looked to nationalise oil production. Iran, Indonesia and Saudi Arabia all partially nationalised their oil infrastructure between 1950 and 1960. Egypt also took control of the Suez Canal, through which nearly 5% of the world’s oil passed, in the crisis of 1956-57.

Despite this, control over oil markets remained split between the US and USSR. And when Russia began to flood the market with cheap oil in the late 1950s, the seven sisters agreed to cut prices on Venezuelan and Arab oil to remain competitive.

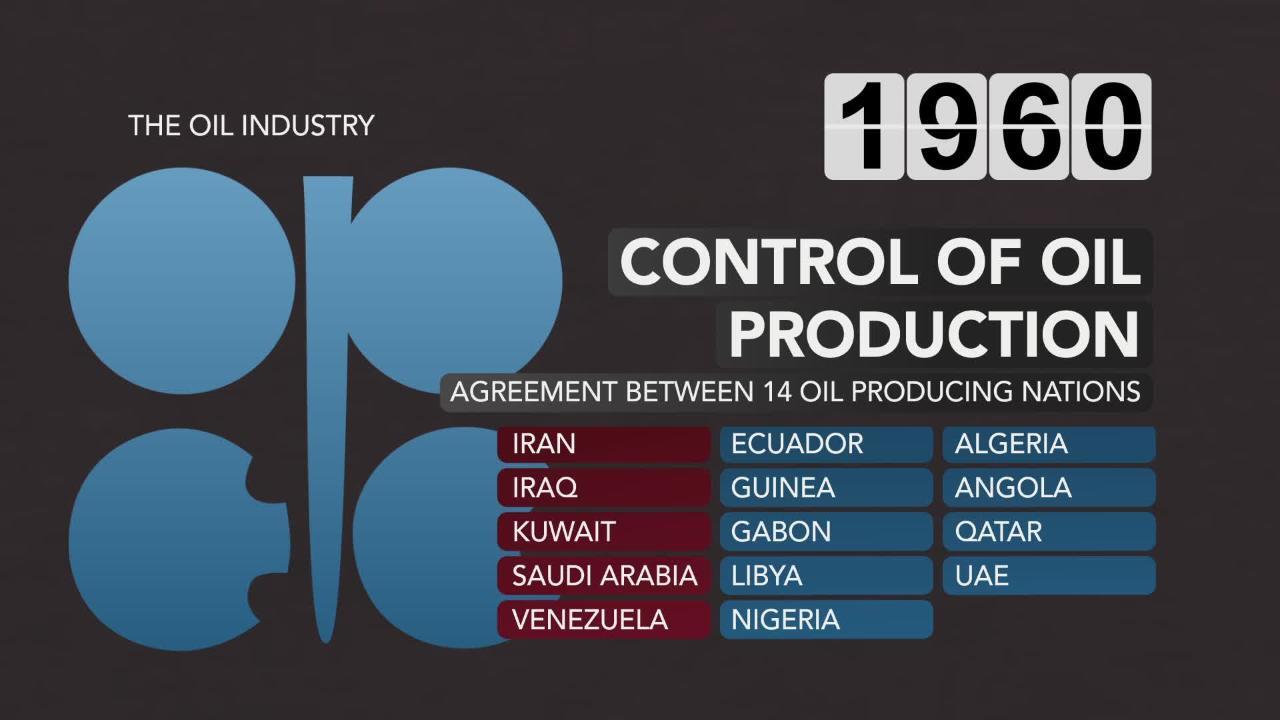

The formation of OPEC

Officials from Kuwait, Iran, Iraq, Saudi Arabia and Venezuela met in Baghdad in 1960 to discuss how to handle the price cuts imposed by the IOCs. They agreed to form the Organization of Petroleum Exporting Countries (OPEC), with the aim of reducing competition between their nations and controlling prices.

Over the next two decades OPEC expanded to include Qatar, Indonesia, Libya, United Arab Emirates, Algeria, Nigeria, Ecuador and Gabon. Many of these nations also took control of their oil reserves between 1960 and 1976, by buying out or forcibly taking shares from the IOCs.

A story of supply and demand

The US and USSR remained in control of oil for a short time, but influence soon shifted to OPEC – as emphasised in 1973 when its members opted to embargo countries supporting Israel in the Yom Kippur war (particularly the US). Global prices increased from an average of $2.48 in 1972 to $11.58 by 1974 (and much higher in some parts of the US).

This period was also marked by the discovery of oil fields in the North Sea, areas controlled by Norway and the UK, with drilling starting the mid-1970s. This oil – Brent crude – is now used to benchmark prices along with WTI crude.

Prices rose rapidly from 1979-80, reaching $36.83, as Iran cut production and exports during its revolution and the Iran-Iraq war began. But prices fell quickly thereafter due to demand shocks and because other producers increased production, particularly the USSR, which became the world’s biggest producer of oil by 1988.

In 1990, Iraq invaded Kuwait, and the ensuing Gulf War created a supply shock that sent prices from $14.98 a barrel before the invasion to $41.00 per barrel in September 1991.

Prices continued to fluctuate for the next few years. And as the Soviet Union fell in 1991, so too did the Russian oil industry, with production halving over the next decade due to reduced investment. Global demand also fell drastically in 1997 due to the Asian financial crisis, but recovered by 1999 as the region’s economic outlook improved.