As a beginner in trading, it’s important to have a solid understanding of how the financial markets work and how you can get exposure to them. Find out what trading is and how it works.

In plain English: what is trading?

When you want to access financial markets, you have two options: buying and owning assets (traditional investing) or speculating on their price movements without taking ownership (trading). So, basically, trading means that you’re only predicting whether a financial asset’s price will rise or fall.

You can trade hundreds of financial markets, including stocks, forex, commodities, indices, bonds and more. We offer more than 17,000 markets for you to speculate on – think Facebook shares, the US dollar against the British pound, crude oil and the FTSE 100.

When you trade, you’ll use a platform like ours to access these markets and take a position on whether you think a market’s price will rise or fall. If your prediction is correct, you’ll make a profit. If incorrect, you’ll make a loss.

The financial instruments you’ll use to trade on an asset’s price movements are known as ‘derivatives’.

This simply means that the instrument’s price is ‘derived’ from the price of the underlying, like a company share or an ounce of gold. As the price of the underlying asset changes, so the value of the derivative changes, too.

To understand this, let’s look at an example of speculating on shares. If the price of a share goes up from £100 to £105, the value of the derivative tracking it’ll increase by the same amount. If you bought the derivative at £100, you could now sell it at £105. Although you never own the share itself, your profit or loss will mirror its price movements.

So, why use a derivative?

There are several benefits to using derivatives – and some risks too.

With derivatives trading, you can go long or short – meaning you can make a profit or a loss if that market’s price rises or falls, as long as you predict it correctly. This is because trading isn’t owning the actual financial asset. With owning something outright, such as actual gold for example, you’ll only make a profit if the gold price climbs.

Leverage can be another reason to trade with derivatives.

Trading with leverage means that, instead of paying the total value of your trade upfront, you’ll put down a fraction of its value as a deposit. This is called ‘margin’. This means leverage can stretch your capital much further as you can open large positions for a smaller initial amount.

With leverage, your total profits or losses are calculated based on the full position’s value, not how much you paid to open that position. So, you can make far more than the initial margin amount you paid to trade – and you can also lose far more. This means leverage has built-in risk.

Interested? Practise trading with a free demo account

All of this new terminology can be a lot to digest. So, we’ve created a table below with five key trading terms every beginner should know.

Five key trading terms

| Term | Definition |

| Spread betting | A type of derivative trading we pioneered. Spread betting allows you to trade on the price movements of an underlying asset. You’d do this by betting an amount of capital per point of movement in that asset’s price. This amount per point is what you stand to gain in profits or lose in loss. How to spread bet |

| CFD trading | A different type of derivative, CFDs (contracts for difference) also allow you to trade on the price movements of an underlying asset. You’d do this by agreeing to exchange the difference in that asset’s price from when you open your position to when you close it. The difference between the asset’s price between opening and closing your position is what you stand to gain in profit or lose in loss. How to trade CFDs |

| Going long, going short | Going long (also known as being ‘bullish’) is a prediction that a market’s price will rise, going short (also known as being ‘bearish’) is a prediction that it will fall. However, short selling is risky because losses can be unlimited if risk isn’t managed properly, since there’s no limit to how much a market’s price can rise. Learn more about short selling |

| Trading on margin | Open a position for less than the total value of your trade – this is also known as a ‘leveraged’ trade. For example, if you bought 10 CFDs on shares worth £100 each, the position’s total value is £1000. With a margin deposit of 20%, you could open a trade with £200. Learn more about leverage |

| Risk | However, margin is dangerous because you risk losing far more than this initial deposit and your losses can far exceed your margin amount. Risk represents the possibility of monetary loss. It’s absolutely essential to understand the risks inherent in trading, and trading on margin especially so. Fortunately, we offer mechanisms to help you manage your risk. How to manage risks when trading |

Financial markets new traders need to know

We offer over 17,000 popular financial markets. You’ll trade these markets with spread bets or CFDs.

What is stock trading and investing?

When you want to speculate on or otherwise profit from a public company, you’d either trade or invest in shares, also known as ‘stocks’.

Trading in shares means you’re using a platform like ours to speculate on the share price of a public company and whether it’ll rise or fall. You can trade shares with us, and you’d do this using spread bets or CFDs.

This means you can go long or short, but also means you won’t have other benefits like dividend payments, since you aren’t an actual shareholder as you don’t own shares.

For this, you’d need to invest in shares – which means you’re purchasing a stake in the company. Unlike trading, you’d pay the full share price outright for a certain number of shares, which you’d now own.

This would entitle you to shareholder benefits like dividends and voting rights in certain company decisions. You can invest in shares with us, too, via share dealing.

What is forex trading?

Foreign exchange trading (called ‘forex’ for short) is the exchange of one currency for another. The forex market is the biggest and most liquid in the world, is decentralised and is one of the few true 24/7 markets.

When trading forex, you’ll be speculating if one currency’s price will rise or fall against another currency – for example, if the US dollar (USD) will weaken against the British pound (GBP) or strengthen.

If your prediction is correct, you’ll make a profit. If incorrect, you’ll make a loss. As with other trading, you can go both long and short.

Forex is traded in pairs which consist of two currencies that are traded against each other.

There are hundreds of different combinations to choose from, but some of the most popular include the Euro against the US dollar (known as the EUR/USD), the US dollar against the Japanese yen (USD/JPY) and the British pound against the US dollar (GBP/USD).

What is index trading?

While you can trade or purchase one company’s shares, you can also trade on an entire market, industry, or collection of stocks at the same time, via an index.

Indices are a collection of publicly traded stocks all grouped together into one entity that can be traded singularly, so that when you trade on the index, you’re trading on all its constituents at the same time.

An index’s stocks will always have something in common which groups them together. For example, the 500 biggest US-listed companies by market cap will be grouped into the S&P 500 index, while the 100 biggest UK stocks will be on the FTSE 100.

Indices can be thematic, too. For instance, smaller ‘alternative’ stocks not big enough to appear on the FTSE 100 or FTSE 250 will be listed on the FTSE AIM (Alternative Investment Market) index.

We offer over 80 international indices, so you can trade any of the world’s the biggest and most popular indices with us. You’d do this via spread betting or CFDs.

What is commodities trading?

Speculating on the price of tangible, usually natural, resources is called commodities trading. For example, taking a position on the gold price, the price of sugar cane or the price of Brent crude oil are all forms of commodities trading.

There are ‘hard’ and ‘soft’ commodities. Hard commodities are mined substances like precious metals, diamonds, oils, gases, and the like. Soft commodities are plant and animal resources like grains, sugar cane, coffee beans and cattle and other livestock.

Some commodities, for example gold, have a reputation for being a safe haven in troubled times and are used as hedges against things such as inflation and macroeconomic volatility.

With us, you can trade on the price of commodities using spread bets and CFDs.

Trading for beginners: where to learn more

Getting started with trading can be an intimidating experience, with so much to learn. That’s why we created IG Academy, a self-learning hub on our platform full of interactive online courses, webinars, and live sessions with our resident experts.

IG Academy’s content ranges from the most beginner concepts right up to the very advanced, professional trader level. It’s completely free and easy to use.

Once you’ve got the basics down, our website’s Analyse and Learn section also contains a host of resources, including Strategy and Planning articles that help you perfect your technique and News and Trade Ideas to keep you up to date on current market events. There are even trading podcasts, seminars, and tips on risk management, too.

But, as we all know, practice makes perfect. That’s why we recommend putting all the theory you’ve learned into real-life use with our free demo account. Here, you’ll be able to trade with £10,000 in virtual funds in a risk-free environment to hone your techniques and build your confidence before doing it for real.

Your first trade: how to do it

After learning about trading beforehand, the only thing left to do is to make your first trade on our live platform. However, if you still want to know more about entering the world of trading, read our How to get into trading page.

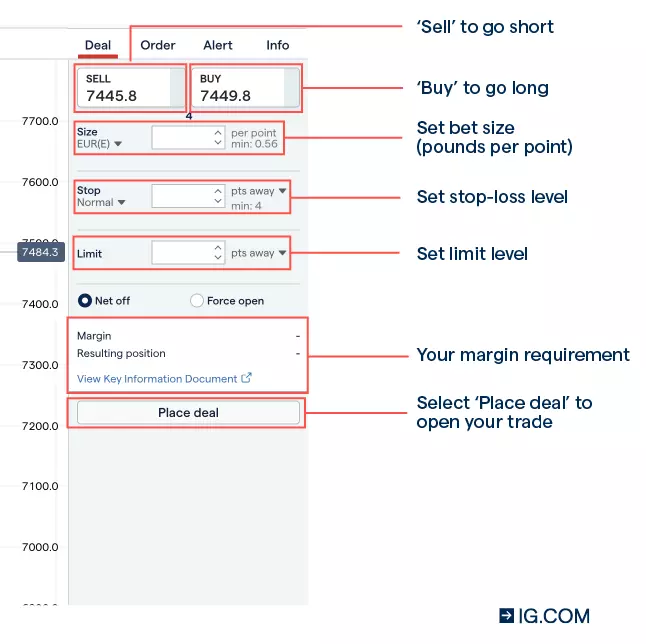

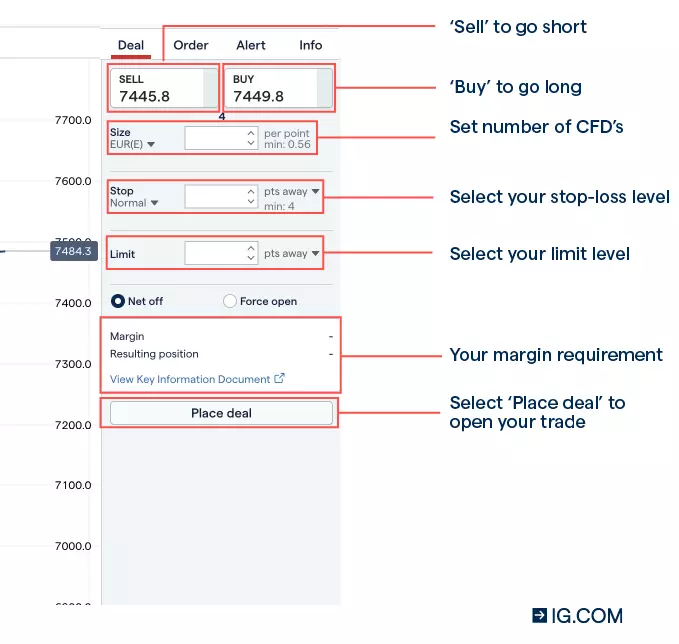

Here’s how to make your first trade:

- Open and fund your live account

- After careful analysis of the market, select your opportunity

- ‘Buy’ if you think that market’s price will rise, or ‘sell’ if you think it’ll fall

- Select your deal size. With spread betting, this is called ‘bet size’, and with CFD trading, it’s called ‘contracts’

- Take steps to manage your risk

- Open and monitor your position by selecting ‘place deal’

Why trade with us?

There are many trading platforms out there, so why should you choose us?

We’re the UK’s No.1 trading platform1 and have been a market leader since 1974. We’re also focused on the success of our clients, providing a host of educational resources and more.

And here are just a few more reasons to trade with us:

Get hours others don’t provide

We offer more out-of-hours and weekend trading on popular stocks and indices than any other platform

Deal with the best

Our award-winning platforms2 are the world’s top choice for spread betting and CFD trading1

Access thousands of markets

Trade on over 17,000 markets, including stocks, forex, indices and commodities

Enjoy 24/7 support

Talk to us by phone, email or Twitter – 24 hours a day from 8am Saturday to 10pm Friday

Stay safe with negative balance protection

UK regulation-mandated negative balance protection means you can never lose more than you have3

Perfect your strategy with trade analytics

Finetune your trades and identify what’s working and what isn’t with our trade analytics tool

Risks and benefits beginner traders should know

You’ll need to evaluate the risks versus the rewards for any trade before you open a position. Here, we’ve included some of the main risks and benefits to be found when trading with us:

| Risks | Benefits |

| Leverage – all spread betting and CFD trades are leveraged, meaning profits and losses can substantially outweigh your initial margin | Leverage – because leveraged trades only require you to put up a fraction of the total position’s value, you can stretch your capital and magnify profits, if you make them |

| Short selling – can give higher risk of losses if a market moves unpredictably. If its price increases, losses could be unlimited, as there’s no limit to how high a market’s price can climb | Short selling – going short also doubles your trading opportunities, because you can profit (or make a loss) from down trending markets as well as appreciating ones |

| Volatility – markets can be volatile, moving very quickly and unexpectedly in reaction to announcements, events, or trader behaviour | Volatility – because of this, a trader with a good strategy and risk management measures in place can find opportunities to trade on volatility |

| Margin call – you need a certain amount of money in your account to keep trades open. This is margin, and if your account balance doesn’t cover our margin requirements, we may close your positions for you | Negative balance protection – that being said, you’re safeguarded by UK regulation in terms of never being able to lose more than the capital in your account, even with leveraged trades3 |

FAQs

How do I get into trading?

The very best way to get into trading is to find a platform you trust, learn as much as you can about trading beforehand and then practise to get your technique right. Thereafter, all that remains to be done is to open a live account and get started.

How much do online brokers cost?

Our IG Academy is a great resource for learning all about trading, from the most basic concepts to the very advanced. You can also take a look at our website’s Analyse and Learn section, with Strategy and Planning articles to help you perfect your techniques and News and Trade Ideas for current market events.

What are the risks of trading?

The main risks around trading involve the fact that, unlike investing, your potential for profit and loss is not capped at the capital you’ve spent. Trades are leveraged, meaning you will put down a small deposit (called margin) to open a larger position. However, profits and losses are calculated on that full position size and so can substantially outweigh your margin amount.

Trading is also speculating on markets’ prices, which means you can go long or short. Short selling is risky, however, as it can give higher exposure to losses if the market traded on moves unpredictably. If an asset’s price increases, your losses could potentially be unlimited, as there’s no limit to how high a market’s price can rise.

Luckily, there are ways you can manage your risk in trading – including setting stops and limit orders.

Can I practise trading?

With us, you can practise trading with your very own free demo account. Here, you can trade with £10,000 in virtual funds in a risk-free environment before doing it for real.

Where can I learn more about the markets to trade?

We offer more than 17,000 international markets on our platform. Learn all about our various markets to trade here.

Try these next

Discover our 17,000 markets to trade

Find out why our platforms come out on top

Learn exactly how to get started trading with us

1 Based on revenue (published financial statements, 2023)

2 Best multi-platform provider as awarded at the ADVFN International Financial Awards 2021

3 Negative balance protection is a regulatory requirement of all providers in the UK, which ensures you can never lose more than is in your account. Negative balance protection applies to trading-related debt only, and is not available to professional traders.