Explore the basics of options trading, including what options are, what moves options prices, and how to start trading options with us. You can trade on the underlying using spread bets and CFDs.

What is options trading?

Options trading is the act of buying and selling options. These are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a set price. In the money options can be exercised within a set timeframe.

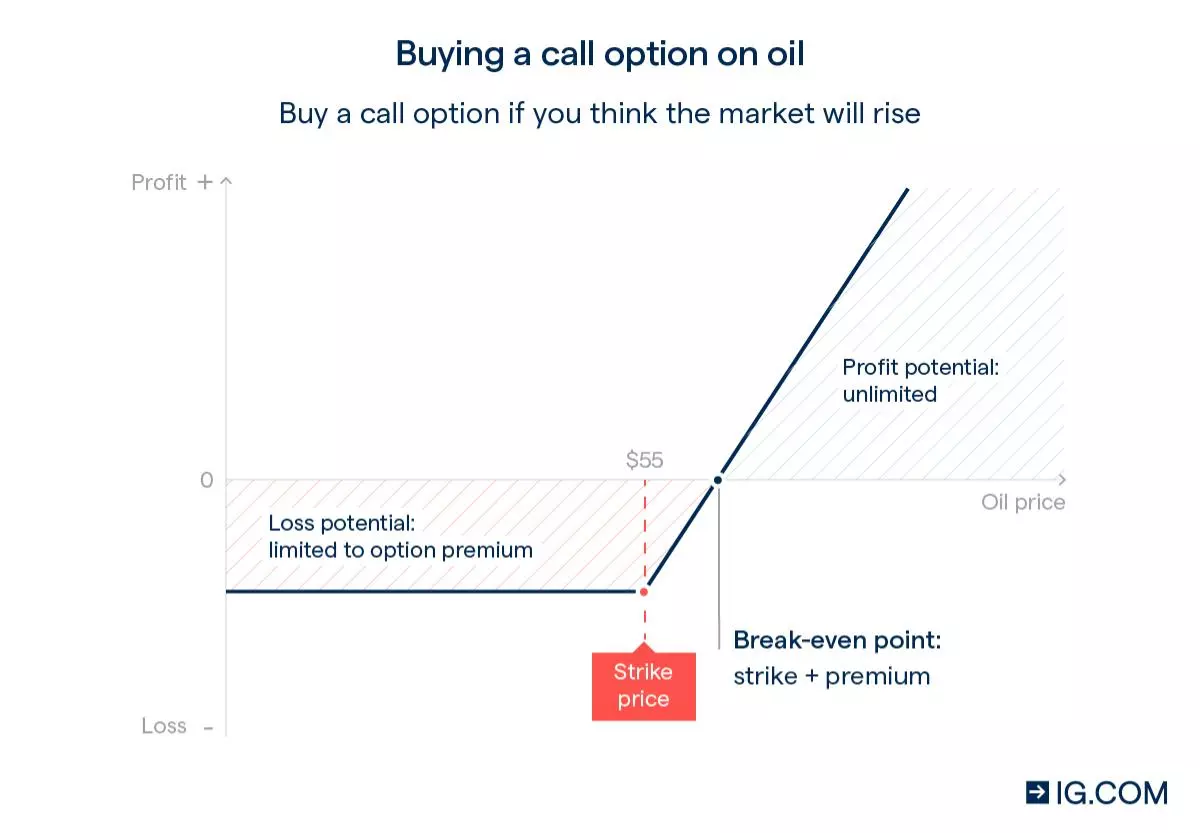

For example, let’s say that you expected the price of US crude oil to rise from $50 to $60 a barrel over the next few weeks. You decide to buy a call option that gives you the right to buy the market at $55 a barrel at any time within the next month. The price you pay to buy the option is known as the ‘premium’.

If US crude oil rises above $55 (the ‘strike’ price) before your option expires, you’ll be able to buy the market at a discount. But if it stays below $55, you don’t need to exercise your right and can simply let the option expire. In this scenario, all you’ll have lost is the premium you paid to open your position.

Trade options offers in the UK:

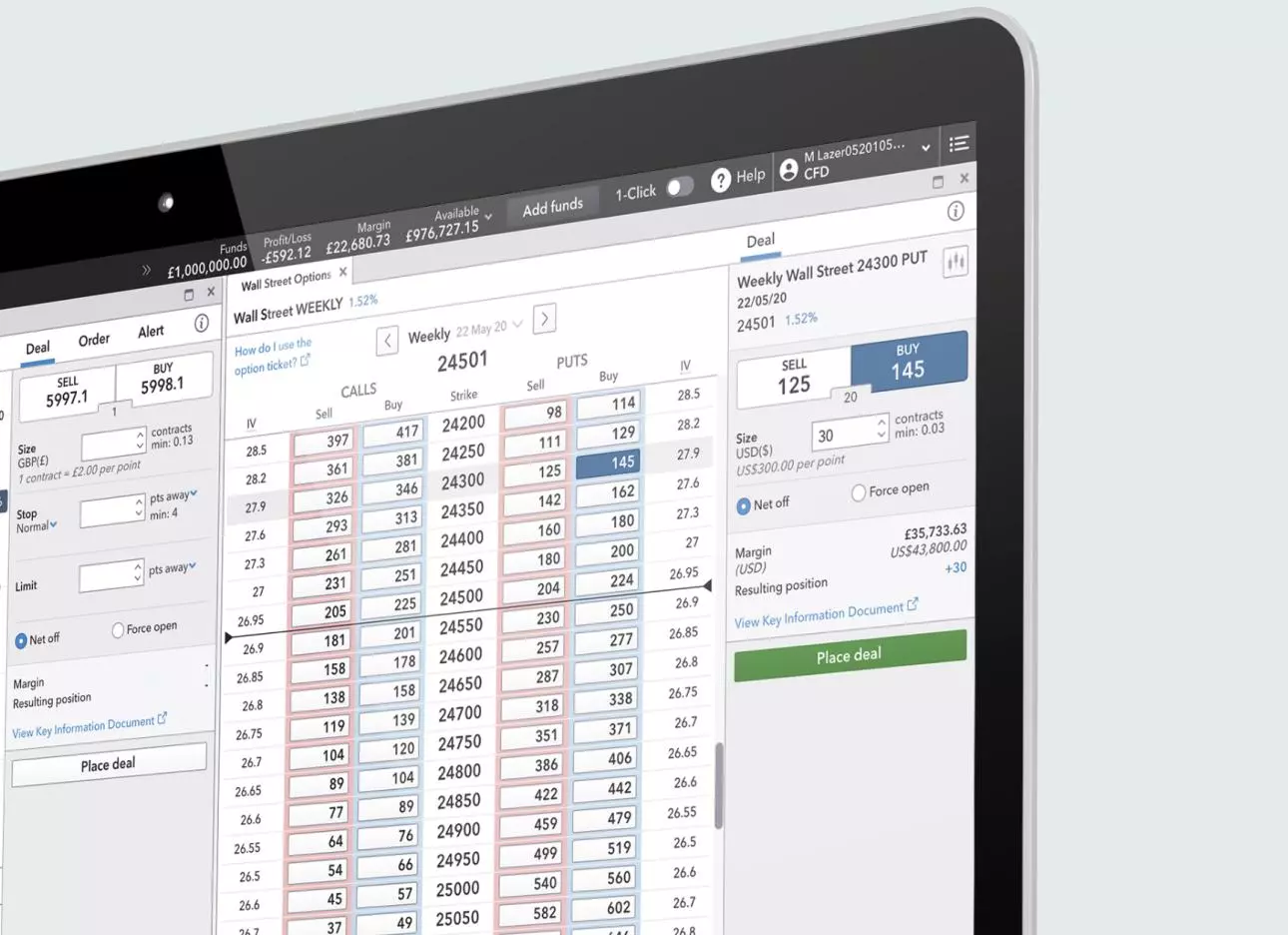

Take your position on global index, forex, commodity or share options with spread bets and CFDs. Note that, when you trade options on these accounts, you are taking a position on the underlying option’s price, not entering into an options contract. This limits the number of strategies you can use.

The essentials of options trading

Take a look at the key types, features and uses of options:

What are call options?

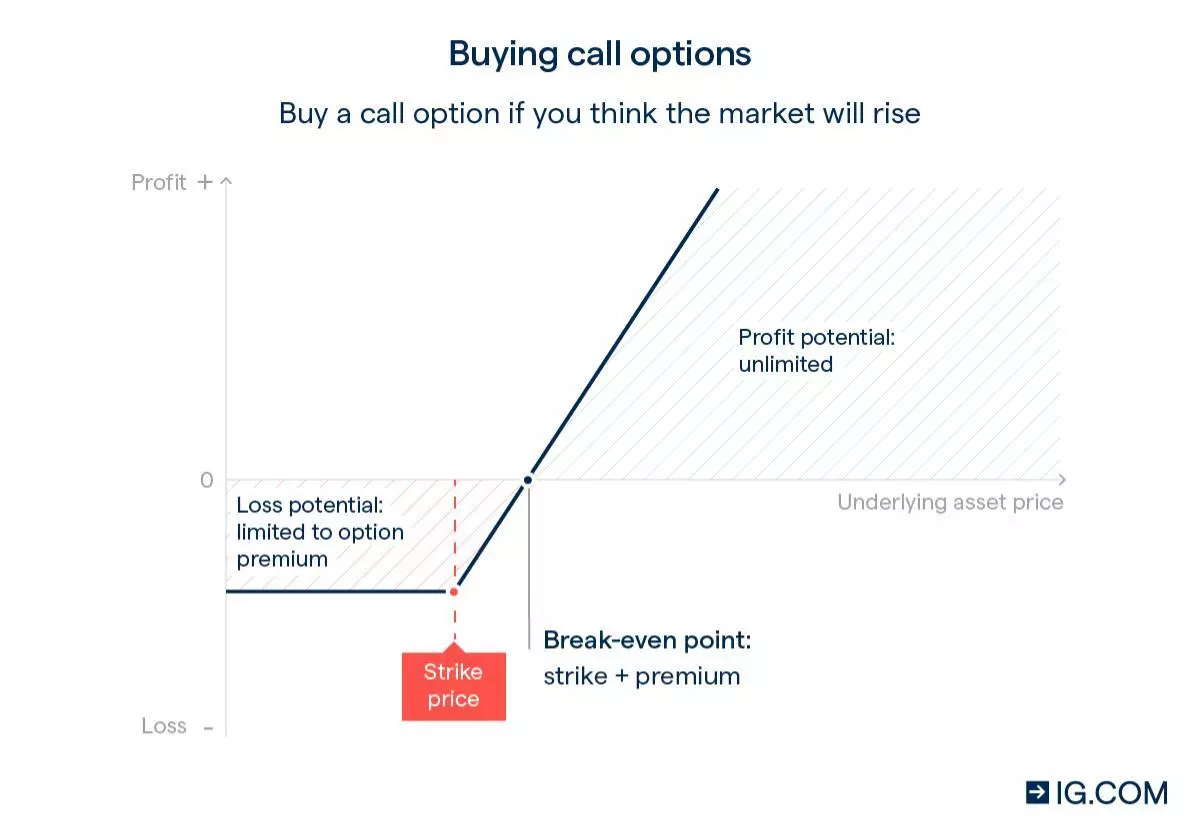

Buying a call option gives you the right, but not the obligation, to buy 100 shares of the underlying (per contract) at a set price – called the ‘strike’ – on or before a set date. The more the market value increases, the more profit you can make.

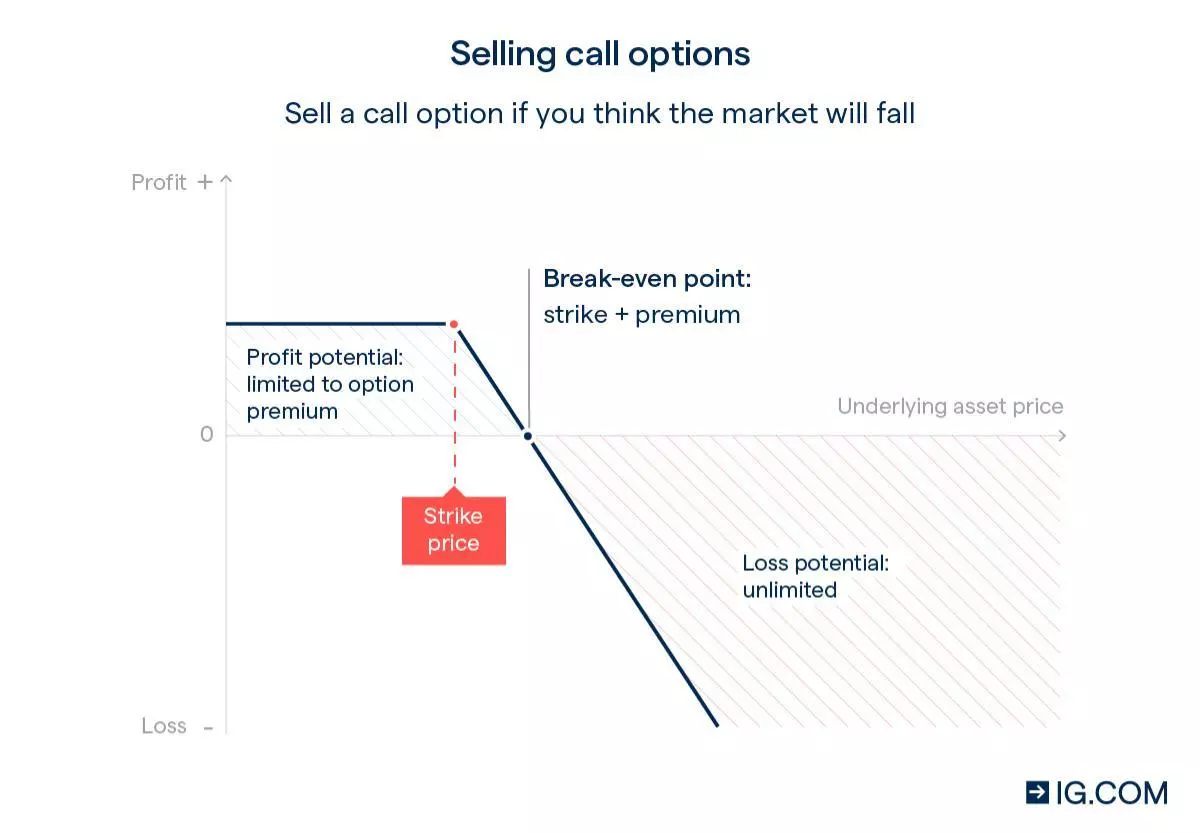

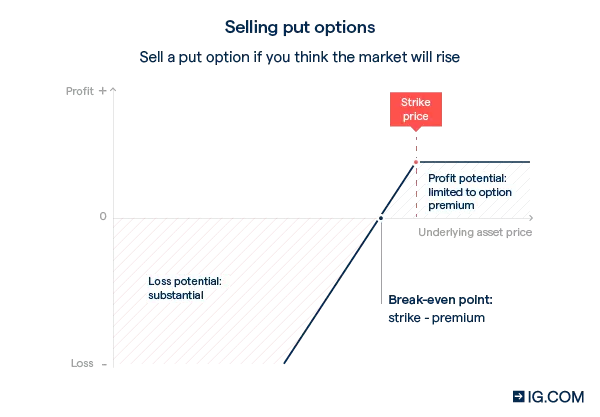

You can also sell 100 shares (per contract). As the seller of a call option, you'll have the obligation to sell the market at the strike price. For European-style options, that's if the option is exercised by expiry. For American-style options, it can happen before expiration.

Options are leveraged products much like CFDs and spread bets; they enable you to speculate on the movement of a market without owning the underlying asset. This means profits can be magnified – as can your losses, if you’re selling options.

When buying call options as spread bets or CFDs with us, you’ll never risk more than your initial payment when buying, just like trading an actual option. When selling call or put options, your risk is potentially high. Your positions will always be cash-settled at expiry. You’ll never have to deliver, or take delivery of, the underlying.

What are put options?

Buying a put option gives you the right, but not the obligation, to sell the underlying at the strike price anytime until expiration or if it expires in-the-money. The more the market value of the underlying decreases, the more profit you make.

You can also sell 100 shares (per contract). As the seller of a put option, you'll have the obligation to sell the market at the strike price. For European-style options, that's if the option is exercised by expiry. For American-style options, it can happen before expiration.

UK options traders can use spread bets and CFDs to speculate on options prices – instead of trading them directly. Since spread bets and CFDs are cash-settled at close, you’ll never have to deliver, or take delivery of, the underlying.

However, these are leveraged forms of trading options. This means that you’ll pay a smaller deposit (known as margin) to open your trade but will have your profits or losses calculated based on the full position size. So, you can lose (or gain) substantially more than your initial deposit.

What is leverage in options trading?

Options are leveraged products; they enable you to speculate on the movement of a market without ever owning the underlying asset. This means your profits can be magnified – as can your losses, if you’re selling options.

For traders looking for increased leverage, options trading is an attractive choice. By choosing your strike and trade size you get greater control over your leverage than when trading spot markets.

If you're a UK trader who's buying call or put options with us, your risk is always limited to the premium (listed options)* if it expires out of the money, or margin (spread betting or CFDs) if you paid to open the position. However, it’s important to remember that when selling call or put options your risk is potentially high, so an effective risk management strategy is important.

* Your losses can be greater if they convert to long/short shares for expiring ITM and it experiences auto-exercises.

How can you hedge with options?

Hedging with options allows traders to limit potential losses on other positions they might have open.

Reducing risk/hedging:

By selling a call option, investors and traders can theoretically limit downside risk if the price of the underlying stock falls. If the price of the stock falls below the strike price of the call option, the option will expire worthless, and the investor/trader will still own the underlying stock, which can be sold or held for potential future gains.

Understand options trading terminology

Traders use some specific terminology when talking about options. Here’s a rundown of some of the key terms:

- Holders and writers: the buyer of an option is known as the holder, while the seller is known as the writer. For a call, the holder has the right to buy the underlying asset from the writer. For a put, the holder has the right to sell the underlying asset to the writer

- Premium: the fee paid by the holder to the writer for the option. When spread betting or trading options with us, you’ll pay a margin that works in a similar way to the premium

- Depending on the type of account, US options and futures accounts enable you to buy and sell call and put options

- Expiration date/expiry: the date on which the options contract terminates

- In the money: when the underlying’s market price is above the strike (for a call) or below the strike (for a put), the option is said to be ‘in the money’ – meaning that if the holder exercised the option, they’d be able to trade at a better price than the current market price

- Out of the money: If an option is out of the money at expiry, exercising the option will incur a loss

- At the money: when the underlying market’s price is equal to the strike, or very close to being equal to the strike, the option is referred to as ‘at the money’

- Break-even point: the point at which your trade or strategy is not making or losing money

Identify what determines an option’s price

There are three main factors that impact the value of an options contract. All these factors work on the same principle: the more likely it is that the underlying market price will be above (calls) or below (puts) an option’s strike price at its expiry, the higher its value will be.

When you spread bet or trade CFDs with us, you’ll pay a margin. When trading options, you’ll pay for it upfront when trading any long premium (debit) strategies or collect cash up front and be subject to a margin requirement when trading any short premium (credit) strategy.

- Underlying price vs strike price

The further below the underlying a call option's strike is, or the higher above the underlying a put option's strike is, the higher their premiums are likely to be as they are ‘in the money’ – there's more chance of them expiring with value - Time to expiry

The longer an option has before it expires, the more time the underlying market has to pass the strike price – if you're short an option, a profitable trade is an OTM that expires worthless - Volatility of the underlying

Volatility drives uncertainty, which drives up option prices. Volatility reflects the risk associated with an option's likelihood of going in the money

Learn about the Greeks

The Greeks are measures of the individual risks associated with trading options, each named after a Greek symbol. Understanding how they work can help you calculate the risk involved with each of the variables that affect option prices.

Trade using the Greeks on our US options and futures platform. Assess risk, manage positions and make informed decisions. You don’t have access to this with spread bets and CFDs.

Delta measures direction and the impact on the option's price/value for every +$1 of the underlying

A derivative of delta, gamma measures how much an option’s delta moves for every point of movement in the underlying market.

- Theta

Theta is a proxy to risk. As volatility increases, expanding the value of the option, the greater theta will be. Time decay is more pronounced as an option approaches expiration.

- Vega

An option’s vega measures its sensitivity to volatility in the underlying market, or how much the option’s value will change for every 1% change in volatility.

- Rho

Rho indicates how much interest rate changes will move an option’s price. If the option’s price will go up as a result of interest rate changes, its rho will be positive. If the option’s price will go down, its rho will be negative.

Pick an options trading strategy

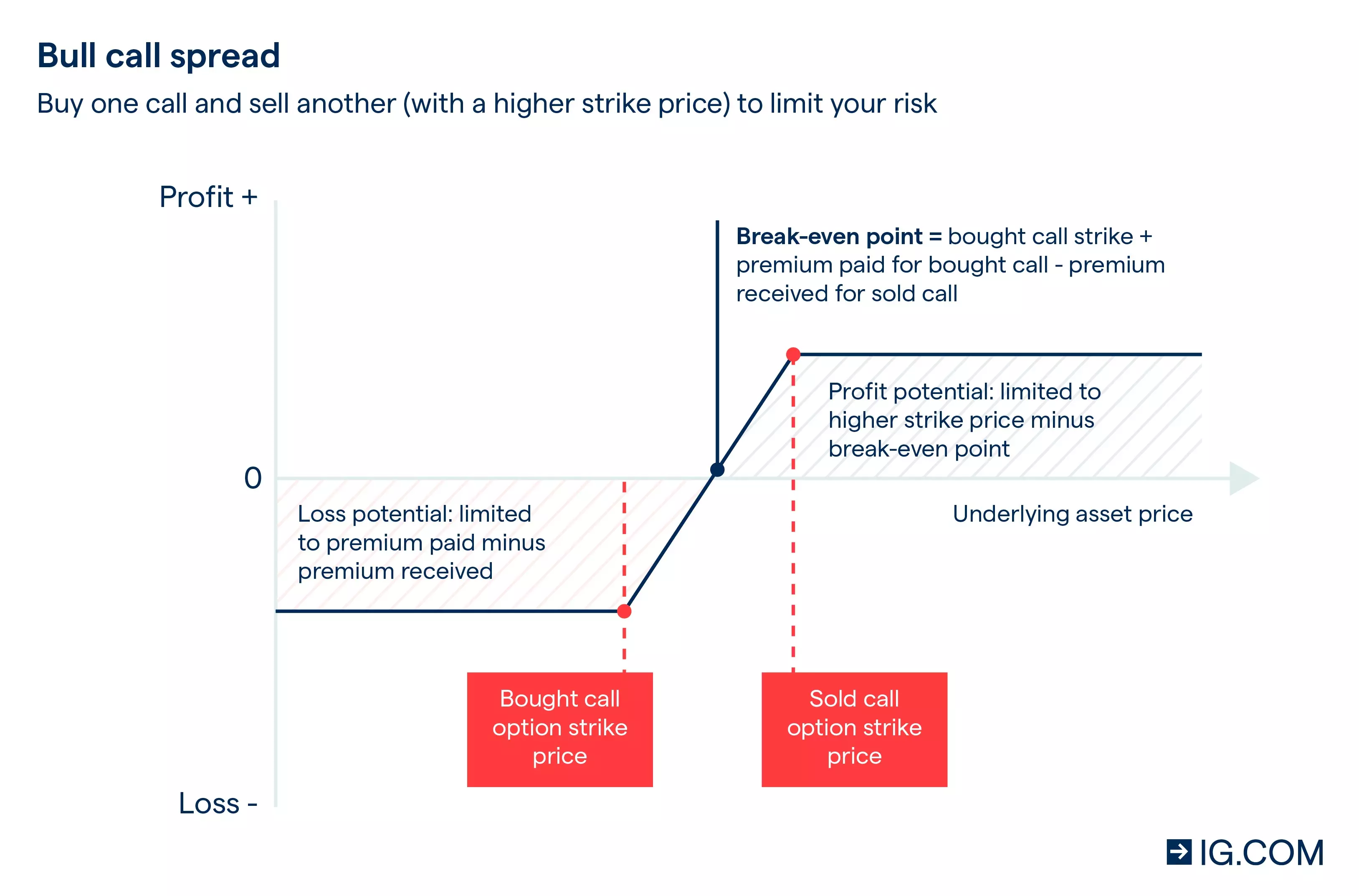

There are numerous strategies you can use to achieve different results when you’re trading options. Popular options trading strategies include:

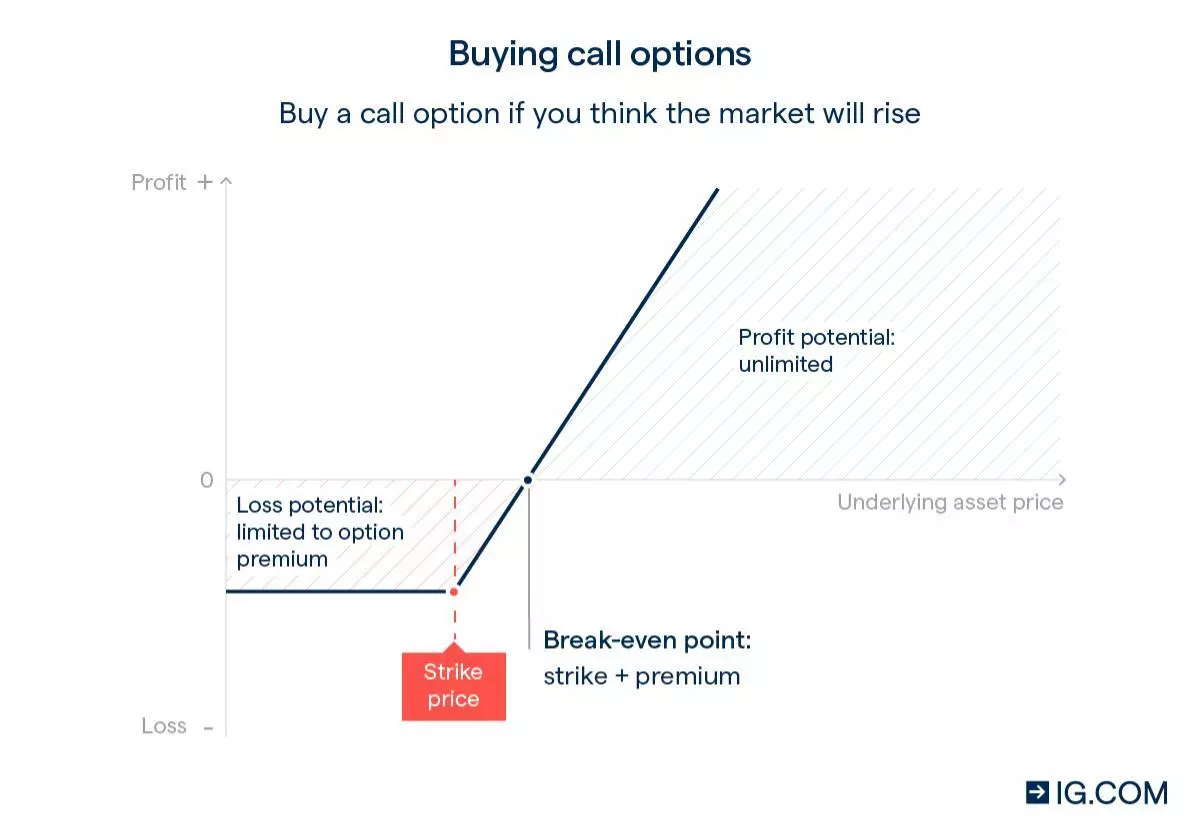

- Buying a call option

The simplest options trading strategy involves buying a call option when you expect the underlying market to increase in value. If it does what you expect and the option’s premium rises as a result, you’d be able to profit by selling your option before expiry. Or, if you hold your option until expiry and the underlying market is above the option’s strike price, you’ll be able to exercise your right to buy the asset at a lower price.

Buying call options is a popular strategy because you can’t lose more than the premium you pay to open if it expires out of the money.

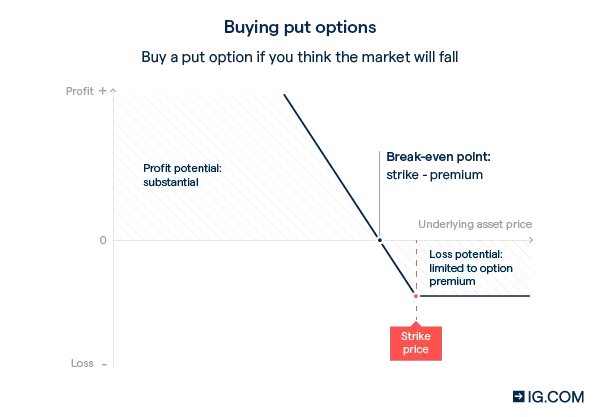

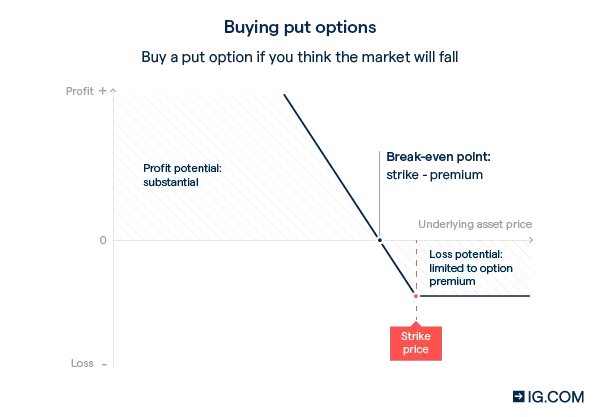

- Buying a put option

Another simple options trading strategy is to buy a put option when you expect the underlying market to decrease in value. If it does what you expect and the option’s premium rises, you’d be able to profit by selling your option before expiry. You could also hold your option until expiry, and would profit if the underlying market was below the strike price. However, this is not the case if the underlying does not drop more than the debit paid from the long put strike price.

Buying puts is popular because you can’t lose more than the premium you pay to open the position if it expires out of the money.

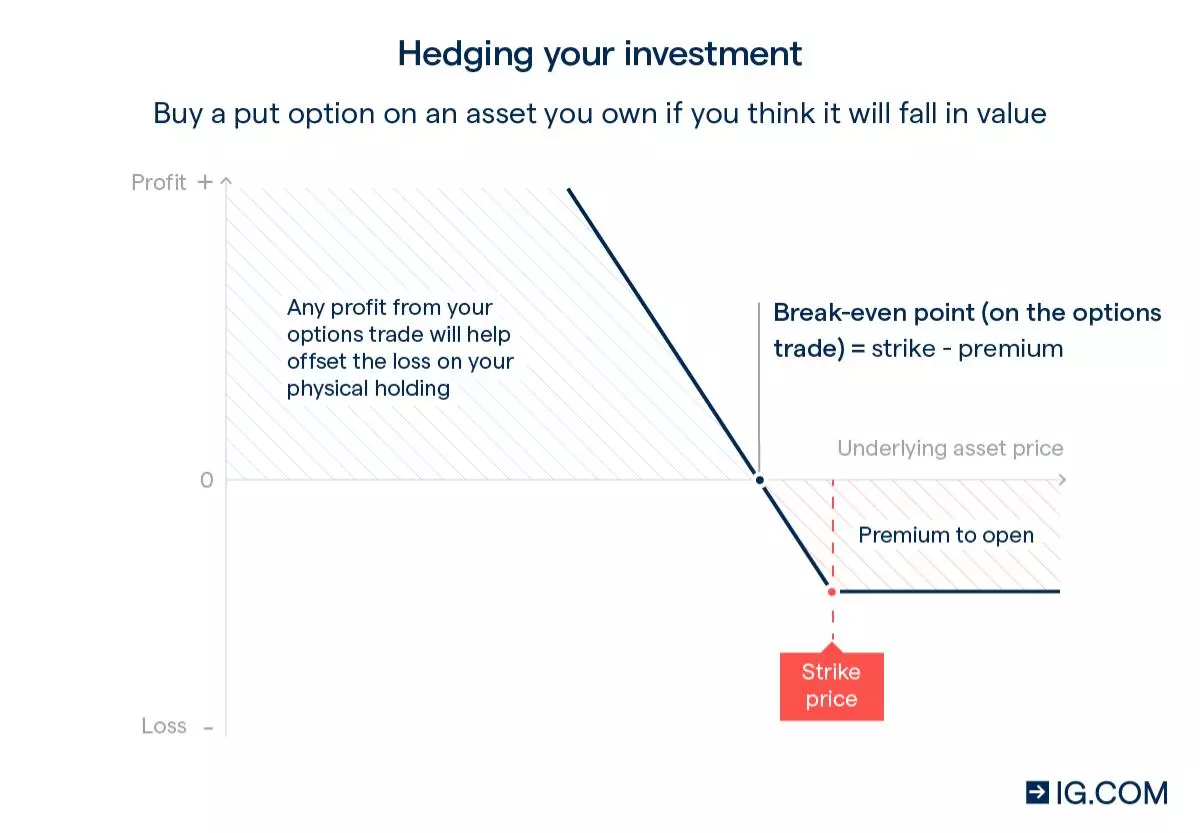

- Hedging your investment

If you own an asset and want to protect it against potential downwards market movement, you could buy a put option on the asset. An investor is fully hedged when they buy one per 100 shares they own. This is called a married put – if the asset price drops, you would make gains on the put which would help limit your loss.

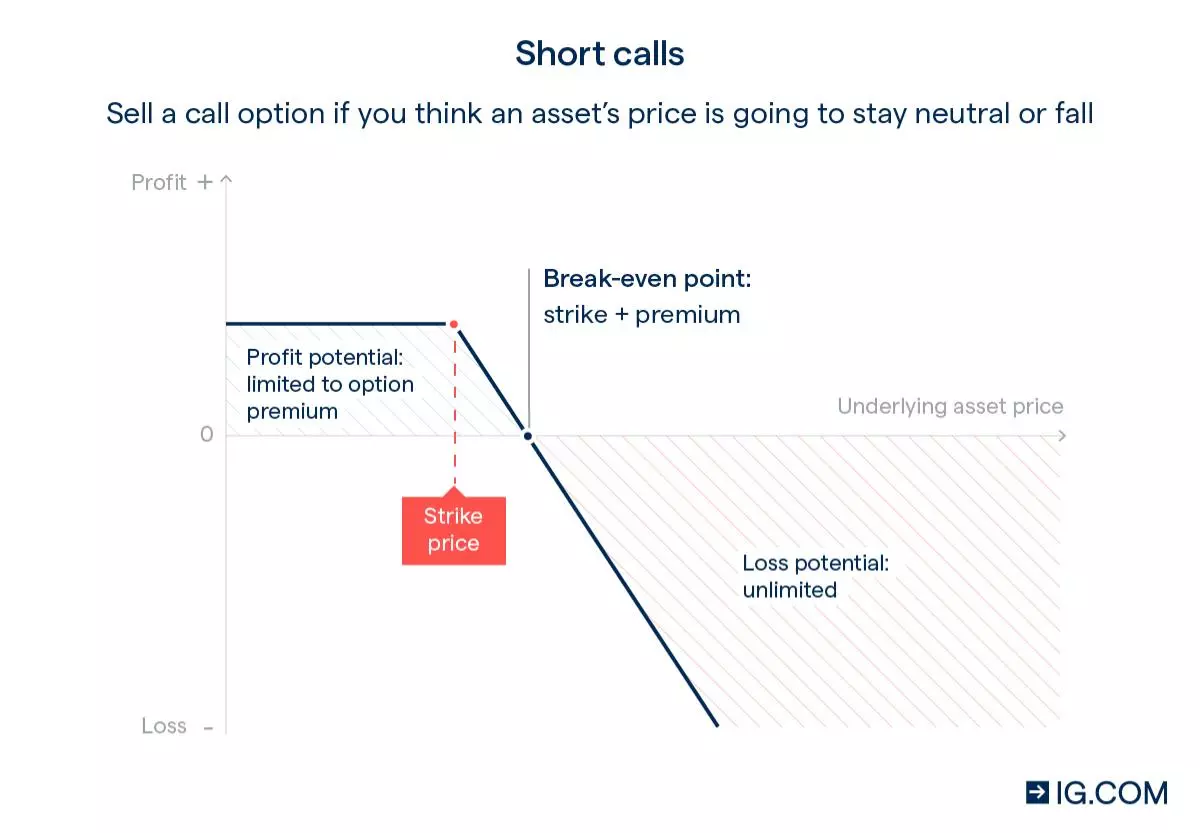

Short calls vs covered calls – market assumptions

Short calls:

The market assumption for short calls is a bearish or neutral outlook. It involves selling call options without owning the underlying stock. Profit potential is limited to the premium received. The risk is theoretically unlimited if the stock price rises significantly.

Covered calls:

The market assumption for covered calls is a neutral to slightly bullish outlook. It involves selling call options while owning the underlying stock. The profit potential is limited to the strike price plus premium received. The risk is limited to the potential opportunity cost if the stock price rises above the strike price.

The key difference in market assumptions is that short calls benefit from falling or stagnant prices, while covered calls can profit from modest price increases up to the strike price.

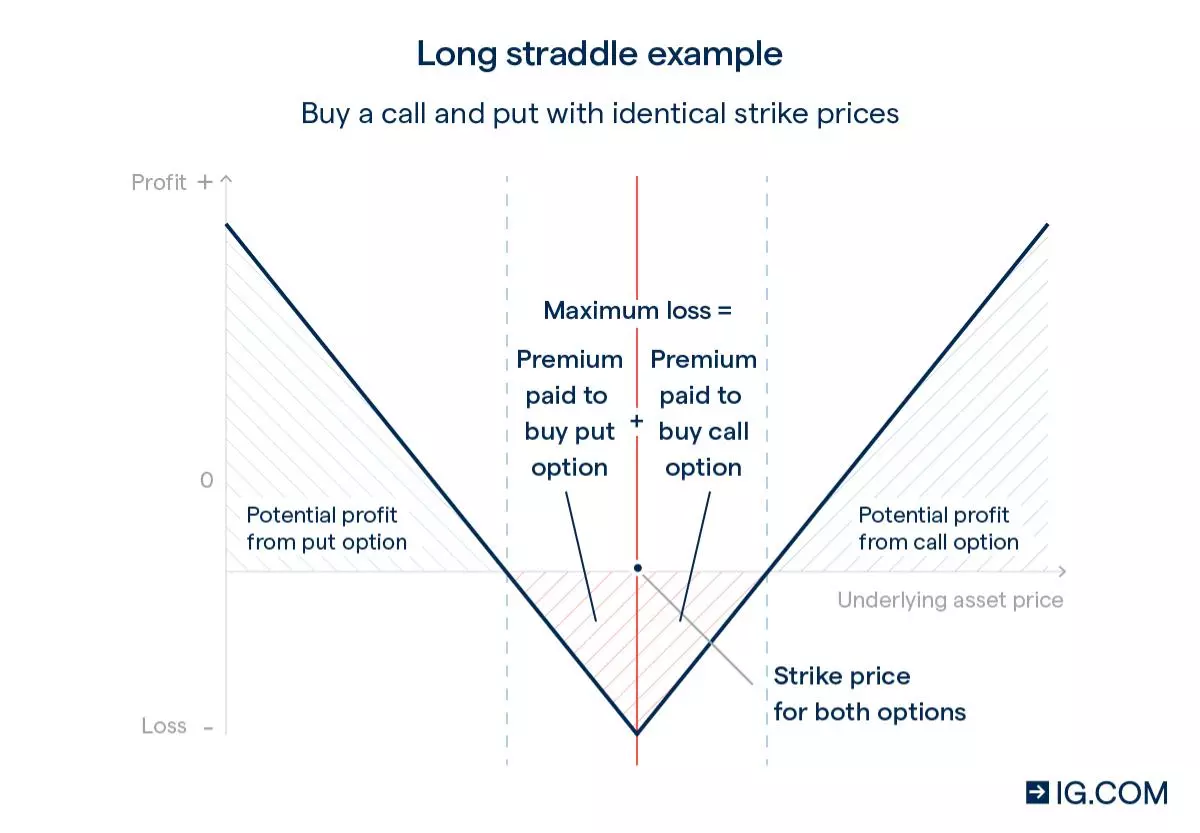

- Straddles

When trading straddles, you buya call and a put position simultaneously on the same underlying at the same strike price. This gives you the potential to profit regardless of whether the market moves up or down, making them a good strategy if you expect market volatility but are unsure which way it will move.

Your break-even levels will be the total premium paid, plus or minus from the strike price. The only way to achieve a maximum loss is if the underlying closes precisely at the straddle's strike price. Otherwise, the long call or long put will, respectively, convert to long or short shares, through auto-exercise. Short shares will only be held in margin accounts.

Long straddles only become profitable if the underlying price exceeds the total debit paid to the upside or downside from the straddle's strike price.

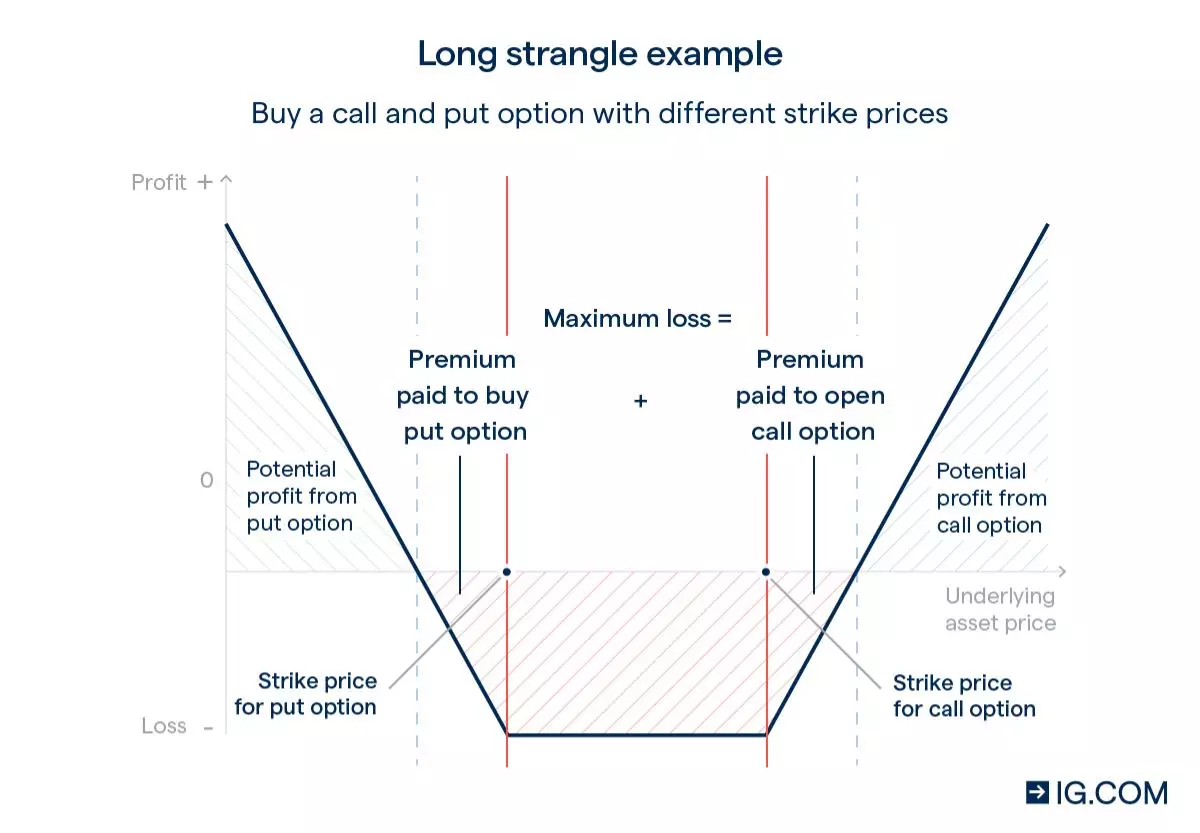

- Strangles

Strangle is very similar to the straddle above. Instead of buying two at the money strikes, you purchase an out of the money call and put (at different strike prices).This means that you typically pay less to open the trade, but will need a larger price movement to profit. The trade is still limited-risk to the debit paid if it expires out of the money.

In the below examples, if you closed your position before expiry, the closing price is affected by a range of factors including time to expiry, market volatility and the price of the underlying market.

You can find out more about options trading strategies in our strategy article.

Choose where to trade options on

Trading on options using spread bets and CFDs

- Forex options – including majors like EUR/USD, GBP/USD, USD/CHF and EUR/GBP

- Share options – like FTSE 100 shares and a selection of leading US shares

- Stock indices – such as leading global shares and Wall Street, based on Dow Jones

- Commodities – like metals and energies

- OTC options

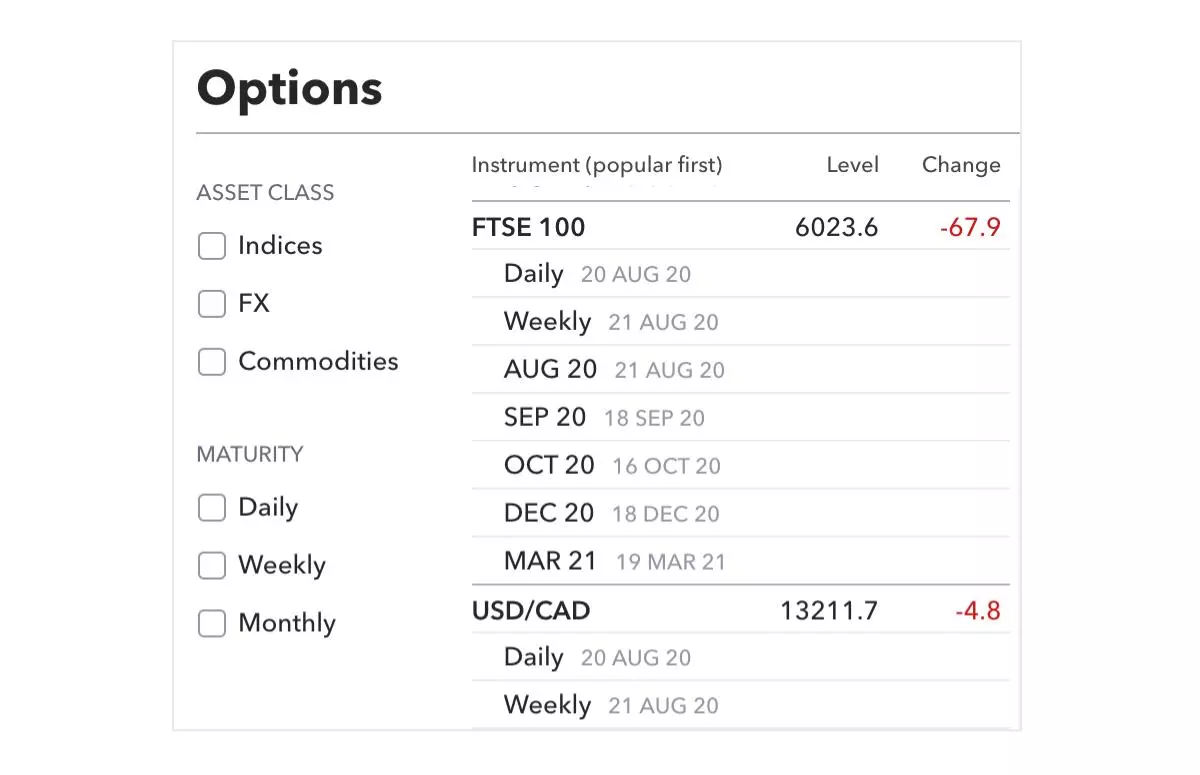

Determine the time frame during which the market is likely to move

Depending on the kind of trade you’re making, you can choose between daily, weekly, monthly or quarterly options to suit your goals.

Use daily and weekly options if you want to take positions on markets quickly, but with greater control over your leverage than when trading other products – such as trading CFDs or spread betting on spot markets.

If you’re looking at longer-term market movement, monthly and quarterly options mean you can take positions up to three quarters before expiry – plus you’ll know your risk upfront and usually save on funding charges.

Find out more about trading daily and weekly, monthly and quarterly options.

Choose between buying a ‘put’ or ‘call’ option

- Decide whether to buy or sell and place your trade

- Once you know the timeframe you’re going to trade, determine whether you want to buy or sell a call or put option on the market you’re trading

Buying a call option: if you anticipate the market will rise, buying a call option gives you the right (but not the obligation) to buy 100 shares (per contract) at a predetermined price (strike price) before the option expires

Buying a put option: if you expect the market to fall, buying a put option enables you to sell 100 shares (per contract) at a specified price (strike price) before the option expires, potentially profiting from a decline in the market - Buying options is limited-risk if it expires out of the money, while selling (whether calls or puts) exposes you to potentially unlimited risk, depending on market movements

Once you’ve decided whether to go long or short, you can choose the strike price and premium (or margin) you want to open the position at, and place your trade.

Monitor your position

Once you’ve opened a position, you need to keep an eye on market movement and the potential profit or loss of your position.

If the option is in the money, you may wish to close it before the expiry to maximise profit. Or if you aren’t in profit you can leave your position open to expiry, and, if it fails to move into profit, only lose the price you paid to open.

Ways to trade options in the UK

There are three ways to buy and sell options in the UK:

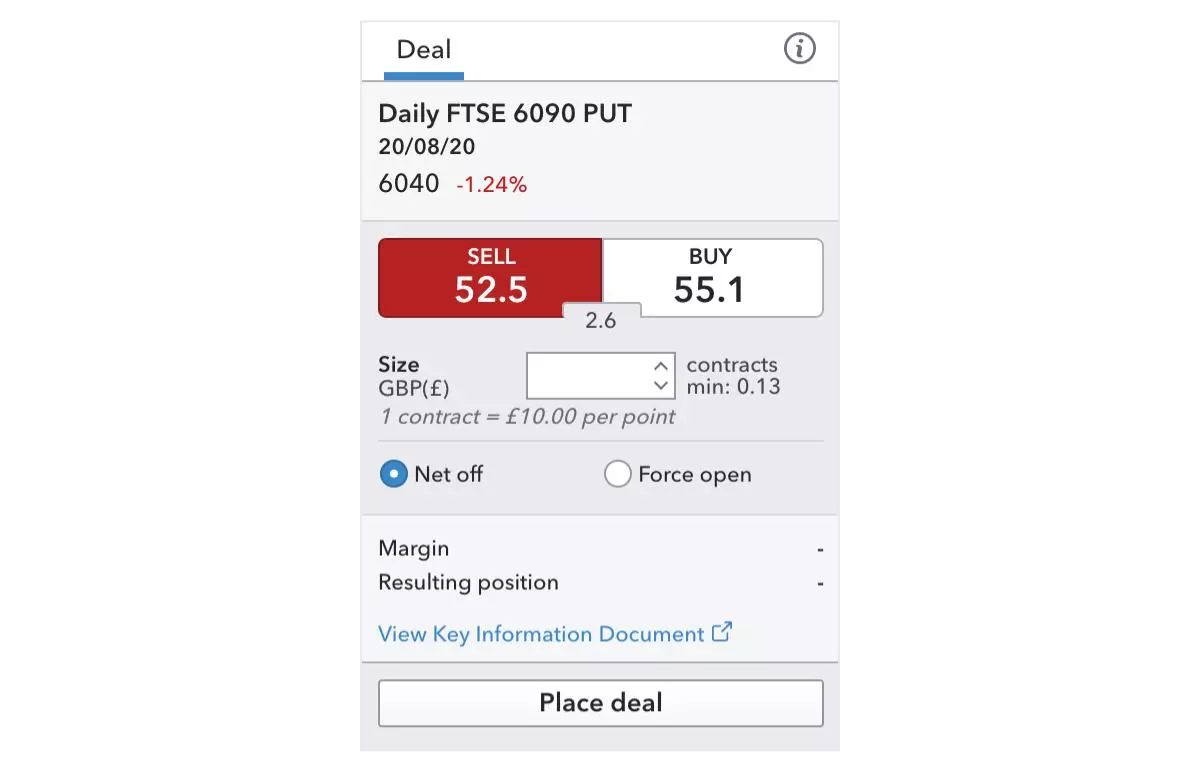

1. Trade options with spread betting

A spread bet on options will mirror the underlying option trade. An option to buy £10 per point of the FTSE call with a strike price 7100 would earn you £10 for every point that the FTSE call moves above 7100 – minus the margin you paid to open the position.

In the UK, you can spread bet on options alongside thousands of other markets, and there’s no tax to pay on your profits.2

Find out more about spread betting

2. Trade options with CFDs

As with spread bets, when you trade options with CFDs, your trade mirrors the underlying options trade.

You need an account with a leveraged trading provider, like IG, to trade CFDs. Find out more about CFD trading.

1 $1.00 commission to open per options contract, $0 commission to close per options contract. Applicable exchange, clearing, and regulatory fees still apply to all opening and closing equity options trades. Some additional applicable commissions are capped at $10 per leg on equity option trades. The following index products are excluded from the capped commissions offer: SPX, RUT, VIX, OEX, XEO, DJX, and XSP. Learn more about our charges.

2 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

FAQs

What is the definition of options trading in finance?

Options trading is the buying and selling of options. Options are financial contracts that offer you the right, but not the obligation, to buy or sell an underlying asset when its price moves beyond a certain price within a set time period.

Can I profit from options trading?

Yes. If you buy an option you can make a profit if the asset’s price moves beyond the strike price (above for a call, below for a put) by more than the premium you initially paid before the expiration date. Your maximum risk is the premium you pay to open.

If you sell an option you stand to make a profit if the underlying market doesn’t hit the strike price before the option expires – you profit from the premium paid to you by the holder at the outset of the trade. However, your maximum risk is potentially unlimited if the market moves in favour of the option holder.

Can I trade stocks with options?

Yes, you can trade stock options. Rather than owning the actual stock, you have the right to buy or sell it at an agreed price on a specific date.

Can I buy a call and a put on the same stock?

Yes, there are various options trading strategies which involve simultaneously buying a put and a call option on the same market. These include straddles, strangles and spreads. Take a look at our strategy article to find out more.

Develop your knowledge of financial markets

Find out more about a range of markets and test yourself with IG Academy’s online courses.

Try these next

Start trading over 70 US markets out of hours with IG

Learn how to make the most of IPOs and grey markets with IG

Discover how to buy and trade shares with IG