Buying or selling CFDs means you’re agreeing to exchange the difference in price of an asset from when your position is opened to when it’s closed. Find out the benefits, as well as the risks, of CFD trading – including leverage, short selling and hedging. Interested in trading CFDs with us?

Why trade CFDs?

CFDs enable you to:

- Make your capital go further with leverage

- Go short or long

- Trade a huge range of markets

- Mirror trading the underlying market

- Pay no stamp duty on your profits

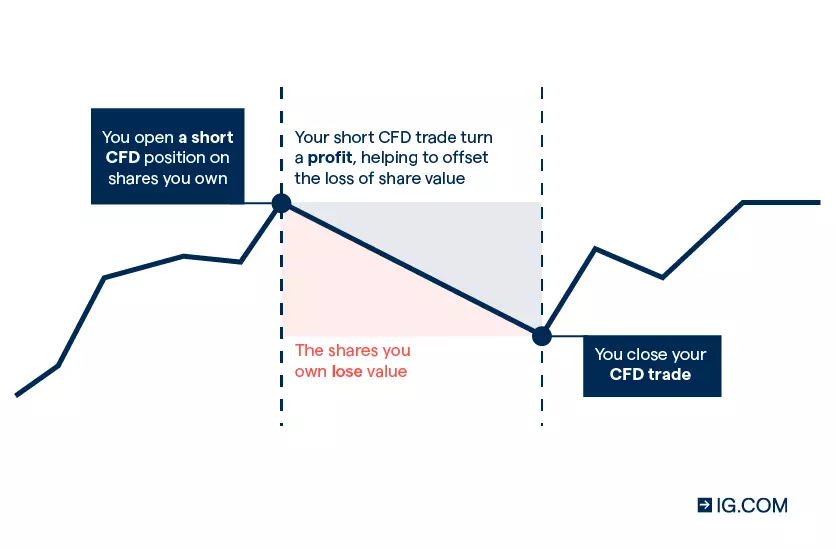

- Hedge a share portfolio

- Benefit from DMA

If you’re new to CFDs, start with our introduction to CFD trading and how it works.

Make your capital go further with leverage

CFDs enable you to stretch your investment capital further, as you only have to deposit a fraction of your trade’s full value to open a position. The deposit you’ll have to put down is called a margin. While this lowers the cost of opening a trade, it can also amplify your losses. This is because CFD profits and losses are calculated on the full size of your trade.

How much you’ll need to deposit depends on the size of your position and the margin factor for your chosen market. For example, many of our share CFDs have a margin of 20%, most major indices have a margin of 5% and most major forex pairs have a margin of 3.33%. Learn more about our CFD margin requirements.

For an easy way to find out the margin requirement for your trade – as well as the potential profit or loss – try out our CFD calculator. An example would be if you decided to trade CFD shares on BT, which has a margin factor of 20%. In this case, a position worth £1000 would only require a deposit of £200.

However, it’s important to remember that your total profit or loss is based on the full size of your position, not your margin. So, in our previous example of BT share CFDs, your potential for loss or profit would be based on the full £1000, even though you only paid £200 to open the position.

The benefits of CFDs vs share dealing: a comparison

Let’s continue with the example of you wanting to open a CFD shares position worth £1000. The below table illustrates the benefits and risks of CFDs, compared to investing in shares.

CFD trade

- Your deposit is a margin of £200

- If your BT position rises to £1025, you’ll make £25, excluding any fees and charges

- If your BT position falls to £975, you’ll lose £25, excluding any fees and charges

Investment

- Your deposit is the full £1000

- If your BT position rises to £1025, you’ll make £25, excluding any fees and charges

- If your BT position falls to £975, you’ll lose £25, excluding any fees and charges

Go short or long

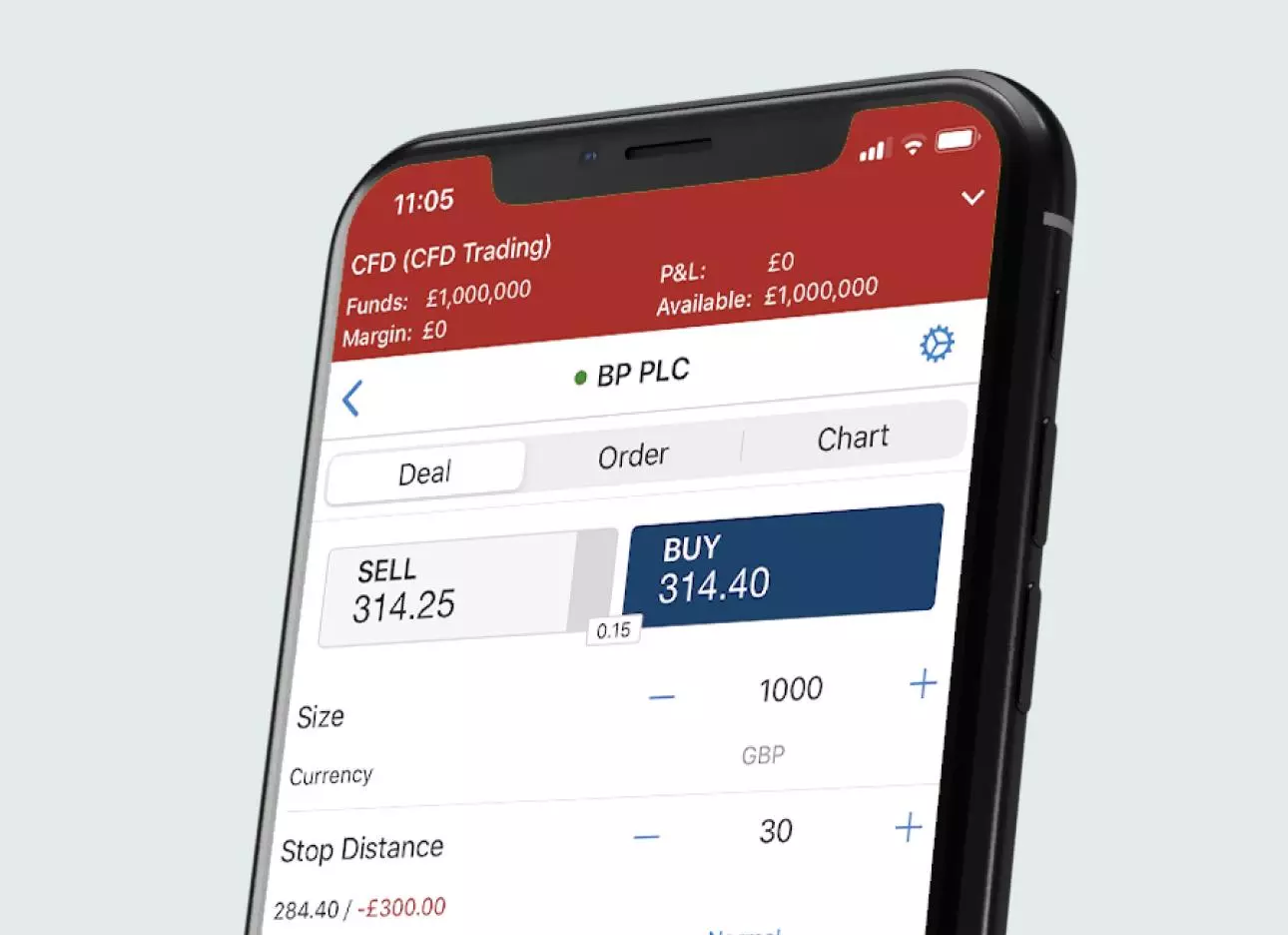

When you trade CFDs on our platform, you’ll see two prices listed: the ‘buy’ price and the ‘sell’ price. You’ll trade at the buy price if you think that the market is going to go up in price (known as going long), and the sell price if you think it is going to go down in price (known as going short).

If your prediction is correct, you will make a profit based on your overall position (not the initial margin amount you paid to open the trade), which can exceed the initial cost of your margin. However, if your prediction is incorrect and you make a loss, that loss is also calculated based on your total position size. This means that your losses can far outweigh the margin cost, so always ensure you are trading within your means.

Trade a huge range of markets

With us, you can trade CFDs on more than 15,000+ markets. This includes over 11,000+ shares and ETFs, 80 of the world’s top indices, 30 commodities, all major, minor and exotic forex pairs and more.

You can even trade some markets outside of trading hours, to make the most of economic and political events and announcements. We have some of the best pre-market and after-hours offerings available, so you can trade long before and after the main market session on our All Session stocks and indices.

Just keep in mind that the market’s opening price may differ from its out-of-hours price and that trades opened and not closed by 10pm (UK time) will incur overnight funding charges

Mirror trading the underlying market

CFDs are designed to mimic trading their underlying market fairly closely. This means you simply buy and sell CFDs as you would the underlying asset. For example, buying an Apple share CFD is the equivalent of buying a single share in Apple – if you want to buy the equivalent of 2000 Apple shares, you’d buy 2000 Apple CFDs.

Buying or selling a forex CFD, meanwhile, is equivalent to buying a certain amount of base currency by selling the equivalent amount of quote currency. These are called lots and there are different sizes of lots for forex: standard, mini, micro and nano. The greater the lot size, the more money you’ll need to put down to open a position. So, buying a single CFD on the GBP/USD exchange would give you the same exposure as buying £100,000 in US dollars for a standard lot, but £1000 with a mini lot. Find out more about lot sizes for forex.

With commodities and indices, the points a market moves are directly correlated to the real-time price of that index or commodity.

Pay no stamp duty on your profits

Your profits from CFD trades are generally exempt from stamp duty in the UK.* However, it’s important to remember that tax law may differ in a jurisdiction other than the UK. These laws are subject to change and depend on individual circumstances.

Most traders will pay capital gains tax on their CFD trade profits, but this can be offset any losses against profits for your capital gains tax (CGT) liabilities.* This means trading CFDs can be a great way of hedging – which we explain below.

Benefit from DMA

If you’re an advanced trader, you can get direct market access (DMA). Our DMA offering enables you to see and interact with the order books of stock exchanges. Instead of trading at the buy and sell prices offered by us, you can see all the available bid and offer prices at any time and trade at market prices you choose.

Using DMA means there’s no spread to pay because these trades are charged on commission. But, while DMA can be a powerful tool, there’s no guarantee that you’ll find prices that are better than the prices we offer.

DMA is only recommended if you’re an advanced trader with plenty of experience, due to the risks and complexities involved.

FAQs

Is there an expiration date on a CFD trade?

Most CFD trades don’t have an expiry. However, it’s important to remember that all spot positions left open after 10pm UK time will incur overnight funding fees. This is slightly different if you’re trading CFD futures – which allow you to speculate on the price that the underlying asset will be on a specific date, at which point the trade will expire. You won’t incur overnight funding on your CFD futures trades.

Can you hold a CFD position overnight?

Yes, you can hold CFD positions overnight. However, you’ll be charged an overnight funding charge on any positions still open after 10pm (UK time). This fee covers the capital you’ve effectively borrowed from us and reflects the cost of holding your position open.

What is the minimum contract size for a CFD trade?

CFD trades are standardised into lots, but each market has its own minimum number of contracts that aim to mimic how the asset is traded on the live underlying market.

For example, for share CFDs, the contract size is usually the equivalent of one share of the company you’re trading. For forex, there are standard lots which equal 100,000 units of the base currency, or mini lots that are equal to 10,000 units of the base currency.

What are the commission rates on CFDs?

For most CFD trades, the cost of opening your position is covered in the spread. This means the buy and sell prices already include any charges additional charges. However, for share CFDs you will pay a commission instead of our spread, which means that the buy and sell prices match the underlying market price as it is in real-time.

Can you trade both rising and falling markets with CFDs?

Yes. Trading CFDs means you can take a position on markets that are both rising and falling in value. You can ‘buy’ an asset in the hope that its price will rise (going long), or ‘sell’ the asset in the hope that its price will fall (going short).

Develop your knowledge of CFD trading

Learn more about CFD trading and test yourself with IG Academy’s range of online courses.

Try these next

Discover the differences between spread betting and CFD trading

Discover how you can start trading online and get exposure to over 15,000+ markets

Browser-based desktop trading and native apps for all devices

* Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.