Our portfolios feature low fees that help accelerate your investment growth. And we're transparent about our charges, so you know exactly what you’re paying.

Our low fees help your investment grow quicker

No entrance or exit fees

No fees when you first open your fund or when you choose to close it

No withdrawal fees

Withdraw funds from your account whenever you want without being charged

No inactivity fee

We’ll never charge an inactivity fee for your IG Smart Portfolio

Affordable investing, complete transparency

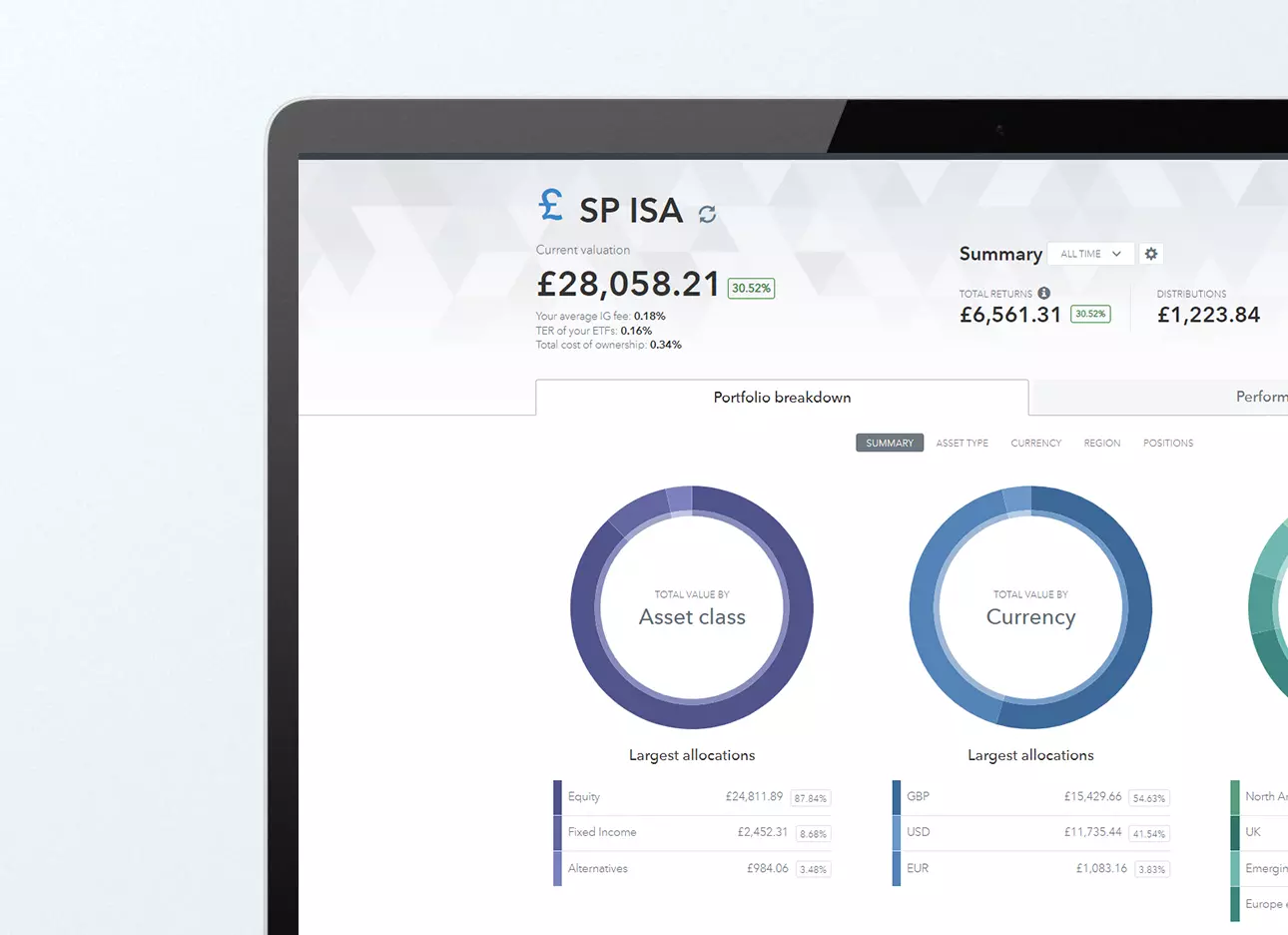

You can reap the benefits of an IG Smart Portfolio for much less than you might expect, without needing to worry about excessive wealth management fees. You’ll pay one low annual management fee – capped at £250 a year – with no hidden admin, performance or exit fees, what you see is what you get. Learn your total annual cost before you invest, below.

Total value of IG Smart Portfolios

| IG management fee | Average fund costs | Transaction costs | Total annual costs | |

| On the first £50,000 | 0.50% | 0.13% | 0.09% | 0.72% |

| Over £50,000 | Free | 0.13% | 0.09% | 0.22% |

Compare our costs against your current provider to see if you could save money by switching to IG.

You can also learn more about the potential effect of costs and charges on your investment returns over time.

Expert portfolio management

An expertly managed portfolio, tailored to your ability and willingness to take on risk

Free portfolio rebalancing

When we need to adapt your investments to follow BlackRock’s model portfolios, we do so free of charge

Dedicated customer service

Our expert team is on hand 24 hours a day to answer any questions you may have

Market-leading technology

Our fractional dealing technology ensures that every pound is invested

Our competitive fund costs

IG Smart Portfolios are built using exchange traded funds (ETFs) from iShares. Regardless of who you invest with, ETFs will always have an inherent ongoing charge. Our portfolios feature average fund costs of 0.13%, automatically deducted from the value of the fund.

There is a small difference in price when we buy and sell the funds used to rebalance your IG Smart Portfolio – we have estimated this transaction cost to be 0.09% a year.

Also, we charge a 0.7% foreign exchange (FX) fee when we convert dividends paid in foreign currency back into GBP – the FX fee on a £10,000 investment would cost you just £0.07.

Save on fees to grow your wealth quicker

Paying high investment management fees over long periods of time will hold back the growth of your investment pot, due to a weaker compounding effect.

If you paid 2% per year for your money to be managed by a leading UK provider1, after 30 years your investment pot could be worth £431,280, assuming you first deposited £20,000, added £500 per month and saw returns of 6% per year.

If you invested the same amount in an IG Smart Portfolio with total costs of 0.71% up to £50,000 and 0.21% thereafter, your pot could be worth £604,384.

That’s a difference of over £173,000 over 30 years.

For indicative purposes only.

Low ETF charges

ETFs have a small charge built into their performance known as the Total Expense Ratio (TER), which is payable to the ETF provider. The average TER for the iShares ETFs held in IG Smart Portfolios is just 0.13%,2 compared to 1.25% for active funds domiciled in the UK.3 We’ve included this charge in our calculations so you have complete transparency, and can see your total cost of ownership upfront.

Regardless of who you invest with, ETFs will always have an inherent ongoing charge.

Please note that trading ETFs on an exchange also includes an in-built transaction cost, known as the bid-ask spread.

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

1 Source: Hargreaves Lansdown Portfolio+, December 2019

2 The Total Expense Ratio (TER) for the ETFs in an IG Smart Portfolio is subject to your portfolio allocation and is currently between 0.11% and 0.14%. Correct as at 6 May 2021.

3 Source: www.theinvestmentassociation.org