Futures are agreements to buy or sell something later, but at a price that’s set at the beginning of the contracts. Learn how to trade futures, which markets are available and more.

Written by Anzél Killian, Senior Financial Writer. Reviewed by Axel Rudolph, Senior Market Analyst

What’s on this page?

What is futures trading?

Futures trading is the act of buying and selling futures. These are financial contracts in which two parties – a buyer and a seller – agree to exchange an underlying asset for a predetermined price at a future date. Both parties are obligated to fulfil the contract terms by making the exchange before the contract’s expiry.

You can also trade on futures using our OTC products – spread bets and contracts for difference (CFDs).

When trading using our OTC products you speculate on the price of a future (or forwards, as they’re known in stocks, ETFs, and forex markets when trading spread bets).

Find out what the differences are between futures and forwards

You can also use these OTC products to trade a wide range of spot (or ‘cash’) markets. OTC futures have wider spreads – the difference between the bid and ask prices that varies depending on market conditions – compared to OTC spot positions. This is because of overnight funding fees being included in the spreads of futures, whereas a charge applies to a spot position that’s left open at the end of a trading day.

Many traders find the abovementioned ways of trading accessible as there’s no obligation to buy or sell the physical asset that the position is based on. So, you won’t be taking or transferring ownership of the underlying asset.1

Whichever way you choose to trade futures, there are possible tax benefits.2

Differences between listed and OTC futures

Listed products that are in their pure form, like exchange-based futures and options differ from over-the-counter (OTC) products like spread bets and CFDs.

Here are some of the main differences between listed and OTC futures:

| Exchange-traded (listed) futures | OTC futures | |

| Trading venue | On exchange (eg CME, ICE, Euronext): centralised marketplace for buyers and sellers | Over the counter: direct trade between two parties (usually through a broker like us) |

| Agreement or contract | Standardised (non-negotiable) | Bespoke (can be customised) |

| Regulation | The exchange is regulated by government authorities, eg Securities and Exchange Commission (SEC) | Subject to less stringent regulatory requirements |

| Counterparty risk* | Mitigated by an exchange’s clearinghouse | Higher; default risk from both parties |

| Liquidity | Typically higher as there’s a higher number of market participants | May be lower due to less participants in decentralised markets |

* When trading on our platform, counterparty risk is limited based on the terms and agreements that govern our relationship with you.

Speculate on a wide range of markets

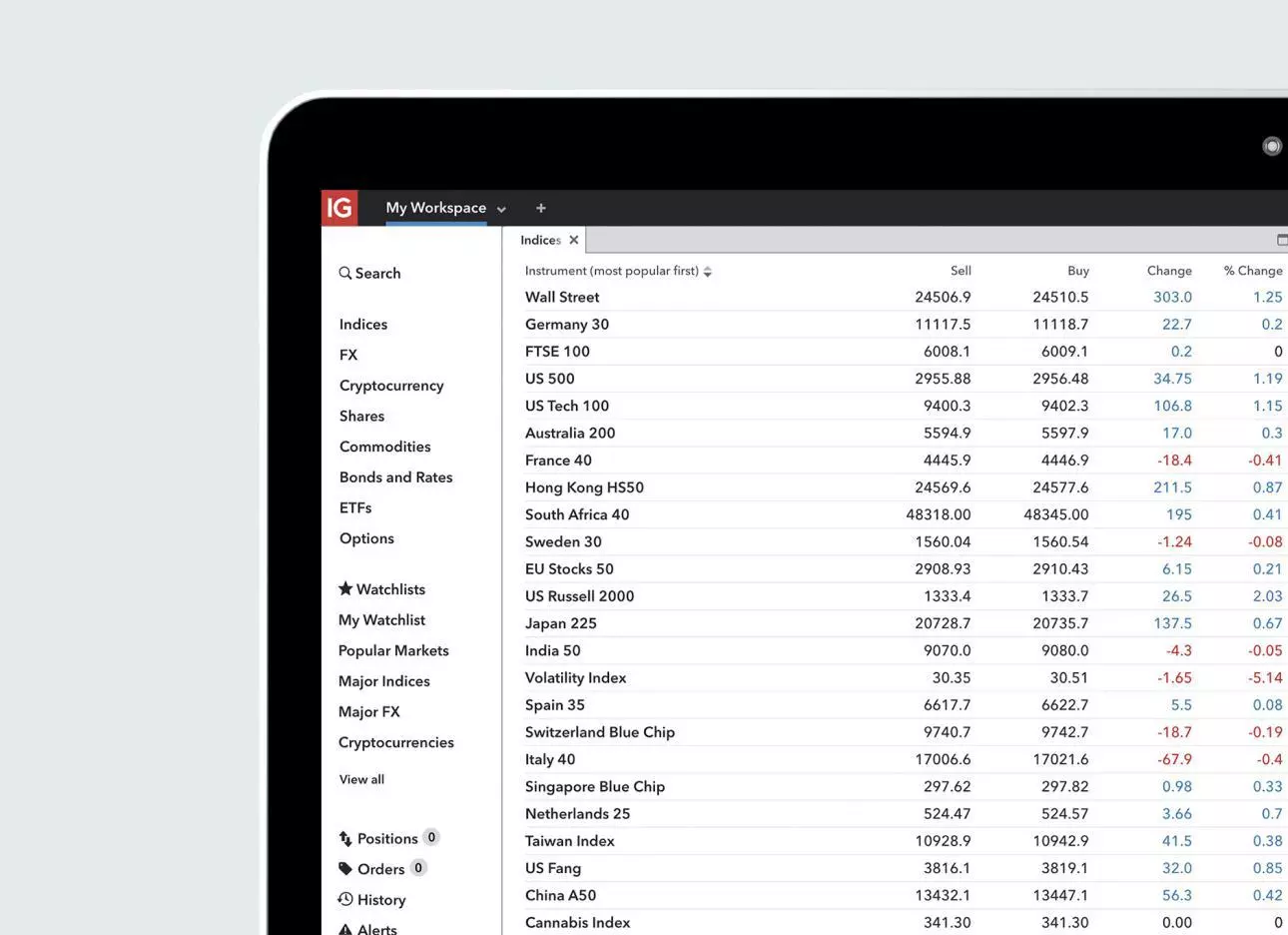

Below are some of the futures markets that you can trade with us:

Share forwards

Take a position on thousands of global shares like Apple, Alibaba, Meta, Samsung Electronics and Amazon

Index futures

Gain exposure to global stock indices including the FTSE 100, Germany 40 and Wall Street

ETF forwards

Trade on price volatility in ETFs across indices, sectors, commodities, bonds or currencies

Commodity futures

Speculate on both hard and soft commodities including gold, silver, wheat, corn and oil

Forex forwards

Go long or short on major currencies like GBP/USD and EUR/USD, plus minor and exotic pairs

Bond futures

Trade on the value of different bonds rising or falling, including German, UK and US government bonds

Markets available with us per product

Below are the futures and forwards markets you can trade with us according to product type.

Spread bet futures: indices, commodities, bonds and interest rates

Spread bet forwards: shares, ETFs and forex

CFD futures: indices, commodities, bonds and rates

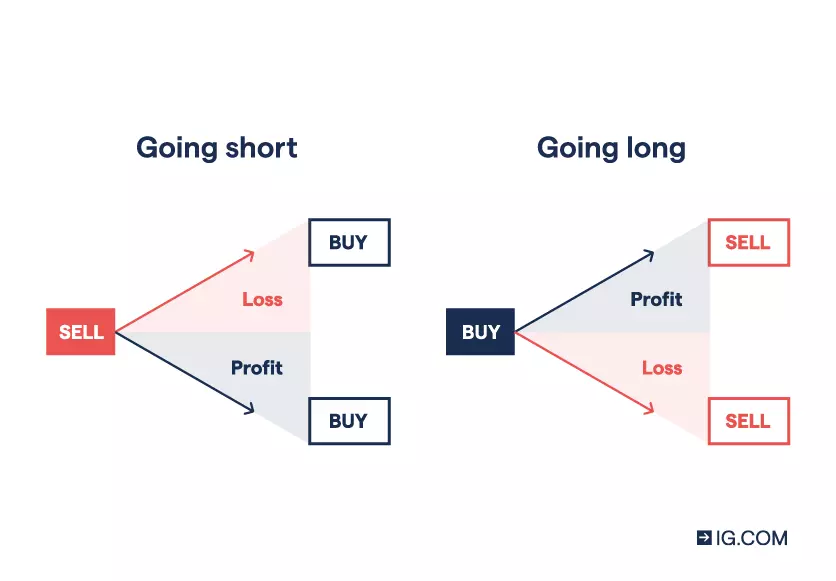

Go long or short

When trading futures you can go both long or short. You’d go long if you think that the underlying market price will rise, and you’d go short if you think it’ll fall. Your profit or loss is determined by the accuracy of your prediction, and the overall size of the market movement.

Get exposure at low costs

With us, you’ll trade listed futures – which are typically held over the medium term – at low commissions. You’ll pay $0.85 each way on a micro futures trade and no commission to close on options on futures, including their micro versions.

We also offer competitive pricing on spread bet and CFD futures (and spread bet forwards). Our OTC futures are suitable for longer term positions – compared to spot positions on the underlying – as no overnight costs apply. Instead, this cost is built into the spread.

You can trade on the spot with continuous, real-time pricing that’s based on the underlying market.

Cash markets are suitable for day trading as overnight funding costs apply.

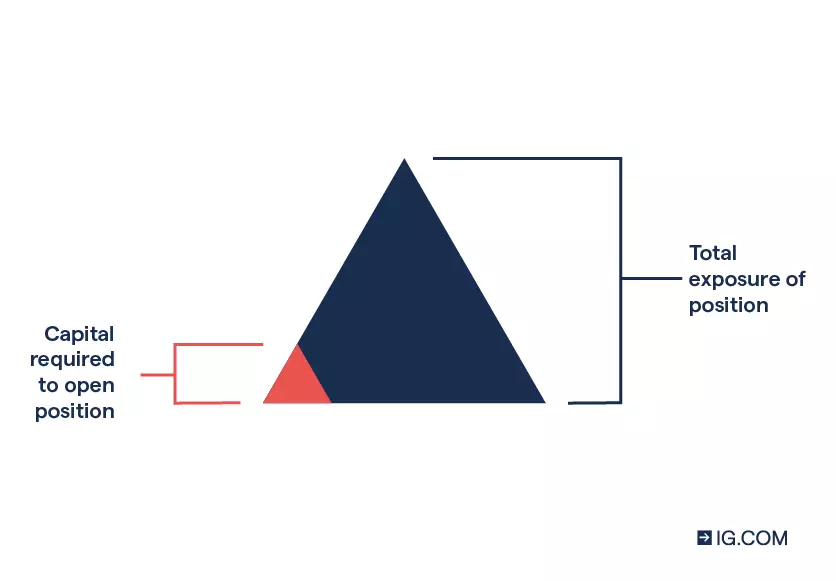

Trade with leverage

Futures contracts are leveraged. So, they enable you to receive increased market exposure for a small deposit – known as ‘margin’ – and your trading provider loans you the rest of the trade’s total amount.3

When trading with leverage, it’s important to remember that your profit or loss will be determined by the total size of your position, not just the margin used to open it. This means there’s an inherent risk that you could make a loss (or a profit) that could far outweigh your initial capital outlay, making it important to manage your risk.3

Access our deep liquidity

Liquidity is typically higher in on-exchange futures as there’s a higher number of market participants.

But even though liquidity can be lower in decentralised markets like OTC futures, you’re likely to have your order filled at your desired price with us. This is because of the number of trades that we handle every day – coupled with our international reach and large client base – it means that our futures markets are particularly liquid.

Learn more about our best execution times and deep liquidity

Hedge your existing positions

Hedging with futures enables you to control your exposure to risk in an underlying market. For example, if you own shares in companies on the FTSE 100 and you’re concerned about them dropping in value, you could short a FTSE 100 index future. Your potential profits from the trade could offset a proportion of your share position losses.

If you had current short positions on the other hand, you could go long on an index future in case the market rises, with the idea that your potential long profits would offset your short losses.

How to trade futures

To trade futures with us, follow the steps below:

Understand how futures trading works

Futures trading works by speculating on underlying market price movements using outright futures contracts that are traded on an exchange or through OTC products.

Direct futures trades between two parties with us – via spread bets or CFDs – you can go long or short. So, you can profit from markets that are rising as well as ones that are falling, provided your predictions are correct. If they aren’t, you’ll incur a loss.

Pick a futures market to trade

With various futures markets to choose from, you should establish which one is most suited to your individual trading style. Some indices – like the Germany 40 – experience higher volatility than others, and could be better suited to day traders for example.

Other markets, such as gold or silver commodity futures are often preferred by traders who have lower risk appetites and enjoy markets with lower volatility. Depending on your needs, you’ll also choose the products to use for exposure to your preferred markets.

Create an account and log in

We’re a FTSE 250 company with 50 years’ experience. To start trading futures on our award-winning trading platform,4 you can create a live account with us.

Our spreads and commissions are among the lowest in the industry. You’ll either pay a spread or commission, depending on the product you’re trading with.

Find out more about futures spreads and charges

We have a diverse range of exchange-traded futures as well as OTC futures and forwards offerings, which include the most popular indices, commodities, bonds, forex pairs and shares on the market.

Decide whether to go long or short

Going long means that you’re speculating on the value of a future’s underlying increasing; going short means that you’re speculating on its value decreasing.

If you think that the underlying price of a future will increase based on your own fundamental and technical analysis, you’d open a long position. If, instead, your analysis suggests that the underlying market price will fall, you’d open a short position. If the market moves in your favour, you can close your position for a profit. If the market moves against your position and you close your trade at an unfavourable price, you’ll incur a loss.

Place your first trade

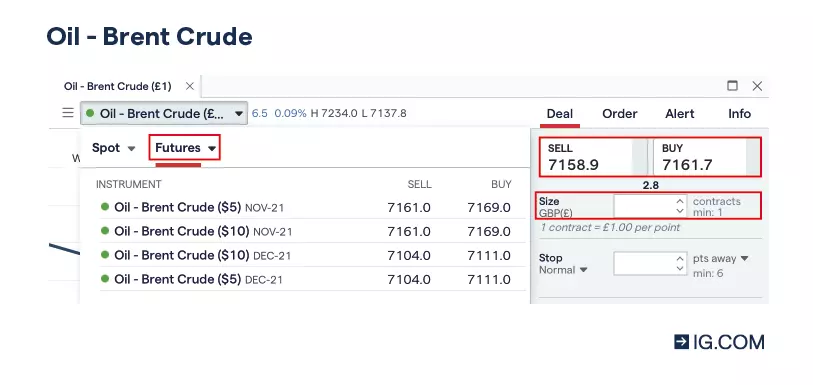

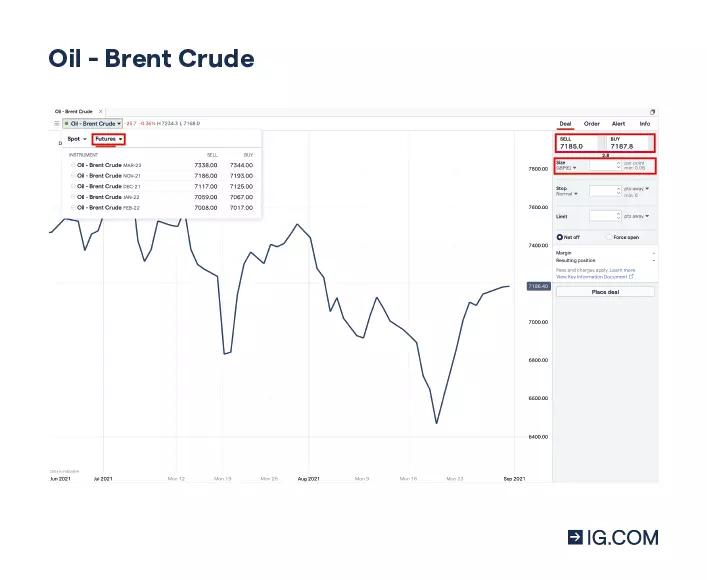

To place your first trade, go to our trading platform, choose an account type and select a market. Decide whether you want to buy or sell the underlying market, and choose your position size.

This is how you’d take an oil futures position using a CFD account with us:*

On our mobile app, futures and forward markets are listed separately to spot and cash markets in spread bet and CFD accounts.

* The interface of our streamlined listed options and futures platform from tastytrade looks different.

Manage your risk

Managing your risk by using tools such as stop-loss and limit-close orders can help you avoid significant losses while aiming to lock in profits. These risk management tools are used to exit a trade and are also referred to as ‘stop and limit orders’ – it’s important to not confuse these with stop-entry and limit-entry orders, which are types of market orders that are used to enter a trade.

A stop-loss order will close your position automatically if the price moves to a less favourable level that you’ve set, while a closing limit order is an automated instruction to exit a trade if it reaches your selected favourable price.

We offer standard, trailing and guaranteed stops,5 and you can set your stops and limits to exit a trade directly from the deal ticket. Once you’re happy with your levels, you can place your deal. You can also set or adjust these exit levels after you’ve placed your trade.

Monitor and close your position

After you’ve placed your trade and it’s been filled, you’ll need to monitor it to make sure that the markets are behaving in the way that you expected. If they aren’t, you might want to close your trade to minimise your losses. If they are, you might want to close your trade after having achieved a profit that’s satisfactory for you.

Remember, you don’t have to wait until the contract’s expiry date to close your position – you can exit a futures trade before the last trading day.1

Futures trading example

Say it’s July and you think the price of oil is going to rise in the future – you could open a long position on a September oil future. Your profit is determined by how much the price of oil has risen by the future’s expiry, and the size of your position – less any relevant charges (eg our spread).

Alternatively, if you think that the price of oil is going to fall, you could go short on the oil future. In this example, you’d profit based on how much the oil price fell and the size of your position (less the amount of relevant costs and charges).

In both scenarios, your position would be closed automatically in September – but you could close it before by the last trading day.1 The months for a futures contract will vary – the example given here (which uses September) is for explanatory purposes only. You should check the expiry of a futures contract before you open a position.

FAQs

What is the definition of futures in trading?

Futures in trading is an agreement between two parties to exchange an underlying asset at a predetermined price at a later date, on or before the contract’s expiry. With us, you can choose from two types of financial derivatives to trade futures: spread bets, and CFDs.

How are futures priced?

Futures are priced according to the spot value of their underlying market, plus a spread or commission that you pay a broker for executing your trade and any other relevant fees. The forces of supply and demand also play a role in determining how the price of a futures contract will move – higher demand and lower supply cause prices to rise, while lower demand and higher supply cause prices to fall.

How does margin work in futures trading?

Margin in futures trading enables you to put down a small deposit to open a trade, while receiving much larger market exposure. However, you should remember that when trading with margin, potential profit or loss is ultimately determined by the full size of the position, and not just the margin required to open it.3

Can anyone trade futures?

Yes, anyone can trade futures.

What are the differences between futures and options?

Futures contracts are different to options contracts because they obligate both parties to exchange the underlying for the agreed upon price. An options contract on the other hand, only obligates the options writer (or seller) to make the exchange (buy or sell) if the contract owner chooses to exercise their side of the agreement. The options holder would typically do this if they feel that the market has moved in their favour.

Learn more about the differences between futures and options

What is the difference between futures prices and spot prices?

The futures price is the price that you lock in when trading a futures contract, and it’s what you’ll be able to buy or sell the underlying market at or before the contract’s expiry date, based on the asset’s quantity that you chose.1 The spot price is the current underlying market price that you would be able to trade at if you opened a position today.

Develop your knowledge of financial markets

Find out more about a range of markets and test yourself with IG Academy’s online courses.

Try these next

Get a rundown on what stock indices are and how to trade them.

Learn how to gain exposure to FTSE 100 price movements.

Choose from a wide range of popular and niche metals, energies and softs.

Learn how to gain exposure to FTSE 100 price movements.

Try these next

Get a rundown on what stock indices are and how to trade them.

Learn how to gain exposure to FTSE 100 price movements.

Choose from a wide range of popular and niche metals, energies and softs.

1 A very small percentage of listed futures contracts end in a physical delivery as most positions are closed before the expiration. In cases of physically deliverable futures, a ‘first notice date’ applies. This date refers to the first day a delivery of an underlying asset can be made. To avoid delivery, tastytrade sends a first notice date email a few days before the actual day, detailing when the contract can be closed or rolled into the next cycle. Agriculture, metals, and interest rates futures contracts are subject to first notice; while the same three plus currency and energy (excluding E-mini) can be physically delivered.

2 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

3 Leveraged products such as spread bets, CFDs and US-listed futures are complex financial instruments, with which an upfront deposit – called margin or buying power – is used to open a larger trade. Your margin will only be worth a certain percentage of your trade, but potential profits and losses will be calculated based on the total position size, not your margin. This makes leveraged trading inherently risky and should never be approached without a trading strategy and adequate risk management in place. Pure-form options are non-marginable, even when traded in a margin account.

4 Best platform for the active trader, best multi-platform provider and best finance app as awarded at the ADVFN International Financial Awards 2024. Best share dealing platform as awarded at the Your Money Investment Finance Awards 2024.

5 Guaranteed stops incur a premium if triggered.