We are no longer supporting listed US Options and Futures. To trade OTC Options and Futures please open a CFD or Spread Betting account.

What is options trading?

Options trading is the act of buying and selling options. These are contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a set price within a set timeframe.

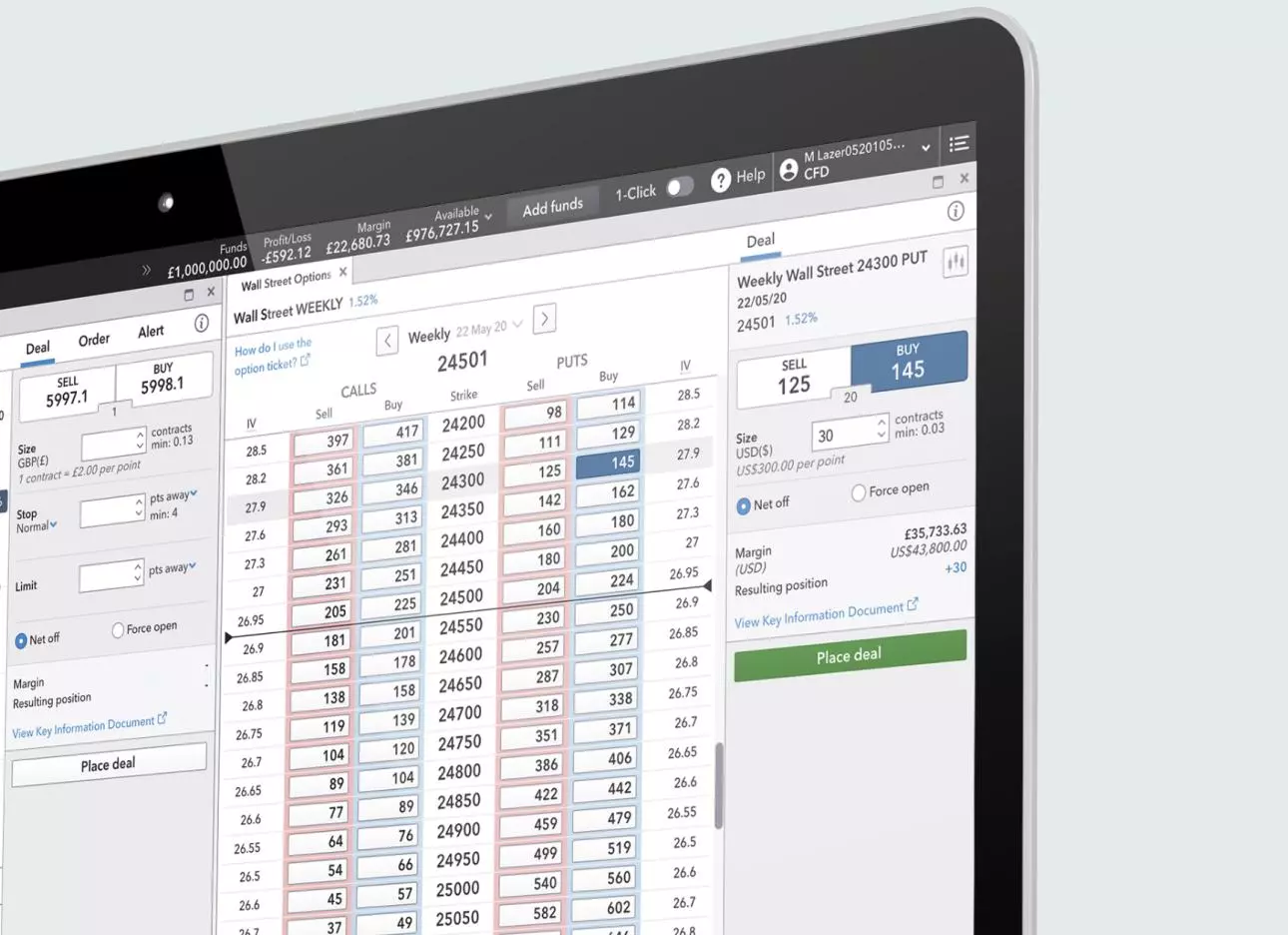

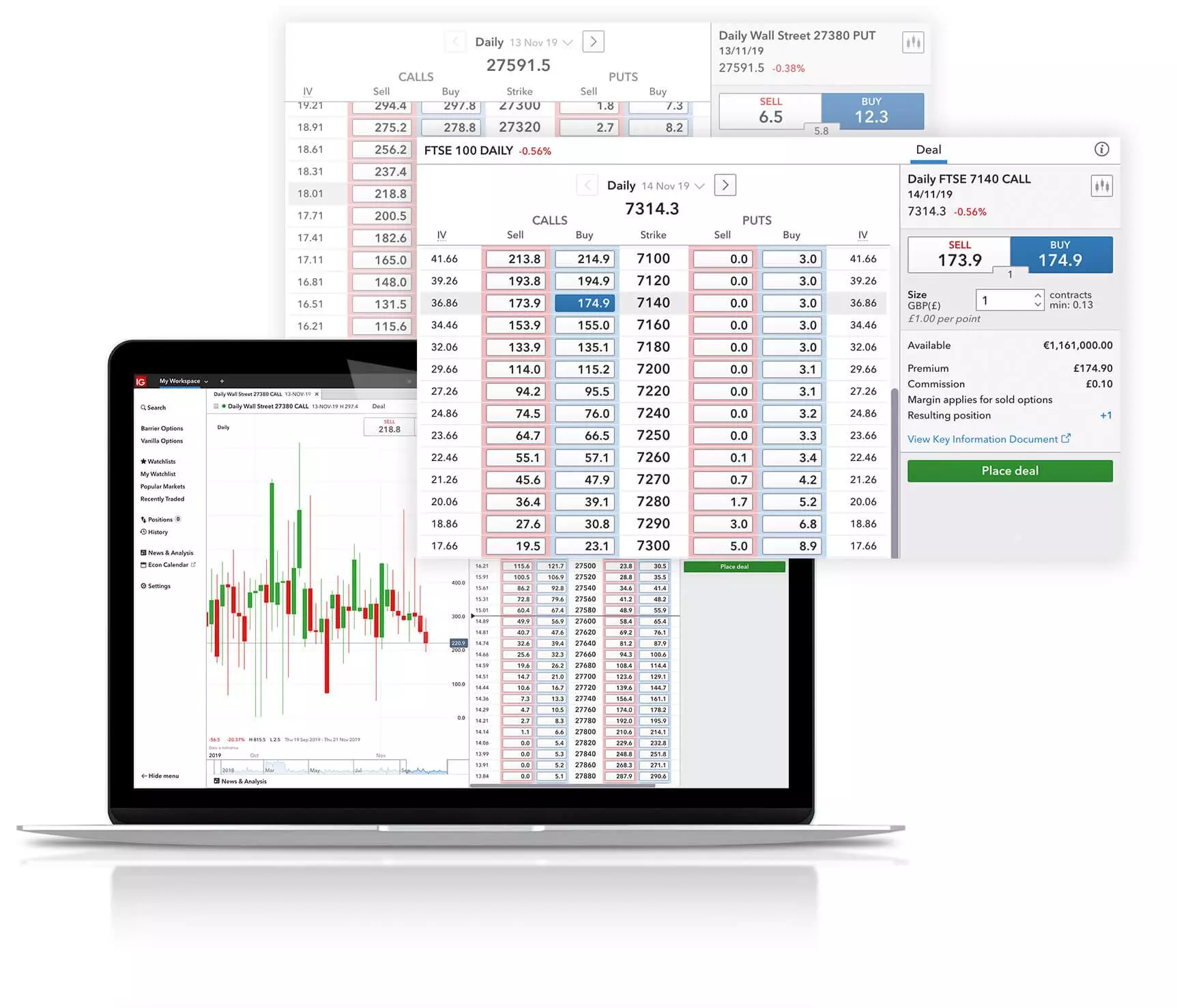

Trade options with spread bets or CFDs. This involves taking a position on the underlying options price, not entering into the options contract directly or employing complex strategies

Why trade options with us?

Find an option to suit you

Trade underlying index, forex, or shares options using spread bets or CFDs

Pay zero spread on expiry

Buy and sell options with no closing spread when you hold them until their fixed expiry date

Discover new opportunities

Develop trading strategies by pairing options trades with CFDs or spread bets

Trade on volatility itself

Take a position on rising, falling and even flat markets in the UK and all over the world

Ways to trade options with us

Use spread bets or CFDs on our award-winning trading platform.2

| OTC: spread betting and CFD trading | |

| Main features | Spread betting stakes an amount of money for every point the underlying market moves. CFDs are the buying and selling of contracts for difference. Both spread bets and CFDs are leveraged, meaning you put down a deposit to gain exposure to a position, with profit and loss calculated on the full position size. |

| Risks | Buying call or put options, your risk is always limited to the margin you paid to open the position. However, when selling call or put options your risk is potentially unlimited |

| Traded in | Spread bets: £ (or other base currency) per point CFDs: contracts |

| Tax | Spread bets: no stamp duty. Profits are generally tax-free in the UK3 CFDs: no stamp duty Tax deductible losses are useful for hedging3 |

| Costs | Spread bets: commission-free (only pay the spread)* CFDs: commission free (except on shares) |

| Platforms | Web and mobile platforms |

| Learn more |

*Other fees may apply

What are options?

Options are contracts that give you the right – but not the obligation – to buy or sell an underlying asset before a certain expiry date. You can use them to speculate on the price of a financial market, and in some cases its volatility too.

What are options?

Options are contracts that give you the right – but not the obligation – to buy or sell an underlying asset before a certain expiry date. You can use them to speculate on the price of a financial market, and in some cases its volatility too.

How do I trade options?

- Discover how options work

- Learn the differences between buying options and selling them

- Choose a trading strategy

- Create an account

- Open your first position

Benefits of trading options in the UK

Choose the option to suit you from our daily, or weekly, monthly and quarterly timeframes.

Over-the counter options

For a flexible, highly leveraged way to trade options – using spread bets and CFDs

Best platforms2

Open positions on our award-winning platforms2 with innovative capabilities and risk-management tools

Go long, short or non-directional

Speculate based on your bullish or bearish stance, or use options strategies for a neutral market assumption

Lower spreads

Trade daily options with reduced spreads – the same as on regular spot markets

Flexible leverage

Get the leverage you want by choosing your strike and trade size

Limited risk

Cap your maximum risk when you buy daily options – you’ll never lose more than the margin you pay to open

Greater freedom

Hold daily long options positions even when the market moves against you. When buying call options, your risk is limited to the premium you paid.

No overnight funding

Pay less for long-term (ie weekly, monthly or quarterly) positions, thanks to zero overnight funding

Greater control

Develop simple or complex options strategies for greater control over your trading

Open an account now

*Demo accounts are only available for spread betting and CFD trading.

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

*Demo accounts are only available for spread betting and CFD trading.

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

Try these next

We’ve been a market-leading online trading and investment provider for 50 years.

Start trading CFDs to discover opportunities on 15,000+ markets.

Take advantage of movement in currency prices – with over 80 FX pairs to choose from.

1 Based on revenue (published financial statements, 2023).

2 Best trading platform as awarded at the ADVFN International Financial Awards and Professional Trader Awards 2024. Best trading app as awarded at the ADVFN International Financial Awards 2024.

3 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.