Open a position using just a fraction of the capital – with spread bets and contracts for difference (CFDs). These leveraged products share many benefits, yet each has unique advantages. Discover which could work best for you.

Written by Anzél Killian, Senior Financial Writer. Reviewed by Axel Rudolph, Senior Market Analyst

Spread betting vs CFD accounts

CFD trading

No stamp duty; CGT applies but losses can be offset against profits for tax purposes*

Commission-free except for shares and ETFs

Trade in underlying market currency

Spread betting

Most popular

Tax-free - keep 100% of your profits*

Zero commission and flexible position sizing - from 3p per point

Trade in GBP to avoid FX risk or charges

* Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

Why spread bet?

- No capital gains tax*

- No commission, just our spread

- Bet easily in your chosen currency – have greater control of currency exposure

- Deal on rising and falling markets

- Leveraged access to the markets

- No stamp duty

- 24-hour dealing

- Use prices based on the underlying market

Why trade CFDs?

- Direct market access (DMA) on shares

- Losses can be offset against profits for tax purposes

- Deal on rising and falling markets

- Leveraged access to the markets

- No stamp duty

- 24-hour dealing

Leverage can magnify both your profits and losses as they’ll be based on the full exposure of the trade, not just the margin required to open it. This means losses as well as profits could far outweigh your margin, so always ensure you’re trading within your means.

Spread betting vs CFDs: key differences

The key difference between spread betting and CFD trading is how they are taxed. Spread bets are free from capital gains tax, while profits from CFDs can be offset against losses for tax purposes. You don't pay stamp duty with either product because you don’t take ownership of the underlying assets when you trade.

You can go long or short with both products, though there are technical differences in how they work:

- Spread betting stakes an amount of money per point of price movement in the underlying asset. For example: if you thought the Ocado share price would rise, you could go long at £50 per point of movement. If the price rose by ten points – equal to 10p – you’d profit £500 excluding additional costs. Conversely, if it fell by ten points, you’d lose £500.

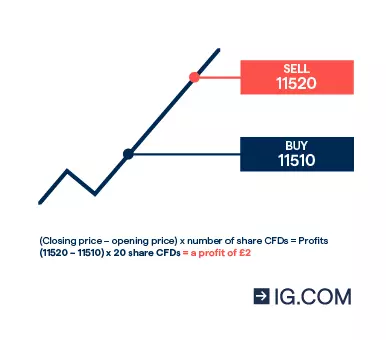

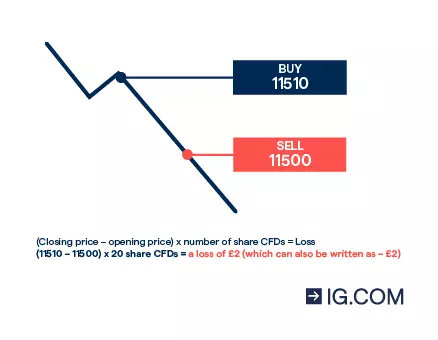

- CFD trading exchanges the difference in price from the point at which the contract is opened to when it is closed. For example, if you thought the Ocado share price would rise by 10 points from an opening price of 11510 to a closing price of 11520, and you could buy 20 share CFDs of Ocado – the equivalent of buying 20 Ocado shares – you’d profit £2, excluding commission fees. However, if the Ocado share price fell by 10 points from 11510 to 11500, you’d lose £2.

All spread bets have a fixed expiry date, while CFDs don’t expire (with the exception of futures).

When it comes to risk, spread bets and CFDs are both leveraged derivatives. Leverage lets you receive full market exposure for an initial deposit, known as margin. While this can help to maximise your potential profits, it can also increase your potential losses.

Before you open a position with spread bets or CFDs, it’s important that you take steps to manage your risk.

Take our free, interactive course

Learn about the advantages of spread betting and CFD trading – and see how you can get started – with IG Academy’s short online course.

Take our free, interactive course

Learn about the advantages of spread betting and CFD trading – and see how you can get started – with IG Academy’s short online course.

Is spread betting or CFD trading best for me?

If you’re experienced in the financial markets, both spread betting and CFD trading can bring variety and range to your portfolio. With either product you could see enhanced profits thanks to leverage – though any losses will be accelerated too. See a full comparison in the table below.

Spread betting could be for you if you want to...

- Take any profits tax-free*

- Control the size of your deal

- Deal shares in smaller sizes without being penalised by a minimum commission

- Trade all international markets in sterling

- Take a longer term view on forex and shares with forward markets

CFD trading could be for you if you want to...

- Find a product that feels similar to trading the underlying market, with the same terminology

- Use DMA for shares trading, while getting our OTC benefits

- Offset your losses against profits as a tax deduction

- Get a corporate trading account

- Hedge physical assets in your portfolio

- Use the tax-deductible benefits of CFDs to hedge efficiently

CFD vs spread betting: product differences in detail

| Spread betting | CFD trading | |

| What is it? | Placing a bet that allows for a range of outcomes | Trading a financial derivative – you deal on prices derived from the underlying market, not on the market itself |

| Are there expiries? | Expiry dates far in the future | No expiry dates (excluding forwards) |

| Do I pay tax? | You don’t pay capital gains tax or stamp duty* | You don’t pay stamp duty, but you do pay capital gains tax. However, losses can be offset as a tax deduction |

| When can I trade? | 24-hour dealing on forex and major stock indices. During the underlying market hours for other markets. You can also trade selected markets on weekends | 24-hour trading on forex and major stock indices. During the underlying market hours for other markets. You can also trade selected markets on weekends |

| Do I pay to keep positions open? | Overnight funding on daily funded bets. Rollovers on forwards and futures | Overnight funding on all markets, except futures. Rollovers on futures |

| Does IG profit if I lose? | We profit mainly from spreads and funding, and hedge the majority of net client exposure. We accept a low level of risk, which means we can make a small profit or loss | We profit mainly from commission, spreads and funding, and hedge the majority of net client exposure. We accept a low level of market risk, which means we can make a small profit or loss. The outcome of a client’s DMA trade never has an impact on our profit or loss |

| What kind of trading is it suitable for? | Intra-day, daily and medium-term |

Intra-day, daily and medium-term |

| Can I receive dividends? | We make a dividend adjustment on equity and stock index spread bets | We make a dividend adjustment on equity and stock index CFDs |

| Can it be used for hedging? | Yes, but CFDs can be more effective because of their tax-deductible benefits. | Yes |

| Can I open a corporate account? | No | Yes, we offer corporate accounts |

| Range of markets | More than 15,000+ markets, including: Forex Stock indices Shares ETFs and ETCs Metals Energies Spot metals Soft commodities Options Interest rates Bonds Sectors Share forwards Forex forwards Daily stock index futures Stock index futures Daily oil futures |

More than 15,000+ markets, including: Forex Stock indices Shares DMA shares ETFs and ETCs Metals Energies Spot metals Soft commodities Options Interest rates Bonds Sectors Stock index futures |

| The mechanics of dealing | You define the size of your deal by selecting the amount you want to bet per point of movement (£/pt). Profits and losses realised in currency you bet in | You define the size of your deal by selecting the number of contracts or shares you want to trade. Each contract has a fixed value. Profits and losses realised in traded market’s base currency. GBP contracts available |

| The charges | A spread on all markets. No commission. Funding adjustments (excluding futures and forwards) | A spread on all markets except shares. We charge a commission on share CFDs, but no spread. Funding adjustments (excluding futures) |

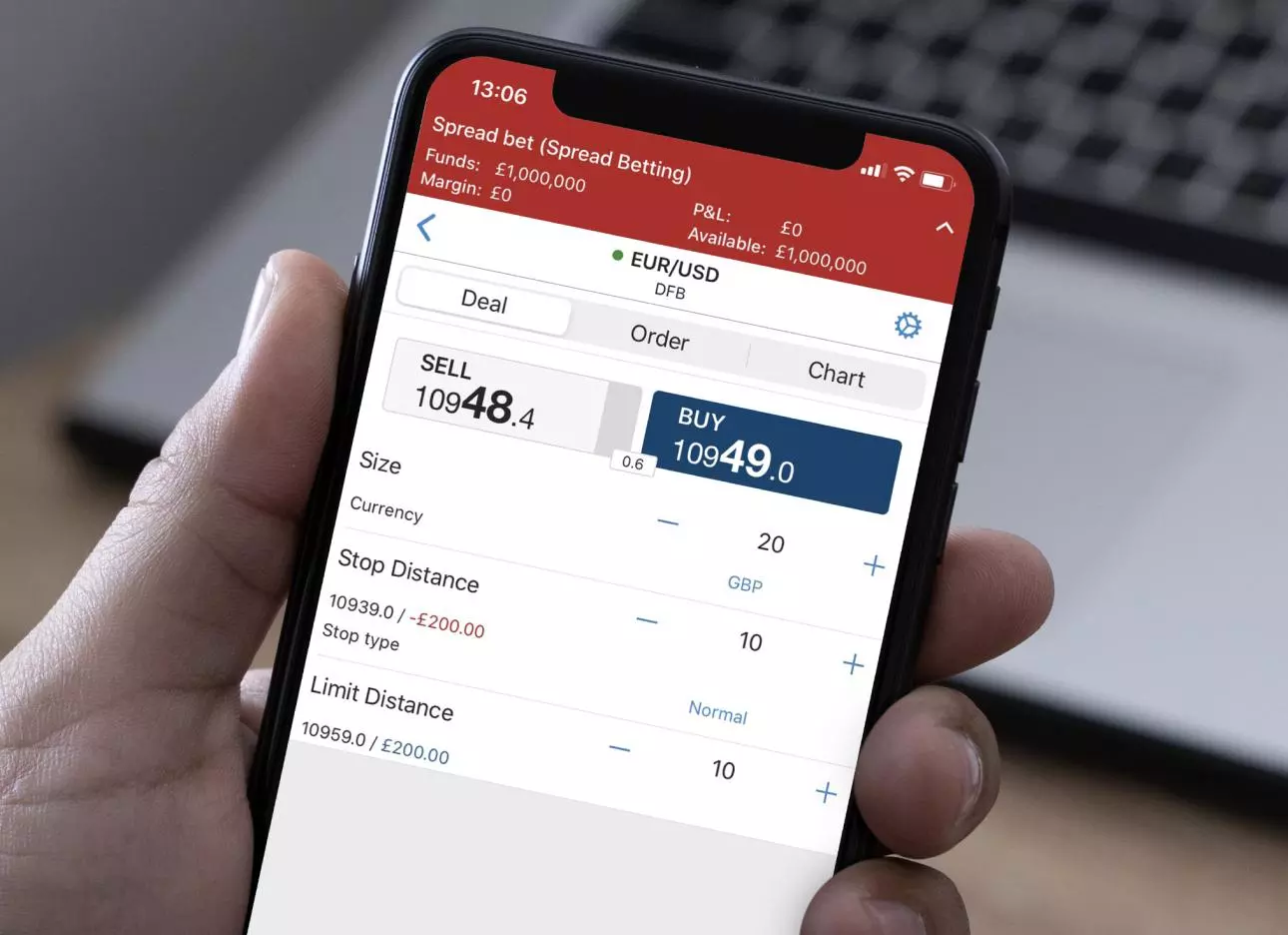

| Dealing platforms | Desktop dealing Mobile app (iPhone, Android) Tablet app (iPad) MetaTrader 4 ProRealTime |

Desktop dealing Mobile app (iPhone, Android) Tablet app (iPad) L2 Dealer (DMA) MetaTrader 4 ProRealTime |

| Direct market access | No | Yes, for shares |

| Getting started | Introduction programme Interactive platform preview Demo account |

Introduction programme Interactive platform preview Demo account |

Example trades

FTSE 100 spread bet vs CFD trade

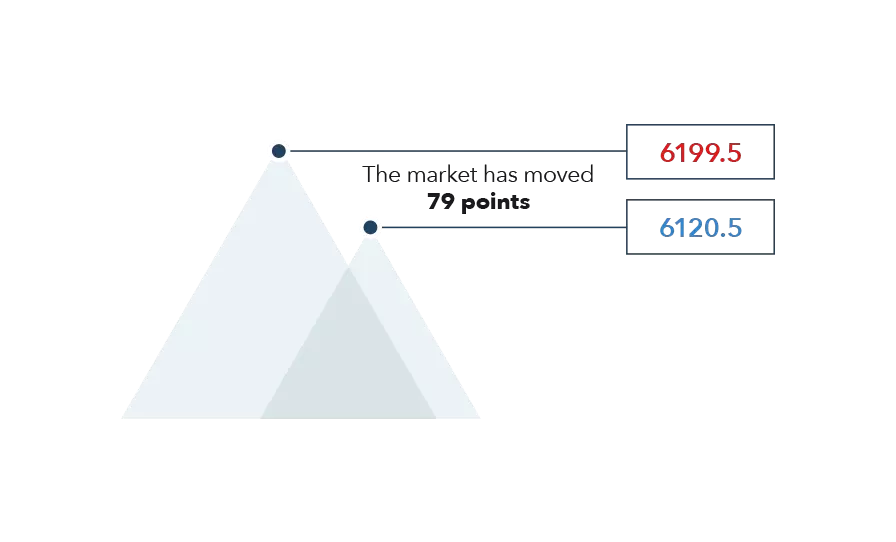

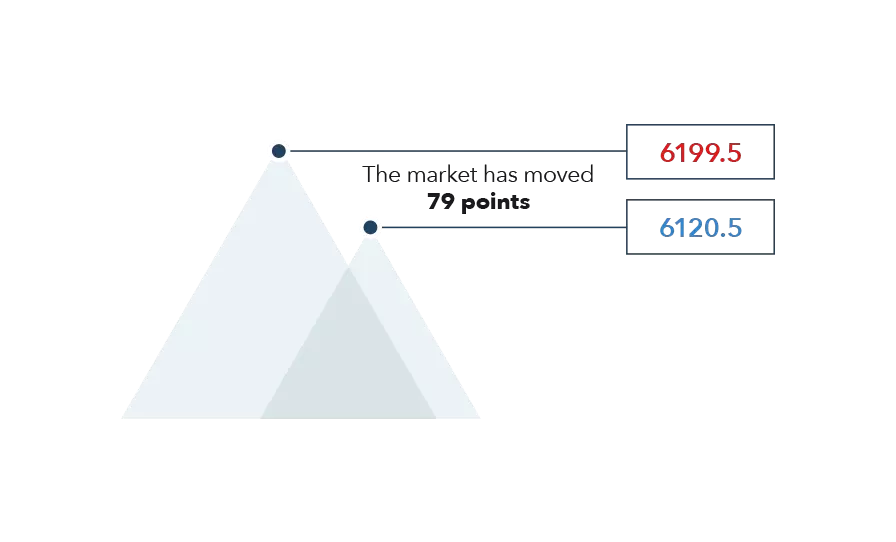

The example below takes a short position on the FTSE 100 – using the same deal size, it compares the process and outcome of a spread bet and a CFD trade if the market falls as predicted.

Spread bet

CFD trade

| Spread bet | CFD | |

| Underlying market value | FTSE 100 6200 | FTSE 100 6200 |

| Our price | 6199.5-6200.5 | 6199.5-6200.5 |

| Deal | Sell at 6199.5 | Sell at 6199.5 |

| Deal size | £10 per point | One contract. Each contract is worth £10 per point |

| Margin required | £3100 Deal size x mid price x margin rate (5%) | £3100 Deal size x mid price x margin rate (currently 5%) |

| What happens next? | The market falls to 6150 by 10pm – the price our funding is calculated at. It continues to fall steadily until the next day, reaching 6120 | The market falls to 6150 by 10pm – the price our funding is calculated at. It continues to fall steadily until the next day, reaching 6120 |

| Funding | Overnight funding charge of £3.38 (SONIA (eg 0.4925%) minus 2.5% x value of deal x underlying level at 10pm) / 365 (-2.0075% x £10 x 6150) / 365 |

Overnight funding charge of £3.38 (SONIA (eg 0.4925%) minus 2.5% x value of deal x underlying level at 10pm) / 365 (-2.0075% x £10 x 6150) / 365 |

| Underlying market | 6120 | 6120 |

| Close | Buy at 6120.5 | Buy at 6120.5 |

| Overall market movement and profit/loss | 6199.5 – 6120.5 = 79 Value of one point = £10 Gross profit = 79 x £10 = £790 |

6199.5 – 6120.5 = 79 Value of one point = £10 Gross profit = 79 x £10 = £790 |

| Costs | 1 pt spread: the underlying fell by 80 pts, but you benefited from a fall of 79. Funding deducted from cash balance: £3.38 | 1 pt spread: the underlying fell by 80 pts, but you benefited from a fall of 79. Funding deducted from cash balance: £3.38 |

| Net profit | £786.62 tax-free* | £786.62 subject to tax |

| What if... | If the underlying market rose to 6280 pts instead: 6280.5 – 6199.5 = 81 pts 81 x £10 + £3.44 (higher funding cost to account for higher market close at 10pm) £813.44 net loss |

If the underlying market rose to 6280 pts instead: 6280.5 – 6199.5 = 81 pts 81 x £10 + £3.44 (higher funding cost to account for higher market close at 10pm) £813.44 net loss |

The profit and net loss for placing this trade via spread bet or CFD is the same.

However, while spread bets are tax-free and you keep all your profit, CFDs can be subject to capital gains tax, depending on individual circumstance.

Because CFDs are subject to tax, you can offset losses you make via CFD as a tax deduction.

* Please note that tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

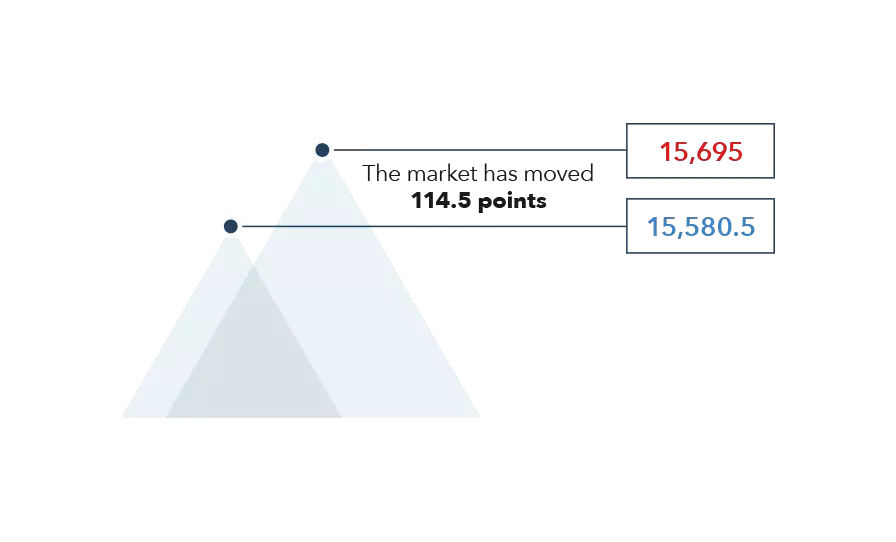

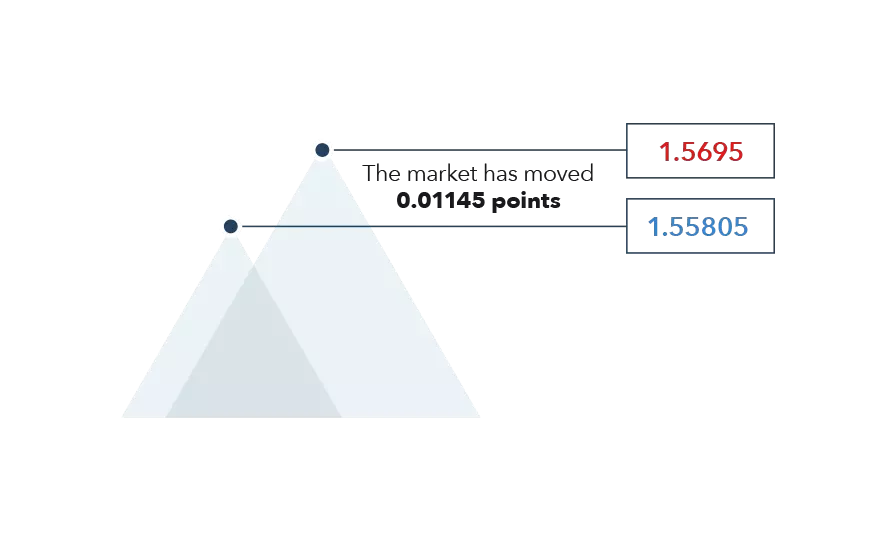

GBP/USD spread bet vs CFD trade

The example below demonstrates the differences between a spread bet and CFD trade on a long GBP/USD position, showing the outcome if the market rises as expected.

Spread bet

CFD trade

| Spread bet DFB | CFD | |

| Market | Spot GBP/USD | Spot GBP/USD |

| Price | 15,579.7/15,580.5 | 1.55797/1.55805 |

| Deal | Buy $10 a point at 15,580.5 | Buy 1 contract at 1.55805 (1 contract = £100,000) |

| Initial margin required | Notional value is $155,805 (or £100,000) and margin factor is 3.33%, so margin = $5188.3 (or £3330) | Notional value is $155,805 (or £100,000) and margin factor is 3.33%, so margin = $5188.3 (or £3330) |

| What happens next? | GBP/USD rallies overnight, and the position is held through 22:00 (London time) | GBP/USD rallies overnight, and the position is held through 22:00 (London time) |

| Funding | Funding = amount per point x funding adjustment factor= $10 x 0.27 = $2.70 Where funding adjustment includes underlying tom-next rate and IG's charge for holding positions overnight which is no more than 0.0022% per day. |

Funding = amount per point x funding adjustment factor = $10 x 0.05 = $0.50 Where funding adjustment includes underlying tom-next rate and IG's charge for holding positions overnight which is no more than 0.0022% per day. |

| Price | 15,695 - 15,695.8 | 1.5695 - 1.56958 |

| Close | You sell at 15,695 | You sell at 1.5695 |

| Gross profit | $1145 15,695 – 15,580.5 = 114.5 Value per point = $10 114.5 x $10 = $1145 |

$1145 1.5695 – 1.55805 = 0.01145 Number of points = 0.01145 x 100000 = 114.5 114.5 x 10 = $1145 |

| Costs | 0.8 point IG spread (included) Funding cost = $2.70 |

0.8 point IG spread (included) Funding cost = $0.50 |

| Net profit | $1142.30 tax free* | $1144.50 subject to tax |

| What if... | If the market dropped 114.5 points instead: $1145 + $2.70 Net loss = $1147.70 |

If the market dropped 114.5 points instead: $1145 + $0.50 Net loss = $1145.50 |

Find more examples of spread betting and CFDs.

What are DFBs?

Daily funded bets (DFBs) are long-term bets on the cash price of an underlying instrument. DFBs have no expiry date, so we make a cash adjustment to your account to reflect funding charges.

Why do CFD and spread betting FX prices look different?

- You trade forex via CFD in contracts or lots. We therefore display CFD forex prices in the same way you would expect to see them on an FX exchange: e.g. 1.31425

- Because you spread bet on forex in currency per point, we display prices differently e.g. 13142.5. This makes it easier to see per point movements.

This makes no difference to the price you deal at or your potential profit or loss: it simply makes it easier to track per point movements.

* Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

Fast, free and secure deposits and withdrawals

Open an account now

*Demo accounts are only available for spread betting and CFD trading.

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

*Demo accounts are only available for spread betting and CFD trading.

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

You might be interested in…

Browser-based desktop trading and native apps for all devices

We're clear about our charges, so you always know what fees you will incur

See how we've been changing the face of trading for more than 45 years

* Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.