Not all forex brokers are created equal – and when you’re trading forex, you need the best of the best. Discover how to choose the best forex broker for your trading needs with us, the UK’s No.1 trading platform.1

What is a forex broker?

A forex broker is an individual or an institution who facilitates the buying and selling of foreign currency for you as a trader or investor. We’re an example of a forex broker, as our platform acts as the ‘middleman’ that enables you to speculate on the value of a forex pair without actually having to buy any physical currencies.

What is forex trading?

Forex trading is the practice of speculating on the price of a currency as measured against the price of another currency (for example, how strong the British pound is compared to the US dollar.) Because you’re not actually taking ownership of any notes or coins outright, but instead predicting on their value, you as the trader need a platform to speculate on. The provider of this platform is your brokerage, or broker.

Find out more about trading forex

How does a forex brokerage account work in the UK?

Forex brokerage accounts in the UK work in slightly different ways, so how it’ll work will be determined by which broker you choose. We try to make our forex accounts simple to use.

The following is a summary of how a forex brokerage account will work:

- In the UK, a forex brokerage account is either an investing account (where you buy actual currencies and own the money outright) or a trading account (where you’ll speculate on currencies’ values in the market.) With us, you’d open either a spread betting or a CFD trading account, which we’ll explain a bit further on

- Because the forex market never sleeps, a good forex brokerage will give you 24/5 access to foreign exchange trading. With us, you can trade forex from 9pm Sunday to 10pm Friday (UK time). These long trading hours are made possible because forex transactions are completed over the counter (OTC), rather than through a central exchange

- You’ll then need to select a currency pair to trade or invest in. With us, you can trade over 80 currency pairs, including major pairs like GBP/USD and EUR/USD, but also more minor and exotic pairs like USD/ZAR or AUD/CNH

- Forex is traded in lots. These are standardised ‘batch sizes’ of currency pairs you can speculate with. For example, a standard lot is 100,000 units of the base currency – but you get smaller denominations as well. So, before you get started, you’ll need to determine the lot size and amount you’re comfortable with spending

- Remember, it’s not just about lots – both your position size, as well as the price of the instrument, need to be factored into the cost. Plus, other fees and charges may apply

- The way a forex brokerage account works is that you are in charge, not a fund manager. So, you’ll need to watch and study the market movements of the currencies you’re trading on and keep close watch of any open positions, setting alerts so as to not miss any significant moves

- For the same reason, you’ll also want a good risk management strategy in place to maximise your chance of profits and minimise your chances of a loss

Want to try trading with us? We’re the UK’s No.1 platform and have over 313,000 clients worldwide.1

How to choose a forex broker

The forex market is the biggest, most liquid (and often the most volatile) market in the world – so you really want a forex broker you can rely on. Here are nine factors to consider when choosing a foreign exchange broker:

Leverage and margin amounts

The levels of leverage and margin amounts available to you is also a crucial factor in your decision.

Leverage is a feature of some trading instruments. It means that the majority of your position size is, essentially, borrowed from your broker. When opening a forex trade, you’ll put down a percentage of its value, known as margin, and your broker will put up the rest.

It also means that your initial outlay to open a trade is only a fraction of the position’s actual size, but both profits and losses are calculated based on the trade’s full value. This means both profits and losses can substantially outweigh your margin amount.

Let’s look at an example – say you want to use spread bets to trade the GBP/USD pair. You want to open a trade worth £1000. With us, you’d have a margin rate of 3.33%, meaning you’d only need to put up £33.30 (33% of £1000) to open that position. However, both your profits and losses would be calculated on the total £1000 position size.

So, while you’d only pay a £33.30 margin amount to trade £1000 per point on GBP/USD, you’d gain £1000 for every point the currency pair moves in your favour – and lose £1000 for every point the market moves against you.

This translates into a leverage ratio of roughly 1:30, which is in line with UK financial regulations. It means that your profits and losses could be 33 times bigger than the amount you paid to open your position.

This is what makes the leverage ratio of the forex broker you’re trading with crucial. A high amount of leverage means you can make far more with a small amount of capital than you could otherwise. However, it also means you’re at risk of losses far outweighing your position size, and you’d forfeit that entire amount if your prediction is incorrect.

We offer retail forex traders a more manageable 1:30 leverage ratio. Some forex brokers have a leverage ratio of 100 or even 1000 times the amount of your margin – but this puts you at risk to enormous losses, which could cripple your trading strategy.

We also, as per UK regulation, give you negative balance protection.2 This means you can’t lose more than the equity available in your account. If your balance does go negative, we’ll bring it back up to zero at no cost to you.

Here are some more margin and leverage specifics on some of our most popular currency pairs:

| FX pair | Retail margin | Leverage equivalent | Minimum bet amount, spot prices (what's this?) | Minimum bet amount, forwards (what's this?) |

EUR/USD |

3.33% |

1:30 |

£0.50 |

£1 |

GBP/USD |

3.33% |

1:30 |

£1 |

£1 |

EUR/GBP |

3.33% |

1:30 |

£0.50 |

£1 |

AUD/USD |

3.33% |

1:30 |

£0.50 |

£1 |

USD/CAD |

3.33% |

1:30 |

£0.50 |

£1 |

USD/CAD |

3.33% |

1:30 |

£0.50 |

£1 |

USD/CHF |

3.33% |

1:30 |

£1 |

£1 |

Spread and commission rate

The margin rate you’ll pay to open a position isn’t the only amount you’ll pay. When trading forex, you don’t pay any commission to us – but you will pay for something known as ‘the spread.’

The spread is the difference between the buy and sell prices when you open a forex trade. In most cases, we charge our own spread on top of the market spread, as our fee for the trade. This charges apply to both spread bets and CFD trades with forex.

The spread amounts are largely determined by the market’s economic conditions. The more volatile a market is, the wider the spread will become in order to manage the volatility. We can usually offer our minimum spread, but when market prices go wider, our spread will increase.

These are the minimum spread amounts on some of the most popular FX pairs:

Deposits and withdrawals

With many forex brokers, there’ll be additional fees involved in trading. It’s important to know what these are before you choose to do business with them.

Hidden charges can rear their heads particularly when it’s time to:

- Make your first initial deposit to begin forex trading

- Make deposits into your account thereafter

- Withdraw your profits as funds

With us, there’s no minimum deposit amount you’re required to make for bank transfers – although you can also deposit via credit or debit card, for a fee. When setting up your forex trading account, you also don’t need to fund your account to make it ‘valid’, as with some brokers.

Learn more about depositing with us

We also try to make depositing seamless. You can make deposits with a bank card or with a bank transfer. Successful card payments are deposited immediately and bank transfers can take up to three working days, depending on the bank. In the meantime, you can upload a proof of payment to trade with the funds right away.

Want to withdraw funds? With us, it’s absolutely free. Bank transfers, too, should reach you on the same day.

For forex traders wanting to withdraw in a currency other than pounds, withdrawals requiring a currency conversion at the prevailing spot rate will be subject to a conversion charge of 0.5%. These requests are processed manually and may take longer to reflect in your account.

Find out more about withdrawing your money

Trading platforms

All forex brokers use some sort of platform – the tool you’ll use to place your actual forex trade. But not all platforms are created equal, and not all brokers have the same variety of platforms to choose from.

We’re proud to have the UK’s best trading platform and an award-winning app to trade on, too.3

In terms of the variety of platforms you can trade on with us, there are a few to choose from. Apart from our fully mobile-friendly platform and app, clients in the UK can trade on ProRealTime and our DMA (direct market access) platform L2 Dealer. We also offer MetaTrader 4 (MT4) – a well-known third-party platform used worldwide.

Trading hours

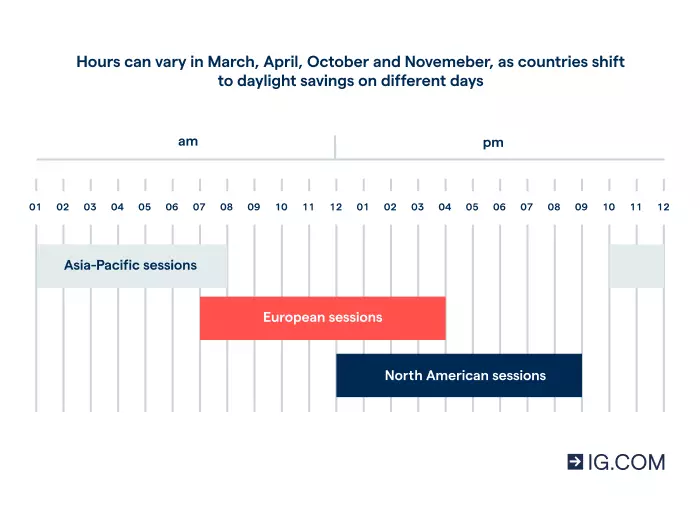

The world of forex never sleeps. It’s the biggest and most liquid market on the planet, with individuals, companies and banks carrying out trillions of dollars’ worth of forex transactions every single day.

The major forex centres are London, New York, Tokyo and Sydney, but within those locales thousands of different currencies change hands, from countries with time zones completely different to each other. All this makes forex an international, 24-hour market.

For this reason, it’s vital to choose a forex broker that can offer you as many trading hours as possible. You might be based in the UK, but if you want to trade on the USD/AUD currency pair, for instance, you’ll know that New York trading hours only start at 12pm UK time, while Australia’s trading day only begins at 9pm at night.

Find out the best hours to trade forex

You can trade forex with us 24 hours a day, Monday to Friday. Our weekend forex trading hours run from 4am Saturday to 8.40pm Sunday (UK time). We’re also the only UK provider to offer weekend trading on major currency pairs like GBP/USD, EUR/USD and USD/JPY.

Explore our out-of-hours offering

Amount of forex markets available

Of course, as a forex trader, you don’t only want the maximum amount of hours available – you’ll also want the most currency pairs, to find the one that best fits with your trading style and strategy. That’s because each currency pair has it’s own unique advantages and disadvantages, levels of volatility and opportunities.

We have more than 80 of the world’s most popular currency pairs to trade, including:

- Major pairs like GBP/USD, EUR/USD, GBP/EUR and USD/JPY

- Minor pairs like CAD/CHF, USD/ZAR and SGB/JPY

- Emerging currency pairs like USD/CNH, and AUD/CNH

- Exotic pairs like EUR/CZK, TRY/JPY, USD/MXN

We also have different ways that you can trade all these currencies: in real-time (known as spot trading), with longer-term futures positions via FX forwards and with FX options.

Educational tools available

Finding an online broker that offers plenty of training materials and learning resources on forex is also beneficial. Simply put, the more you know about FX trading, the more likely you are to succeed in your trading journey and maximise your chances of making profits while minimising your chances of suffering losses.

You can improve your trading knowledge and skills with IG Academy. This tool that offers courses for you to learn at your own pace – for free. You can then put your new skills to the test by opening a free demo trading account, along with £10,000 in virtual funds to practice with before forex trading live. Apart from this, we also have both strategy tips and news and analysis articles by news service Reuters and our own in-house analysts to help you understand what’s happening in the forex market right now.

Customer service

Of course, there are times you’ll need support, no matter how good your strategy is. Not only do you want to choose an online trading broker that’s got a good platform, you also want them to help you when you have questions.

This is especially crucial for forex traders in the UK, where trading can be done at irregular hours, but a lot of ‘UK platforms’ are based in other countries. If that’s the case, what are their customer support hours? Will they be able to field your queries when you need them? Always consider lines of communication and immediate availability when choosing your broker.

We’re based in the UK, plus our customer support is available by phone, email or Twitter – 24 hours a day from 8am Saturday to 10pm Friday. This is especially designed to be helpful to forex traders – a lot of whom trade outside of regular office hours and make use of Twitter for FX trading tips.

If you’re a beginner forex trader who’s yet to start trading with us, you can also make use of our client services team for a one-on-one walk through of our platform while setting up your account.

UK forex broker comparison

To see how we stack up to the competition, see five of the most prominent forex brokers in the UK compared. Including us – we’re the No.1 trading platform in both the UK and the world.1

| IG | eToro | Trading 212 | CMC Markets | Plus500 | |

| Accounts | Spread betting, CFD trading and share dealing accounts available, plus managed portfolios | One account for CFD trading and share dealing | CFD trading, share dealing | Spread betting, CFD trading | CFD trading only |

| Currencies pairs | More than 80 currency pairs worldwide, including major, minor, exotic and emerging market pairs | More than 45 currency pairs | More than 80 currency pairs | More than 80 currency pairs | More than 80 currency pairs |

| Forex markets | We have over 18,000 markets on offer, including forex markets | Over 2000 markets, including forex markets | Over 10,000 markets, including forex markets | Over 11,000 markets, including forex markets | Over 2000 markets, including forex markets |

| Trading hours | 24/5 trading on all forex pairs, with weekend and out of hours trading for the world’s most major pairs | No 24/7 trading or after hours trading on stocks | No 24/7 trading on forex | 24/5 trading for forex, Mondays to Fridays | 24/5 trading for forex |

| Trading platforms | You can trade on the web, our app, L2 Dealer, MT4 and ProRealTime | Web and app platforms only | Web and app platforms only | Web, app and MT4 platforms available | Web and app platforms only |

| Educational tools | Upskill yourself with IG Academy. Plus, get news and strategy tips from Reuters and our in-house analysts and trading signals – all free of charge | Academy and news from in-house analysts | Community forum and help centre | News from in-house analysts | News from in-house analysts |

| Based in | UK | Israel | Bulgaria | UK | Israel |

| Customer service | 24/7 phone support in the UK, plus 24/7 email and Twitter support | No phone support. Live chat and email support from Monday to Friday | No phone support. Live chat and email support 24/7 | Phone and email support from Monday to Friday | No phone support. Live chat, WhatsApp and email support 24/7 |

What’s the best forex broker for you?

The best forex broker for you will depend on your trading style and the goals you hope to achieve. Whatever those may be, the right forex broker for you will have:

- The market hours that you’ll most want to trade, depending on your chosen currency pair – we have 24/5 trading, plus more weekend hours than any broker in the UK

- A platform that works for your needs – we offer our classic platform, mobile app, ProRealTime, L2 Dealer and MT4

- Not too many hidden fees – we offer free deposits and withdrawals

Ultimately, the only way to find out which forex brokerage is right for you is to try platforms out and see what works for your specific FX strategy.

How to start forex trading with us

Ready to give us a try? Follow these three steps :

- Fill in a form. Here, we’ll ask about your trading knowledge to ensure you get the best experience

- Get verification – this is usually instant

- Fund your account and start trading

FAQs

Do I need a broker for forex trading?

Yes, you do. When you trade forex, it’s always done on a platform that enables you to speculate on the prices of currency pairs. The owner of this platform (who also facilitates your transactions) is the forex broker.

When is a bad time to trade forex?

This depends on your forex broker – and what kind of times they offer. The forex market itself is open 24/7. We offer forex trading 24 hours a day, 5 days a week. Plus, you’ll also get weekend hours on the most popular major pairs.

Learn more about the best time of day to trade forex with our analysts

Which day is the best day to trade forex?

Again, this will vary vastly depending on the currency pair you choose to trade on. The ‘Monday effect’ from shares trading can apply to forex, but it all depends on the markets’ hours you’re trading.

Is it good to trade forex at night?

This depends on which currency pair you’re trading, and what time of the day their respective markets are open. If you’re trading USD/JPY, for example, trading forex at night (UK time) will be very different to trading GBP/EUR at the same time.

Try these next

Trade FX in real-time and harness the volatility of spot trading

Predict what the FX market will do on a predefined expiry date

Learn how to buy and sell currency options

1 Best trading platform as awarded at the ADVFN International Financial Awards 2021 and Professional Trader Awards 2021.

2 Negative balance protection applies to trading-related debt only and is not available to professional traders.

3 Awarded ‘best financial app’ at the ADVFN International Financial Awards 2024 and ‘best multi-platform provider’ at the ADVFN International Financial Awards 2024.