What is the FTSE 100?

Many traders and investors consider the FTSE 100 to be the most important indicator of the health of the UK stock market and economy. Learn more about the index, see how it's calculated, and discover the steps to trade it with IG. Interested in trading the FTSE 100 with IG?

FTSE 100 explained

The FTSE 100 is an index made up of shares from the 100 biggest companies by market capitalisation on the London Stock Exchange (LSE). The price of the index is determined by the price movement of these constituent stocks.

To be included on the FTSE 100, a company must be listed on the LSE, it must be denominated in pounds, and it must meet minimum float and stock liquidity requirements.

What does FTSE stand for?

‘FTSE’ is short for ‘Financial Times Stock Exchange’, which is derived from the names of two companies that launched the FTSE – ‘Financial Times’ and ‘London Stock Exchange’. The ‘100’ in ‘FTSE 100’ represents the number of stocks in the index.

How is the FTSE 100 calculated?

The FTSE 100 is calculated by weighing all stocks listed on the London Stock Exchange by market capitalisation. The 100 companies with the highest market caps make it into index.

Stocks with higher market caps have more weight in the FTSE 100 and therefore have a bigger effect on the index’s price movements. The market capitalisation of each company is reviewed once a quarter, and the index is adjusted if necessary.

Remove table and say: Some of the top FTSE 100 constituents include Royal Dutch Shell, GlaxoSmithKline, Unilever and Barclays. You can view a full list of FTSE 100 constituents here.

What are the other UK indices?

Other UK indices include the FTSE 250, FTSE 350, FTSE SmallCap and FTSE All-Share. FTSE also has three indices for AIM stocks – smaller, growing companies owned by the London Stock Exchange. These include FTSE AIM UK 50, FTSE AIM 100 and FTSE AIM All-Share.

What has the FTSE 100 returned over time?

The FTSE 100 returned an average of 8.3% per year from 2010 to 2019 for investors who reinvested their dividends. Without dividend reinvestment, the FTSE 100 returned around 4.3% per annum over this period. Returns depend on factors that impact the individual companies or industries on the index, and ultimately the index price.

FTSE 100 performance over the last ten years

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Ten-year annualised return | |

| Total return with dividends reinvested (%) | 12.6 | -2.2 | 10.0 | 18.7 | 0.7 | -1.3 | 19.1 | 11.9 | -8.7 | 17.3 | 8.3 |

| Total return without dividends (%) | 8.9 | -5.6 | 5.8 | 14.4 | -2.7 | -4.9 | 14.4 | 7.6 | -12.5 | 8.9 | 4.3 |

Individual FTSE 100 stocks yielded returns of 3238% between 2010 and 2019 (as of 30 August 2019). You can use our Hindsight Investments tool to see how much you could have made by investing in individual FTSE 100 shares.

How can you trade the FTSE 100?

You can trade the FTSE 100 with derivatives such as CFDs and spread bets, which enable you to speculate on price movements – positive or negative – without owning any underlying assets. Both products are leveraged, and you’ll get full exposure with a small deposit, known as a margin. Bear in mind, though, that with leverage you run the risk of any losses or profits far outweighing your deposit as they are calculated on the position’s full size – not its margin. You can trade spread bets without paying any tax and offset CFD losses against profits.1

With both CFDs and spread bets, you’ll get access to two types of indices market:

Cash indices

When you choose to trade cash (spot) indices, you deal at the current price of the underlying market. Cash indices have tighter spreads, but open positions are subject to overnight funding charges.

Index futures

When you choose index futures, you agree to trade the index at a specific price on a specific date. Index futures have wider spreads, but open positions are not subject to overnight funding charges.

You can also trade individual FTSE constituents and ETF trackers with derivatives or buy their shares outright via share dealing.

FTSE 100 trading steps

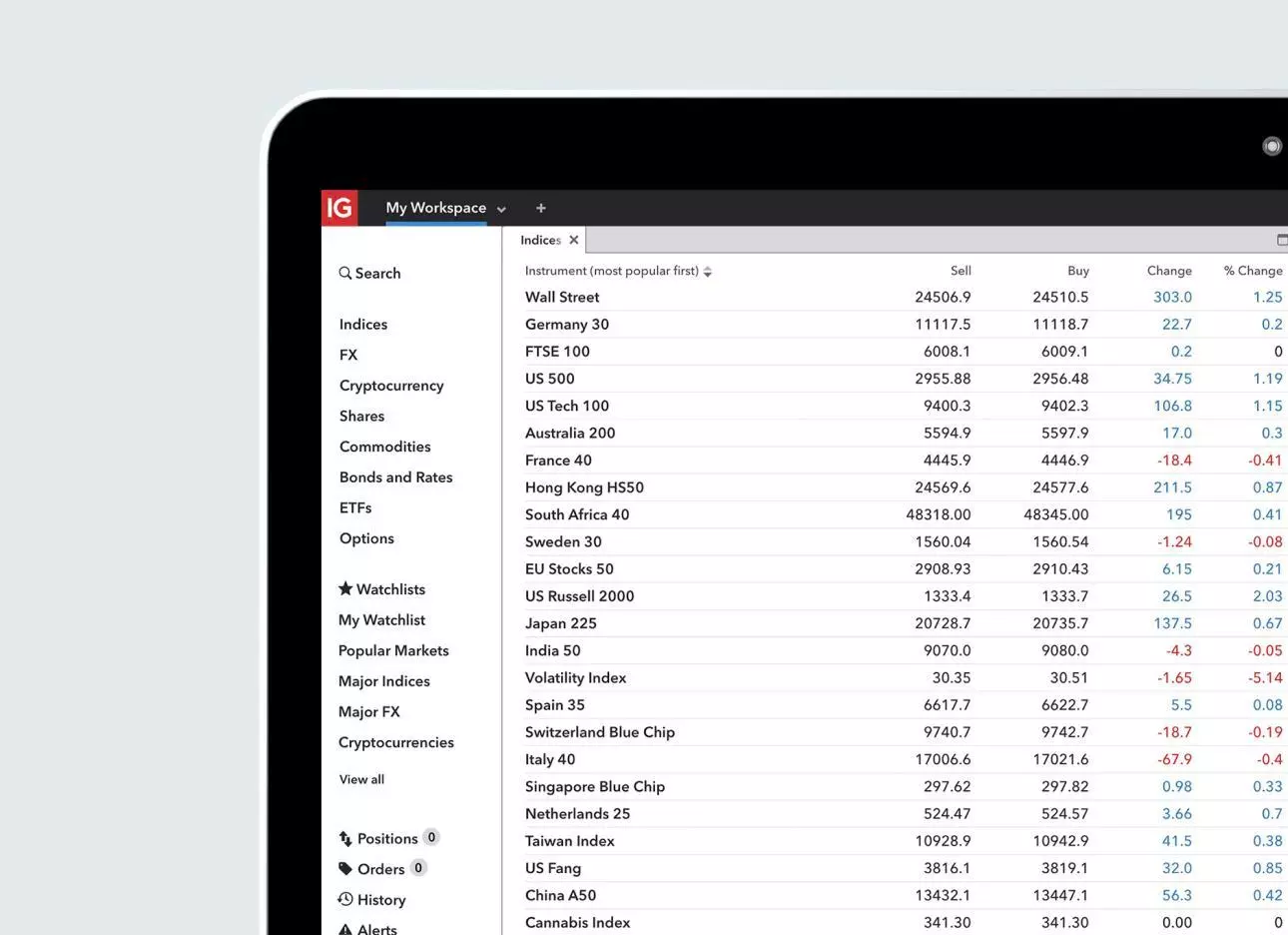

- Create or log in to your IG trading account

- Look for ‘FTSE 100’ in the search panel

- Select ‘buy’ or ‘sell’ in the deal ticket and enter your position size

- Enter your stops and limits to manage your risk

- Confirm the trade and monitor your position

FAQs

What is the definition of the FTSE 100?

The FTSE 100 is an index consisting of the shares of the 100 biggest companies by market capitalisation on the London Stock Exchange (LSE). You can trade the index’s price movements, or buy, sell or short shares of the constituents of the index.

How often do FTSE 100 companies change?

FTSE 100 companies change when the stocks listed on the FTSE 100 are reviewed – this happens every quarter. If one company’s market capitalisation overtakes another, the composition of the index might change. That’s because the FTSE 100 is a capitalisation weighted index and only consists of shares of the 100 companies on the London Stock Exchange (LSE) with the largest market caps.

How old is the FTSE 100?

The FTSE 100 is more than 36 years old. It was launched in January 1984, replacing an index called the FT30, which was the main guide for the performance of companies listed on London Stock Exchange (LSE) at the time.

Can the FTSE 100 be referred to as the ‘Footsie 100’?

Informally, yes, but ‘Footsie’ is just a nickname for the index that was derived from the sound of the acronym FTSE (Financial Times Stock Exchange). You will not see the name ‘Footsie 100’ being used formally on our platforms.

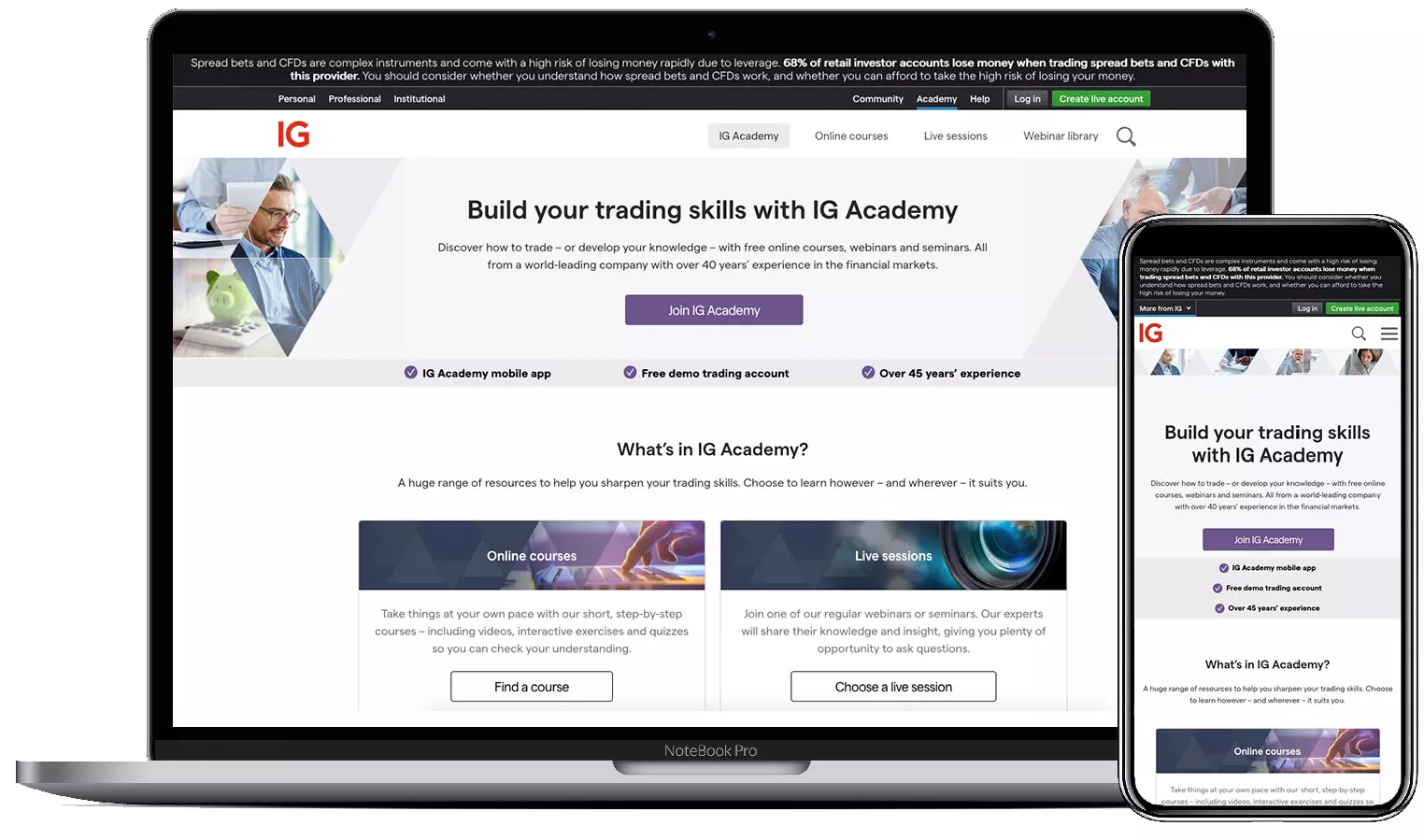

Develop your knowledge of financial markets

Find out more about a range of markets and test yourself with IG Academy’s online courses.

You might be interested in…

See how you can react to volatility in the markets

Learn how to make the most of IPOs and grey markets with IG

Make the most of company announcements with IG’s out-of-hours trading

1 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.