What is a lot in forex and how do you calculate the lot size?

To trade currency pairs, you need to understand the concept of a lot in forex. This guide explains what a forex lot is, why it’s important and how you can use it to calculate your position size.

What is a lot in forex trading?

A lot in forex trading is a unit of measurement that standardises trade size. The change in the value of one currency compared to another is measured in pips, which are the fourth decimal place and therefore very tiny measures. This means trading a single unit isn’t viable, so lots exist to enable people to trade these small movements in large batches.

The value of a lot is set by an exchange or a similar market regulator, which ensures everyone trades a set amount and knows how much of an asset they are trading when they open a position.

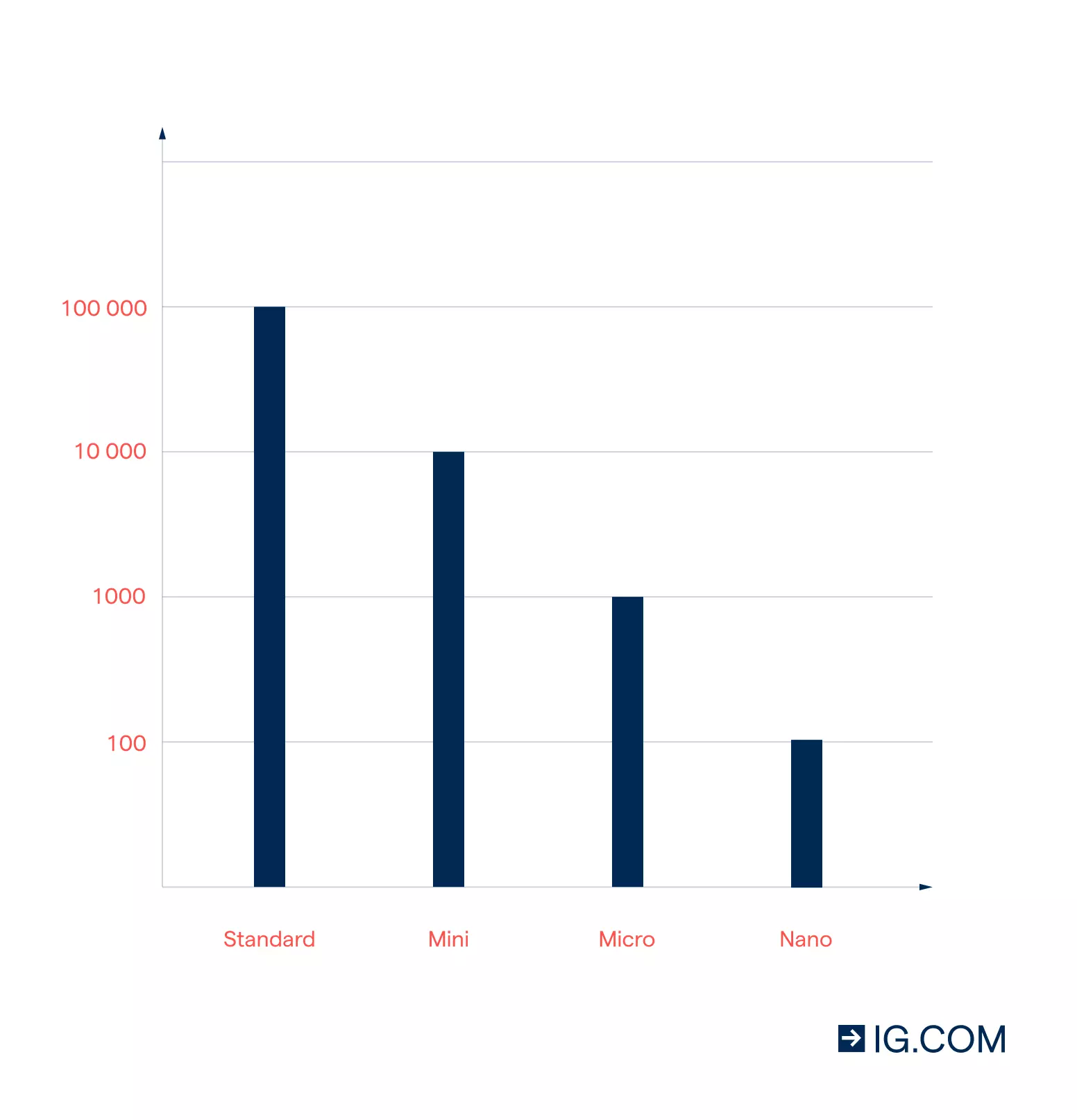

Lots are subdivided into four sizes – standard, mini, micro and nano – to give traders more control over the amount of exposure they have.

Understanding lots in forex with boxes of chocolates

Let’s say that a company sold boxes of chocolates in two sizes: 12 and 24 chocolates. These are standard sizes and ones consumers have come to expect. They don’t often expect to buy just one chocolate out of the box.

It’s the same with forex currency pairs. You can’t just buy one unit of currency; instead, you buy a lot. Lots come in standard sizes that are universally recognised. For example, you could buy 100,000 lots of base currency GBP for the currency pair GBP/USD. That’s a standard lot. Alternatively, you could buy a micro lot of 1000 GBP.

Forex lot sizes explained

So, how much is one lot in forex? It depends on whether you’re trading a standard, mini, micro, or nano lot. Forex trades are divided into these four standardised units of measurement to help account for small changes in the value of a currency.

The following examples all relate to the currency pair EURUSD, which compares the euro (the base currency) against the dollar (the quote currency). For context, if you buy EUR/USD, you’re speculating that the euro is going to strengthen against the dollar. If the quote price is currently $1.3000, that means you can exchange €1 for $1.3000. To put it the other way around, you need $1.3000 to buy €1.

What is a standard lot in forex?

A standard lot in forex is equal to 100,000 currency units. It’s the standard unit size for traders, whether they’re independent or institutional.

Example:

If the EURUSD exchange rate was $1.3000, one standard lot of the base currency (EUR) would be 130,000 units. This means, at the current price, you’d need 130,000 units of the quote currency (USD) to buy 100,000 units of EUR.

What is a mini lot in forex?

A mini forex lot is one-tenth the size of a standard lot. That means a mini lot in forex is worth 10,000 currency units. The size of a mini lot means the profit and loss effect is lower than a standard lot.

Example:

If the EURUSD exchange rate was $1.3000, one mini lot of the base currency (EUR) would be 13,000 units. This means, at the current price, you’d need 13,000 units of the quote currency (USD) to buy 10,000 units of EUR.

What is a micro lot in forex?

A micro forex lot is one-tenth the size of a mini lot. That means it’s worth 1000 units of currency. Pip movements result in a cash swing of 1 currency unit, eg €1 if you were trading EUR. Micro lots also require less leverage, so a swing won’t have as much of a financial impact as with larger lot sizes.

Example:

If the EURUSD exchange rate was $1.3000, one micro lot of the base currency (EUR) would be 1300 units. This means, at the current price, you’d need 1300 units of the quote currency (USD) to buy 1000 units of EUR.

What is a nano lot in forex?

A nano forex lot is one-tenth the size of a micro lot. It’s equal to 100 units of currency. A one-pip movement with a micro lot is equal to a price change of 0.01 units of the base currency you’re trading, eg €0.01 if you’re trading EUR.

Example:

If the EURUSD exchange rate was $1.3000, one nano lot of the base currency (EUR) would be 130 units. This means, at the current price, you’d need 130 units of the quote currency (USD) to buy 100 units of EUR.

You can find out more about how to buy currency pairs in our guide to forex trading.

How do you calculate the lot size when trading forex?

You won’t normally need to calculate the lot size yourself, as your trading platform should tell you what you need to know. It should be clear when you’re placing a trade what options are available – standard, mini, micro, and nano – and which lot size you’re using. You can calculate the overall size of your position by the size of a lot and the number of lots you’ve bought.

With IG, you can trade standard or micro lots using CFDs. Our platform allows you to toggle between the two before you execute the order. For spread bets, lot size isn’t as important because you’re speculating on the amount of value per point movement. To increase the size of your spread betting position, you would increase your bet size.

How to choose lot size in forex

To choose your lot size, think about the risk you want to take. The greater the lot size, the more money you’ll need to put down or leverage you’ll need to use – and the greater each pip movement will be magnified.

A one-pip movement is worth the following monetary amounts for each lot sizes, assuming you’re trading EURUSD:

- A standard lot = $10

- A mini lot = $1

- A micro lot = $0.10

- A nano lot = $0.01

Remember the currency value will depend on the base currency within the currency pair you’re trading. As you can see, the smaller the lot, the less a one-pip movement costs. In turn, that means you can have a smaller outlay by trading smaller lots.

How can I start trading forex?

You can trade forex online with us. Before you start, you might want to read our guide to forex and how to trade currency pairs. Once you’re comfortable with the basics and how lots in forex work, you can either get started with live trading straight away or create a free demo account to hone your skills.

Plus, with us you’ll be able to take advantage of forex price movements over the weekend with our Weekend GBP/USD, Weekend EUR/USD and Weekend USD/JPY offerings – which some other UK providers might not offer.

To create an account and trade forex at IG, follow the steps below:

How to trade forex

- Create or log in to your trading account

- Find the pair you want to take a position on

- Decide whether to go long to buy or short to sell

- Confirm your deal size

- Open and monitor your position

When you trade with us, you’ll be able to use spread bets and CFDs to go long or short on a currency pair’s price. Going long means that you’re speculating that the pair will increase in value, meaning that the quote is weakening against the base. Going short means that you’re speculating that the pair will decrease in value, meaning that the quote is strengthening against the base.

One main advantage of using CFDs and spread bets to trade forex is leverage. This enables you to open a position by paying a small percentage of the full value upfront – but bear in mind your exposure will be based on the full value of the trade. A spread bet on EURUSD might require a deposit of just 3.33%.

Spread betting doesn’t incur capital gains or stamp duty charges because you never own the underlying asset. You do have to pay capital gains tax on CFDs, but it’s possible to offset your losses against profits. Therefore, overall, it’s considered tax-efficient to trade forex using CFD and spread bets.1

Forex lots summed up

To trade forex effectively, you need to understand lots. Here’s a reminder of what lots in forex are and why they are important:

- Forex lots are units of measurement. They determine how many units of a currency you’re buying

- You can buy four types of lots in forex: standard, mini, micro, and nano

- Your position size is determined by the lot size, and the number or lots you buy or sell

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Discover how to trade forex

Learn how forex works – and discover the wide range of markets you can spread bet on – with IG Academy's free ’introducing the financial markets’ course.

Put learning into action

Try out what you’ve learned in this forex strategy article risk-free in your demo account.

Ready to trade forex?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Trade over 80 major and niche currency pairs

- Protect your capital with risk management tools

- Analyse and deal seamlessly on smart, fast charts

Inspired to trade?

Put what you’ve learned in this article into practice. Log in to your account now.