Top position trading strategies

Position trading can be a great way to take up long-term positions on stocks and other assets. Here, we’ll run you through some of the top position trading strategies and show you how to trade or invest.

What is position trading and how does it work?

Position trading involves keeping a trade open for a long period of time. With position trading, you’ll be more concerned with price movements over weeks, months or years compared to price movements in the short term, such as intraday.

Position trading can refer to either speculating on prices with financial derivatives or investing. Speculating on price with financial derivatives means you’ll be taking a position with CFDs or spread bets. These products let you open a position without taking ownership of the asset, which enables you to speculate on prices rising by going long, as well as on prices falling by going short.

Investing means that you’ll be buying an asset outright, which will grant you ownership of it and you’ll benefit from any increases in its price. When talking about ‘position trading’ in a general sense, many people are actually talking about long-term investments. These can include shares, bonds, funds or other assets that are held for a long time.

In the context of position trading, long trades or investments are often the go-to, but if you’re expecting an asset to fall in value over a weekly, monthly or yearly time frame, you could also open a short trade to profit from prolonged bearish market sentiment.

To be a successful position trader, you’ll need to use a mix of fundamental analysis and technical analysis to evaluate potential market trends and risks before opening a trade or investing.

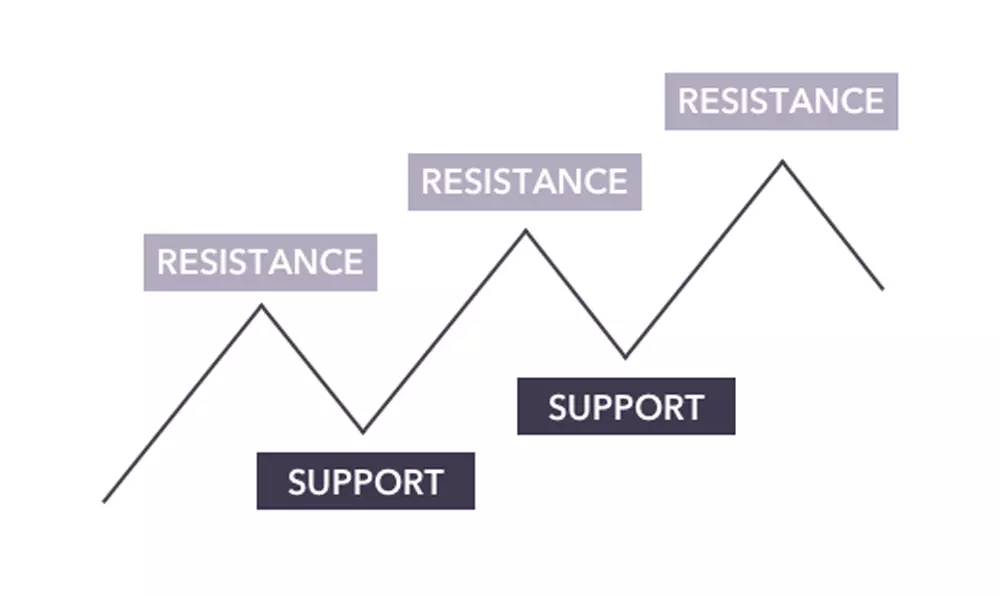

Support and resistance trading strategy

Support and resistance levels can help you recognise whether an asset’s price is more likely to fall into a downward trend or increase into an upward trend. Based on this assessment, you can decide whether to open a long position and profit from weekly, monthly or yearly increases in price, or a short position to profit from prolonged drops in price.

A support level is the price an asset will not usually fall below, as buyers tend to purchase the asset at this level. The resistance level is the point at which the price of an asset ceases to rise, because buyers will tend to stop purchasing the asset at this level. If an asset breaks through resistance, it could indicate that price will go on to reach higher highs, and if it breaks below support, it could indicate that the price will go on to reach lower lows.

Support and resistance levels are essential tools to analyse long-term trends, which will come in use if you are looking to start position trading. There are three main factors to consider when trying to identify support and resistance levels.

- The historical price is the most reliable source for identifying support and resistance levels. Normally, periods of significant gains and reductions in price will be used as potential indicators of future movements

- Similarly, position traders can look at previous levels of support and resistance as an indicator of future movements. For example, if a support level is breached it could turn into a resistance level for future trades

- Finally, certain technical indicators can provide dynamic support and resistance levels which change with the price of a given asset

Breakout trading strategy

Breakout trading means you'll attempt to open a position in the early stages of a trend. Usually, a breakout strategy forms the foundation for trading large-scale price movements.

Similar to support and resistance trading, a breakout trader will usually open a long position after the stock price breaks above the resistance level, or will enter a short position after the stock falls below the support level. As a result, to be a successful breakout trader, you need to be comfortable identifying levels of support and resistance.

Range trading strategy

Range trading is a strategy which works best in a market that is constantly shifting up and down. Forex traders particularly benefit from range trading because forex markets don’t always have a clear and obvious trend.

A range trading strategy is good when you have identified an overbought or oversold asset. The aim would be to buy the oversold assets and sell the overbought ones. In this case, an ‘oversold asset’ might be approaching the support level, while an ‘overbought asset’ might be approaching the resistance level.

Pullback and retracement trading strategy

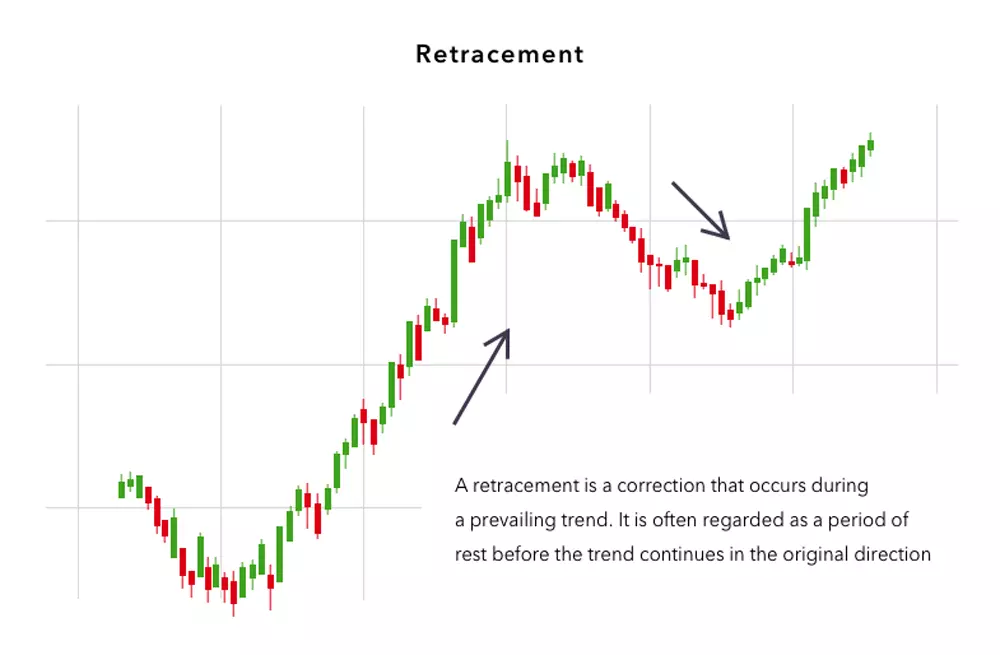

A pullback is a temporary dip or brief reversal in an asset’s prevailing upward trend. Pullback trading can enable traders to capitalise on these dips or pauses in the upward movement of an asset’s price. The aim is to buy low and sell high once the asset moves out of the pullback and continues its upward trend.

Pullbacks are sometimes referred to as retracements, but should not be confused with reversals. Reversals tend to be long-term or permanent deviations from the prevailing trend.

One way to determine whether a market dip is a pullback or a reversal is to utilise a Fibonacci retracement.

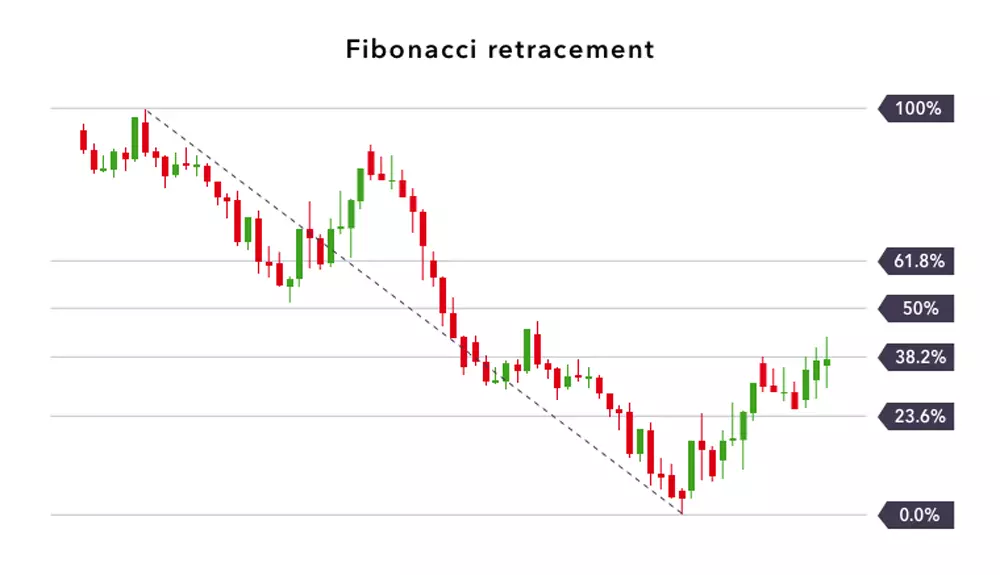

How do position traders use a Fibonacci retracement?

A Fibonacci retracement is a technical indicator that can help you to decide when to open or close a trade when using a position trading strategy.

To calculate Fibonacci retracements, position traders draw six lines across an asset’s price chart. The first line goes at 100%, the next at 50%, and then one line at 0%. After this, position traders will draw three additional lines at 61.8%, 38.2% and 23.6%.

In theory, these percentages adhere to the golden ratio, which can sometimes be used to identify support and resistance levels. It is at these points that position traders may choose to open or close a position.

With our trading platform, you won’t need to worry about drawing these lines yourself because you can select for this indicator to be overlaid on any price chart at the click of a button.

Learn more about our trading platform

Top position trading strategies summed up

Position trading sounds simple, but it involves carrying out detailed fundamental and technical analysis as well as a thorough understanding of the markets. Here are some key points to keep in mind:

- Support and resistance levels can help you to recognise when an asset’s price movement is more likely to fall into a downward trend or increase into an upward trend

- Breakout trading is a good strategy to use in the early stages of a trend, but you’ll have to be comfortable identifying periods of market support and resistance to spot an opportunity

- Range trading is best used in markets which move up and down with no obvious trend including some forex markets

- A pullback trading strategy can enable position traders to buy low and sell high, so long as an asset’s upward price momentum recovers after a temporary dip, instead of progressing to a more permanent bearish reversal

Learn more about candlestick charts and other technical analysis

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Discover how to trade the markets

Explore the range of markets you can trade – and learn how they work – with IG Academy's free ’introducing the financial markets’ course.