Ever wanted to start trading, but simply didn’t know where to begin? We’ve put together a guide on how to get started. Learn how to get into trading with us, the world’s No.1 provider.1

8 steps to start trading

Understand how trading works

Trading is the buying and selling of an asset of your choice – be it indices, shares, forex or commodities – without owning the underlying instrument. With us, you can trade using spread bets or CFDs. Trading is different to investing in many ways; we’ll unpack it below.

Ways to trade in the UK

With us, you can trade by using two types of accounts – one for spread bets and another for CFDs. These are leveraged derivatives that enable you to get full exposure to the value of the underlying asset at a fraction of cost, by using a deposit called margin. Leverage will result in magnified profit or loss, it’s important to ensure you manage your risk carefully.

Spread betting account

Bet on points per movement, in either direction. You’ll earn a profit if the market moves in line with your prediction and make a loss if it moves in the opposite direction.

CFD trading account

Buy or sell contracts to exchange the price difference of a financial instrument between the open and close position. As with spread bets, your profit or loss will depend on the outcome of your prediction.

Note that if you want to buy and own company shares outright, you’d invest via our share dealing platform.

Ways to invest in the UK

You can use a share dealing account to invest in stocks, exchange trade funds (ETFs) and investment trusts with us. Share dealing is the buying and owning of assets outright, which is usually done with the intention to make a profit or earn an income from dividends.

When you buy shares, you’re buying a shareholding or part-ownership of the asset. And, unlike when trading derivatives, you’ll have to pay the full value of the asset you want to buy upfront.

Share dealing

Choose to buy and sell shares from over 10,000 different companies, investment trusts and exchange traded funds on our share dealing platform. You can hold shares for as long as you like and sell them at a time most suitable to you.

Smart Portfolios

No matter what your investment goals are, you can find an expertly managed IG Smart Portfolio that suits you. We can give you institutional-quality portfolios that cater to five distinct risk profiles, from conservative to aggressive.

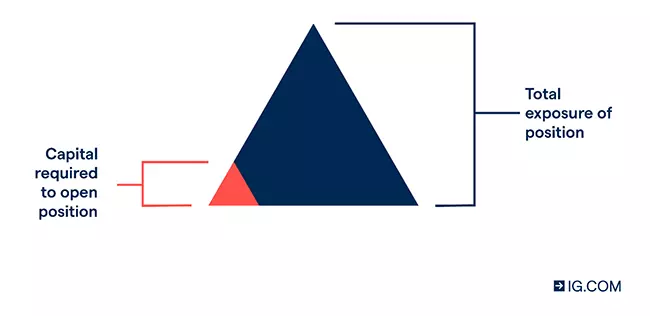

Leverage and margin 101

Leverage is a tool used when spread betting and trading CFDs. It enables you to open a position using margin (a deposit) while still getting full exposure to an underlying asset. This means you’re paying an initial deposit, that’s a fraction of the full value of your trade, with your provider loaning you the rest.

For example, at a margin requirement of 20%, you’d need to deposit £200 to open a shares position worth £1000. In the case of indices, a 5% margin would require a £50 to open a position at £1000. And for forex, a 3% margin requirement would need you to deposit £30 to open a position worth £1000.

Trading on margin comes with risk, because the position is still based on full exposure. This means you can gain or lose money quickly, which is why you should set free stops on all positions to ensure you don’t lose more money than you’re comfortable with.

If you don’t set stops, you could be placed on margin call and your positions might be closed out automatically. However, note that our margin policy doesn’t guarantee against your capital running into a negative balance.

For standard trading accounts, the margin call will be triggered when your equity drops below 50% of your initial deposit requirement. We’ll do our best to contact you when your equity drops beneath 99%, 75% and 55% of margin, respectively. However, it’s your responsibility to ensure your account has sufficient funds.

To avoid your position from being closed, transfer enough funds into your account to increase your equity above the margin requirement, or just close positions to reduce it.

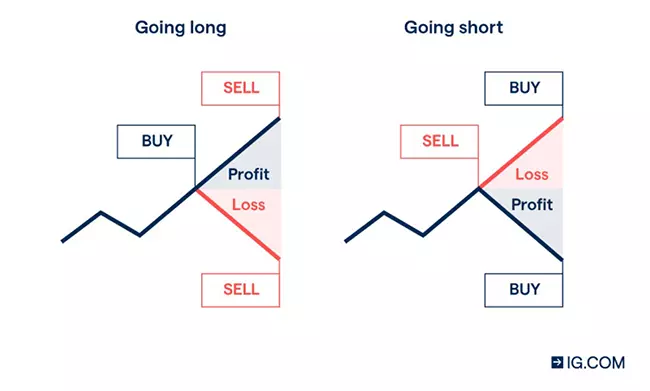

You can trade rising and falling prices

When trading, you can speculate on rising or falling asset prices. You’ll buy (go long) if you think the asset’s price will rise, and sell (go short) if you think it’ll fall. So, if you go long and the price rises, you’ll make a profit – but if it falls, you’ll make a loss. The opposite is true when you open a short position.

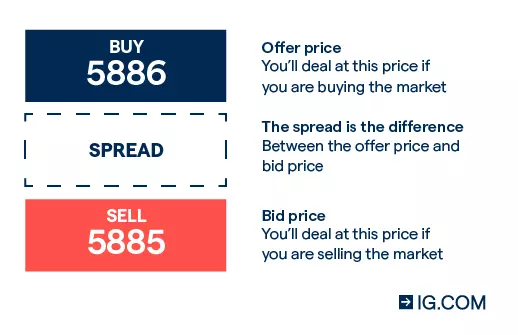

What is the bid-ask spread?

A spread is the difference between the bid (sell) and ask (buy) price that’s quoted for an asset. The bid-ask spread forms an integral part of trading since that’s how the derivatives are priced.

By applying a spread, the asset’s buying price will be a bit higher than the underlying market price and the selling price a bit lower.

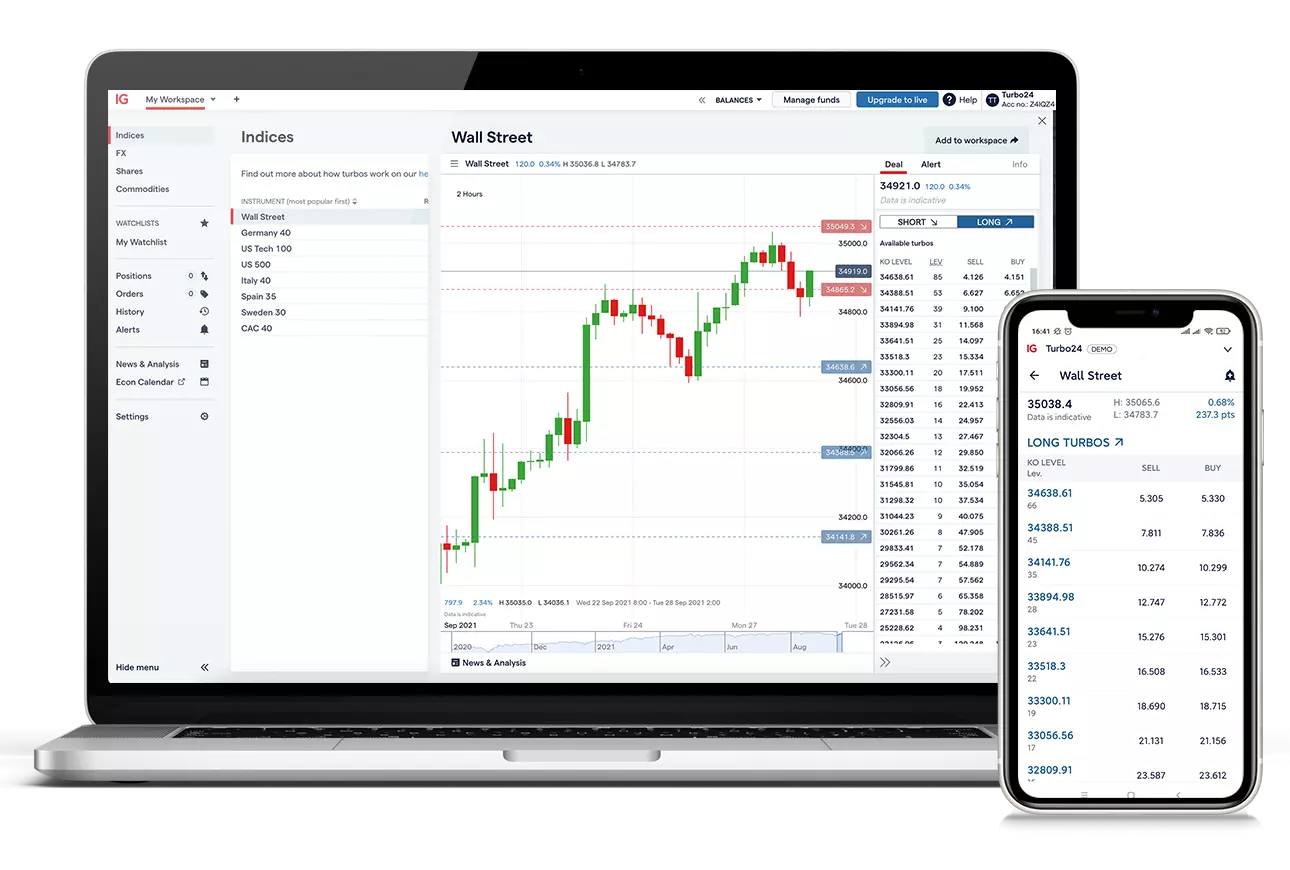

Why a top trading platform is important

A good trading experience is essential – and we offer various tools and resources to make sure you can trade how and where you want. We’re the UK’s No.1 trading provider and we offer an award-winning platform and mobile app.1

You’ll have access to price charts to track the performance of numerous asset classes across more than 15,000 financial markets worldwide. Our platforms also offer technical indicators and a Reuters news feed – plus, we give you access to IG Academy, expert webinars and seminars, and more.

See examples of trades and how they work

Below are some examples that can help you understand how trading works:

- Spread betting on shares example

- CFD trading on commodities example

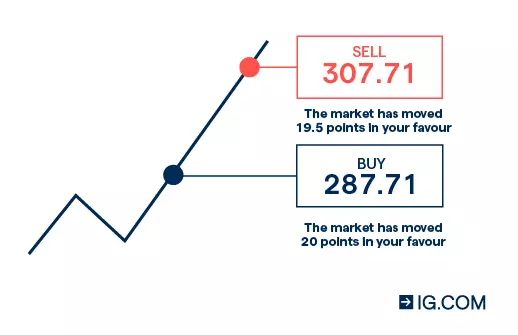

Let’s use UK supermarket giant Tesco as an example to demonstrate how spread betting on shares works. If Tesco’s stock was trading at a mid-price of 287.21, a one-point spread either side would result in a 287.71 ask price and a 286.71 bid price.

If you open a long spread bet position on Tesco by buying at £10 per point of movement at 287.71p, and the stock has a 20% margin requirement, you’ll need a deposit of £575.42 (£10 x 287.71p x 20%).

If your shares spread bet was correct

If Tesco shares rose to a sell price of 307.71, you might consider closing your spread bet position at this new price. The market moved in the same direction as your prediction by 20 points (307.71 – 287.71), meaning you’ve made a profit of £200 (20 x £10). There’s no tax payable on any gains you make, but you’d have to pay charges if you kept your position open overnight.2

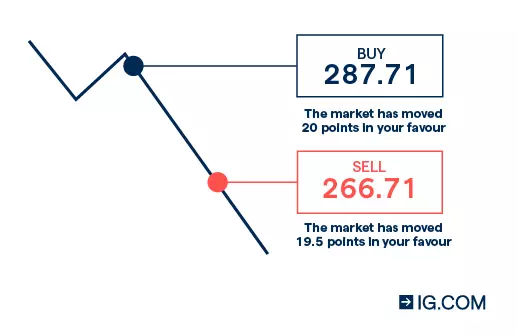

If your shares spread bet was incorrect

On the other hand, assume Tesco shares dropped to a new sell price of 266.71. Since the markets moved against you by 21 points (266.71 – 287.71), you’d make a loss of £210 (210 x £10), plus any additional funding charges.

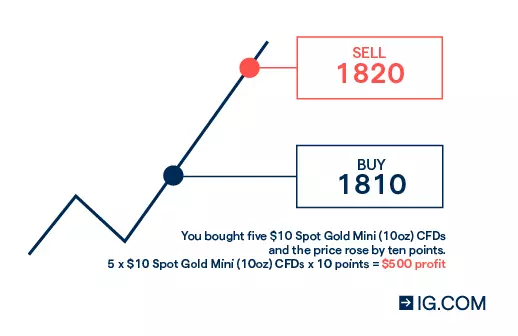

If your CFD trading prediction is correct

Let’s say, after some research on commodities, you believe the spot gold price will increase from its current level of 1809.75.

You decide to take a position by buying five ‘Spot Gold Mini (10oz)’ CFDs, each with a contract size of $10 per point of movement, making it a total of $50 per point (5 CFDs x $10). The current buy price is 1810, which is a little higher than the underlying market price because of the spread.

The margin factor of spot gold CFDs is 5%, which means to open a position worth $90,500 you’d require a margin deposit of $4525 ($50 x 1810 x 5%).

If there’s a rise in the spot gold price that increases its value to 1820.25 and you decide to close your position at 1820, you’d make gains of $500 (10 points x $50) if the market moved in your favour by 10 points. This excludes other costs.

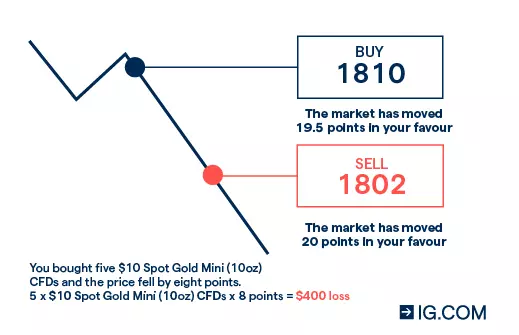

If your CFD trading prediction is incorrect

On the other hand, if the spot gold price dropped to 1802.25, you’d make a loss. You’d lose $400 (8 points x $50) - excluding any other charges - if you were to close the position at the new sell price of 1802.

Research the available markets you can start trading

With us, you’ll get access to over 15,000 international markets. You can also benefit from out-of-hours trading that’ll give you access to more markets and opportunities.

Some of our exclusive weekend markets include weekend GBP/USD, FTSE 100, Wall Street and Germany 40. These markets can help you to mitigate your risk by hedging your weekday trades against a weekend position on the same market.

Below are the most popular markets you can trade with us:

- Shares: go long (‘buy’) or short (‘sell’) on over12,000 shares, like Apple, Tencent and Lloyds

- Indices: trade over 80 global indices, including the FTSE 100 and the S&P 500

- Forex: get exposure to more than 80 forex pairs, including majors like USD/GBP and EUR/USD, as well as minor and exotic pairs like SGD/JPY and GBP/TRY

- ETFs: choose from over 5400 ETF markets, covering indices, sectors, commodities and more

- Bonds: trade a variety of government or corporate bonds

- Commodities: buy and sell 35 different types of commodities, such as gold, oil or orange juice

- Interest rates: take a position on the future short-term (quarterly) direction of a range of global interest rates

- IPOs: buy IPO stocks before and after they list on various exchanges across the globe

- Themes: trade the future with themes like electric vehicles, AI and robotics

Know the risks of trading and how to manage them

It’s vital to understand the risks of trading, and to take the necessary steps to manage them effectively. Fortunately, we provide several tools to help you manage your risk, including stop-losses and limit orders.

What are the risks of trading?

There are number of risks associated with trading. Since spread bets and CFDs are leveraged products, they give you increased exposure to the underlying asset at the fraction of cost.

However, any losses you make will be based on the full position size and could exceed your initial deposit – it’s important to use our risk management tools to mitigate this.

Risk management tools

There are a number of risk management tools you can use when trading, such as stops (also called stop-losses) and limits.

- Stop-loss orders will automatically close your position if the market moves against you. However, there’s no guarantee they’ll protect you against slippage

- Guaranteed stops offer complete protection, closing your position at the exact price you’ve specified. Note that, when this stop is triggered, you’ll be charged a premium

- Price alerts help you to keep track of market activities. This’ll be done by sending push notifications or emails notifying you on when a specified market level is reached

Note that FCA-regulated negative balance protection means your account will be restored back to zero – for free.3

Learn more about trading styles and strategies

Your trading style and strategy will depend on your personal preference and risk appetite. We’ve outlined some of the most popular styles and strategies below.

- What is a trading style

- What is a trading strategy

A trading style is the preference you have when it comes to the frequency of your trading activities, ie whether you’re looking trading over the long or short term. You can adapt a style based on the behaviour of the market you’d like to trade.

| Trading style | Timeframe | Holding period | Trading volume | Further resources |

| Position trading | Long term | Weeks, months or years | Low | Learn more |

| Swing trading | Medium term | Days to weeks | Medium | Learn more |

| Day trading | Short term | Intraday | High | Learn more |

| Scalping | Very short term | Seconds to minutes | Very high | Learn more |

A trading strategy is a plan you’ll use to analyse market performances and keep track of its prices. Analytical tools like fundamental and technical analysis are useful here. Trading styles and strategies aren’t the same. The style is the main plan on the trading frequency, while the strategy is the method you’ll use when opening and closing your positions.

While fundamental analysis will help you with predicting shifts in prices, most strategies concentrate on tracking particular technical indicators.

Fundamental analysis will measure a company’s intrinsic or actual monetary value by taking into consideration certain economic and financial factors like its balance sheet, management forecast and macroeconomic markers.

Technical indicators are maths computations plotted on price charts as lines. They’re useful in assisting traders to detect market signals and trends.

| Trading strategy | Core characteristics | Further resources |

| Trend trading | Used for medium and long-term positions. Tries to find market rises and falls (trends) and adopts long or short positions. Ideal for position and swing trading styles. | Learn more |

| Range trading | Used for short and very short-term positions. Traders seek to trade on price oscillations that taking place within known ‘support’ and ‘resistance’ level ranges. Ideal for day and scalping trading. | Learn more |

| Breakout trading | Used for short and medium term positions. Prices deviating or ‘breaking out’ from a normal range of fluctuations are used as signals to open positions. Ideal for day and swing trading. | Learn more |

| Reversal trading | Can last for varying lengths of time. Based on identifying reversal points in present upward or downward trends. A reversal marks a key turning point in market sentiment. Ideal for position and swing trading. | Learn more |

Create a trading plan

A trading plan is a comprehensive decision-making tool you’ll use when buying and selling assets. It’s helpful in assisting you to make a decision on what asset to trade, when to do so and how much to spend on this. This plan should be personal to you and must be adapted to factor in your attitude to risk and the amount of capital you have at your disposal.

Start trading on a practice account

You can open a free demo account with us to put your newly acquired trading knowledge to the test. This is a risk-free environment that enables you to cut your teeth into trading using £10,000 worth of virtual funds. Once you’ve gained enough confidence and you’re familiar with trading on the platform, you can decide to upgrade to a live account.

Get into trading by opening your live account

Once you’ve practised trading with a demo account and you feel you’ve refined your trading skills and plan, you can open a live brokerage account with us. You’re under no obligation to deposit funds immediately.

Here’s how to open your live trading account:

- Fill in a form. You’ll be asked about your trading knowledge to ensure you get the best experience

- Get verification. We can usually verify your identity immediately

- Fund your account and start trading. Deposit funds into your account so you can start your trading journey. There's no minimum deposit. You can also withdraw your money whenever you like for free

FAQs

What is trading?

Trading is the buying and selling an asset of your choice – be it indices, shares, forex or commodities – without owning the underlying instrument. With us, you can trade using spread bets or CFDs. Trading is different to investing.

How do I start trading?

To start trading, you can open a demo or live account with us. There, you’ll get access to the trading platform and the various markets. However, it’s important to learn as much as you can about financial trading before you commit your capital.

You can get access to our free online courses on IG Academy to learn more about what trading is and how it works. To improve your confidence as a trader, you can practise using the £10,000 virtual funds in a risk-free environment. Once you’re comfortable with trading, you can open a live account with us.

What risks should I know about before getting into trading?

There are number of risks associated with trading. Since spread bets and CFDs are leverage products, they give you increased exposure to the underlying asset at the fraction of cost. However, any losses you make will be based on the full position size and could exceed your initial deposit – it’s important to use our risk management tools to mitigate this.

How can I learn more about trading?

You can learn more about trading by taking online courses on IG Academy – for free. Plus, you can make use of articles in the ‘Strategy and planning’ section under the ‘Analyse and learn’ tab on our website.

Try these next

Learn how to trade online in the UK, and access markets such as shares, indices, forex and commodities

Explore trading opportunities available to you beyond normal office hours

Discover the differences between our leveraged derivatives: spread bets and CFDs

1 Best trading platform as awarded at the ADVFN International Financial Awards 2021 and Professional Trader Awards 2021.

2 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

3 Negative balance protection applies to trading-related debt only and is not available to professional traders.