The FTSE 100 – the UK’s most popular index – offers plenty of opportunities for traders and investors. Learn how to get exposure to FTSE 100 price movements with cash indices and index futures, as well as ETFs and individual shares.

If you’re ready to open a position on the FTSE 100, follow these three steps:

1. Decide whether you want to trade or invest

There are several ways to get exposure to the FTSE 100 – trading or investing in ETFs and individual shares, or trading on the index’s value.

2. Create a trading plan

Before taking a position on the FTSE 100, you'll need to decide whether you're a short- or long-term trader – and how you're going to manage your risk.

3. Open a live account

To open any or all of the following accounts – spread betting, CFD trading and share dealing – fill in our simple application form.

To help you decide whether you want to trade or invest in the FTSE 100, we explain each method in detail below.

How can you trade or invest in the FTSE 100?

With us, there are a number of ways to get exposure to the FTSE 100. You can:

When trading the FTSE 100, you’ll do so using spread bets or CFDs. Both are financial derivatives, which means that you never take ownership of any underlying assets.

Instead, you’ll speculate exclusively on the underlying asset’s price movements – in this case, either fluctuations in the index level of the FTSE 100, or movements in the prices of FTSE 100 ETFs or shares.

When investing in the FTSE 100, on the other hand, you’ll do so via our share dealing platform. This means that you’ll buy and own actual assets – for example, shares in a FTSE 100-tracking ETF or FTSE 100-constituent company. Because you’ll be a shareholder, you’re entitled to dividends if any are paid, and granted voting rights if applicable.

But, please bear in mind that all trading and investment incurs risk. Before trading or investing, you should always understand the risks involved, and consider whether you can afford the potential monetary losses.

Trade the FTSE 100 index directly

- Access the performance of the UK’s largest 100 companies from a single position

- Trade on the index’s price (ie its level) directly using spread bets or CFDs

- Get exposure to the index in a market with high liquidity

- Go either ‘long’ (if you think the price will rise) or ‘short’ (if you think the price will fall)

- Trade commission free with spread bets or CFDs as charges are included in the spread

- Choose our FTSE 100 ‘cash’ (spot) market to take a position in the short term

- Choose our FTSE 100 futures or options markets to take a position in the longer term

- Trade 24/7 (except 10pm Friday to 8am on Saturday and 10.40pm to 11pm on Sunday)

Trade or invest in FTSE 100 ETFs

- Take a position on the price of the ETF – calculated using the fund’s net asset value (NAV) – rather than on the current index level of the FTSE 100

- Speculate on FTSE 100 ETF price movements with spread betting or CFD trading without owning the underlying asset

- Use spread bets or CFDs to go long or short – note that this offers lower liquidity and higher spreads than trading the index directly

- Buy and hold actual shares in a FTSE 100 ETF by opening a share dealing account

- Invest in FSTE 100 ETFs from £3 commission using our share dealing platform1

|

Trading the FTSE 100 index directly |

Trading or investing in a FTSE 100 ETF |

Trading or investing in FTSE 100 shares |

Account types |

Spread betting or CFD trading account. |

Spread betting or CFD trading account to trade, or share dealing account to invest. |

Spread betting or CFD trading account to trade or share dealing account to invest. |

Market hours |

24/7 (except 10pm Friday to 8am Saturday and 10.40pm to 11pm Sunday). Please note that our Weekend UK 100 market is separate to the main FTSE 100 market. |

Trade or invest in UK-listed FTSE ETFs when the LSE is open - 8am to 4.30pm, Monday to Friday (UK time). |

When the LSE is open - 8am to 4.30pm, Monday to Friday (UK time). |

Timeframe |

Short to medium term. |

Short to medium term for trading and longer term for investing. |

Short to medium term for trading and longer term for investing. |

Liquidity and execution |

0.014 second execution speed and unique deep liquidity. |

Higher liquidity offered by trading the index directly. |

Higher liquidity offered by trading the index directly. |

Costs |

Commission-free, with spreads from just 1 point.

Cash (spot) trading incurs overnight fees, but none for index futures. |

Invest in FTSE 100 ETFs from £3 commission per trade.1

Commission-free for spread betting, with min spreads of 0.1% to 0.35%.

Min commission £10 for CFD ETFs. |

Invest in FTSE 100 shares and ETFs from £3 commission per trade.1

Commission-free for spread betting, with min spreads of 0.1%.

Min commission £10 for CFD shares. |

How to start trading or investing in the FTSE 100

Open your FTSE 100 trading or investing account

The type of account you’d open depends on your timeframe preferences, goals and strategy. With spread betting and CFD trading accounts, you can enter and exit positions on the FTSE 100 quickly in highly liquid markets.

Because spread bets and CFDs are derivatives, you can speculate on both rising and falling prices by going ‘long’ or ‘short’. Importantly, our derivatives enable you to trade the FTSE 100 index directly. This gives you exposure to the performance of the UK’s top 100 stocks from a single point of entry.

Spread bets and CFDs are leveraged, so you can open a trade by depositing only a fraction of the total value of your position. But, because your total exposure is greater than the deposit (known as ‘margin’), your losses could substantially outweigh this initial amount. When trading with leverage, it’s vital to take steps to manage your risk.

If you’d prefer to become an actual shareholder instead of trading on price movements with derivatives, you can invest in FTSE 100 ETFs and companies through our share dealing platform. When investing in ETFs or stocks, you’re taking direct ownership of shares.

To invest in a FTSE 100-tracking ETF or FTSE 100-constituent company, you’ll need to commit the full value of the shares upfront because leverage isn’t available. While you might need more initial capital to get started when compared to trading, your losses are capped at this amount. That said, you should be aware that you might get back less than your initial outlay.

Take your FTSE 100 trading or investing position

Here’s a more detailed look at the various ways you can take a position using spread bets, CFDs or share dealing.

Spread betting on the FTSE 100

When you spread bet, you’ll be putting up a certain amount of capital per point of change in the underlying market. Your profit and loss is calculated by multiplying your bet size by the number of points of movement.

For example, if you think the FTSE 100 is set to rise from its current level of 7150, you’d go long and open your position by ‘buying’ the market. If it increased to 7200 and you bet £10 per point, you’d earn a profit of £500 – excluding other costs (50 points increase x £10 per point). If the index moved against you, however, you’d cut a loss in equal measure.

Spread betting on FTSE 100 cash indices

You’ll always deal at the current price of the underlying market while receiving tight spreads. These two facts combine to make spread betting a popular option with short-term traders. But, because overnight funding fees are charged if you hold your position open after 10pm (UK time), you could consider FTSE 100 futures or options for longer term positions.

Our out-of-hours and weekend trading offering enables you to trade the FTSE 100 almost 24/7 (with the exception of 10pm Friday to 8am Saturday and 10.40pm to 11pm Sunday). You have to open your weekend positions separately from your weekday ones – however, once the weekend is over, it’ll be rolled over to a weekday position.

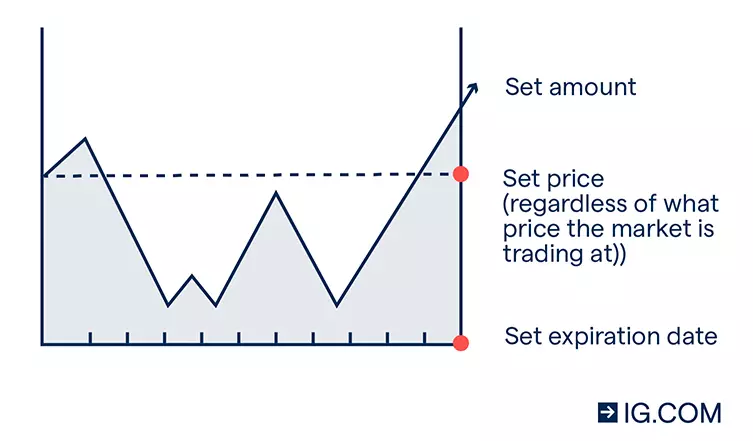

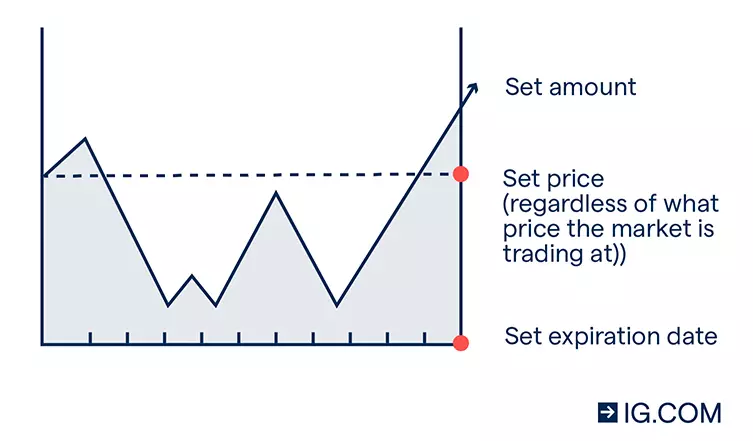

Spread betting on FTSE 100 index futures

Trading FTSE 100 futures means you agree to trade the index at a specific price on a specific date. Index futures are popular among longer-term traders because the overnight funding charge is included in the spread – enabling you to hold positions for a long time without this additional cost. When spread betting, you won’t pay a commission on index futures.

Spread betting on FTSE 100 options

Options give the holder the right, but not the obligation, to exercise the contract on or before its expiry date. When you trade options by spread betting, you’ll be using the derivative to speculate on an option’s premium – which will fluctuate as the probability of the option being profitable at expiry changes.

In practice, for example, a call option to buy £10 per point of the FTSE with a strike price of 7100 would earn you £10 for every point that the FTSE moves above 7100 – minus the margin you paid to open the position.

Buying options is inherently limited-risk – you’ll only risk as much as the margin you pay when opening your trade; but, there is substantial risk when selling options. In fact, selling a call incurs potentially unlimited risk as market prices can keep rising without limit. Options trading is often only recommended for experienced traders.

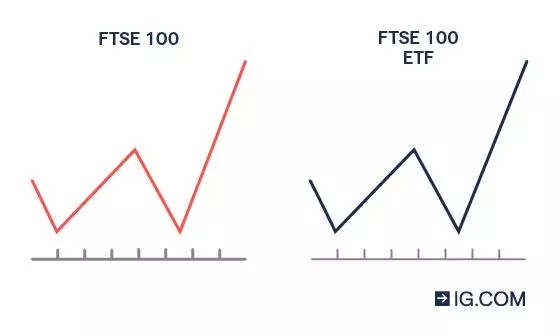

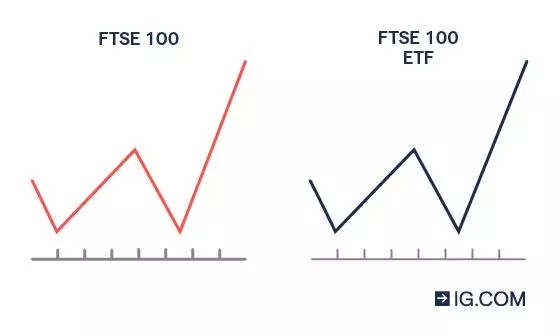

Spread betting on FTSE 100 ETFs

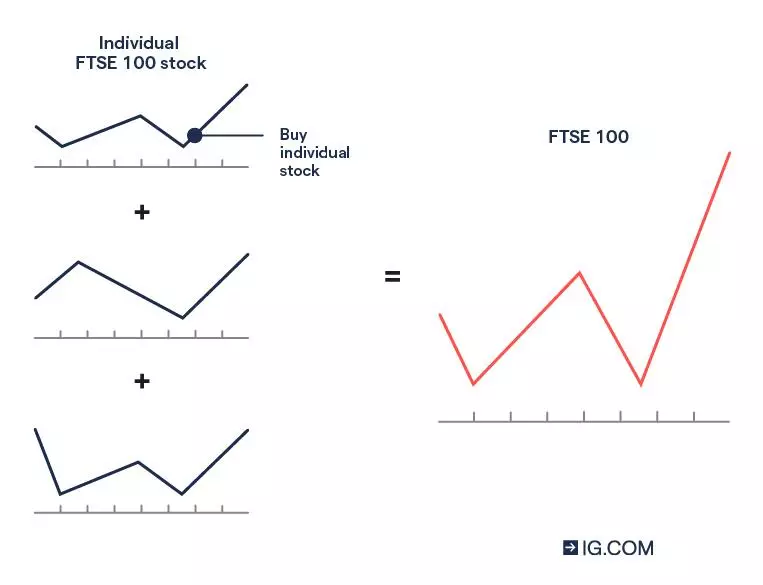

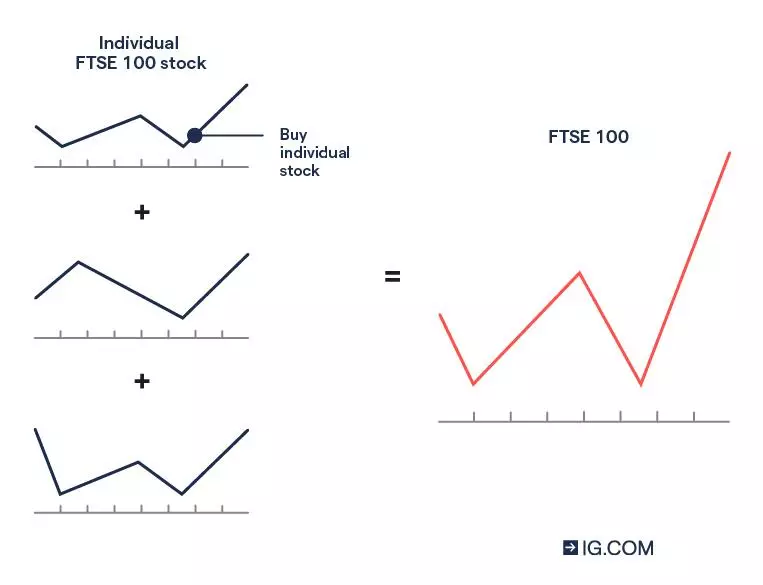

When you speculate on the price movements of a FTSE 100 ETF, you are essentially taking a position on the performance of the top 100 companies in the UK. The most common form of FTSE 100 ETF is a weighted tracker, which mirrors the make-up of the FTSE 100 directly.

Examples of weighted trackers include the Vanguard FTSE 100 UCTIS ETF and the iShares Core FTSE 100 UCITS ETF. When spread betting, you also have the choice of trading ETF forwards.

You’ll pay zero commission on ETFs with spread betting. However, an overnight funding fee will apply if you hold your trade open past 10pm UK time.2

Spread betting on FTSE 100 shares

You can spread bet on all the FTSE 100 shares with us. You might do this to take a speculative position, go short, or trade with leverage. In addition to cash (spot) share prices, we also offer share forwards with spread betting. If you’d prefer to buy and own shares, you can do so through our share dealing platform.

You’ll never pay commission on share spread bets, and our spreads are some of the lowest available. Our cash shares incur overnight funding fees if you hold your position open past 10pm UK time.2 Overnight funding fees aren’t charged on our forwards, but the spread is wider than on our cash offering.

Trading CFDs on the FTSE 100

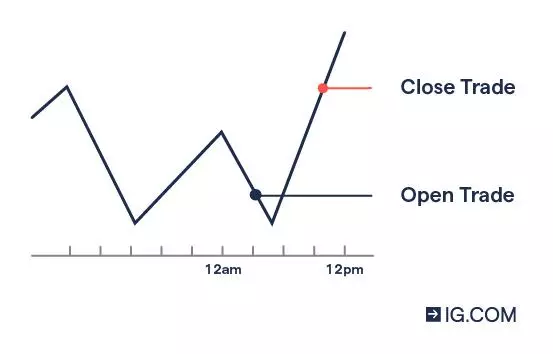

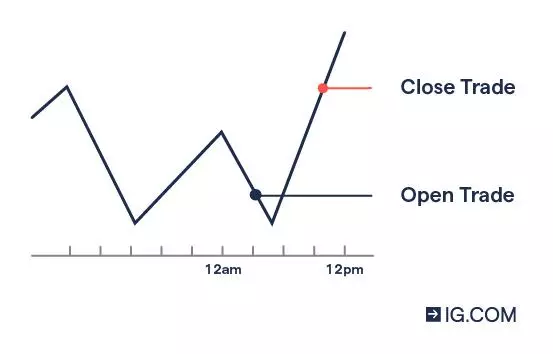

A contract for difference, or CFD, is an agreement to exchange the difference in price of an underlying asset, as measured from the time the contract is opened until the time it’s closed.

For example, you believe that the FTSE 100 is set to rise from its current level of 7000. So, you buy a FTSE 100 CFD worth £10 per point. Your forecast is correct, and you close your position when the market reaches a sell price of 7100. The difference is 100 points, so your profit is £1000 – excluding other costs.

If, however, the market had moved against you, and you closed at a level of 6900, your loss would be £1000 – excluding other costs.

Trading CFDs on FTSE 100 cash indices

Along with spread betting, this is the most direct way to access the performance of the FTSE 100 with us. Deal at the current market price and receive tight spreads. But, if you’d like to hold your position open overnight – or for a longer period – consider trading CFD futures or options as our cash (spot) CFDs incur overnight funding fees if you hold your position open after 10pm UK time.2

Our out-of-hours and weekend offering enables you to trade the FTSE 100 almost 24/7 (with the exception of 10pm Friday to 8am Saturday and 10.40pm to 11pm Sunday). Your weekend positions are automatically rolled over to a weekday position, but you’ll have to open any weekend positions separately from your weekday trades.

Trading CFDs on FTSE 100 index futures

Trading FTSE 100 futures means you agree to trade the index at a specific price on a specific date. With our index futures, overnight funding fees are included in the spread, meaning that you can hold positions for a long time without this additional cost. When trading futures CFDs on indices, you won’t pay a commission.

Trading CFDs on FTSE 100 options

Options give the holder the right, but not the obligation, to exercise the contract on or before its expiry date. When you trade options via CFDs, you’ll be using the derivative to speculate on an option’s premium – which will fluctuate as the probability of the option being profitable at expiry changes.

For example, if you buy a CFD worth £10 per point of FTSE 100 movement, you’d earn £10 for every point that the index rises above your chosen strike price, minus the margin you paid to open your trade.

Please remember that whereas buying options is inherently limited-risk – you’ll only risk as much as the margin you pay when opening your trade – there is substantial risk when selling options. Selling a call, for instance, incurs potentially unlimited risk as market prices can just keep rising. Options trading is often only recommended for experienced traders.

CFD trading on FTSE 100 ETFs

Open a position on a FTSE 100 ETF with a CFD and speculate on the collective performance of the UK’s top 100 companies. The most common form of FTSE 100 ETF is a weighted tracker, which mirrors the make-up of the FTSE 100 directly.

Examples of weighted trackers include the Vanguard FTSE 100 UCTIS ETF and the iShares Core FTSE 100 UCITS ETF. However, unlike spread betting, we don’t offer CFD forwards on ETFs.

Our charges include a commission of between 0.1% and 0.35% each side of the trade (with a minimum fee of £10) and an overnight funding fee if you hold your position open after 10pm UK time.2

CFD trading on FTSE 100 shares

With us, you can trade CFDs on all the FTSE 100 shares. Trading CFDs enables you to take a speculative position, trade with leverage, or go short. Our charges include a 0.1% commission each side of the trade (with a minimum fee of £10) and an overnight funding fee if you hold your position open after 10pm UK time.2

If you’d rather buy and own shares, you can do so through our share dealing platform.

Investing in the FTSE 100 with share dealing

When you invest in the FTSE 100 via a share dealing account, you’ll buy and own actual shares in an ETF or company. This entitles you to dividend payments if the fund or company grants them. Investing is usually better suited to those willing to take a longer-term view.

As you buy and hold shares when investing, you’ll be restricted to ‘going long’ (you’d aim to buy low and sell high at a later date to earn a profit). Additionally, you won’t be able to trade with leverage when using our share dealing platform – instead, you’ll have to commit the full value of the investment upfront.

Whereas this caps your risk, if your shares depreciate over the period you’ve held them, you’d cut a loss on your investment and receive back less than what you initially put in.

With us, you can invest from just £3 commission per trade for UK-listed shares and ETFs.1 As passively managed funds, ETFs enjoy the benefit of avoiding the large performance fees typically associated with actively managed funds.

Buying FTSE 100 ETFs with share dealing

Buying shares in a FTSE 100-tracking ETF is one of the most traditional ways for investors to gain access to the whole index. FTSE 100 ETFs will either buy assets – eg stocks appearing in the index – or use derivative instruments like futures contracts to mimic the performance of the underlying. If, for example, the FTSE shows positive growth, the tracking ETF will mirror that growth as closely as possible.

The most common form of FTSE 100 ETF is a weighted tracker, which mirrors the make-up of the FTSE 100 directly. Examples of weighted trackers include the Vanguard FTSE 100 UCTIS ETF and the iShares Core FTSE 100 UCITS ETF.

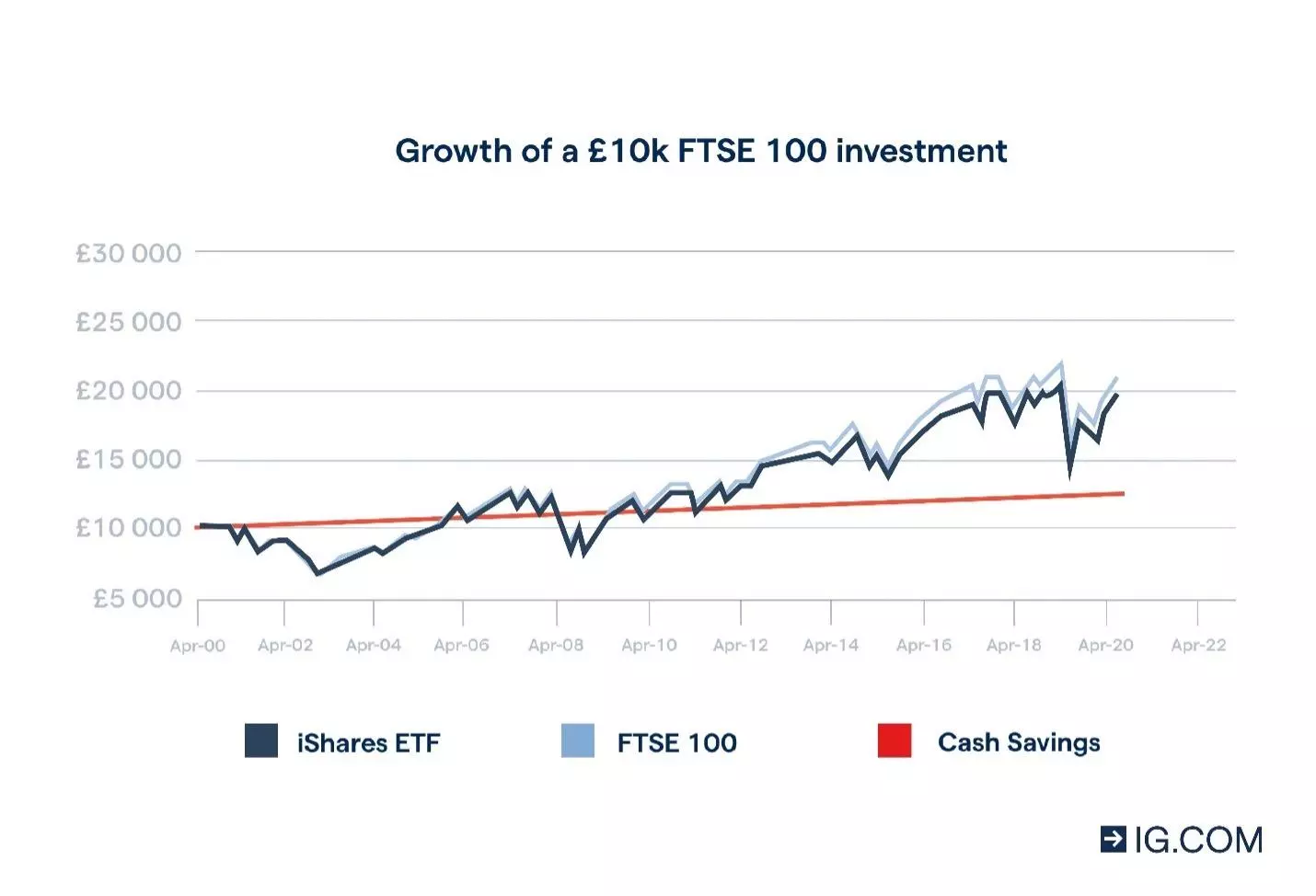

The above graph plots the returns on an initial £10,000 investment into the iShares Core FTSE 100 UCITS ETF against its benchmark and a cash savings account earning 1.5% interest per annum. Whereas the data show a higher return on the ETF, it’s important to remember that cash savings don’t incur the same risks associated with investing

An index ETF is one of the most effective ways to diversify an investment portfolio, thereby mitigating a portion of the risk of holding just a few, concentrated assets. With our share dealing service, you’ll pay from £3 commission per trade if you traded three or more times in the prior month.1 Otherwise, a standard rate of £8 applies.

Buying FTSE 100 stocks with share dealing

Depending on your investment goals and appetite for risk, you could invest directly into shares of FTSE 100 constituent companies through a share dealing account. You won’t get exposure to the full index, but you’ll be able to target companies that have a market capitalisation large enough to be included in the index.

Often, these companies offer income streams by way of dividends and show positive results over long periods of time – although this is never a given, as past results can at no time guarantee future returns. With our share dealing service, you’ll pay from £3 commission per trade if you traded three or more times in the prior month.1 Otherwise, a standard rate of £8 applies.

Investing in a managed portfolio

If you’d prefer to have experts manage your investments for you, you can opt for a Smart Portfolio. To get started, you’ll undertake an assessment to gauge your risk appetite and suitability. Based on the results, we’ll then recommend a portfolio that consists of a balance of investments, including FTSE 100 ETFs and companies, to suit your preferences.

Once you’ve made your selection and deposited the necessary funds, our managers will invest on your behalf. Smart Portfolios are subject to an estimated 0.72% fee on the first £50,000 and 0.22% thereafter.

What moves the FTSE 100’s price?

Understanding what influences the FTSE 100’s price is important not only for opening your position, but also for knowing when to exit it. Amongst many other factors, the index’s price is moved by:

- Economic events: to cite but one example, the economic effects of the Covid-19 pandemic saw the index experience significant volatility throughout 2020, including a drop from the 7600 level to below 4900 in just over two months (-35.5%)

- Exchange rates: fluctuating exchange rates can affect the FTSE 100’s price because its constituents earn a lot of their income in other countries

- News releases: certain news releases are generally followed by a period of volatility in the market. If the news pertains to any of the industries or constituents of the FTSE 100, its price may be affected

- Earnings reports: changes to FTSE constituents’ valuations can have a substantial impact on the index price, depending on the weight of the stock

- Commodity prices: because around 15% of companies on the FTSE 100 are commodity stocks, commodity price fluctuations can influence the index’s price quite heavily

Traders should always use a combination of fundamental analysis and technical analysis before trading the FTSE 100, and follow their trading plan and risk management strategy.

Refine your FTSE 100 trading strategies

Refining your trading and investment strategies is an on-going project. Below are just a few tips to consider as you continue to develop your knowledge and master your craft.

- Decide on your trading style: there are four main trading styles – scalping, day trading, swing trading and position trading. Each trading style describes how often you place a trade, and how long you keep those trades running

- Study charts and price action: daily and weekly charts can help you to gauge market sentiment, while price action can help you get a feel of what the market might do next

- Use technical analysis and indicators: it can be helpful to use technical analysis and trading indicators as part of your trading strategy to identify certain signals and trends within the market

- Look for FTSE trading signals: by looking at the FTSE 100 chart, you should be able to tell if it is in a trend. You can confirm trading signals with momentum indicators such as the stochastic oscillator or relative strength index (RSI)

- Set trading alerts: trading alerts enable you to set specific criteria for the FTSE 100 price and be notified immediately once the criteria have been met

- Follow news: every time news about a company, such as earnings, is released, it can affect share prices. Keep a close eye on the economic calendar to help you trade according to the latest events

What else you need to know about the FTSE 100

How is the FTSE 100 calculated?

The FTSE 100 is calculated by weighing all stocks listed on the London Stock Exchange (LSE) by market capitalisation. The 100 companies with the highest market cap make it onto the index. Companies with a higher market capitalisation will represent a higher weight in the index and stocks with higher weightings have a bigger effect on the FTSE 100’s price.

What are the FTSE 100’s trading hours?

The FTSE 100’s trading hours are 8am to 4.30pm UK time. With us, however, you can trade our exclusive weekend trading hours – from 4am on Saturday to 10.40pm on Sunday (UK time).

Moreover, our spread betting and CFD FTSE 100 futures trade 24 hours (11pm Sunday to 10pm Friday UK).

FTSE 100 news and strategies from IG

FTSE 100

-

UK assets stumble as AI doubts rattle global sentiment

2026-02-05T10:45:41+0000 -

FTSE 100 hits record high as Wall Street stumbles on AI anxiety

2026-02-04T12:30:01+0000 -

Global equities hit records as metals rebound

2026-02-03T10:33:29+0000

FAQs

What is the FTSE 100?

The FTSE 100 is an index of the UK’s largest 100 public companies by market capitalisation. It has become a popular way to gain exposure to the UK stock market and track the performance of the country’s economic health.

The market capitalisation of the index has grown significantly since its inception in 1984, as its constituents have experienced success and growth.

With us, there are a number of ways to gain exposure to the FTSE 100. You can:

- Trade the FTSE 100 index directly

- Trade or invest in FTSE 100 ETFs

- Trade or invest in FTSE 100 shares

When trading the FTSE 100, you’ll do so using spread bets or CFDs. Here, you’ll speculate exclusively on the underlying asset’s price movements – in this case, either fluctuations in the index level of the FTSE 100, or movements in the prices of FTSE 100 ETFs or shares.

When investing in the FTSE 100, on the other hand, you’ll do so via our share dealing platform. This means that you’ll buy and own actual assets – for example, shares in a FTSE 100-tracking ETF or FTSE 100-constituent company.

What should you know before trading the FTSE 100?

Before trading the FTSE 100, make sure you do your research and understand how the index works. Then, decide whether you want to trade or invest.

How do companies get onto the FTSE 100?

To get onto the FTSE 100, a company must be listed on the London Stock Exchange (LSE) and it must be one of the top 100 companies by market capitalisation on the exchange. If its market capitalisation drops drastically, a company might lose its listing on the FTSE 100.

Develop your knowledge of financial markets

Find out more about a range of markets and test yourself with IG Academy’s online courses.

Try these next

Discover everything you need to know about stock indices, including how to trade them

Learn how to gain exposure to FTSE 100 price movements

Spread bet or trade CFDs on a wide range of popular and niche metals, energies and softs

1 Please note published rates are valid up to £25,000 notional value. See our full list of share dealing charges and fees.

2 Overnight funding is the charge you pay for keeping daily funded bets or cash CFD trades open past 10pm UK time; we‘ll make an interest adjustment to your account to reflect the cost of funding your position. Learn more about how overnight funding is calculated.