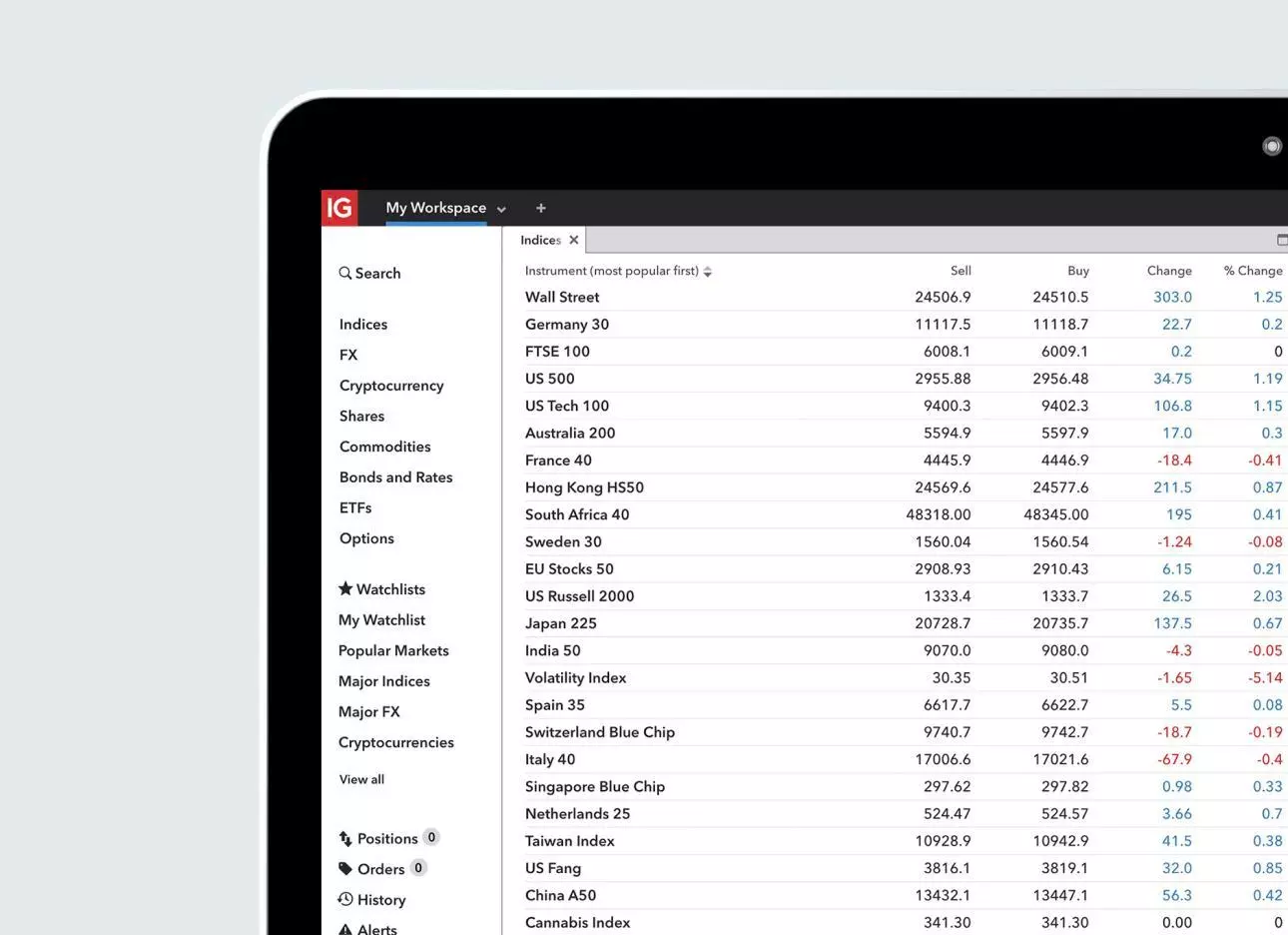

The DAX is Germany’s most popular index, listing the country’s 40 biggest companies. Learn how you can get exposure to DAX price movements with us via cash indices and index futures, as well as ETFs and individual shares.

With us, you can get exposure to the DAX via our Germany 40 index. You can’t trade or invest in the DAX itself. To open a position, follow these three steps:

1. Decide whether you want to trade or invest

You can get exposure to the DAX price by trading or investing in Germany 40 ETFs and individual shares, or trading on the index’s value

2. Create a trading plan

Before taking a position on the Germany 40, you'll need to decide whether you're a short- or long-term trader – and how to manage your risk

3. Open a live account

To open any or all of the following accounts – spread betting, CFD trading and share dealing – fill in our application form

To help you decide whether you want to trade or invest in the Germany 40, we explain each method in detail below.

How can you trade or invest in the DAX?

With us, there are a number of ways to get exposure to the DAX price. You can:

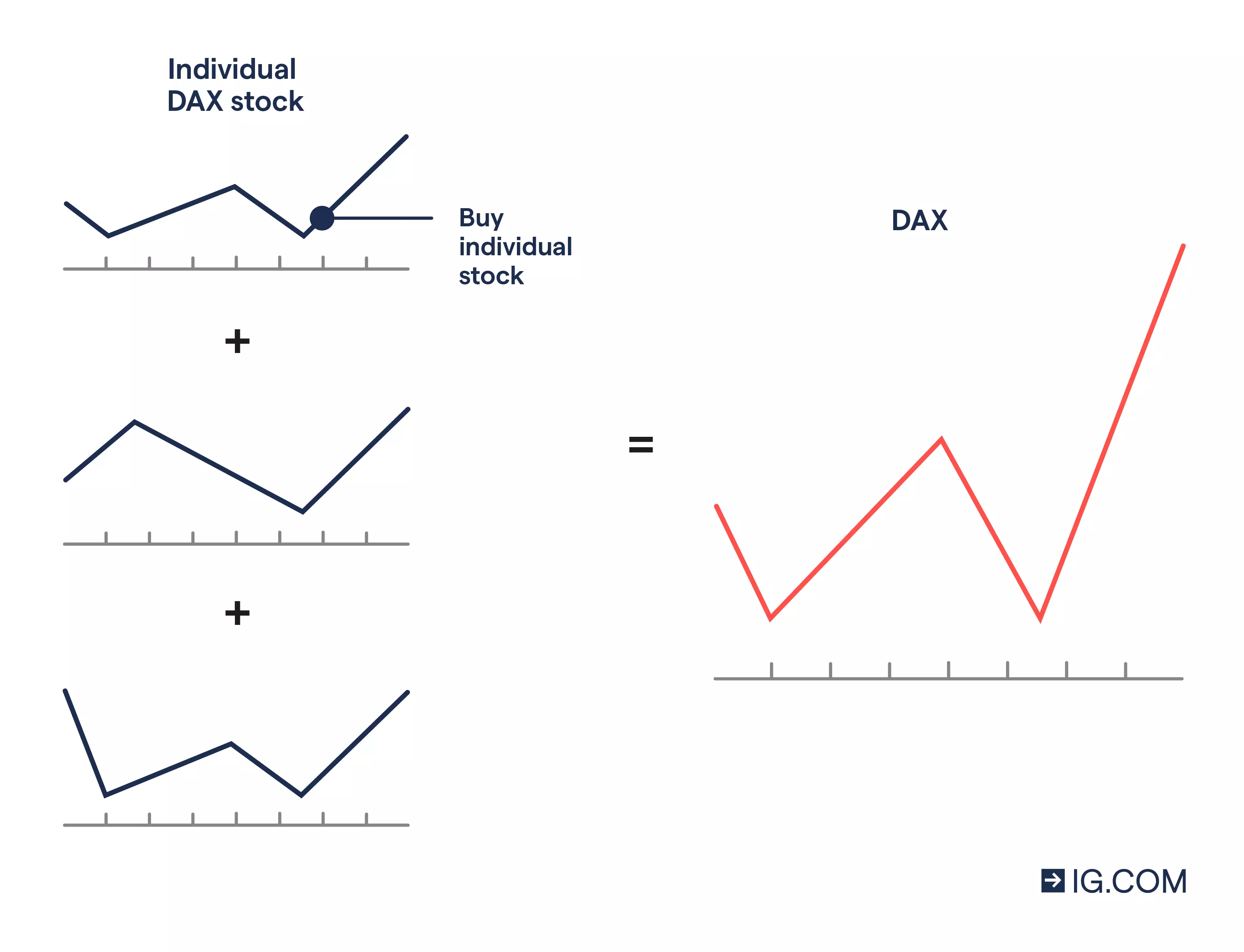

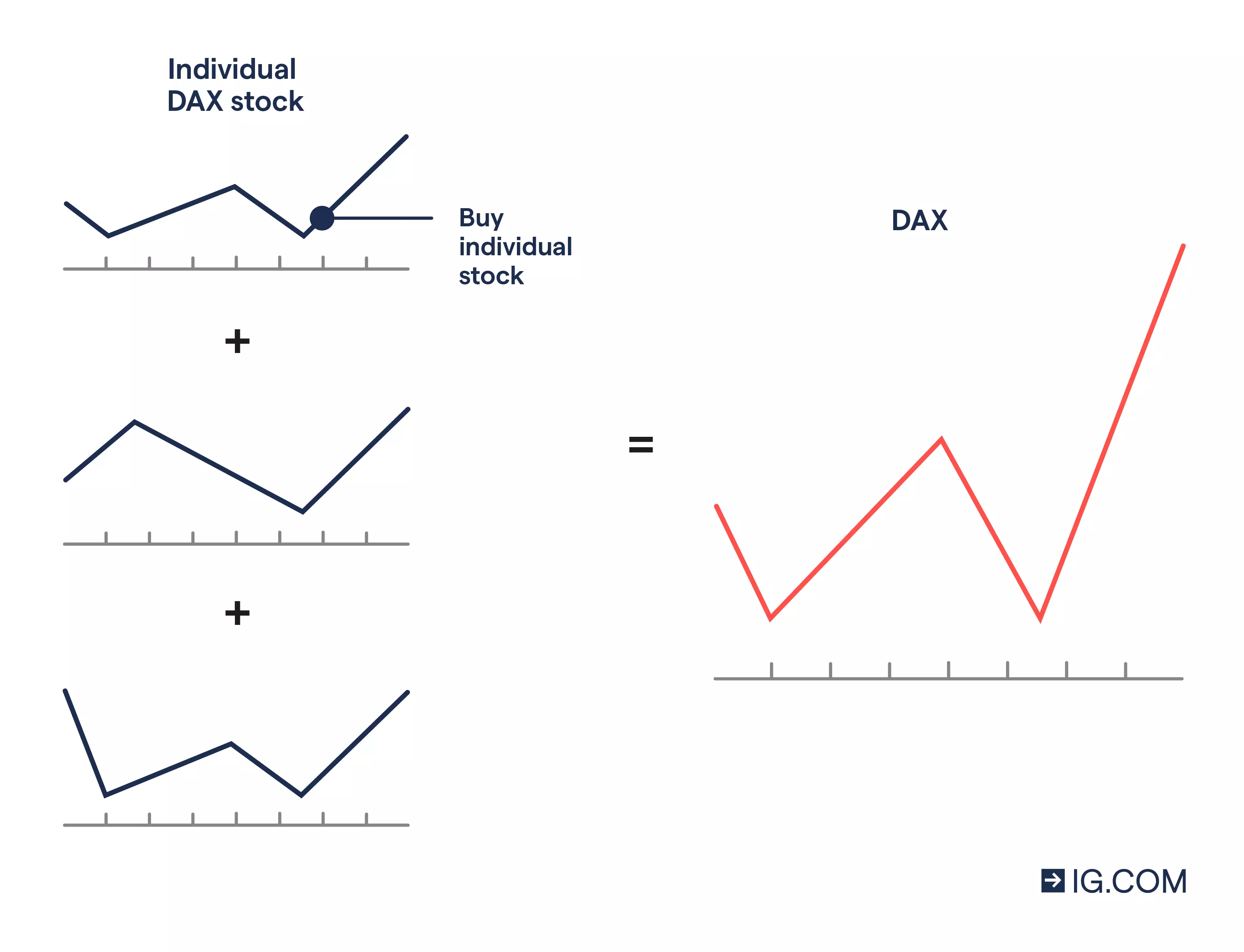

You’ll trade on the Germany 40 price (derived from the DAX) using either spread bets or CFDs. Both are financial derivatives, meaning that you won’t own any underlying assets, such as shares in a DAX-listed company. Instead, you’ll speculate on the underlying asset’s price movements – in this case, either fluctuations in the Germany 40, or movements in the prices of DAX-listed companies’ shares or ETFs.

Financial derivatives are leveraged. This means that you won’t pay the entire value of your position upfront (as you would when buying shares, for example), but you’ll pay an initial deposit called margin to open your trade. Because both profits and losses of leveraged trades are calculated based on the full position size, rather than your deposit amount, you can earn or lose far more than the price you paid to place the trade.

When investing in shares listed on the DAX, you’ll use our share dealing platform instead. This means that you’ll buy DAX-listed assets outright – for example, shares in a DAX-tracking ETF or DAX-constituent company. This’ll make you a shareholder, entitled to any dividends paid and granted voting rights if applicable. You can invest in DAX-tracking ETFs there, too.

Remember – all trading and investing incurs risk, so always ensure you understand the risks involved, and whether you can afford the potential losses.

Trade on the Germany 40 price directly

- Speculate on the performance of Germany’s largest companies – some of the most popular in Europe – from a single position

- Take a position on the index’s price using spread bets or CFDs – although these are derivative trading products, this is the most direct way to trade on the price of the underlying index – the DAX

- Gain exposure to the DAX in a market with high liquidity

- Enjoy the freedom to go ‘long’ (if you think the price will rise) or ‘short’ (if you think the price will fall)

- Trade commission-free with spread bets or CFDs (excluding share CFDs) as charges are included in the spread

- Use our Germany 40 ‘cash’ (spot) market to take a position in the short term

- Choose our Germany 40 futures or options markets for the longer term

- Trade around the clock, almost 24/7 (excluding 10pm Friday to 8am on Saturday and 10.40pm to 11pm on Sunday)

Trade or invest in DAX-related ETFs

- Gain broad exposure to the DAX index with our related ETFs

- Take a position on DAX-linked ETF price movements with spread betting or CFD trading without owning the underlying asset

- Use spread bets or CFDs to go long or short – but remember that this offers lower liquidity and higher spreads than trading the Germany 40 directly

- Instead of speculating on the current index level of the Germany 40, you trade on the price of and ETF – calculated using the fund’s net asset value (NAV)

- Buy and hold actual shares in a DAX-related ETF by opening a share dealing account

- Invest in DAX-linked ETFs from just £0 commission using our share dealing platform1

Overnight funding fees are charged on cash index, share and ETF positions held open after 10pm (UK time). These fees are not charged on futures and options2

| Trading the Germany 40 price directly | Trading or investing in a DAX-related ETF | Trading or investing in DAX-listed shares | |

| Account types | Spread betting or CFD trading account. |

Spread betting or CFD trading account to trade, or share dealing account to invest. |

Spread betting or CFD trading account to trade or a share dealing account to invest. |

| Market hours | 24/7 (except 10pm Friday to 8am Saturday and 10.40pm to 11pm Sunday). Please note that our Weekend Germany 40 market is separate to the main Germany 40 market |

UK-listed ETFs that relate to the DAX can be traded when the LSE is open - 8am to 4.30pm, Monday to Friday (UK time) | When the Frankfurt Stock Exchange is open – 8am to 4.30pm, Monday to Friday (UK time) |

| Timeframe | Short to medium term. |

Short to medium term for trading and long term for investing. |

Short to medium term for trading and long term for investing. |

| Liquidity and execution | 0.014 second execution speed and unique deep liquidity. |

Higher liquidity offered by trading the index directly. |

Higher liquidity offered by trading the index directly. |

| Costs | Commission-free, with spreads from just 1.2 points.

Trading the Germany 40 on the spot (cash) incurs overnight fees, but index futures don’t incur these fees. |

Invest in UK-listed DAX ETFs from £3 commission per trade.1

Commission-free for spread betting, with min spreads of 0.1% to 0.35%.

Min commission £10 for CFD ETFs listed in the UK. |

Invest in German shares for 0.1% of total trade size – min commission is €101

Commission-free for spread betting, with min spreads of 0.1% to 0.35%.

Min commission £10 for CFD ETFs. |

Overnight funding fees are charged on cash index, share and ETF positions held open after 10pm (UK time). These fees are not charged on futures and options2

Open a trading or investing account

There are different types of accounts you can open to take a position on the Germany 40: spread betting or CFD trading accounts, or a share dealing account.

Spread betting and CFD trading |

Share dealing |

|---|---|

Speculate on the price of the index, shares and ETFs rising or falling |

Pay the full value of the shares or ETFs you buy upfront |

Leverage your exposure – you’ll only pay a deposit to get exposure to the full position size |

Pay the full value of the shares or ETFs you buy upfront |

Leverage means both profit and loss will still be magnified to value of the full trade – so you could gain or lose money faster than you’d expect |

You may get back less than you put in because the value of shares and ETF can fall as well as rise |

Trade tax-free with spread bets and offset losses with CFDs3 |

Invest tax-free with a stocks and shares ISA3 |

Take shorter-term positions |

Focus on longer-term growth |

You can look to hedge your portfolio when trading |

Build a diversified portfolio |

Trade without owning the underlying asset |

Take ownership of the underlying asset |

No shareholder privileges |

Gain voting rights and dividends (if paid) |

Trade in both our spread betting account and CFD account |

Invest in our share dealing account or with a ready-made Smart Portfolio |

If you’d prefer to become an actual shareholder instead of trading on price movements with derivatives, you can invest in DAX-related ETFs and DAX companies’ stocks through our share dealing platform. This means you’ll be taking direct ownership of shares.

To invest in a DAX-tracking ETF or constituent company, you’re essentially buying, not trading, so you’ll commit the full value of the shares upfront. While you might need more initial capital to get started when compared to trading, your losses are capped at this amount and so can be less risky than trading. That said, you could still get back less than your initial outlay as with any other investment.

Learn what moves the index price

If you want to successfully trade the Germany 40, you’ll need to predict the index’s price movements. This means understanding what influences its price, which will help you decide when to open and close your positions for the maximum chance of profit.

Among other factors, the Germany 40’s price is moved by:

- Earnings reports: changes to DAX constituents’ valuations and results, as well as significant positive or negative news released in their latest earnings report, can have a substantial impact on the index price, depending on the weight of the stock

- Economic events: for example, the index experience significant volatility throughout 2020 during the economic fallout of the Covid-19 pandemic

- News releases: just as with significant economic events, high profile news releases can be followed by a period of volatility in the market. If the news pertains to any of the industries or constituents of the DAX, its price may be especially affected

- Exchange rates: fluctuating exchange rates can affect the Germany 40’s price because DAX constituents, like BMW and Volkswagen for instance, earn a lot of their income in other countries

Remember, information from research is power. You should always use a combination of fundamental analysis and technical analysis before trading DAX-listed stocks, and follow a trading plan and a risk management strategy.

Hone your trading strategy

A trading strategy is never perfect, nor is your knowledge of the Germany 40, so both will be an ongoing process of refining your craft. Here are a few tips to consider as you continue to develop your trading strategy:

- Decide on a trading style: there are four main trading styles – scalping and day trading for more short-term traders, swing trading and position trading for longer term. Your chosen trading style determines how often you place a trade and how long you keep them open

- Study charts and price action: daily and weekly charts can help you to gauge market sentiment, while price action can help you recognise patterns and get a feel for what the market might do next

- Use technical analysis and indicators: use technical analysis and trading indicators can help you identify certain signals and trends on the Germany 40

- Look for trading signals: by analysing the Germany 40 chart often and knowing its rhythms, you should be able to tell if it’s in a trend. You can confirm trading signals with momentum indicators such as the stochastic oscillator or relative strength index (RSI)

- Keep up to date with the news: every time news about a DAX-listed company (like earnings) is released, it can affect share prices. Keep a close eye on the economic calendar to help you trade according to the latest events

- Set trading alerts: no one can watch the markets all the time. Trading alerts let you to set specific criteria for the Germany 40 price and be notified immediately once those market conditions have occurred

Take your first Germany 40 trading or investing position

Let’s take a more detailed look at the various ways you can open a position using spread bets, CFDs or share dealing.

Spread betting on the Germany 40

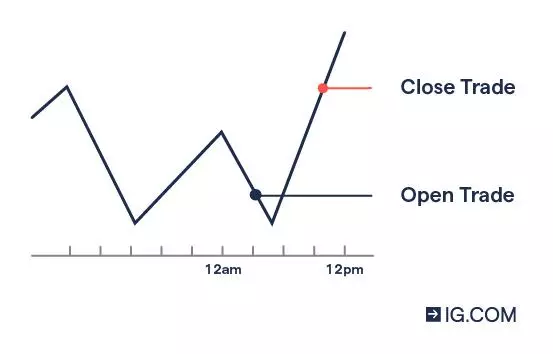

When you spread bet, you’ll be putting up a certain amount of capital per point of movement in the underlying market. Your profit and loss is calculated by multiplying your bet size by the number of points of movement.

Let’s look at an example. You think the Germany 40 is going to rise from its current level of 7150, so you go long and open your position by clicking ‘buy’ on our platform.

If the index’s price increased to 7200 and you bet £10 per point, you’d earn a profit of £500 (50 points x £10 per point) excluding any other costs you might incur like overnight funding. If the index price dropped in value instead, moving against your prediction, you’d make a loss of £500.

- Spread betting on cash indicies

- Trading the Germany 40 with spread bets

- See how to take your cash position with spread betting

- Spread betting on Germany 40 index futures

- Spread betting on Germany 40 options

- Spread betting on DAX-related ETFs

- Spread betting on DAX-listed shares

Spread betting on cash indices is a popular choice, as you’ll always deal at the current price of the underlying market while receiving tight spreads. Just remember, though, that overnight funding fees are charged if you hold your position open after 10pm (UK time). This means that spread betting on cash indices like the Germany 40 is a popular option with short-term traders. However, you could consider futures or options for longer term positions.

Our out-of-hours and weekend trading enables you to trade the DAX almost 24/7 (with the exception of 10pm Friday to 8am Saturday and 10.40pm to 11pm Sunday, UK time). Remember that you’ll have to open your weekend positions separately from your weekday ones. However, once the weekend’s over, any weekend positions will be rolled over to a weekday position.

Our out-of-hours and weekend trading enables you to trade the Germany 40 almost 24/7 (with the exception of 10pm Friday to 8am Saturday and 10.40pm to 11pm Sunday, UK time). Remember that you’ll have to open your weekend positions separately from your weekday ones. However, once the weekend’s over, any weekend positions will be rolled over to a weekday position.

Spread betting on cash indices is a popular choice, as you’ll always deal at the current price of the underlying market while receiving tight spreads. Just remember, though, that overnight funding fees are charged if you hold your position open after 10pm (UK time). This means that spread betting on cash indices like the Germany 40 is a popular option with short-term traders. However, you could consider futures or options for longer-term positions.

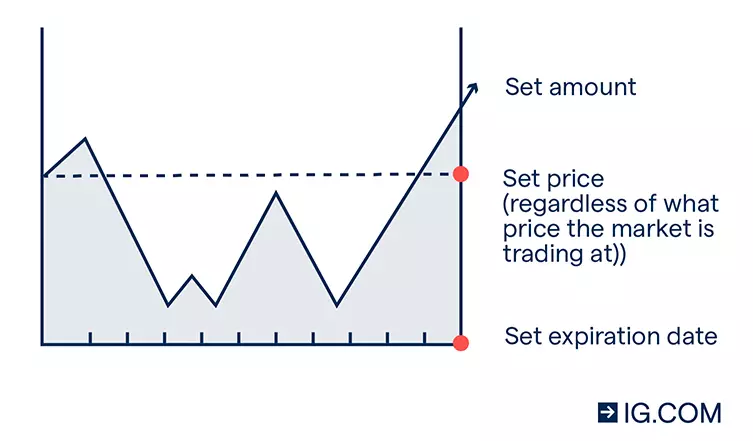

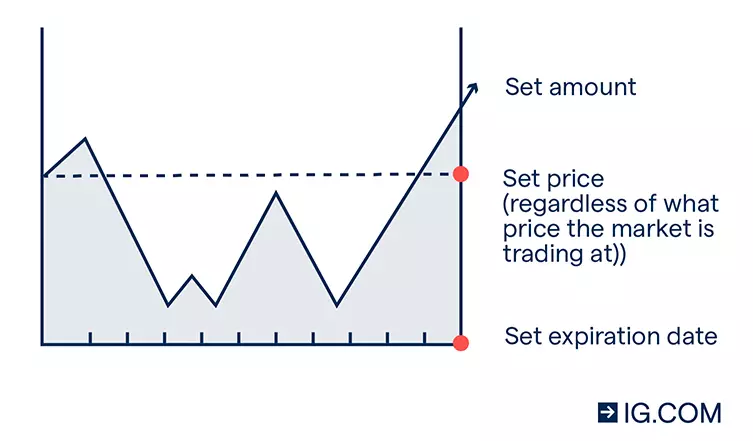

When trading Germany 40 index futures, you’re agree to trade the index at a specific price on a specific date. Index futures are popular among longer-term traders because there are no extra overnight funding charges as there are in spot trading. Instead, these are included in the spread – enabling you to hold positions for a long time without this additional cost. With spread betting, you also won’t pay a commission on index futures.

You can also trade on the Germany 40 via options, which give the holder the right (but not the requirement) to exercise the contract on or before its expiry date. When you trade options by spread betting, you’ll be using the derivative to speculate on an option’s premium – which will fluctuate as the probability of the option being profitable at expiry changes.

In practice, for example, a call option to buy at £10 per point, with a strike price of 127.5, would earn you £10 for every point that the index moves above 127.5 – minus the margin you paid to open the position.

You only have limited risk when buying options as you’ll only risk as much as the margin you pay when opening your trade. However, there is substantial risk when selling options. In fact, selling a call incurs potentially unlimited risk as market prices can keep rising without limit. Options trading is often only recommended for experienced traders.

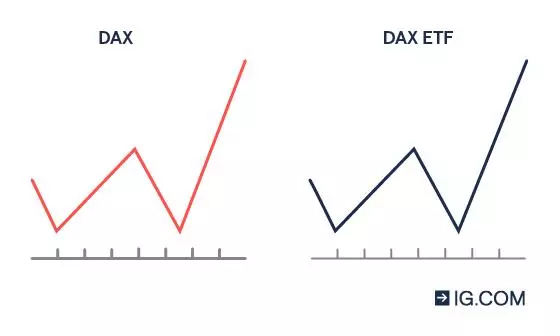

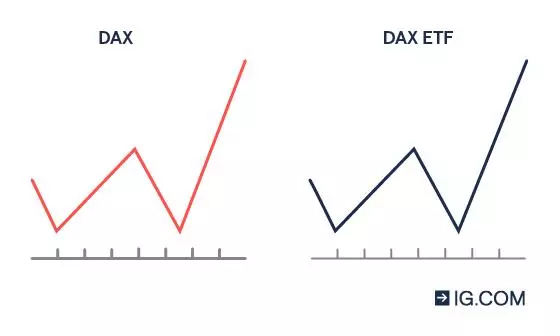

Speculate on all 40 best-performing companies in Germany, all at once, when you trade the price movements of a DAX-related ETF.

The most common form of DAX-related ETF is a weighted tracker, which mirrors the make-up of the DAX directly.

You can also trade ETF forwards when spread betting, which means you’ll speculate on the price of a DAX-tracking ETF on a specific future date.

You’ll pay zero commission on ETFs with spread betting. However, an overnight funding fee will apply if you hold a trade (that isn’t a forward) open past 10pm UK time.2

With us, you can spread bet on all the shares of all companies listed on the DAX, such as BMW and Siemens.

When you do, you’ll be speculating on these companies’ share prices, not owning the shares outright, and can go long or short and trade with leverage.

While you can trade cash (spot) share prices, we also offer share forwards with spread betting.

You’ll never pay commission on spread betting shares, and our spreads are some of the lowest available. Our cash shares incur overnight funding fees if you hold your position open past 10pm UK time.2 Overnight funding fees aren’t charged on our forwards, but the spread is wider than on our cash offering.

If you’d prefer to buy and own shares, you can through our share dealing platform.

Trading CFDs on the Germany 40

A contract for difference (CFD) is an agreement to exchange the difference in price of an underlying asset, as measured from the time the contract is opened until the time it’s closed. So, however much the price of that asset has risen or dropped since you opened your position is what you stand to make as a profit or a loss, depending on whether your prediction is correct or incorrect.

For example, you believe that the Germany 40 is set to rise from its current price of 16296.7. So, you buy a CFD worth £10 per point. Your forecast is correct, and you close your position when the market reaches a sell price of 16396.7. The difference is 100 points, multiplied by the £10 per point, so your profit is £1000 – excluding other costs.

If your prediction is incorrect and the market drops, and you closed your trade at a level of 16196.7, your loss would be £1000 – excluding other costs.

- Trading CFDs on cash indices

- Trading CFDs on Germany 40 futures

- Trading CFDs on Germany 40 options

- CFD trading on DAX-tracking ETF

- CFD trading on DAX-listed shares

Just like with spread betting, you can trade the Germany 40 cash (spot) price using CFDs.

With this method, you can deal at the current market price and receive tight spreads. But, if you’d like to hold your position open overnight – or for a longer period – consider trading CFD futures or options as cash (spot) positions incur overnight funding fees if still open after 10pm UK time.2

Our out-of-hours and weekend trading enables you to trade the Germany 40 almost 24/7 (with the exception of 10pm Friday to 8am Saturday and 10.40pm to 11pm Sunday, UK time). Any positions opened over the weekend are automatically rolled over to a weekday position after 11pm Sunday, but you’ll have to open any weekend positions separately from your weekday trades.

Just as in spread betting, trading index futures with CFDs means you agree to trade the Germany 40 at a specific price on a specific date. With our index futures, overnight funding fees are included in the spread, meaning that you can hold positions for a long time without additional costs. When trading futures CFDs on indices, you also won’t pay any commission.

Options give you as the holder the right, but not the obligation, to exercise the contract on or before its expiry date. When you trade Germany 40 options via CFDs, you’ll be speculating on an option’s current market price (known as premium) which will fluctuate as the probability of the option being profitable at expiry changes.

For example, if you buy a CFD option worth £10 per point of Germany 40 movement, you’d earn £10 for every point that the index rises above your chosen strike price (the set price at which the option can be bought or sold), minus the margin you paid to open your trade.

Buying options is inherently limited-risk – you’ll only risk as much as the margin you pay when opening your trade. However, there is substantial risk when selling options. Selling a call, for instance, incurs potentially unlimited risk as market prices can just keep rising. Options trading is often only recommended for experienced traders.

Open a position on a DAX-tracking ETF with a CFD and speculate on the collective performance all 40 of Germany’s top companies. The most common form of DAX-related ETF is a weighted tracker, which mirrors the make-up of the DAX directly.

It’s important to note, though, that unlike spread betting, we don’t offer CFD forwards on ETFs.

Trading ETFs with CFDs incur a minimum commission of between 0.1% and 0.35% each side of the trade (with a minimum fee of £10) and an overnight funding fee if you hold your position open after 10pm UK time.2

Would you rather trade on specific DAX-listed stocks, like Volkswagen, BMW or Allianz? With us, you can trade CFDs on any DAX company. Trading CFDs means you’re trading with leverage and are able to go long or short, depending on what the market’s doing.

Just remember that trading with leverage means your profits and losses can substantially outweigh the margin amount you paid to open the position, so ensure you’re always trading within your means.

Share CFD charges include a minimum 0.1% commission charge of 0.1% and up to 0.35% on each side of the trade (with a minimum fee of £10 for online transactions) and an overnight funding fee if you hold your position open after 10pm UK time.2

If you’d rather buy and own shares instead of speculating on them, you can do so through our share dealing platform.

Investing in the DAX with share dealing

When you invest in the DAX (or Germany 40) via a share dealing account, you’ll buy actual shares in a DAX-linked ETF or DAX-listed company.

This entitles you to dividend payments if the fund or company grants them.

As you buy and hold shares when investing, you’ll be restricted to ‘going long’ (you’d aim to buy low and sell high at a later date to earn a profit). This means investing is usually better suited to those willing to take a longer-term view.

You won’t be trading with leverage when using our share dealing platform. Instead, as you’re buying the shares or ETF outright, you’ll commit the full value of the investment upfront.

While this caps your risk (you can only lose as much as you bought for) if your shares depreciate over the period you’ve held them, you’d make a loss on your investment by getting back less than what you initially put in.

However, you’ll also be entitled to any dividends that company pays to its shareholders.

With us, commission costs on shares are from just 0.1% of your position size, plus a foreign exchange fee of just 0.7%.

As passively managed funds, ETFs enjoy the benefit of avoiding the large performance fees typically associated with actively managed funds.

- Buying DAX ETFs with share dealing

- Buying DAX stocks with share dealing

- Investing in a managed portfolio

Buying shares in a DAX-tracking ETF is one of the most traditional ways to gain access to the whole index from a single investment.

DAX-linked ETFs will either buy assets – such as stocks appearing in the DAX – or use derivative instruments like futures contracts to mimic the performance of the underlying index. If, for example, the DAX index shows positive growth, the tracking ETF will mirror that growth as closely as possible.

The most common form of DAX ETF is a weighted tracker, which mirrors the make-up of the DAX directly.

An index ETF is a good way to diversify an investment portfolio, lessening the risk of a loss you face when holding just a few, concentrated shares.

You can buy DAX-listed shares using a share dealing account. This will enable you to buy shares in a DAX-listed company or DAX-linked ETF.

Prefer to have experts manage your investments for you? You can opt for a Smart Portfolio.

To get your bespoke portfolio solution, you’ll complete an assessment to gauge your risk appetite and suitability. We’ll then recommend a portfolio that consists of a balance of investments, including DAX-tracking ETFs and companies, to suit your goals and investor preferences.

Once you’ve made your selection and deposited the necessary funds, our managers will invest on your behalf.

Smart Portfolios are subject to an estimated 0.72% fee on the first £50,000 and 0.22% thereafter.

FAQs

What is the DAX?

The DAX is an index of Germany’s 40 largest companies, by market capitalisation, listed on the Frankfurt Stock Exchange. It has become a popular way to gain exposure to the European stock market and also to track the performance of Germany’s economic health.

What are the ways you can trade or invest the DAX?

With us, there are a number of ways to gain exposure to the DAX. You can:

- Trade on the Germany 40 price directly

- Trade or invest in DAX-tracking ETFs

- Trade or invest in DAX-listed shares

When trading the Germany 40, you’ll do so using spread bets or CFDs. You can speculate on the index’s price movements or movements in the prices of DAX-linked ETFs or DAX-listed shares.

When investing, you’ll use our share dealing platform. This means that you’ll buy and own actual assets – for example, shares in a DAX-tracking ETF or DAX-listed company.

What are the DAX’s trading hours?

The DAX’s trading hours are from 9am to 5.30pm (CET time), Monday to Friday. But to get exposure to the index via us, you’ll need to use the Germany 40 that’s available during 8am to 4.30pm (UK time), Monday to Friday. Deutsche Börse (the Frankfurt Stock Exchange) calculates the late DAX (4.30pm-9pm UK time) and early DAX (7am-8am UK time) for out-of-hours prices.

However, you can also trade our exclusive Germany 40 weekend trading hours – from 4am on Saturday to 10.40pm on Sunday (UK time).

As an added bonus, our spread betting and CFD DAX-tracking futures trade 24 hours (11pm Sunday to 10pm Friday UK time).

How do companies get onto the DAX?

To get onto the DAX, a company must be listed on the Frankfurt Stock Exchange and it must be one of the top 40 companies by market capitalisation on the exchange. If its market capitalisation drops drastically, a company might lose its listing on the DAX.

1 See our full list of share dealing charges and fees

2 Overnight funding is the charge you pay for keeping daily funded bets or cash CFD trades open past 10pm UK time; we‘ll make an interest adjustment to your account to reflect the cost of funding your position. Learn more about how overnight funding is calculated.

3 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.