Share dealing enables you to invest in stocks, ETFs, and more. Discover how share dealing works and learn about some of its pros and cons.

Share dealing and compound growth

Many people invest because – in the past – it has led to greater returns than savings accounts. However, investing comes with more risk and past performance doesn't guarantee future results. Savings accounts have a guaranteed flat rate, whereas share prices move up and down.

Over time, share price volatility tends to smooth out, particularly when you factor in dividend payments. This is because dividend payments provide protection to offset price declines when the market goes against you.

Additionally, if you were to reinvest dividend payments when your investment performs well, each time you do so, you’ll increase the value of your holdings. This is known as compound growth.

When you receive dividends and reinvest them, you’re able to buy more shares of the same stock with those funds and it becomes a snowball effect. Think about the analogy of folding paper.

If you folded a piece of paper 42 times, it would reach the moon. So, by reinvesting dividends upon dividends, your total shareholding will automatically increase.

Remember, past performance is not a guarantee of future results. Every investment decision should be based on a thorough analysis of market conditions and the prospective investment itself.

Ways to deal shares

There are three main ways to deal shares:

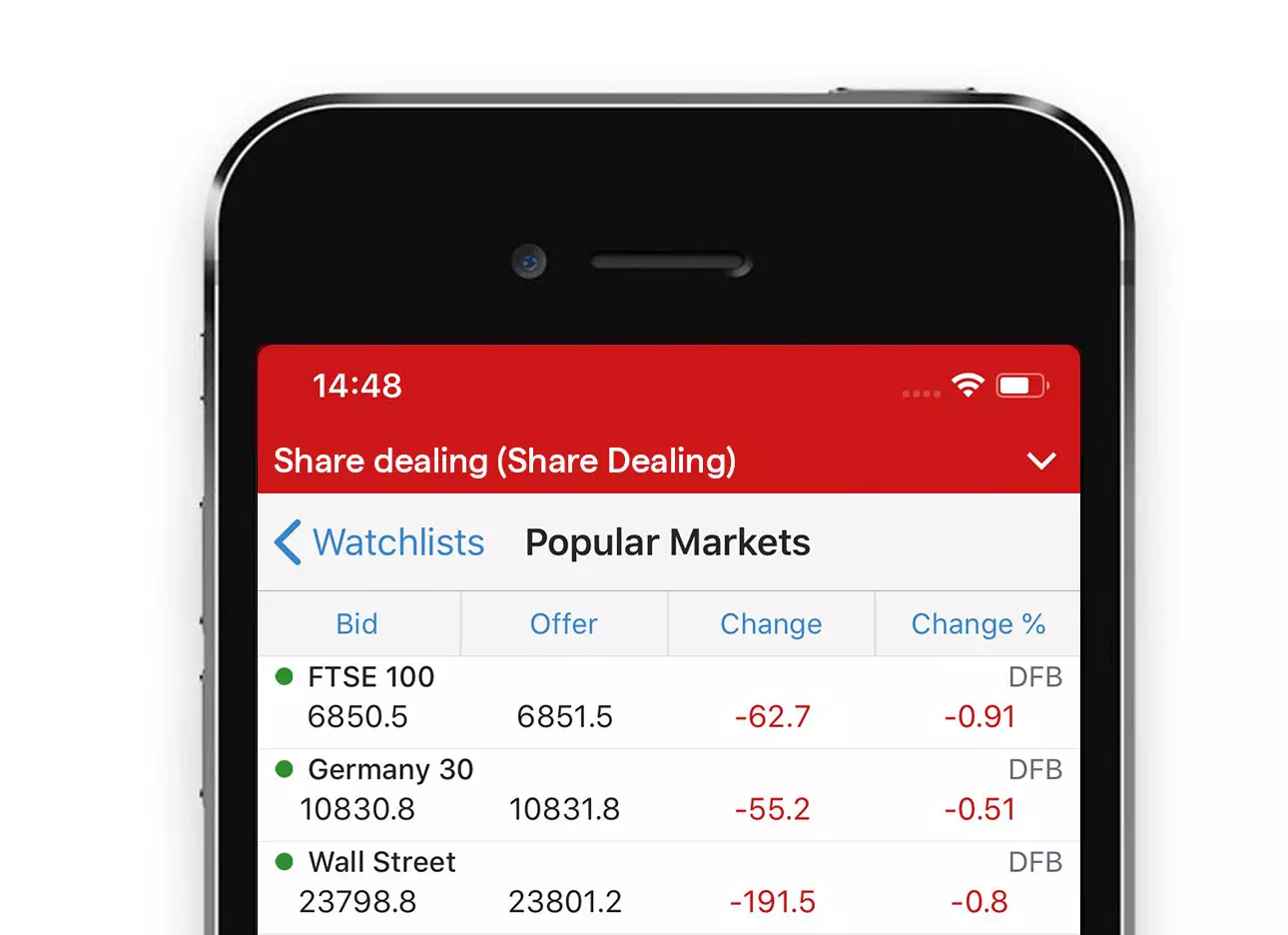

- Online share dealing is the most common way to get exposure to stocks. You’ll create an account with an online stockbroker, like us, and get access to shares listed on an exchange

- A managed share dealing account enlists the assistance of expert managers to handle your investments by creating a portfolio tailored to your liking and risk profile. You can do this via our Smart Portfolios

- Buying shares through the company can be done via direct stock purchase plans, dividend reinvestment plans (DRIPs), and employee stock purchase plans (ESPPs)

Charges and fees

Here’s a list of charges and fees that you need to consider when share dealing:

Commission – this is usually the main fee when buying and selling shares. Most brokers charge a flat commission depending on how often you trade and the type of stock you’re trading

Account charges – some brokers levy a charge based on the value of the shares or funds you own, usually as a percentage, eg 0.5%*.

FX fees for foreign shares – a standard conversion fee that charges a percentage when you buy or sell overseas shares

Deposits and withdrawals – depending on the method you use to deposit and withdraw your money, eg your bank, you may get charged upon making transactions, especially if an international transfer is required

Transfer fees – if you already own shares with a different broker and want to switch, you can transfer your investment at a small cost. It’s advisable to perform a comparison regularly to ensure that you’re with the best investment platform

Be careful to do your research before you open an account. This is because the commission charged will differ based on the location of the market, currency required, and frequency of your trading.

For example, our fees are suited for active investors. When trading US shares, you'll pay £0 commission plus 0.7% FX conversion fee.

What are the benefits and risks of share dealing?

| Benefits | Risks |

|---|---|

| Investments generally outperform interest earned from savings accounts2 | You can lose your initial investment if the share price or ETF value drops |

| You’ll buy and own an asset outright | You need to put down the full value of the position size upfront to open a position |

| You can use dividend payments to reinvest, or take it as extra income | Common stockholders only get paid after preferred shareholders, creditors and other costs have been settled |

| Get voting rights to have a say in how a company operates | Liable to pay capital gains taxes3 |

You can also get exposure to ETFs and trusts to protect your investment from being eroded if the stock market moves against you. With ETFs and trusts, you can diversify your portfolio by tracking the performance of a group of markets.

FAQs

What’s the difference between share dealing and an ISA?

Share dealing enables you to buy and sell a stake in a company, ETFs or investment trusts via a broker who’ll execute orders on a stock exchange on your behalf, while an ISA is an Individual Savings Account that offers investors substantial tax breaks.

We offer a Share Dealing ISA, which does both.

What is a share dealing account?

A share dealing account is an online investment account that enables you to get exposure to shares, funds and investment trusts.

Is share dealing tax free?

No, share dealing is not tax-free. You’re liable to pay government taxes depending on the country where the stock is listed and other taxes relating to the particular instruments you trade that are charged by the particular market. However, note that you’ll get tax benefits if you invest in a share dealing ISA.

What’s the difference between share dealing and trading?

Share dealing enables you to invest in stocks, ETFs and investment trusts, while trading lets you predict the rise and fall of the market price using derivatives such as spread bets and CFDs.

Can I withdraw from my share dealing account anytime?

Yes, you can withdraw from your share dealing account anytime you sell your investment. Once you’ve sold your holding, your cash will be available to reinvest or withdraw immediately for free with us.

Try these next

Compare online brokers that offer a share dealing account

Learn more about what a Smart Portfolio is and how it works

Discover what an ISA is and the benefits of owning the account

1 |

Trade in your share dealing account three or more times in the previous month to qualify for our best commission rates. Please note published rates are valid up to £25,000 notional value. See our full list of share dealing charges and fees. |

2 |

Barclays, 2023 |

3 |

Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK. |