The stock market: what is it and how does it work?

If you want to invest, you’ll need to know all about the stock market – which can seem intimidating at first. Here, we’ll answer all your questions about the stock market.

Call 0800 409 6789 or email helpdesk.uk@ig.com if you have any questions about trading or investing. We're available 24/7 between 8am Saturday and 10pm Friday.

What are stocks?

Stocks are a type of financial asset you can buy, and represent a share of ownership in a company. The name for the unit of ownership you’ll purchase is ‘shares’.

If you buy shares on the stock market, you and any other shareholders now have a stake in that company. This means you’re entitled to voting rights in business decisions. It also often means you share in the company’s successes by getting dividends – a proportionate payout per share in any profits, if the company you’ve invested in pays dividends (some don’t).

What is the stock market?

As the name suggests, the stock market is where shares are bought and sold. It’s the marketplace within which the ‘merchandise’ of company stocks is exchanged between parties.

Rather than a place with vendors at various stalls, the stock market is a single abstract concept that refers to all the sales of stocks around the world.

What is a stock exchange?

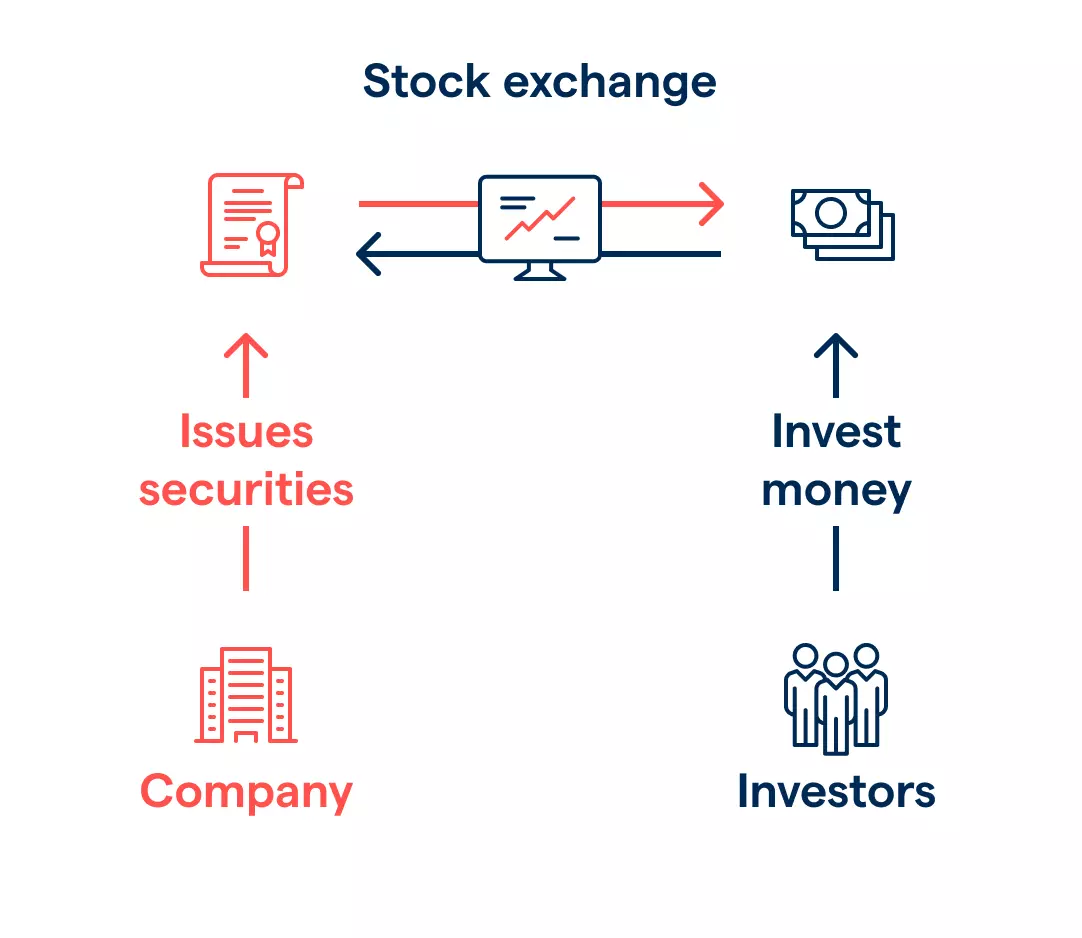

A stock exchange, on the other hand, is far more specific. Stock exchanges are physical buildings and legal entities within the various countries of the world. They’re the forum and the platform where companies’ stocks are sold and bought by investors, stockbrokers, funds and other ‘shoppers’.

Some of the biggest and most popular stock exchanges in the world include the United Kingdom’s London Stock Exchange (LSE), famous American exchanges like the New York Stock Exchange (NYSE) and the Nasdaq. There are also several, well-known exchanges in other parts of the world, such as Germany’s DAX (standing for ‘Deutscher Aktienindex’) and Japan’s Tokyo Stock Exchange (TYO).

How does the stock market work?

Picture a traditional marketplace – vendors selling their wares, while buyers mill in between the stalls looking at what’s on offer, negotiating pricing and purchasing goods, or trading one item for another. This is very much the way the stock market works – just in a digital, online form.

Companies looking to make more money or create cash flow for their business will list its stock on an exchange (in a form called securities) for other entities to buy. If buyers are interested in owning shares in that company, they’ll purchase them. All this happens on and through the stock exchange.

Like an old-fashioned market, the buyers (you as an investor via a broker, or a fund via an asset manager) will assess a stock. You may then offer to purchase it at what’s known as the ‘buy price’. This is the amount a stock is worth at any given time as determined by supply and demand and conditions of the overall market. Whatever amount the stock goes for, that’s called the share price.

Once the deal goes through, you as the shareholder can in turn sell the stock you purchased to another entity via a broker. This can be for a higher amount than you paid for it to make a profit, or for a lower amount to make a loss.

Stock exchanges, like markets, are public venues – so a company needs to list their stock on an exchange as a public entity. Companies are publicly listed and ‘debut’ on an exchange in a process called an initial public offering (IPO for short).

What’s a primary stock market?

A primary stock market isn’t an exchange, but rather a specific time in the life cycle of a stock. The first-time stocks are publicly traded in an IPO is on the primary stock market.

Once an IPO has been completed and a stock is officially listed on an exchange, its shares can be publicly traded on that stock exchange. This is known as a secondary market.

What is a stockbroker?

A stockbroker is the person who deals for you on the stock exchange.

Just like only public companies as sellers can list stock on an exchange, only registered buyers can interact on the stock exchange. This means you as in individual can’t personally buy shares on a stock exchange – you’ll have to use a stockbroker to execute your deals for you.

A stockbroker is an entity legally authorised to buy and sell on a stock exchange, and they’ll do so on your behalf, usually charging a commission for their services.

To use a stockbroker, you’d typically open a share dealing account. Your funds to buy and sell shares, as well as any of the ones you’ve bought, will be held in this account. The account is also where dividends will be paid into.

We’re an example of a stockbroker, as we enable you to buy or sell on an exchange. This means you’ll tell us which investments you want to make and we’ll carry them out for you. Stockbrokers like us may also offer managed portfolios: these are portfolios that invest in a collection of ETFs and are managed for you by our experts.

3. Place your order

Once your account is set up, you can place your first order:

Through the IG Invest app with just a few taps

Or on our comprehensive web-based share dealing platform

4. Monitor your position

Keep track of your investments through either platform:

Use the IG Invest app for monitoring on the go

Access detailed charts and analysis tools on our web platform

Set price alerts to stay informed of market movements

Review your portfolio performance at any time

What affects the prices of stocks?

Share prices are affected by things such as supply and demand, macroeconomic factors, and industry classes. The most common factors are:

- The latest earnings results reported by the company, eg revenue or profits

- Company news, either positive or negative

- Trends and sentiment in that company’s industry

- Changes to monetary policy in the country where a stock is listed, eg interest rate hikes

- Macroeconomic events in the market at large like recessions, bull runs, etc

What is market volatility?

Market volatility is how much assets’ prices rise and fall, and how rapidly, and it’s also a significant factor affecting stocks’ pricing. When prices tend to rise and fall sharply, suddenly, that’s when a market is considered volatile. When prices don’t fluctuate significantly and move comparatively slowly, that’s called a ‘flat’ market.

The more volatile a market is, the more profits and losses you can make and the faster they can happen. For this reason, it’s often wise to choose stocks at first that move relatively little (ie are flat and have low volatility) if you’re still new on your stock investing or trading journey.

What are the risks of investing in stocks?

For all the benefits of investing in shares, there are risks, too. This isn’t in and of itself a bad thing – there is no reward without risk. Rather, you need to know and manage your risk to reap all the rewards that being a shareholder can bring.

These are the ones you’ll most likely face if you choose to invest in stocks:

- Investment risk is the blanket term for all of the possible risks your stock will face. It simply means the danger of incurring losses or a lower-than-expected return on investment

- Business risk is the dangers faced by the company you’ve invested in, and could in turn affect the share price. An example would be significant management restructuring or cash flow constraints in the business

- Unsystematic risk (also known as idiosyncratic risk or specific risk) is just a fancy term for risks that are unique to a particular company. If, for example, you’ve invested in a company that’s CEO is known for wildly affecting the share price with their social media posts, that’s an unsystematic risk that stock poses

- This particular example above is called headline risk – the danger that negative publicity for a company will impact their share price

- Liquidity risk is the chance that you’ll encounter circumstances that mean you need to sell your stocks in a hurry, to increase your liquidity, and may not get a good price for them as a result

- Market risk is much more general to the macroeconomic environment. It’s the ongoing risk of the market fluctuating up and down, affecting your stock’s prices

- The broad umbrella term for risks that affect not only your stock, but all assets, is systematic risk – risks that plague the whole financial system

- One type of systematic risk is commodity price risk. This occurs when extreme fluctuations in commodities’ prices have a knock-on effect on stocks’ prices

- Inflation risk is the chance that a country’s rising inflation, which causes the value of money to decrease. Because of this, the monetary value of your stocks’ worth can lessen

- Legislative risk is also on a national level. It means the chance that government decisions, for example increased red tape or regulatory burdens for corporates, will in turn affect the bottom line of businesses and their stock prices

Why choose IG Invest?

With IG Invest, smart investing starts here. Our investment app offers everything you need to build your financial future:

Commission-free trading on stocks

Access to over 13,000 global stocks and ETFs across eight exchanges

Choice of General Investment Account or ISA

Secure login with face or fingerprint ID

24/5 support via the app and WhatsApp

Earn up to 4.6% interest* with our Xtrackers UK interest rate-linked fund

Tax-free3 investing with stocks and shares on all Individual Savings Accounts (ISAs)

Individual Savings Account (ISA) up to £20,000

* Interest-earning ETFs are tied to, and aim to beat, the SONIA (Sterling Overnight Index Average) benchmark rate. The current SONIA rate is 4.7%, and XSTR has a 0.1% TER fee. Dividends are paid semi-annually.

Our competitive fees

Here's what you'll pay:

| UK shares | US shares | European shares | Australian shares | |

| Commission | Free* | Free* | Free* | Free* |

| Forex conversion fee | 0%** | 0.5%** | 0.5%** | 0.5%** |

| General Investment Account | Free | |||

| Stocks and shares ISA | Free | |||

| News and insights | Free | |||

| Access to the learning centre | Free | |||

*Other fees may apply

**Increasing to 0.7% from 7 April 2025

FAQs

How do I buy stocks?

To invest in stocks, you can buy shares on the go using the IG Invest app. You can also buy shares in a company via a broker’s platform – for example, with us. You can buy and sell US shares commission-free on our platform.1 If you’d prefer to trade on stocks instead, we’re the No.1 CFD trading platform in both the UK and the world.2

Can anyone buy stocks?

Yes and no. Anyone can buy shares, but individual investors can’t buy them directly. Instead, you’ll need a stockbroker, an entity legally authorised to deal in securities, to make the transactions on your behalf.

Where is the stock market?

The stock market isn’t specific place, like Wall Street. Rather, it’s an abstract term that encompasses all of the exchanges, and the stocks listed on them, in the world. These days, this means that the stock market is largely a digital, online phenomenon.

Is there a minimum amount for stock investing?

With us, you can start investing on the IG Invest app or set up a share dealing account for free. With a foreign exchange fee of just 0.5%* and zero commission on shares.1 However, there’s a minimum of €10 and A$10 for European and Australian shares and a minimum charge of $15 on US stocks. See our charges for more details.

*Increasing to 0.7% from 7 April 2025

Is stock investing risky?

Yes, there’s risk associated with investing in stocks – but without risk there are no rewards. The chance to make a profit inevitably goes hand in hand with the possibility of making a loss. The trick is to know the potential risks and plan for them. We’ve included a handy list of all the most likely risks that stocks face in the section above.

How do I get an IG Invest account?

First, download the IG Invest app from the Apple App store or Google Play store. Setting up your profile and signing in takes just a few minutes. Then, open your investment account directly in the app.

Try these next

Discover the ins and outs of how to begin investing in shares with us

Find out all about our unique managed portfolios offering for investors

Explore the different platforms available to you when you invest with us

1 Please note published rates are valid up to £25,000 notional value. See our full list of share dealing charges and fees.

2 Based on revenue excluding FX (published financial statements, October 2022)