What are share options and how do you trade them?

Share options are derivative contracts that give you the right, but not the obligation, to buy or sell shares. Find out how stock options work and how you can trade them with us.

What are stock options?

Stock options, called share or equity options, are contracts that give you the right, but not the obligation, to buy or sell a predetermined number of a company’s shares at a specified price, on or before the contract’s expiry date. It’s only one of the forms of options trading available.

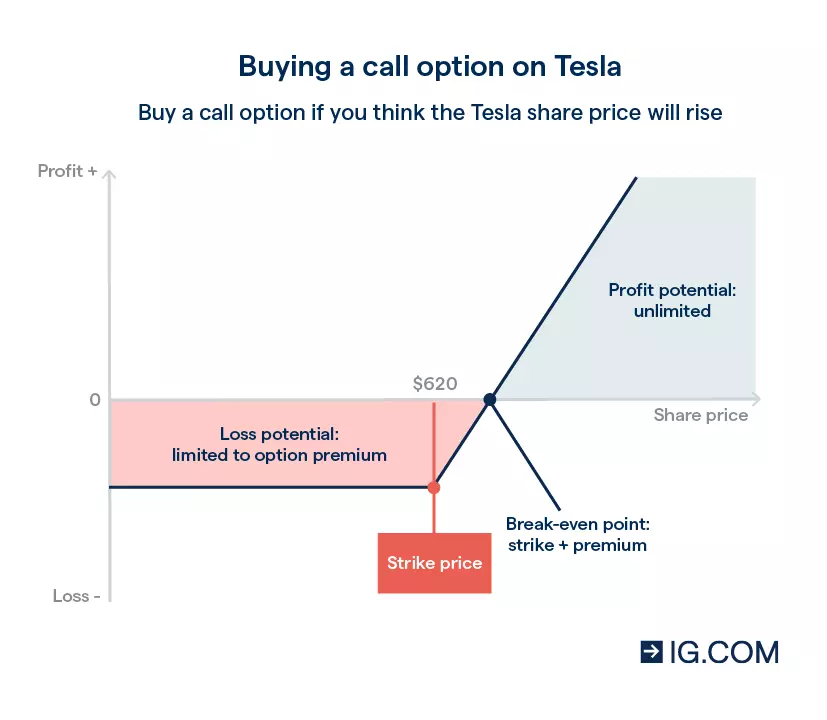

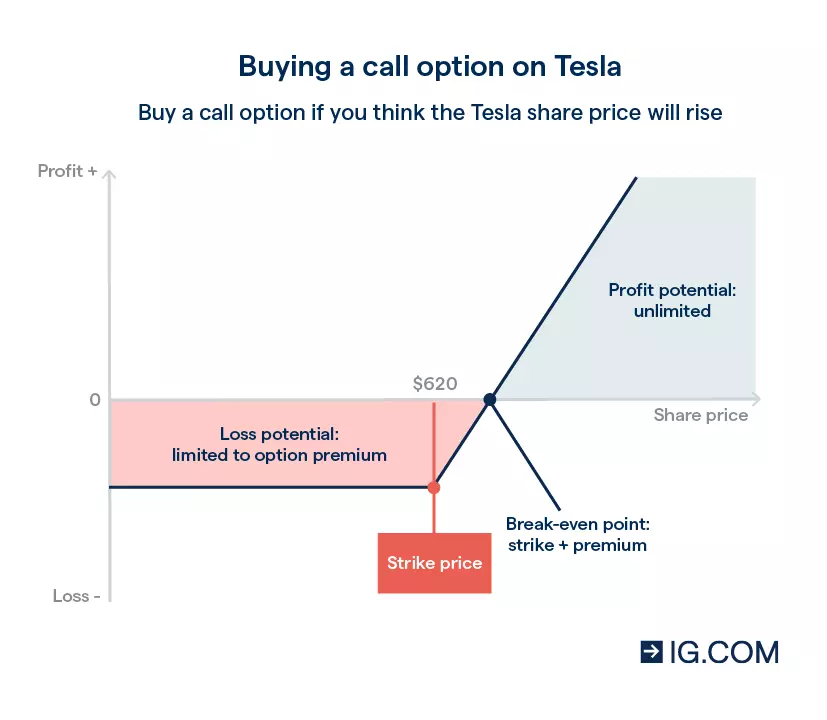

Let’s look at an example of trading share options. Say you expect Tesla’s share price to rise from $600 to $650 in the coming month. So, you decide to buy a call option at the strike price of $620 – above Tesla’s current share price but still a way from your predicted share price climb to $650. This strike price enables you to buy the stock at $620 any time before the option expires. The price you pay for the option is known as its ‘premium’.

If Tesla’s share price rises above $620, as you predicted, you can exercise the option and buy that market at a lower price. If, however, the share price remains below the strike price, you’d choose not to exercise it, and simply let it expire. In this case, your loss is limited to your premium paid.

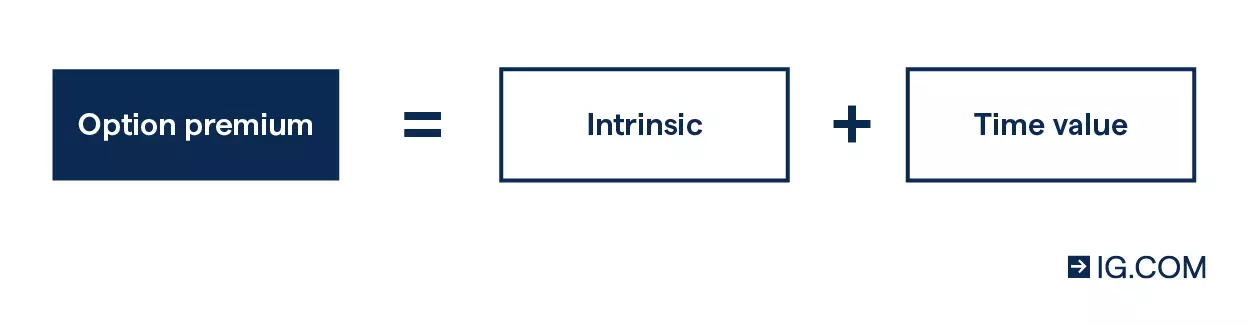

Because share prices are volatile, an option’s premium will fluctuate as the probability of that option being profitable on or before its expiry date changes.

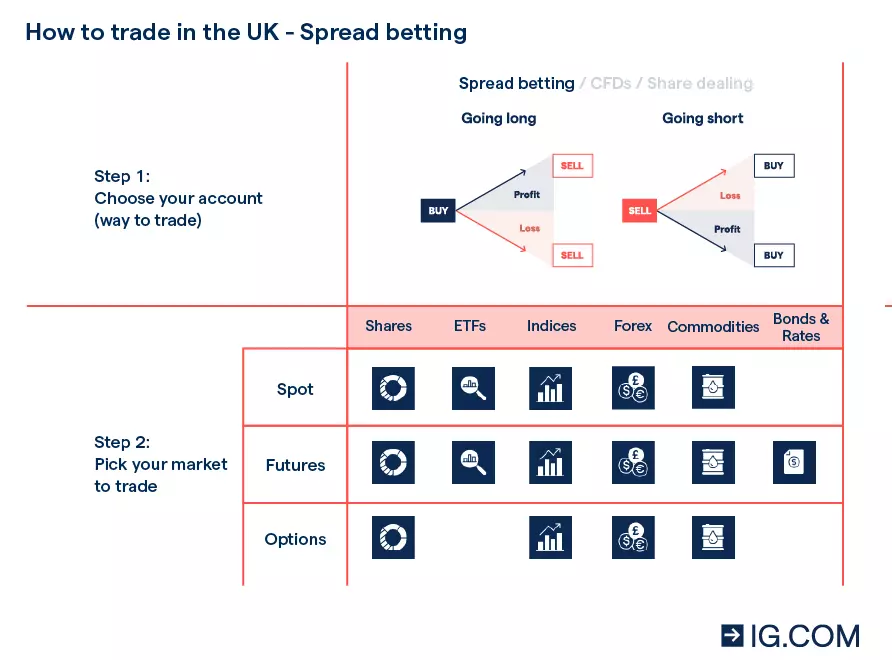

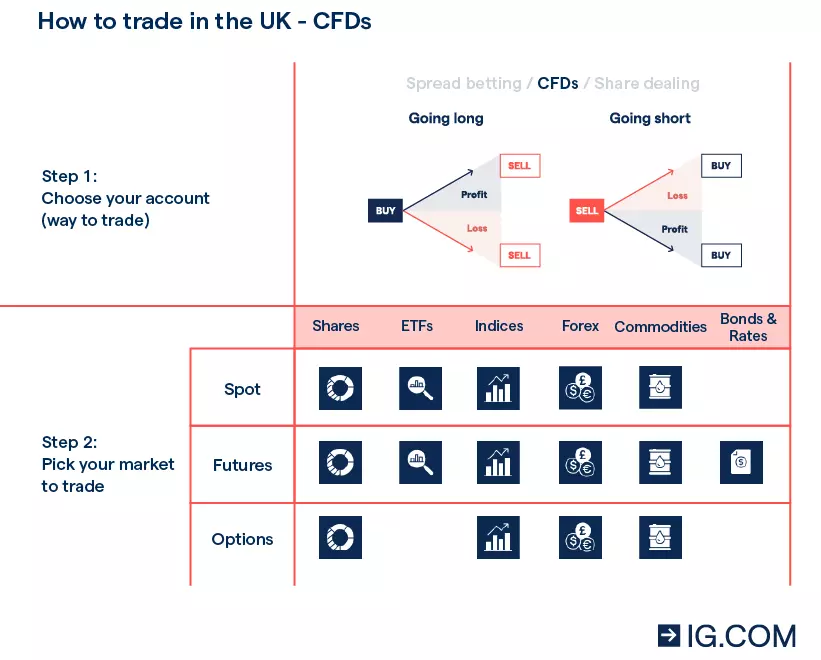

When you trade stock options with us, you’ll use derivatives – either through spread bets and CFDs, (if you want to trade over the counter (OTC).

It’s important to bear in mind that derivatives are leveraged. So, profits will be magnified – as will your losses. It also increases your trading risk, which means an effective risk management strategy is important. We explore how your risks vary between buying and selling options in more detail below.

Five key characteristics of stock options

A stock options contract has five distinct elements that define it:

1. Strike price

This is the level that determines the price at which you have the right to buy or sell shares if you exercise the contract – regardless of the current market price. The strike price can be equal to, less than or greater than the market price.

2. Contract size

The standard deliverable per stock option contract is 100 shares of the underlying. However, contract sizes may differ, for example between companies, exchanges or locations.

3. Expiry date

This is the date on which the contract ceases to be valid. With us, you can exercise options on or before this day – these are also known as ‘American-style options’. European-style options, on the other hand, can only be exercised on the expiry date itself.

4. Type of option

There are two types of options, known as calls and puts.

- A call gives you as the holder the right to buy shares at the option’s stated strike price. If the strike is below the stock’s current market price, the option holder is ‘in the money’, meaning you’re essentially buying the shares at a discount. If the strike is above the market price at expiry, the option becomes worthless

- A put is the opposite, instead giving you the right to sell shares at the stated strike price. This time, you’re ‘in the money’ if the strike is above the current market price, meaning you’re essentially selling the shares for a profit. If the strike is below the market price at expiry, the option is rendered worthless

5. Type of settlement

When trading stock options with us, positions are either cash settled or physically delivered. If cash settled, no actual shares change hands – instead, the difference between the stock’s price and the strike price is settled in a cash payment However, stock options contracts are also often physically settled. This means that real company shares are either bought or sold, and then delivered.

6. Intrinsic and extrinsic value

Intrinsic value is the difference between the asset price and strike price. For calls: asset price minus strike price. For puts: strike price minus asset price. Extrinsic value is the option's time and volatility value, present in all options before expiration.

How do share options work?

Share options work by fixing a strike price at which an agreed-upon number of shares can be either bought or sold on or before their expiry date. You can choose to buy a share option and become the option’s holder; or you can sell an option for a premium. Each comes with different advantages and risks.

Buying a share option

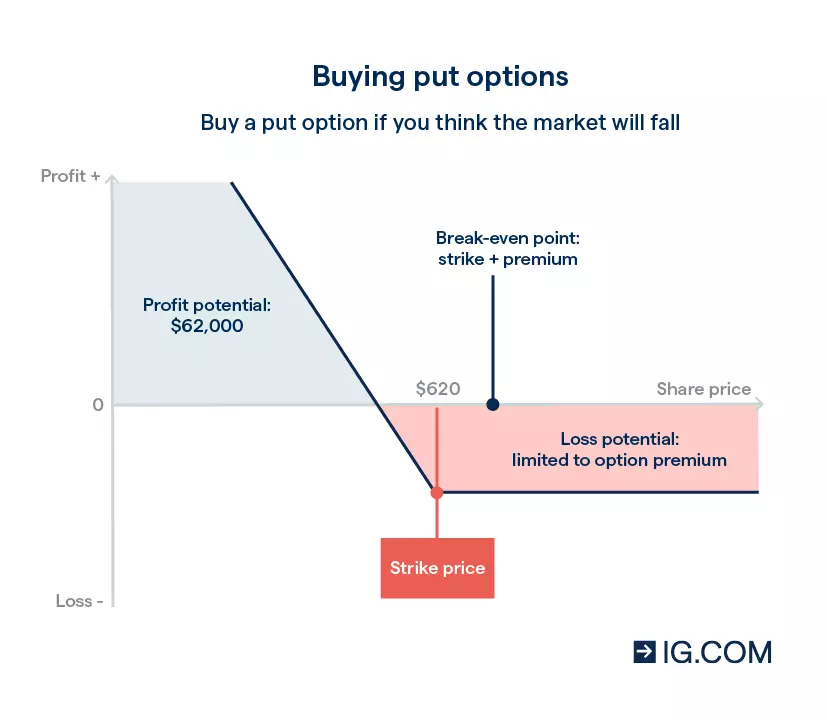

Here, you’ll purchase a call or put and pay a premium to the option’s seller. The main advantage of buying a share option in either of these is limited risk, as your risk is limited to the premium amount. You'd lose the premium paid if the strike price remains above the market price (for a call) or below the market price (for a put) at expiration.

However, it’s important to remember that you can also lose part money if you close the option (by selling it) for less than what you paid for it.

- You’ll buy a call if you think the share price will rise. You'll earn a profit at expiration if the stock rises more than the premium paid from the option's strike price. For example, if you paid $10.00 for a $100-strike call, the underlying must be trading above $110 to yield a profit. However, if the stock were trading at $105, you'd incur a $5 ($500 total) loss despite being in the money

- You’ll buy a put option if you think the share price will fall. For example, you’ll earn a profit if the difference between the strike price and the share’s market level is greater than your premium amount. For example, if your strike was $110 and your premium was $10, you’d start earning a profit when the market level is lower than $100. If the market level is $105, for example, the strike price has been exceeded, but not by enough to cover your initial outlay, so you’d incur a $5 loss

Selling a share option

Selling share options often incurs greater risk than buying. If you're long, your potential losses could be substantial if the stock’s market price moves a large distance from the strike. Your maximum potential upside is the premium you could earn from the option.

- You’ll sell a call if you think the share price will fall. Here, your risk is technically unlimited. This is because there’s theoretically no ceiling to what the share price could rise to, which you’re obligated to buy

- You’ll sell a put if you think the share price will rise. Your risk is limited to the value of the strike price, multiplied by your position size. So, say the strike is $100 and the share becomes worthless ($0), your loss is limited to $100. However, if the market level rises to above the strike price, you keep the entire the premium. If, however, you earned $10 from the premium, but the market level is at $95, you’d lose $5 of your premium

Share options: looking at the risks and rewards

| Buying options | Selling options | |||

| Buy a call | Buy a put | Sell a put | Sell a call | |

| Long or short | Going long | Going short | Going long | Going short |

| Maximum upside | Potentially unlimited | Strike price value x position size | The premium received | The premium received |

| Maximum risk | The premium paid | The premium paid | Strike price value x position size | Potentially unlimited |

Ways to trade stock options in the UK

There are three ways to take a position on stock options in the UK:

Spread betting on stock options

A spread bet on a stock option tracks the price of an underlying listed option, where you’ll bet per point on the movement of the price being traded on. For example, using a spread bet to buy a call option at £10 per point of price movement will earn you £10 for every point that the option’s value increases.

In the UK, you can spread bet on options alongside thousands of other markets, and there’s no tax to pay on your profits.1

Spread betting is the only way to trade stock options tax-free, and spread bets give you greater control over your position size than buying or selling listed options through a broker.

All spread bets are cash settled, so you never have to deliver, or take delivery of, the actual underlying shares.

Example of spread betting on a stock option

Let’s say that you expect options on Tesla, with a strike price of 54.00, to rise 10 points over the next few weeks. So, you buy a call option worth £10 per point. With us, you’ll open your position by depositing a margin amount equal to the option’s listed premium.

When you’re using spread betting to trade on the stock option, you’re staking an amount of capital per point of movement in the underlying option’s price. In this example, because you bet £10 per point on its price rising, you could make £100 (10 points movement x £10 per point) if your prediction is correct.

It’s important to remember that if the share price stays below the option’s strike of 54.00, the option will expire worthless. In this scenario, your losses will be capped at the premium (or margin) you paid to open your position.

CFD trading on stock options

As with spread bets, when you trade stock options with CFDs, your trade mirrors the underlying options market. The main difference is that, instead of betting per point as in spread betting, CFD options are traded in contracts that are worth a selected amount.

For example, if you buy a CFD on a call option worth $10 per point, the number of contracts you buy will multiply that amount. So, if you bought five contracts, you’d earn $50 per point the call option’s price moves beyond the strike, minus your margin.

It’s important to remember that trading with CFDs gives you less control of your deal size than spread betting does.

CFDs are subject to capital gains tax (CGT), though losses can be offset from profits.2 This ability to offset losses from profits for CGT purposes means that CFDs can be used to hedge against the depreciation of stocks in your existing portfolio.

All CFD trades are cash settled, just like spread bets. So, you’ll never have to deliver, or take delivery of, actual shares.

Example of CFD trading on a stock option

Let's say you decide the Tesla share price will rise from its current share price at$775 to $850. So, you’d buy a call option with a strike price of $800. If Tesla on expiration day of the option is at $850, the option is worth $5000 ($50 x 100).

One option represents 100 shares, which why we multiply the options (worth $50 each) by 100. The margin is the premium you pay for the option.

Why trade share options?

- Options provide leveraged exposure. When buying an option, you're gaining exposure to an underlying at a fraction of the contract's notional value in exchange for paying a premium. This premium is your maximum risk if the option expires out of the money and is worthless

- When buying an option, you set your own maximum risk when choosing the premium you’re willing to pay

- Stock options can be used to hedge against losses in an existing share portfolio. For example, you can buy a put if you expect the value of a share to decrease. Alternatively, you can sell a call to short the market, but this incurs significant risk – which is potentially unlimited

Understand how stock options work

Options are particularly complex instruments. Before trading options, ensure that you understand how they work, how they’re priced, and what risks you face as a buyer or seller.

Additionally, make sure to research the stock you want to take a view on, and determine your predicted price level. This’ll set your strike price and premium.

Find out more about options, and see the difference between options and futures.

Learn what moves option prices

The value of a stock options contract will typically fluctuate during its lifespan, depending on the price of its underlying security, the time left until expiry, and the volatility of the market. Other variables like interest rates also influence its value.

Option pricing is mathematically sophisticated. But, it can be divided into two core components:

- Intrinsic value – the current relationship between strike price and the price of the underlying. As an option goes deeper in the money, it becomes more valuable because of intrinsic value

- Extrinsic value – time left to expiry and the volatility of the underlying. The more time left to expiry, the greater the chance that the option will become in the money. Moreover, the greater the volatility of the underlying stock, the more uncertainty (and therefore risk) is carried by the option seller, pushing the premium up

Spread bets are traded per point of price movement, which enables for more control over your position sizes, so you can potentially trade smaller amounts if you’d like to. Spread betting is completely tax free, too.1

As CFDs are traded in contracts, you’ll deal in standardised lots of 100 shares per CFD, which essentially functions much like trading listed options does. However, you’ll also be exempt from stamp duty in the UK.1

Create a trading account

Open a spread betting or CFD account via our online form to trade on our award-winning platform,2 with no obligation to add funds until you want to place a trade.

You’ll get access to over 17,000+ popular markets, plus round-the-clock phone support and lower minimum deal sizes for your first month. Note that not all markets are available to options traders.

Alternatively, you can practise trading first in our risk-free demo account.

Determine your preferred expiry date

The longer the time left to expiry, the more time value an option has, which means its premium is higher. Knowing how long you want to hold an option for is a fundamental aspect of options trading. This is especially important because the time value of an option decays more quickly as it nears expiry – thereby dropping the premium at an increased pace.

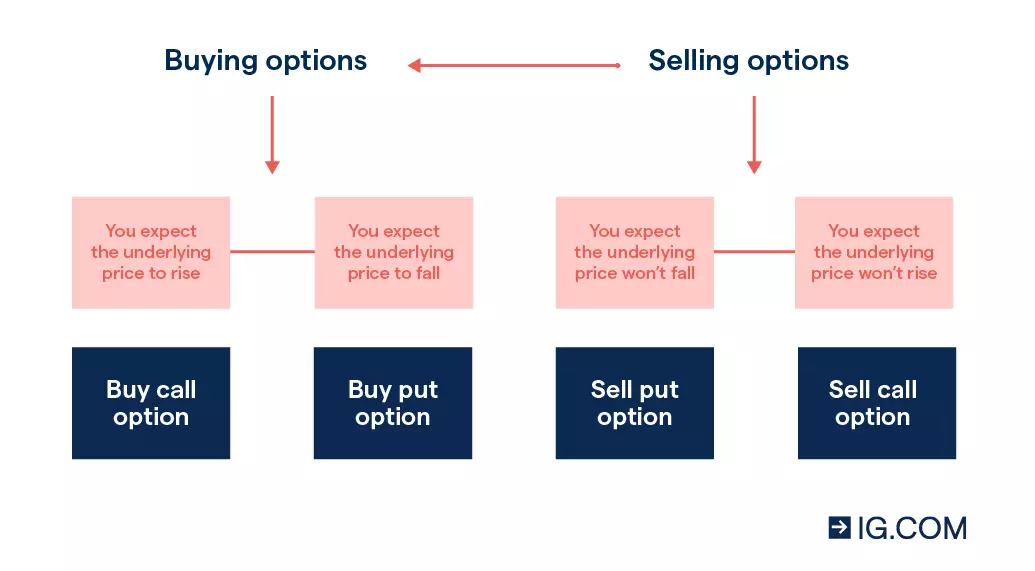

Decide whether to buy or sell calls or puts

You have more strategies available to you, and you can go long, short, or non-directional (if you think the price will move sideways). Call and put options are the two types of options, and more complex strategies simply combine these two types of options from the long (bought) or short (sold) side

When trading underlying options using spread bets or CFDs, you can be bullish in two ways – buying a call option or selling a put option. Likewise, you can be bearish in two ways – buying a put or selling a call.

Each has its own advantages and risks. If you sold a call, your profit potential is limited to the option’s premium amount. However, your loss potential is theoretically unlimited, so be sure to have a risk management strategy in place.

Open and monitor your position

First, you’ll go into either your chosen platform, depending on which trading instrument you’ve chosen to use for options. Once you’ve selected which shares to trade and whether to buy or sell calls or puts, click ‘place deal’ in the deal ticket.

This’ll automatically open your trade and, from here, you can watch the trade in real time to see how you’re doing. In fact, you can monitor all your open trades within our award-winning platforms.2

When you’re comfortable with the profit you’ve made – or want to limit any more losses – you’ll close your position by clicking the ‘close’ button.

You can also get to know trading stock options better and build your confidence in a risk-free environment by opening a demo account, where you’ll practise with £10,000 in virtual funds.

FAQs

How can I trade stock options in the UK?

You can trade several listed stock options with us on our platform, via futures account or via financial derivatives: spread bets and CFDs. Derivatives mirror the underlying the options market, giving you exposure to a variety of popular stock options.

Options trades are either cash settled or physically settled, depending on which instrument you use to trade them.

Can I use options for hedging?

Yes, you can. If you think a stock in your portfolio is going to depreciate, you don’t have to sell it. Instead, you can open a short position (buying a put or, with more risk, selling a call) using a stock option. This enables you to keep your investment stocks, while offsetting any potential losses by hedging.

You can hedge with stock options using either spread bets or CFDs. CFDs have the additional advantage of being able to be used for capital gains tax purposes – ie offsetting losses against profits.1

Are options limited risk?

Different types of options have different degrees of risk involved.

When buying options, your risk is limited to the premium paid. When selling a put, your risk is larger, but limited to the strike price, multiplied by your position’s size.

When selling a call, though, your risk is technically unlimited, as there’s no limit to how high a share price can climb. So, it’s important to understand and manage your risk before opening a position on a stock option.

Try these next

Learn the basics of trading and investing in shares with us.

Find out how to trade cash (spot) markets with us – and why you should.

1 Applies to UK spread betting. Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

2 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

3 Based on revenue (published financial statements, 2023).

4 Best platform for the active trader, best multi-platform provider and best trading app as awarded at the ADVFN International Financial Awards 2024. Best share dealing platform as awarded at the YourMoney.co.uk Investment Awards, 2024.

5 In the UK only. Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.