Get to the heart of price action and seize your opportunity with our free live trading charts for forex, shares, indices, commodities and more. Perform in-depth analysis with 32 indicators and 19 drawing tools.

Benefit from intuitive live trading charts on the UK’s No.1 platform1

Trade at the cutting edge

Take advantage of lightning-fast HTML5 technology and watch market developments in real time2

Enhance your analysis

Perform in-depth technical analysis with the help of 32 customisable indicators and 19 drawing tools

Bring charts up-to-date

Keep your charts informed with a curated news and analysis feed, plus add notable dates, like earnings seasons

See the full picture across multiple timeframes with our graphs

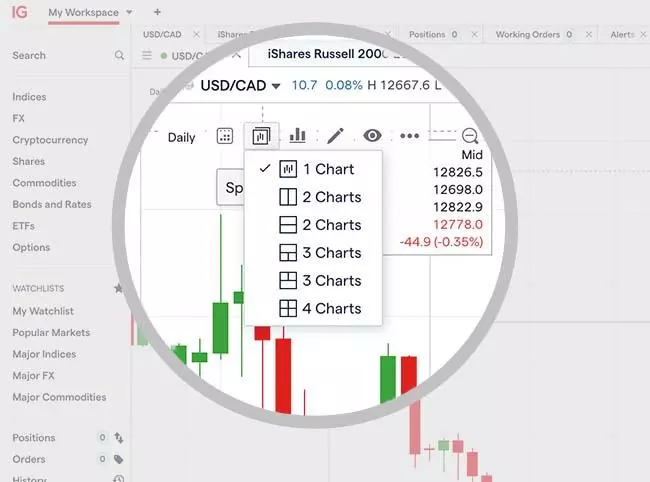

Compare the same market across multiple timeframes with our innovative chart-splitting feature. Split charts up to four times, and apply the layout that best fits your needs.

With a clear view of different periods, from tick-by-tick to monthly, you’ll be in the best possible position to identify – and react to – significant price movements.

In-depth chart analysis with 32 indicators and 19 drawing tools

Indicators

Make informed trades using state-of-the-art technical analysis tools. With our award-winning platform, you’ll have access to Bollinger Bands, the MACD, pivot points, and many others.

Add indicators to a selected price chart easily by clicking on the ‘Indicators’ icon on the chart. Alternatively, right click and select ‘Indicators’ from the menu bar.

Drawings

Identify and visualise trends, triangles and wedges, amongst other important chart patterns with drawings.

Select the object you want from the ‘Drawings’ icon on the chart (or right click on the chart and select ‘Drawings’ from the menu). Our drawing objects include Fibonacci retracements and extensions, Elliott Waves, channels, and more.

Lightning-fast live graphs

Enjoy an effortless trading experience with our HTML5 technology. You can split charts, apply as many indicators as you like and add your own annotations, all without sacrificing speed or stability.

Our charts are designed to perform on any browser – though we recommend Google Chrome for the very best experience.

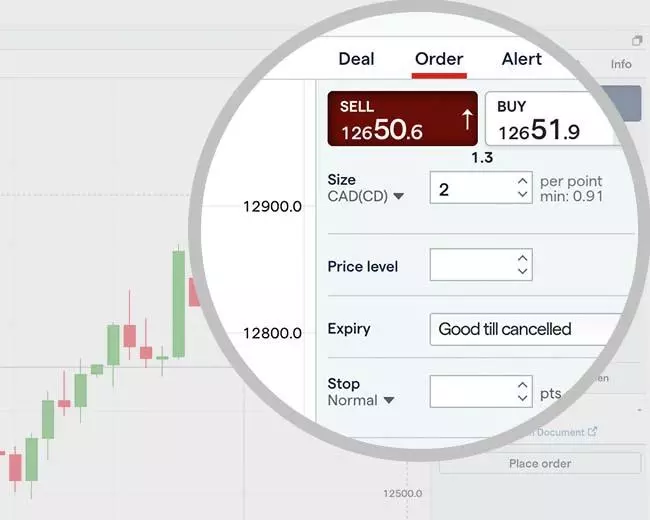

Trade direct from your charts

React faster than ever to new opportunities in the markets, by trading directly from charts. Open, close and edit positions in a couple of clicks with our easy-to-use functionality – and choose one-click trading to take positions instantly.

Our platform is designed to make it as quick as possible for you to respond to key market movements – especially from our charts.

Open an account now

*Demo accounts are only available for spread betting and CFD trading.

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

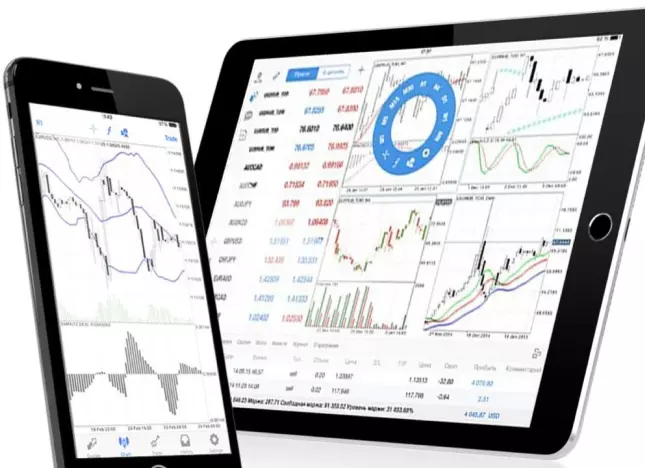

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

*Demo accounts are only available for spread betting and CFD trading.

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

What are the types of trading charts and how do you read them?

- Candlestick chart

- Heikin-Ashi

- HLOC chart (bar chart)

- Line chart

- Mountain chart

Candlestick charts display pricing information in long, thin bars that resemble candles. Each candlestick shows price movement over the period of time you selected. At a glance, a green candlestick indicates that the market moved up in price over the given period, closing at a higher price than it opened. A red candlestick, on the other hand, indicates that the market's price decreased, closing at a lower price than it opened.

Candlesticks give you information about four key price variables:

- Open – the price at the start of the period

- Close – the price at the end of the period

- High – the highest price traded during the period

- Low – the lowest price traded during the period

The relationship between the four prices shown by a candlestick can tell you a great deal about how market conditions are shaping up and who is driving the price action: buyers or sellers.

On first encounter, Heikin-Ashi bars may look very similar to the candlestick chart. But, there is a significant difference between the two. Heikin-Ashi, which more or less translates from Japanese as ‘average pace’, gives you an indication of price averages – and their changes – over a period.

Heikin-Ashi charts are smoother than candlesticks and, rather than offering an exact price at any moment, are often looked to for determining general trends over longer timeframes. The opening price of a Heikin-Ashi bar is the mid-point of the previous bar, and the closing price equals the average price for the current time period.

In short, each Heikin-Ashi bar shows you the direction and magnitude of every period’s change in average price level. For example, a long green bar will indicate that the average price has increased substantially. Conversely, a long red bar tells you that the average price in the market has dropped significantly.

The next type of chart, HLOC, which stands for ‘high, low, open, close’, shows exactly the same data as a candlestick chart, but in a different way:

- The open price is represented by the horizontal notch to the left of the vertical line

- The close price is represented by the horizontal notch to the right of the vertical line

- The high price is the uppermost point of the vertical line

- The low price is the lowest point of the vertical line

Once again, the line will be green if the market moved up over the given period, closing at a higher price than it opened. It’ll be red if the asset’s price decreased over the given period, closing at a lower price than it opened. In the instance that the market opens and closes at the same level, a chart formation known as a ‘doji’ will be shown. Doji’s look like crosses, and because neither green nor red can be applied, they will appear in black.

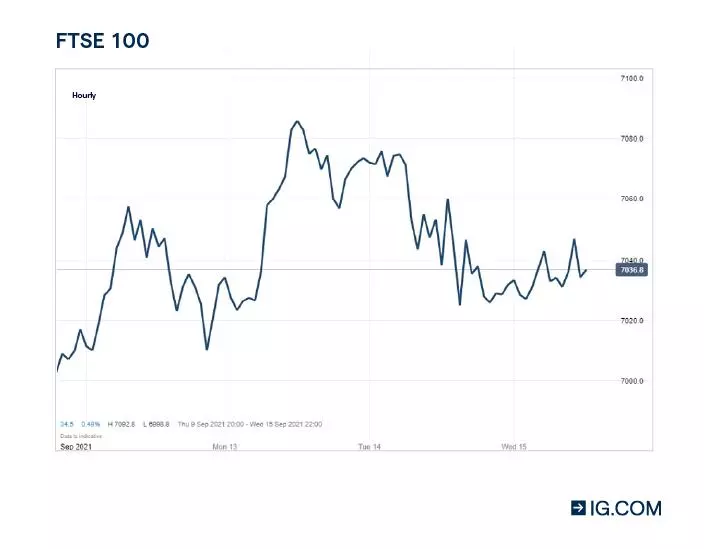

Unlike a candlestick or HLOC chart, a line chart only shows the close price for the time period you have selected (eg one hour). The close prices are joined together so that the consecutive points form a line.

This is a very simple way to display pricing data as it does not give any indication of what the high, low or open price for the period was. For this reason, many traders only use line charts when assessing long-term trends, where some of the additional information may not be quite as relevant as it is when trading short-term patterns.

When trading short-term volatility, such as in a highly liquid forex market, you’ll want to know the extent and pace of price movements, as well as the exact price of the market at any given moment – meaning that a candlestick or HLOC bar chart will be a better source of data.

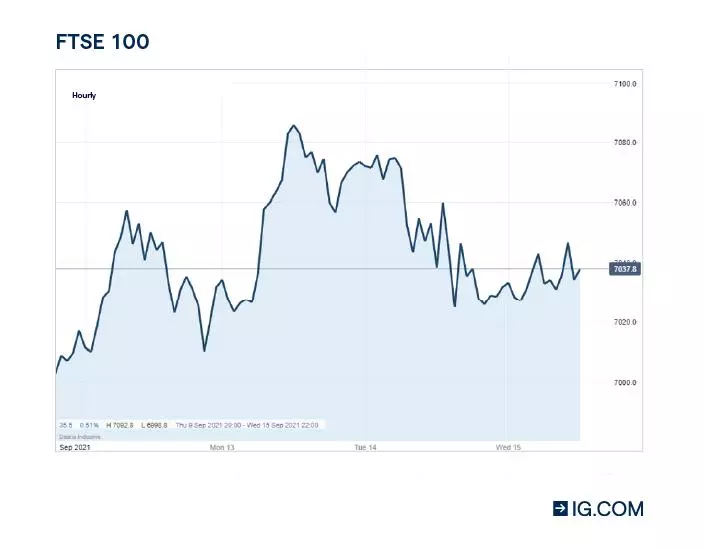

The final type of chart is a mountain chart. This is the same as a line chart, except the area beneath the line is shaded, giving it the appearance of a mountain in silhouette. Like line charts, this type is mainly used to assess long-term trends, as the high, low and open prices for each period are not on show.

The shaded ‘mountain’ gives you a quick impression of the shape of the market and its volatility – frequent peaks and valleys, with steep gradients, indicate higher levels of volatility, while smoother gradients suggest more stability.

Technical indicators that are drawn directly onto charts – Bollinger bands, for example – may be easier to read when applied to mountain or line charts than candlesticks and HLOC bars.

Free trading charts on the UK’s best platform

- Web-based platform

- Mobile trading app

- MetaTrader 4

- ProRealTime

Access top-quality charts and key indicators for over 15,000 markets. Make informed decisions with the UK’s No. 1 trading platform1 – a faster, clearer and smarter way to trade.

Charts on-the-go, wherever you are, whenever you want. Access thousands of markets – including stocks, forex and indices – with the UK’s best trading app.1

Analyse the markets and customise your MetaTrader 4 experience with our range of free indicators and add-ons.

Perform expert market analysis and automate your trading with the leading web-based charting package, ProRealTime.

Free trading charts for forex, shares, indices, commodities and more

View detailed charts on the UK’s best platform1 for over 15,000 markets, including our exclusive 24/7 pricing on global indices and GBP/USD, and 24-hour trading on over 70 key US stocks.3

Access our free trading charts by opening a demo or live trading account, or click on a market below to see a preview.

- Forex

- Shares

- Indices

- Commodities

These prices are indicative only, and subject to our website terms and conditions

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

These prices are indicative only, and subject to our website terms and conditions

These prices are indicative only, and subject to our website terms and conditions

FAQ

What charts are best for trading?

The best charts for trading are those that offer you the information you need to form an interpretation of the market.

For beginners, line and mountain charts are uncluttered and show price movements clearly. For more experienced traders, candlestick and HLOC charts are useful to gauge price volatility and the pace of change across the shorter-term. Heikin-Ashi charts are suited to experienced traders looking for general price movements and trends over longer periods of time.

Where can I get free trading charts?

You can get free trading charts in our award-winning platform.1 You can sign up for a free demo account and receive £10,000 in virtual funds to practise with. You can also create a live trading account. There’s no requirement to fund a live account, so you don’t have to trade until you want to.

What indicators can I use for technical analysis on charts?

With us, you can choose from 32 popular indicators to use for your technical analysis. We also offer 19 drawing tools for you to help visualise important patterns and trends.

Our range of free technical indicators includes (but is not limited to):

- Bollinger Bands

- Exponential moving average

- Ichimoku

- MACD

- Moving average

- Moving average pivot point

- SuperTrend

- Standard deviation

- Stochastic oscillator

- RSI

- Volume

Try these next

Perform technical analysis and customise your MT4 platform with free indicators and add-ons.

Learn more about using our trading signals so that you never miss an opportunity.

Find out how you can use the advanced capabilities of ProRealTime to perform analysis and automate your trading.

1 Awarded ‘Best Finance App’ and ‘Best Multi-Platform Provider’ at the ADVFN International Financial Awards 2024.

2 All chart prices are indicative of IG prices, and not necessarily those of an exchange or third-party broker-dealer.

3 24/7 excludes the hours from 10pm Friday to 8am Saturday (UK time), and 20 minutes just before the weekday market opens on Sunday night.