Learn everything you need to know about trading forex options. Here, we look at the essentials of buying and selling currency options.

What are forex/currency options?

Forex/currency options are derivatives that give you the right, but not the obligation to buy and sell FX on a specific date (called the expiry) at a specific price (called the strike price). There are two types of forex options: puts and calls.

Remember, forex trading in general is a way to speculate on currencies without taking ownership of the physical assets. You can choose between FX options, spot currency trading or FX forwards . Many individuals prefer trading forex options because it offers limited risk when buying, as they are not obliged to complete the purchase. However, the risk is potentially unlimited when selling.

Forex/currency options essentials

Keep these four things in mind if you’re thinking about trading forex/currency options:

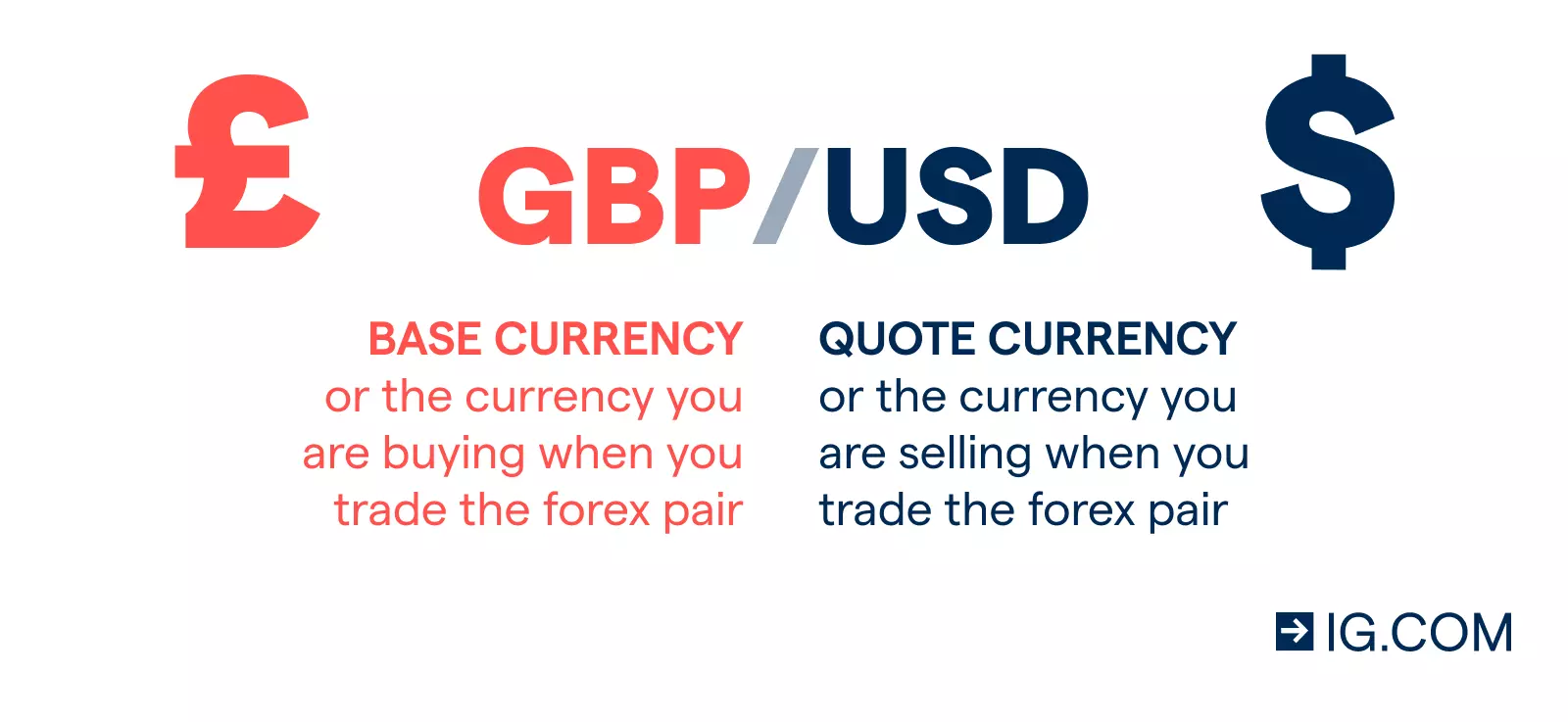

You’re always trading a currency pair with FX options

When you trade FX options, you are buying the right to trade a currency pair at a specific price on a specific date. This means you intend to buy one currency (the base currency) and sell another (the quote currency) because you believe one of the currencies will strengthen against the other. When trading options with us, you are entering into a contract for difference (CFD) or spread bet.

You can trade FX put or call options

There are two types of currency options you can trade: puts and calls.

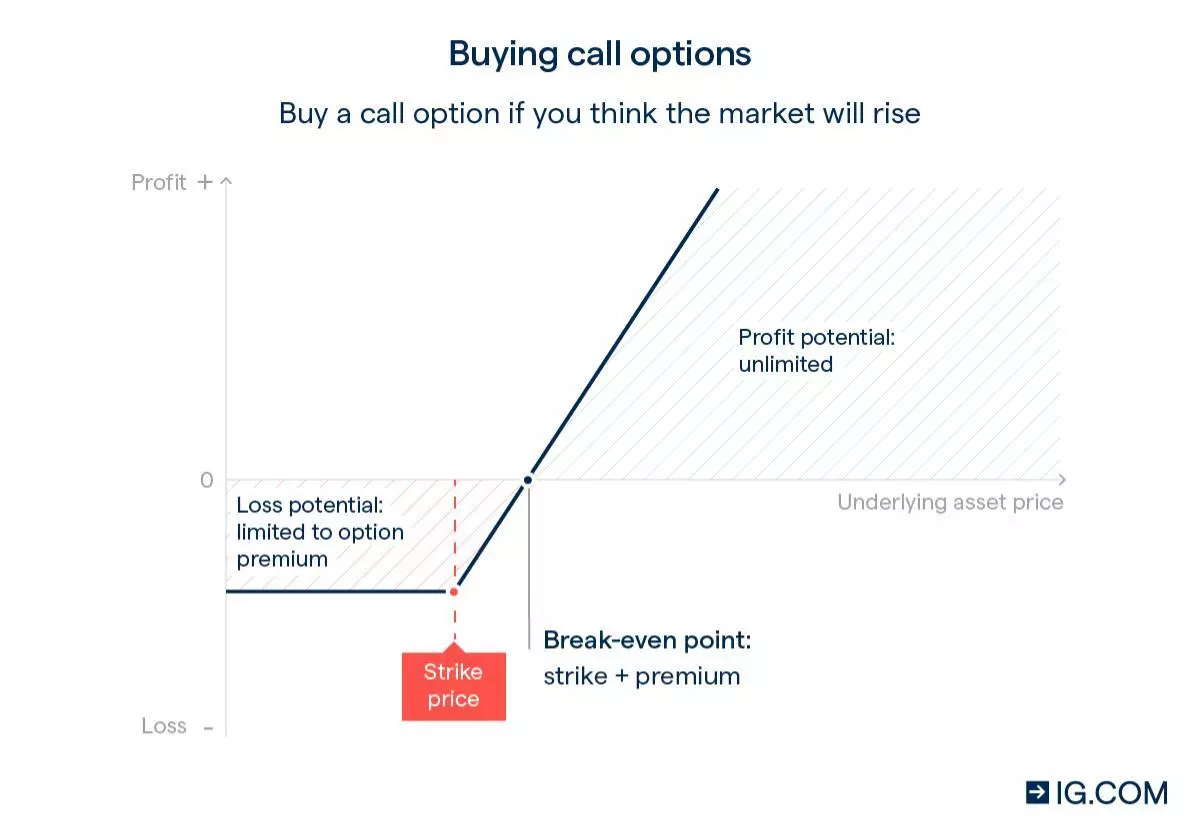

Call options in forex

You’d buy a forex call option if you thought the base currency will strengthen against the quote currency before the expiry date. For example, you would buy a GBP/USD call option if you thought GBP would rise in value against USD. Your potential profit would be unlimited in this case, and your losses would be limited to your options premium.

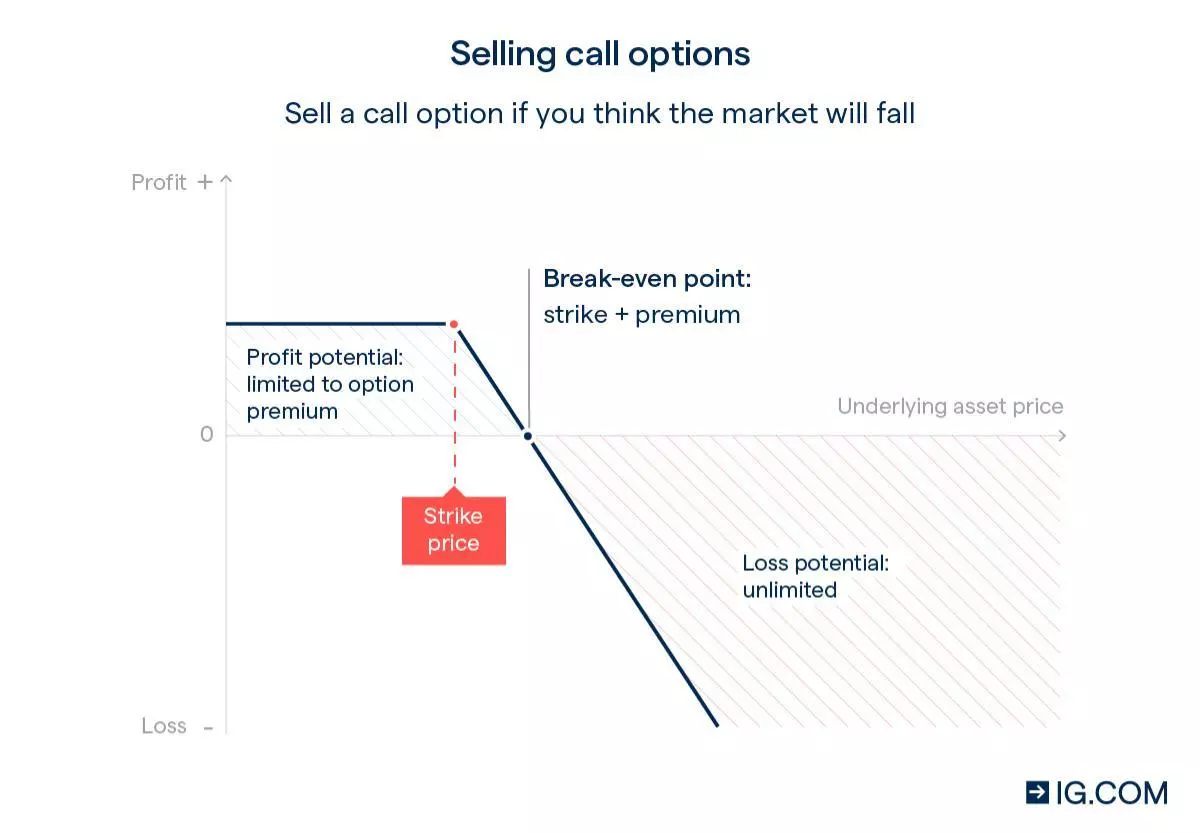

You can also sell FX call options – if you believe the quote will rise against the base currency. However, this could result in unlimited losses if the pair doesn’t move in your favour.

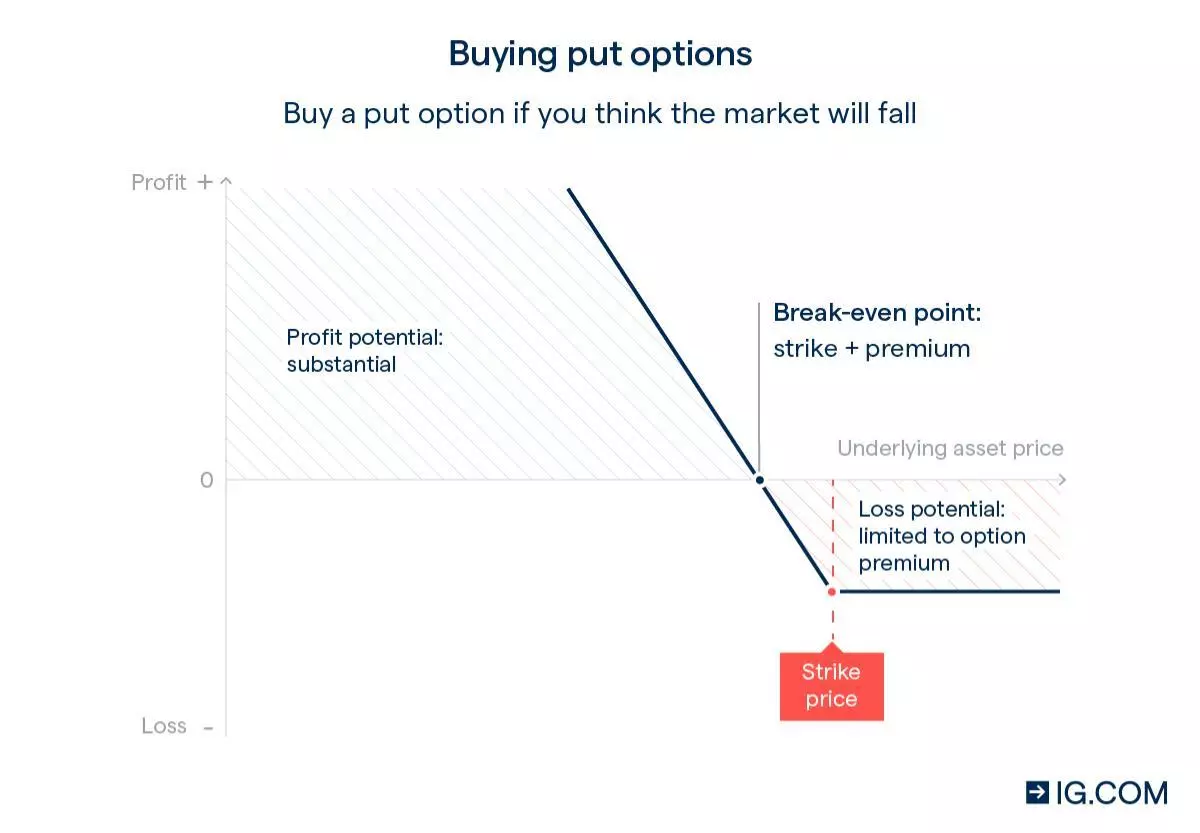

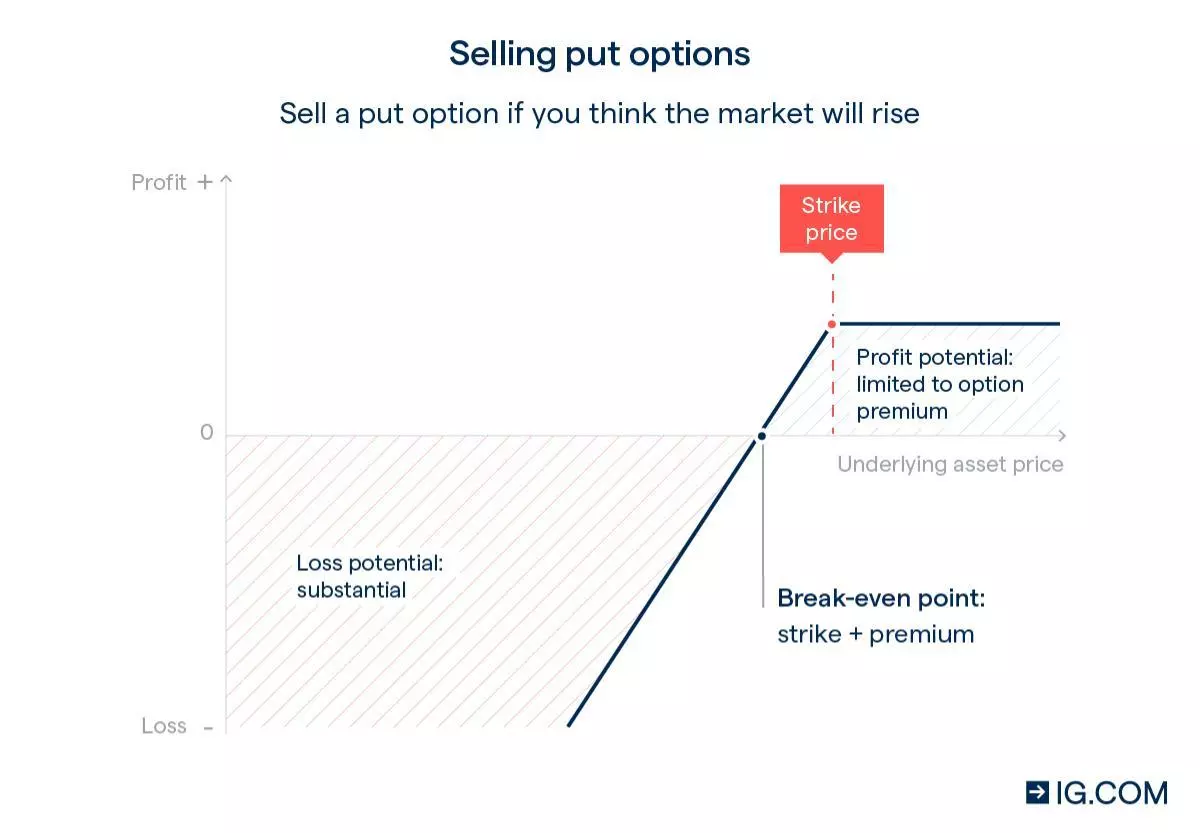

Put options in forex

You’d buy a forex put option if you thought the quote currency will strengthen against the base currency before expiry. For example, you would buy a GBP/USD put option if you thought USD would rise in value against GBP. Again, your potential profit would be unlimited in this case, and your losses would be limited to your options premium.

You can also sell forex put options if you believe the base currency will rise against the quote. Note that this could result in unlimited losses if the pair doesn’t move in your favour.

You can hedge other positions with FX options

Hedging with options involves opening a position that will offset risk to an existing trade, such as an open spot forex position. For example, an FX put option is a popular method of protecting yourself against the depreciation of a currency. In this instance, you’d open an option with a strike price below the current market level, and if the market moves below that put option price, you’d profit from the decline.

You can speculate on currency markets with less risk

Buying forex puts or calls comes with lower risk than spot forex trading or FX forwards, because you can only lose your initial option premium (margin) if the trade doesn’t go your way. However, option premiums can be quite high, your risk is unlimited when selling options, and not all FX options markets are available 24 hours a day.

How to trade forex/currency option

Make sure FX options is how you want to trade currency

Besides trading forex options, you can also trade spot forex or FX forwards. Plus, we’re one of the few UK providers to offer forex trading on Saturday and Sunday with our Weekend GBP/USD, Weekend EUR/USD and Weekend USD/JPY offerings.

| Forex options | Forex forwards | Spot forex | |

| How it's priced | Based on spot price | Based on spot price | ‘On the spot’, with continuous, real-time pricing |

| Weekday trading hours | 9pm Sunday to 10.15pm Friday (UK time) |

9pm Sunday to 10.15pm Friday (UK time) |

9pm Sunday to 10.15pm Friday (UK time) |

| Weekend trading hours | Not available | Not available | 8am Saturday to 8.40pm Sunday (UK time) on GBP/USD, EUR/USD and USD/JPY |

| How many pairs can I trade? | 9 | 33 | 80+ |

| Costs and charges | Higher premium but no overnight funding charges | Larger spread but no overnight funding charges | Narrower spread but with overnight funding charges |

| Risk to capital | Limited to premium if you buy put or call, could lose more than premium if you sell | You could lose more than your deposit (margin) | You could lose more than your deposit (margin) |

| Expiry | Yes | Yes | Yes |

Learn more about options trading

Get more details on how options trading works and which markets you can trade with options.

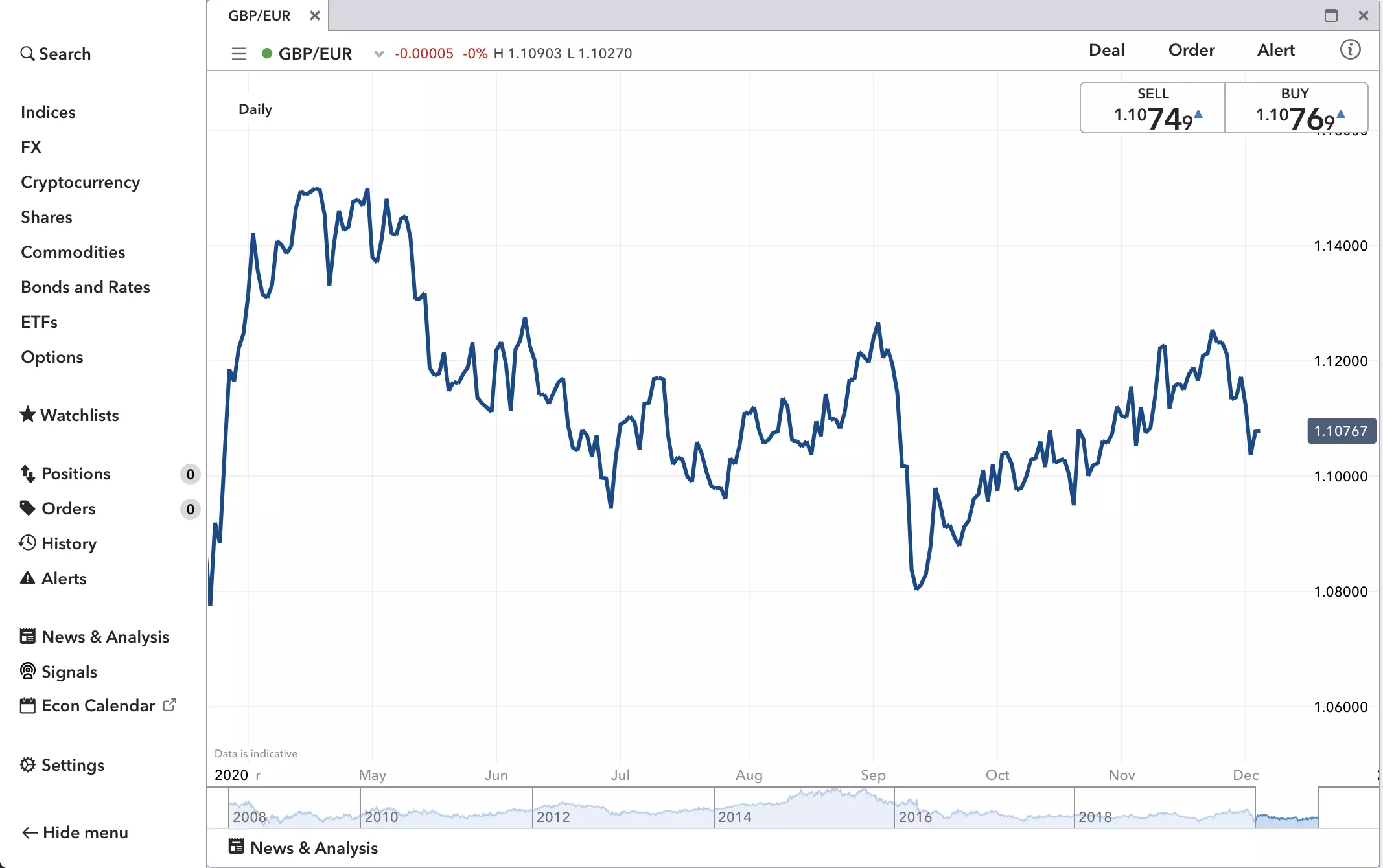

Pick the currency pair you want to trade

You can choose from over 80 currency pairs, including:

- Major currency pairs, eg GBP/USD, EUR/USD, and USD/JPY

- Minor pairs, eg USD/ZAR, SGB/JPY, CAD/CHF

- Emerging currency pairs, eg USD/CNH, EUR/RUB and AUD/CNH

- Exotic pairs, eg EUR/CZK, TRY/JPY, USD/MXN

Open a trading account

You can trade FX options with a spread betting or CFD account. Both are derivative products, which means you only need a small deposit – called margin (your options premium) – to open a position.

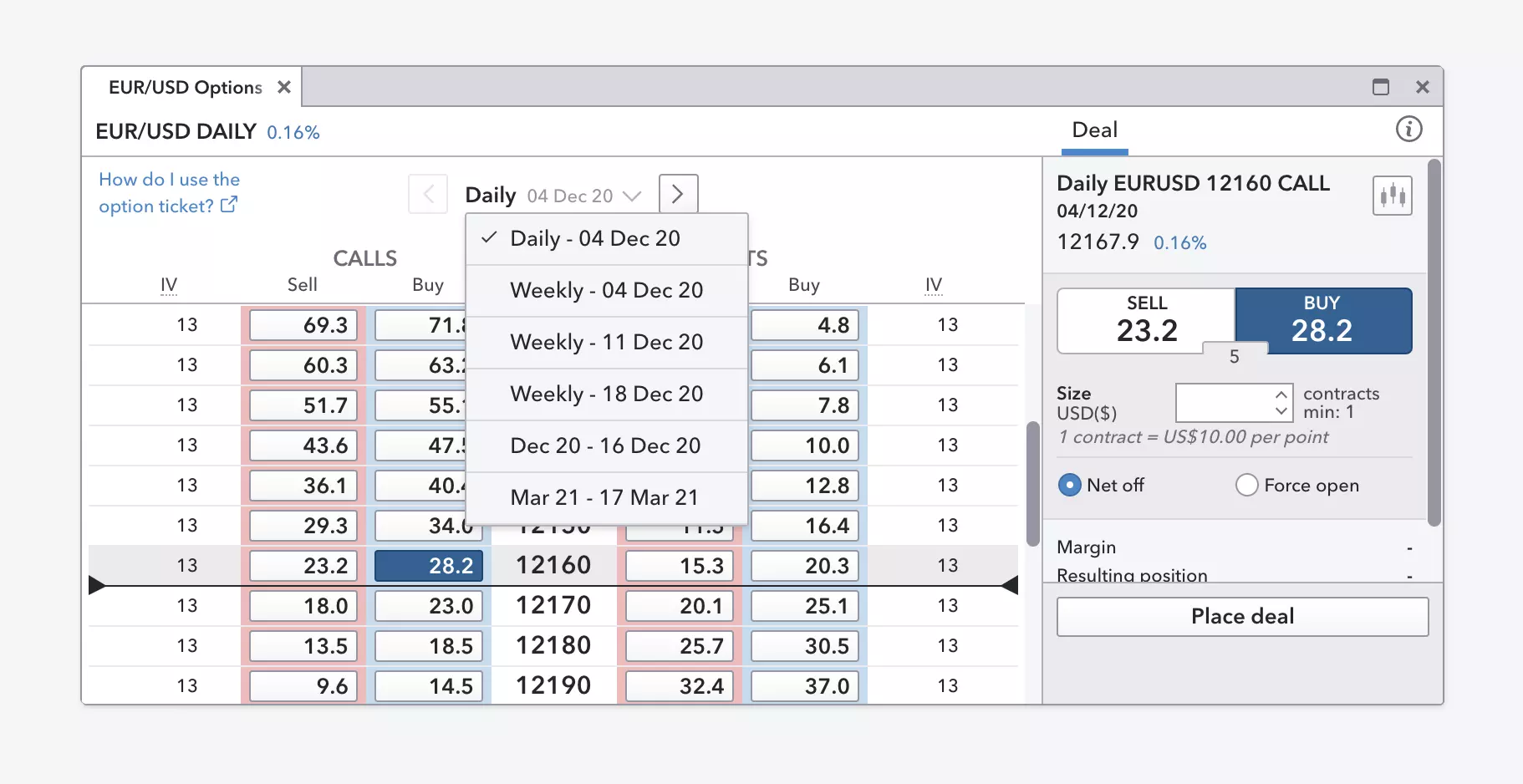

Choose your FX option and timeframe

Decide whether you want to buy a put or a call. If you think the market is going to rise, you’d buy a call and if you think the market is going to fall, you’d buy a put. We offer daily, weekly, monthly and quarterly options. With daily options, you’ll take a view on whether you think a market will be above or below a certain level at market close on the same day that you open your trade. It’s the same with weekly, monthly and quarterly options, but expiry will be before a certain weekly, monthly or quarterly date.

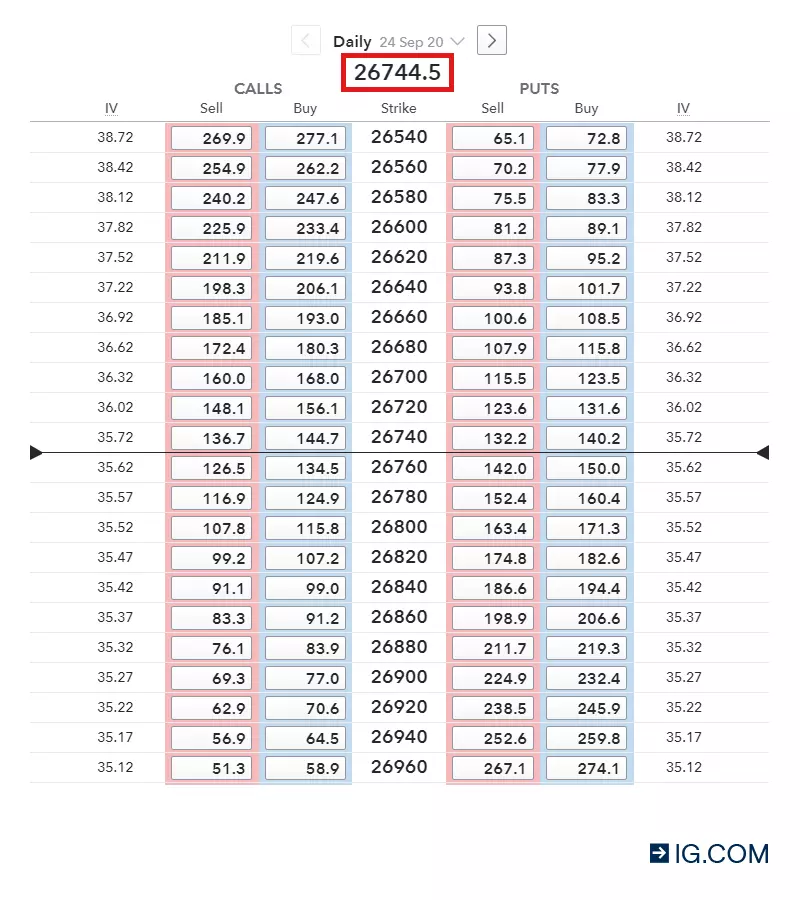

Pick your strike price

The strike price in options trading is the price at which an options contract can be exercised. The underlying market price must move through the strike price to make it possible for that option to be executed – known as in the money. If this doesn’t happen, the option will expire worthless – known as out of the money. Learn how to pick the right strike price.

Open and monitor your position

Once you’ve decided whether to buy or sell your chosen currency pair, you can monitor your position on our forex trading platform using the free tools and indicators available to you. Remember to stay abreast of any news and events that may affect the price of the FX pair you’re trading.

Develop your forex knowledge with IG

Find out more about forex trading and test yourself with IG Academy’s range of online courses.

Try these next

Explore spread betting and learn how you can use it to speculate on positive or negative market movements.

Learn about trading contracts for difference, and see how you can trade the markets using this derivative.

Discover everything you need to know about futures contracts, including how to trade them.

Try these next

Explore spread betting and learn how you can use it to speculate on positive or negative market movements.

Learn about trading contracts for difference, and see how you can trade the markets using this derivative.

Discover everything you need to know about futures contracts, including how to trade them.