Trading CFDs allows you to speculate on shares, indices, commodities, forex and more. Learn how to trade CFDs step by step, from opening an account to closing a position, with examples of CFD trades. Interested in trading CFDs with us?

Learn what CFD trading is

CFD trading is the buying and selling of contracts for difference – which are financial derivatives that let you take a speculative position on whether an asset (including shares, indices, commodities and forex) will rise or fall in value.

Your first step towards trading CFDs is to learn how they work. Read our quick introduction: what is CFD trading and how does it work?

Create and fund a CFD trading account

Creating a CFD trading account with us is easy:

1. Fill in a simple form

We’ll ask about your trading knowledge to ensure you get the best experience

2. Get instant verification

We can usually verify your identity immediately

3. Fund and start trading

You can also withdraw your money easily, whenever you like

Not ready to trade CFDs yet? Build your confidence in a completely risk-free environment with a demo account, and practise with £10,000 in virtual funds.

Choose your market and timeframe

One of the features of CFD trading is that there are a variety ways to trade them. We offer 15,000+ markets, including:

• Shares – over 11,000+ international shares

• Indices – over 80 indices including the FTSE 100, Wall Street and US Tech 100

• Forex – including all the top major, minor and exotic currency pairs

• Commodities – over 30 commodities, from precious and base metals to oils, gas and softs

• Other markets – like ETFs, bonds, options, thematic and more

There are also different ways to trade CFDs: via spot markets and via futures.

- Spot trading is best for shorter-term trading as the spot price is the immediate real-time price of the asset

- CFD futures are best for medium to longer term trades as they allow you to speculate on the price that the underlying asset will be on a specific date

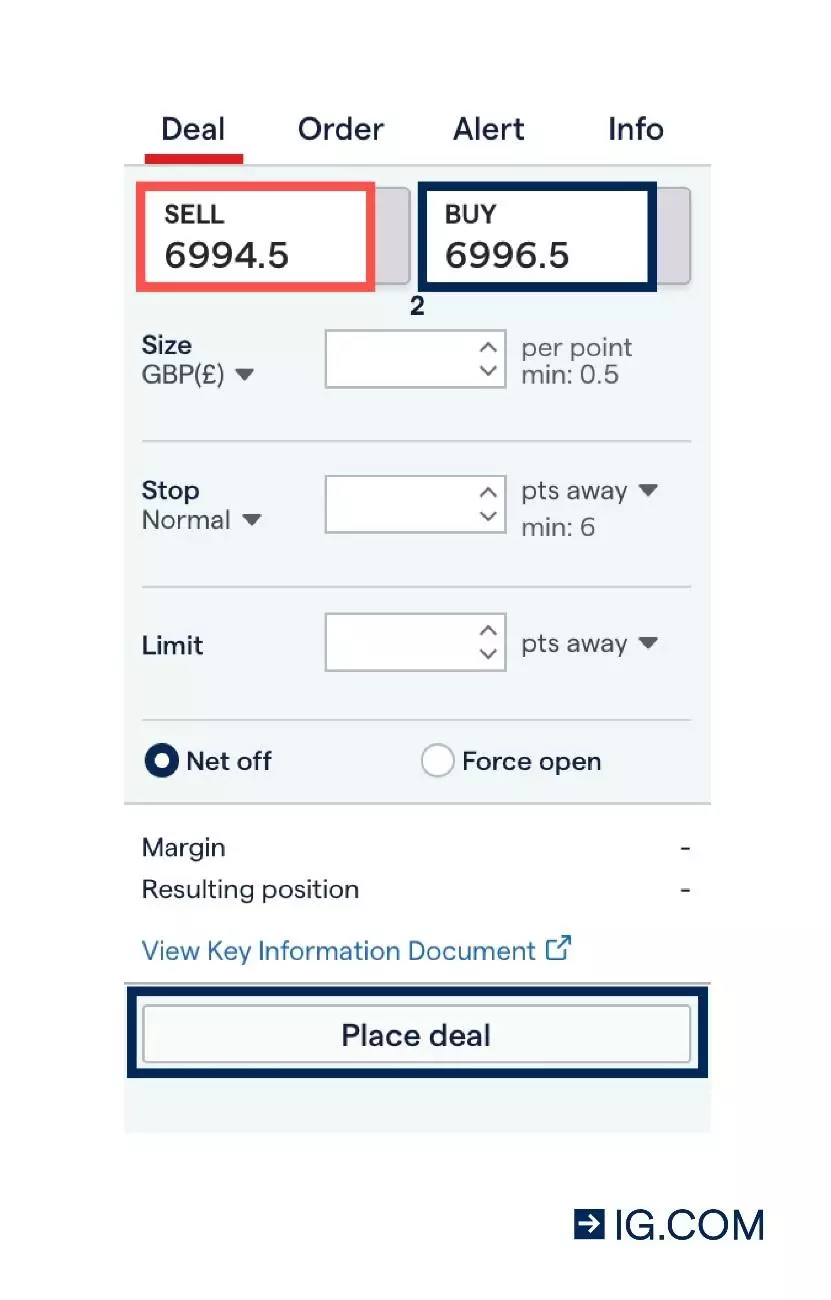

Decide whether to buy or sell

With CFDs, you can take a ‘buy’ or ‘sell’ position on an underlying market. You’d ‘buy’ if you thought the price was going to rise, and you’d ‘sell’ if you thought it was going to fall.

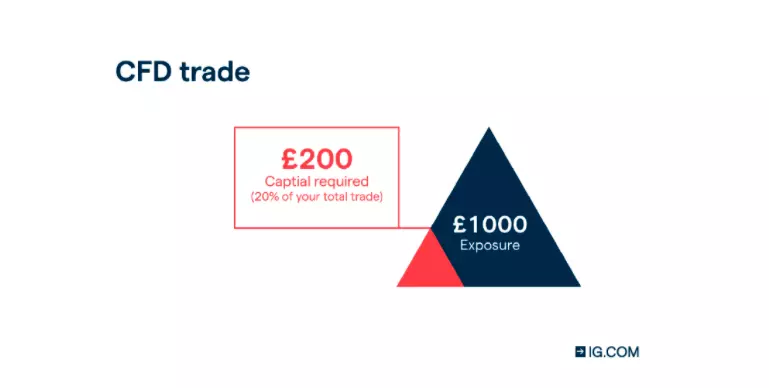

CFDs are leveraged, meaning that you can receive full market exposure for a deposit, known as a margin. Your margin is a product of leverage – think of it as the deposit with which you open the position. Trading on margin enables you to get exposure to the full value of the trade without committing a higher value upfront.

So, if you wanted to open a £100 position on Apple shares, you’d put down a margin of £20 (20% of the position size). It’s important to remember that, while leverage can help to amplify your profits, it can also increase your losses. This is because your profit or loss will still be calculated on the full size of your position.

The difference in price between the ‘buy’ price and ‘sell’ price for an asset is called the spread.

You’ll need the current market price to pass above our buy price when going long, or fall below our sell price when going short, in order to make a profit. The difference between these two amounts is called the spread.

The spread is the difference between the bid and ask prices, and varies depending on market conditions. In most cases we charge our own spread on top of the market spread, as our fee for the trade. Spread charges apply to CFD trades for all markets except shares.

For every shares CFD trade, you’ll pay a commission instead of a spread.

Set your stops and limits

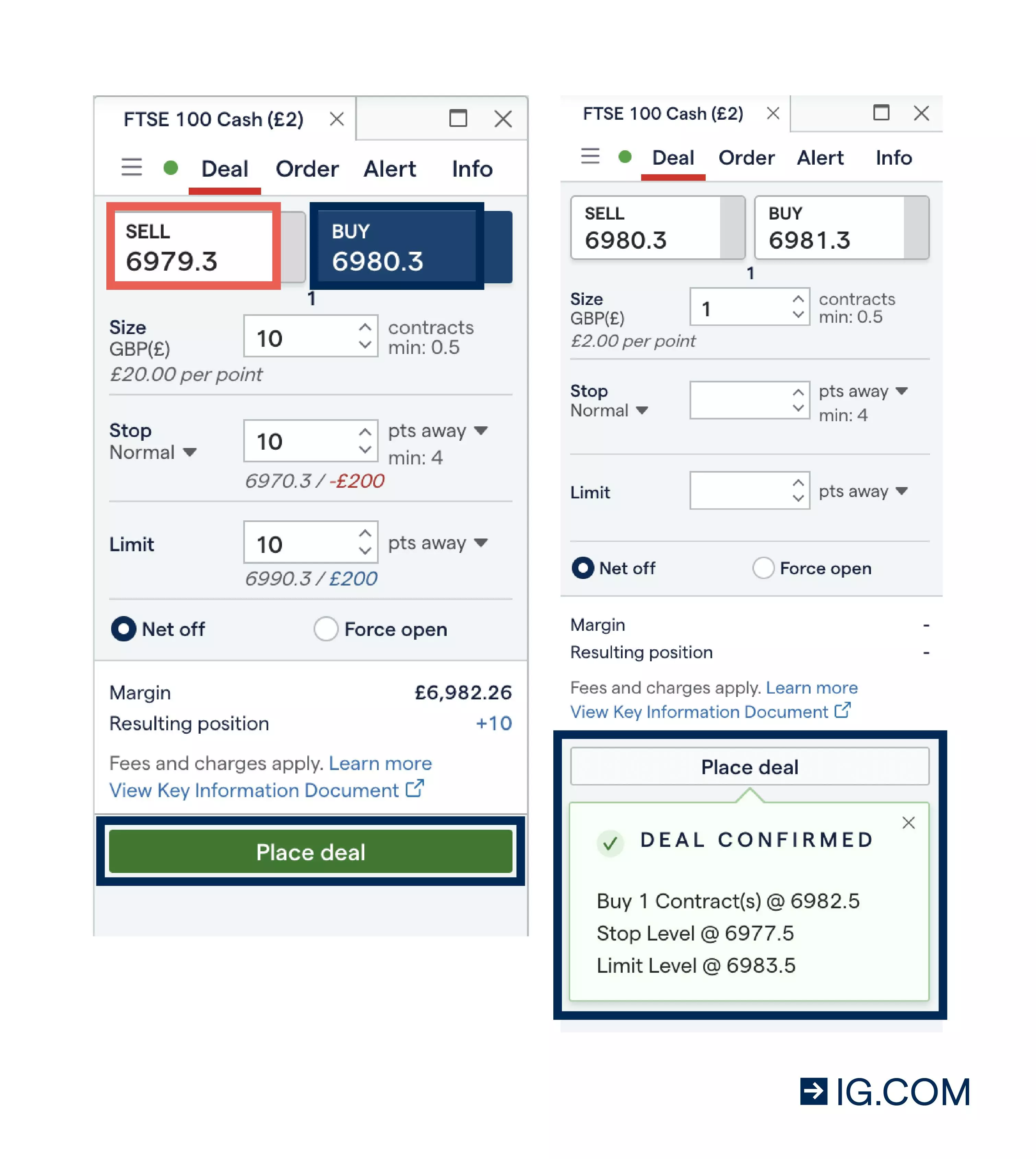

Once you’ve decided on what to trade and the position size (and margin) you want, it’s time to set stops and limits. Because a trade’s profit or loss is only calculated once it’s closed, stops and limits are parameters that close your trade for you automatically once it has reached the level of profit or loss you’re comfortable with.

In this way, your stops and limits help you to calculate potential profits and losses from your CFD trades. They can also be useful ways to lock in your profits, or to minimise your exposure to risk.

Learn more about risk management

Under the ‘size’ button, choose an amount for your stop order, or ‘stop’ as it is known, which is an order to close your trade when the market price moves to a level which is less favourable to you. A limit order or ‘limit’ is the opposite: an order to close the trade when the market moves to a level which is more favourable to you.

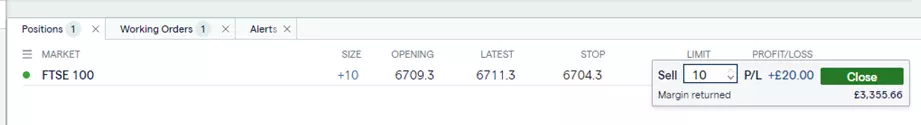

Open and monitor your CFD trade and close your position

As soon as you’ve opened your trade by clicking ‘place deal’, you can watch your trade in real time on our CFD platform to see how you’re doing. You can monitor all your open CFD trades within our award-winning platform1 and, when you’re comfortable with the profit you have made – or wish to limit any more loss – close your position by clicking the ‘close’ button.

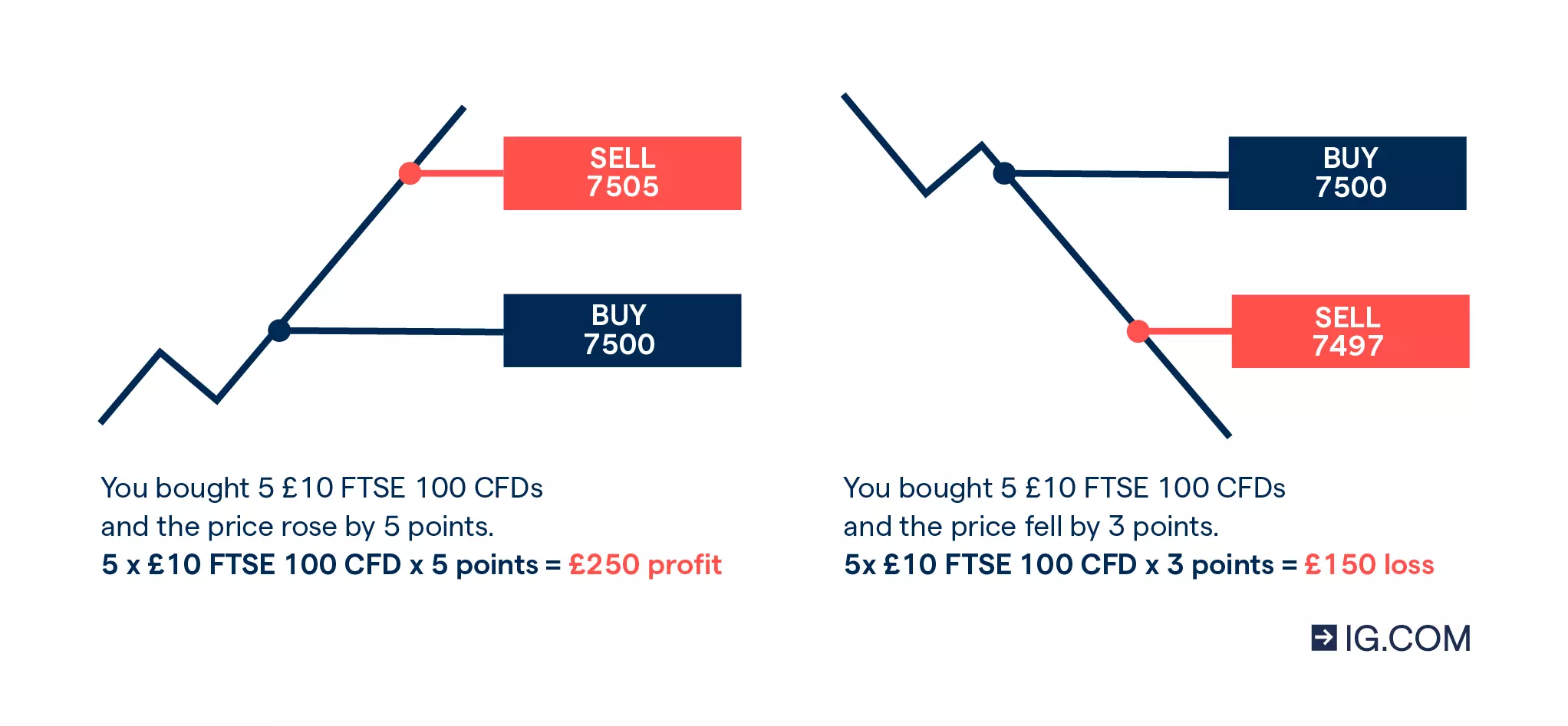

Your profit or loss is calculated by multiplying the amount the market moved by the size of your trade in pounds per point. Here’s an illustrated example of how this works:

CFD trading examples

We’ve put together some CFD trading examples to guide you through the process of trading CFDs on a range of markets including shares, indices, commodities and forex.

- Share CFD trade example

- Index CFD trade example

- Spot gold CFD trade example

- Forex CFD trade example

Shares of Lloyds Banking Group Plc (LLOY) are currently trading at 51.615 with a buy price of 51.630 and a sell price of 51.600. You anticipate that the stock is going to increase in value over the next few days, so you decide to buy 150 share CFDs of LLOY at 51.630.

Say the Lloyds share price did climb and was trading at 52.615 with a new buy price of 52.630 and sell price of 52.600. You would close your position by reversing your initial trade, selling 150 share CFDs of LLOY at 52.600. To calculate your profit, you’d multiply the difference between the closing price and opening price of your trade by its size. In this case, your profit would be £145.50 ([52.600 – 51.630] x 150), excluding any additional costs.

However, if the Lloyds share price had decreased to 50.515 (buy price 50.530 and sell price 50.500) and you had closed your position by selling the shares at the new sell price, you would make a loss. You could calculate this loss as the difference between the closing price and opening price of your trade by its size. In this case, that would be a loss of £169.50 ([51.630 – 50.500] x 150 share CFDs), excluding any additional costs.

-03.png/jcr:content/renditions/original-size.webp)

-04.png/jcr:content/renditions/original-size.webp)

Let’s say that you wanted to speculate on the FTSE 100 index going up, above its current price of 6900 (buy 6901.2, sell 6898.8). So, you buy 100 FTSE 100 CFDs at the buy price of 6901.2. A single FTSE 100 CFD is worth £10, so if you predict correctly and the FTSE 100 price goes up to 6911 (buy 6912.2, sell 6909.8), and you close your position by selling your CFDs at the new sell price of 6909.8, you’d have made a profit of £8600 ([6909.8 – 6901.2] x £10 x 100 CFDs).

If the index moves against you and you decide to close your position, you’d make a loss. For example, if the price drops to 6890 (buy price 6891.2, sell price 6888.8), you’d close your position by selling at the new sell price of 6888.8) In this case, you would have made a loss of £12,400 ([6901.2 – 6888.8] x £10 x 100 CFDs).

-05.png/jcr:content/renditions/original-size.webp)

-06.png/jcr:content/renditions/original-size.webp)

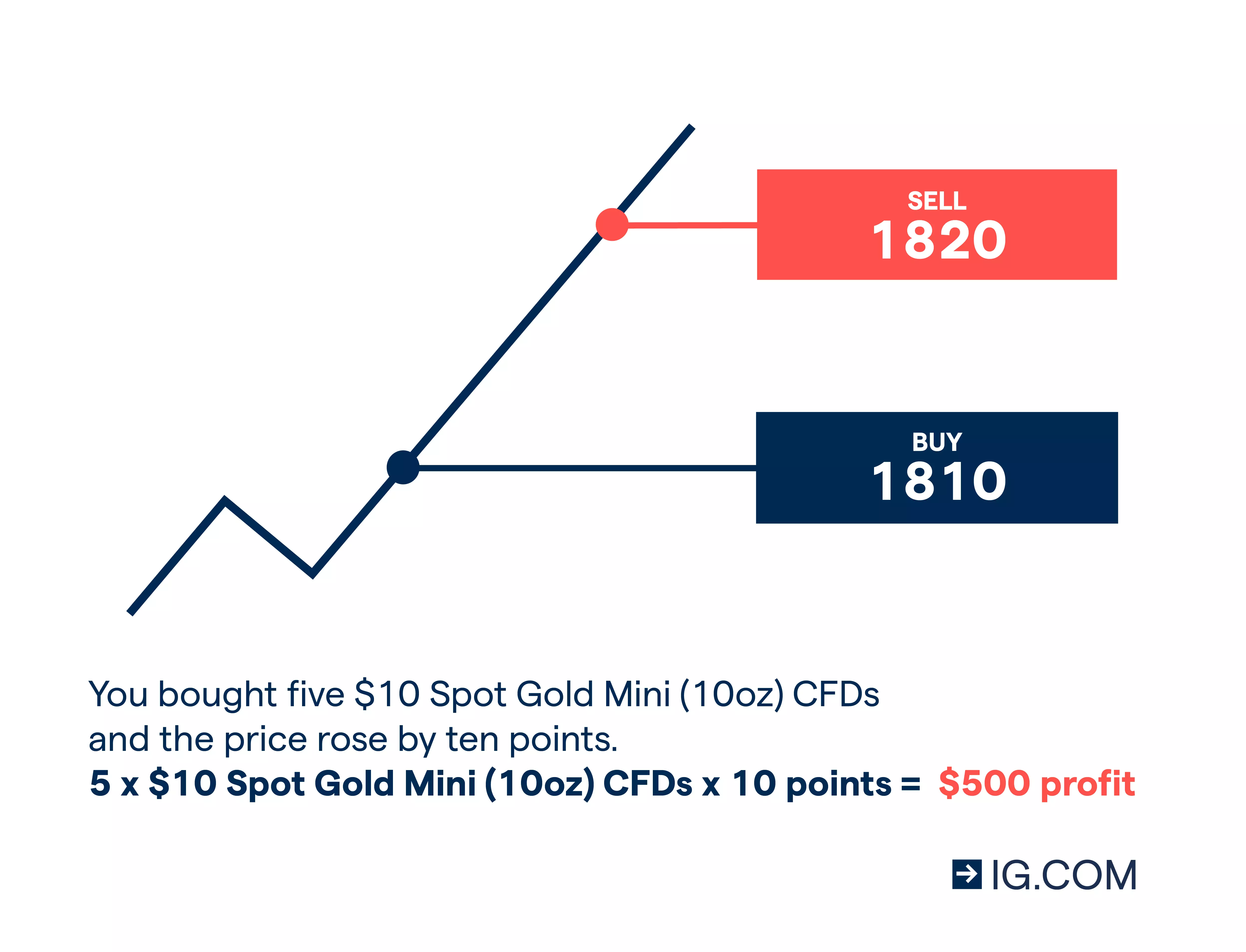

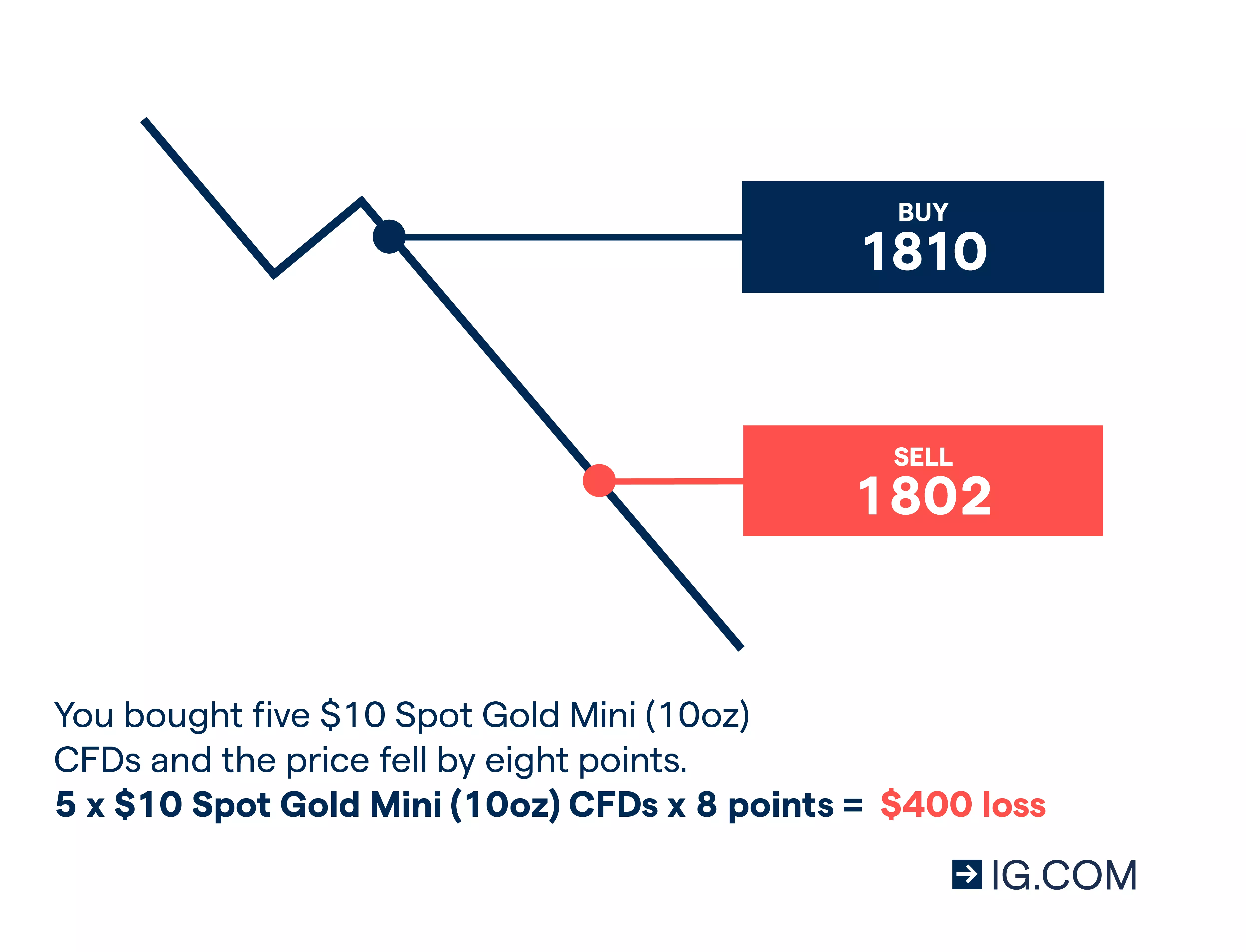

You believe the price of gold is going to rise from its current level of 1809.75. So, you buy five ‘Spot Gold Mini (10oz)’ CFDs, each with a contract size of $10 per point of movement – bringing the total to $50 per point (5 CFDs x $10 per point). As you’re buying slightly above the underlying market due to the spread, the current buy price is 1810.

Spot gold CFDs have a margin factor of 5%, so you’d need to deposit $4525 ($50 x 1810 x 5%) to open a position worth $90,500. It is important to note that because this latter amount is your total exposure, your losses could exceed your margin deposit.

The spot price of gold does increase, up to a new price of 1820.25. Consequently, you decide to close your position at the new sell price of 1820. The market moved in your favour by ten points, so you’d be taking a profit of $500 (10 points x $50) – excluding other costs.

In cases where our CFDs are denoted in US dollars, your profits or losses will be realised in dollar terms and then converted into pounds at the prevailing rate of exchange.

However, if gold had decreased in price instead, down to 1802.25, you would have made a loss. Closing your position at the new sell price of 1802, you’d have lost $400 (8 points x $50) – plus funding charges.

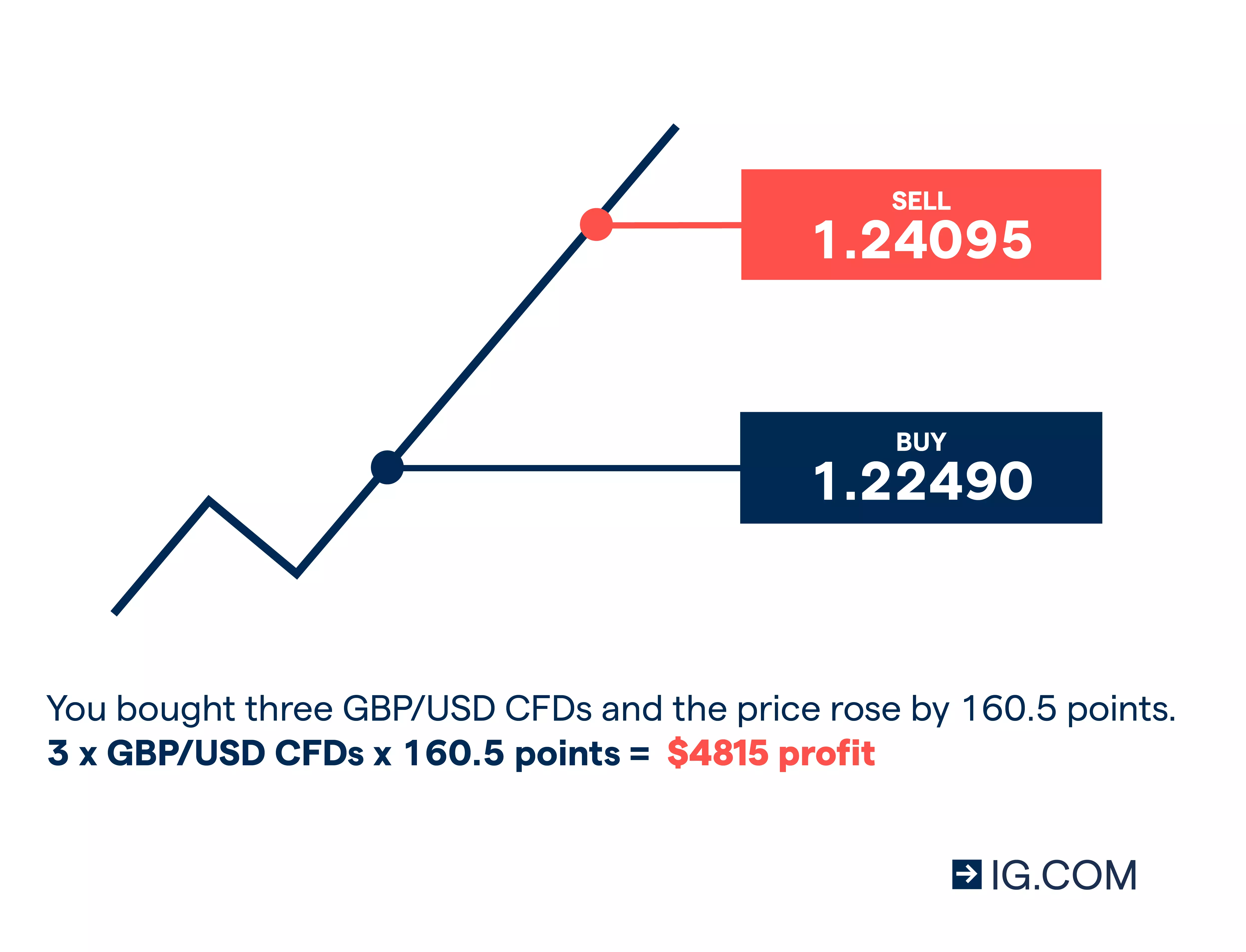

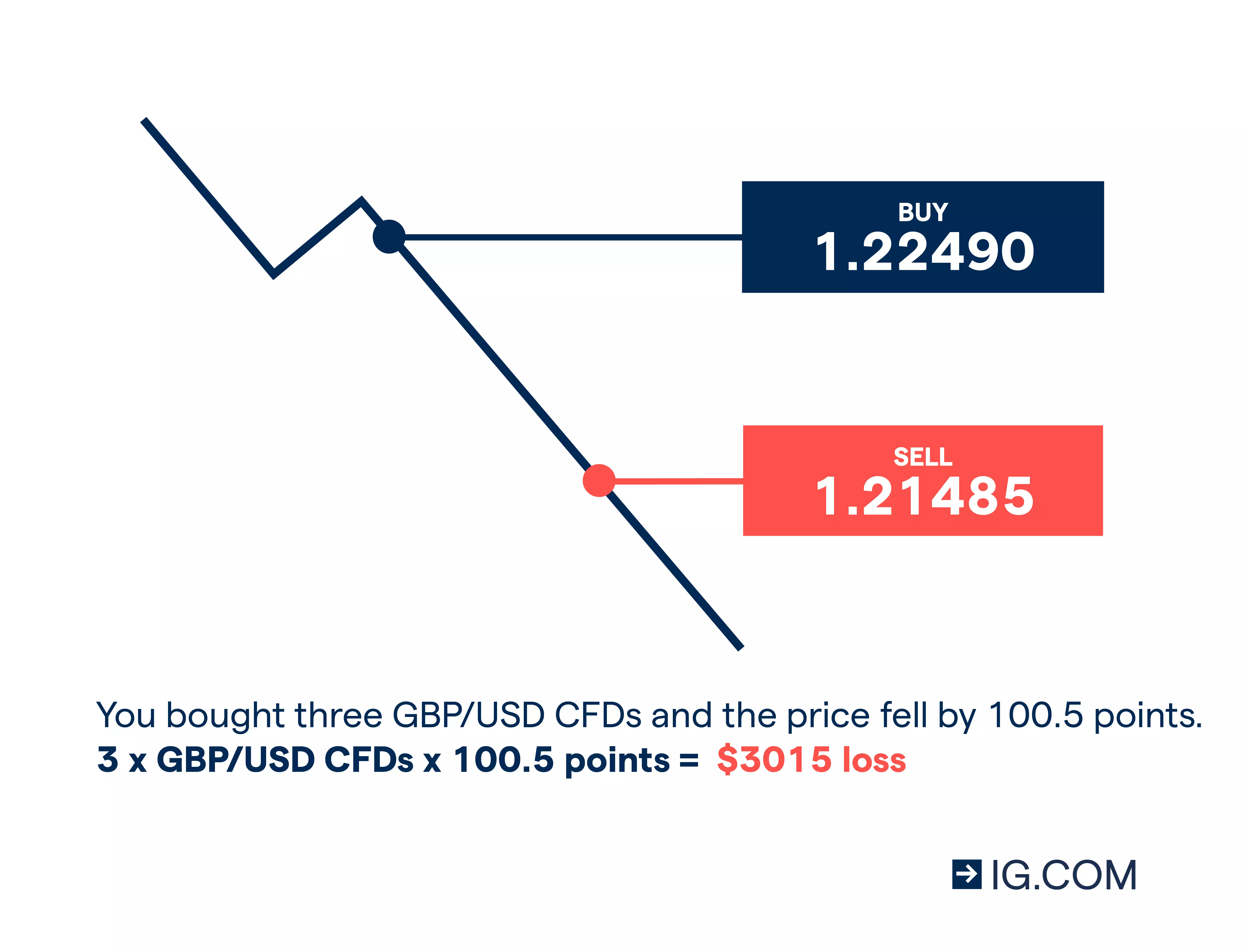

Assume that the GBP/USD pair is trading at 1.22485, with a buy price of 1.22490 and a sell price of 1.22480. The difference between the buy and the sell price is called the spread. Because you believe that that the pound is set to appreciate against the dollar, you buy a standard GBP/USD contract at 1.22490.

Here, buying a single standard GBP/USD CFD is the equivalent of trading £100,000 for $122,490. You decide to buy three CFDs, giving you a total position size of $367,470 (£300,000). However, because you’re trading the forex pair using leverage, your margin will be 3.33%, which is $12,236.75 (£9990). You could add a stop to your position to manage your exposure to risk.

Your prediction was right and the pound rose to 1.24100 against the US dollar. You can now reverse your trade to close your position by selling three contracts at the new ‘sell’ price of 1.24095. Your profit from this would be $4815 ($372,285 - $367,470).

1.24095 (USD sell price) x 3 (contracts) x 100,000 (lot size) – 1.22490 (USD original buy price) x 3 (contracts) x 100,000 (lot size) = $4815

If your prediction was wrong and the pound fell to 1.21490 against the US dollar (sell price of 1.21485), you’d still reverse the trade to close it, but you’d make a loss of $3015 ($364,455 - $367,470). This is because the new contract value would be lower than the initial value.

1.21485 (USD sell price) x 3 (contracts) x 100,000 (lot size) – 1.22490 (USD original buy price) x 3 (contracts) x 100,000 (lot size) = -$3015

In either case, there would be no commission to pay but you’d have to pay a funding charge to keep your position open overnight.

Learn more about trading forex CFDs

FAQs

What markets can I trade with CFDs?

With IG, you can trade CFDs on over 15,000+ markets, including indices, shares, forex, commodities and more.

You can even trade CFDs out of hours on certain markets, enabling you to make the most out of company announcements after the market closes.

Who can trade CFDs?

Whether you’re new to trading or have previous experience, CFD trading can provide a wide range of benefits – including the opportunity to deal on thousands of markets without the need for large amounts of capital.

However, it is important to be aware that CFD trading is not for everyone. As it is a leveraged product, losses can exceed deposits. This means it is especially important to understand the risks involved and take steps to prepare yourself to trade CFDs.

How much does it cost to trade CFDs?

With IG, you’ll need to fund your account by a minimum of £250 to get started.

The costs of CFDs themselves depend on the market you choose, changing according to factors such as the liquidity of the market in question. You generally only pay a commission charge for share CFDs, and a spread (the difference between the buy and sell prices) for all other markets. Plus, every market comes with its own minimum number of contracts you will need to buy or sell to open your position.

There is also a small charge to fund positions overnight and for guaranteed stops (if triggered), and there may be additional fees for specialist tools.

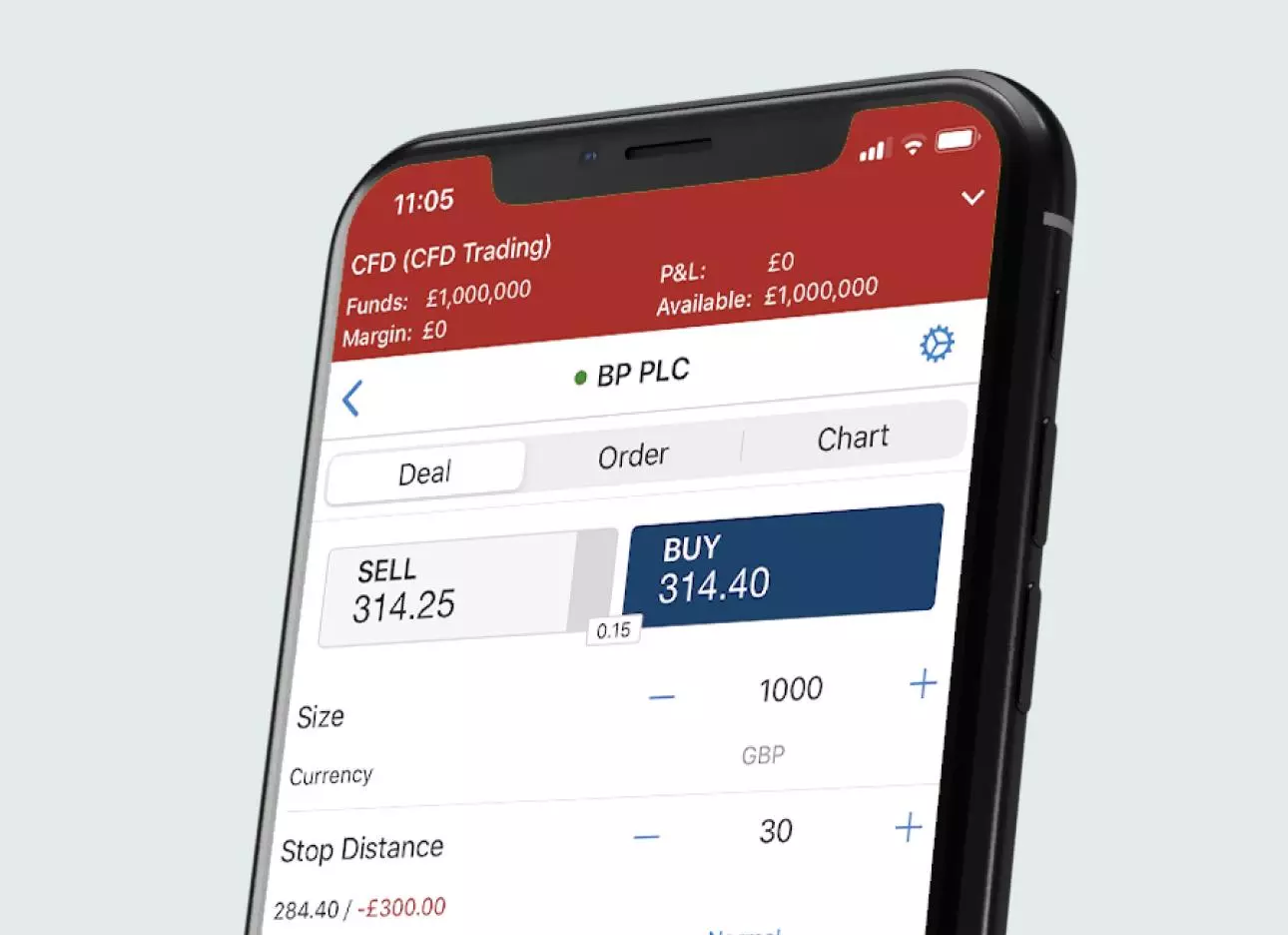

What platforms can I use to trade CFDs?

With IG, you can trade CFDs on our online trading platform and on the go with our mobile trading apps. You can also use our services with specialist third-party platforms such as L2 dealer, ProRealTime and Metatrader4.

I already have a CFD account with a different provider, but I’m thinking about opening a new account with IG. What do I need to be aware of?

To open a new CFD trading account with IG, you just need to fill in a simple form so that we can establish your previous experience and available funds. This way we can ensure that you get the best trading experience possible.

Our mobile trading apps, state-of-the-art technology and free educational tools make the process of switching your account to us an effortless experience. So, you can be signed up and ready to trade within minutes.

Develop your knowledge of CFD trading

Learn more about CFD trading and test yourself with IG Academy’s range of online courses.

Try these next

Discover the differences between spread betting and CFD trading

Discover how you can start trading online and get exposure to over 15,000+ markets

Browser-based desktop trading and native apps for all devices