The right asset type for wealth building

Recommended:

Financial independence foundations

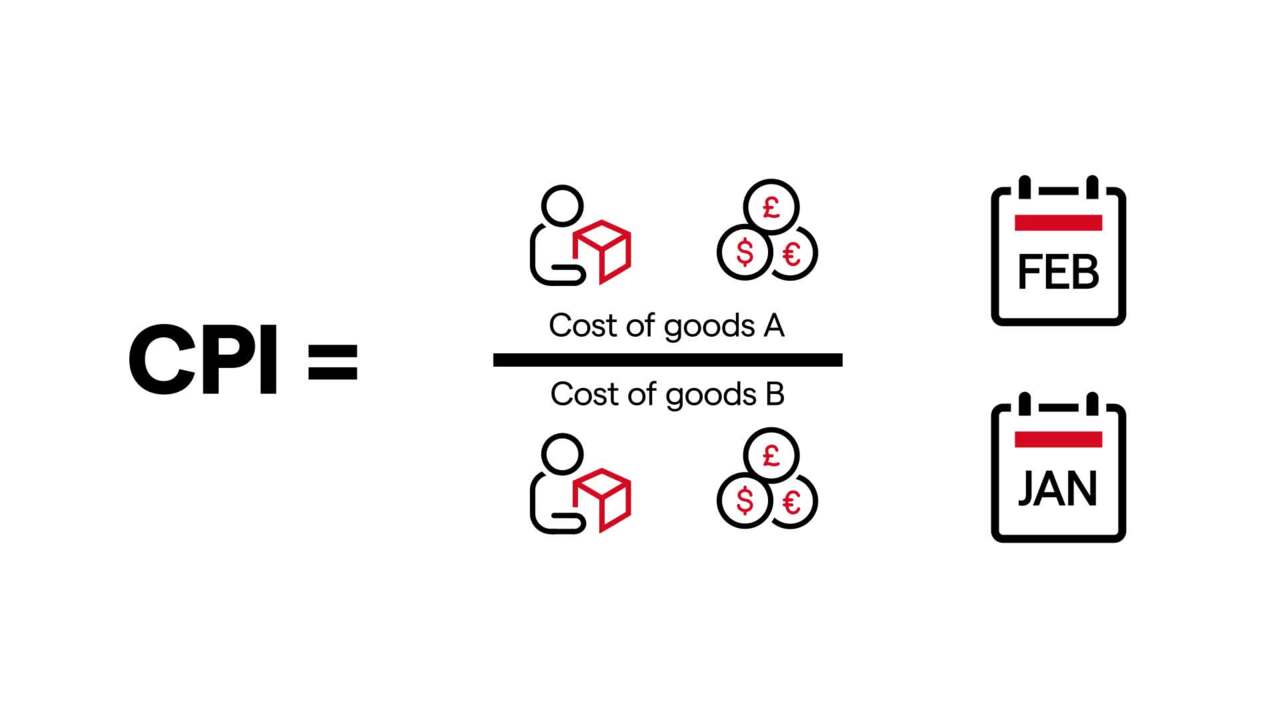

Money loses value over time because the things we spend money on become more expensive. This tendency for prices to go up over time is called inflation and it’s the reason why keeping money under a mattress is a sure-fire way to become poorer over time.

Wealth building is any activity that allows the money you set aside for the future to grow above inflation. There are many roads to achieving inflation-beating growth, but a risk-balanced and diversified portfolio that can deliver returns year after year is a worthy pursuit.

Designing a wealth-building portfolio requires some skill and market knowledge. A wealth building portfolio should contain a mix of assets, with a balance of risk and a good chance of capital growth. This means carefully choosing a combination of bonds, property investments, equities, and alternatives.

Bonds

A bond is a way for companies or governments to borrow money. Investors effectively loan their money to the bond issuer (the company or government) over a fixed period. While the bond issuer holds the investors’ money, they will pay the investor a monthly, quarterly or annual rate of interest. At the end of the bond’s term, the original amount borrowed is returned to the investor, just like it would be had you lent the money to a friend.

Bonds are great for anyone investing over the long term, as your money is locked away for several years at a time. While it is possible to make early withdrawals from a bond holding, it can be costly, depending on the terms of the bond.

Bonds are also considered to be relatively low risk, particularly if you invest in good quality bonds. Ratings agencies such as Fitch and Moody’s issue ratings on any new bond issuance, with the highest rated bonds (those rated with an A or higher) representing the lowest risk. By investing in low-risk, fixed income bonds you can maintain a degree of consistency across your portfolio. As with any other asset class, bonds issued by countries or institutions with lower ratings have a higher return to compensate for the increased risk. However, a portfolio of only bonds is unlikely to beat inflation over time.

Property

Real estate is often favoured by investors because property as an asset class is easier to understand. Getting rental income while you hold an investment property and then selling the property at a higher price than you paid for it is how investors typically make money from this asset class.

While the property market can deliver great returns, getting started in property can be expensive. Buying a property is the culmination of many years of hard work for most people, and buying a second property for investment purposes can be even harder to afford. To get approved for a mortgage, you will often need to put up a deposit, plus any fees and other costs attached. With the average cost of a property in the UK reaching £278,000 in 2022, this means you will need to have almost £30,000 in cash before you can enter this market.

However, there are other ways to access property market returns without buying an actual building alone. You could buy stocks in housebuilding companies and property management companies, you could take part in property-backed crowdfunding or peer-to-peer loans, or you could invest in property-focused funds. These funds often invest in companies that build or own properties in various sectors, adding a further diversification to your portfolio.

Equities

Also known as stocks and shares, equities are a way for ordinary people to become co-owners of large corporations. When we talk about equities, we are usually talking about stocks and shares investing.

Equity investment involves choosing a company or a suite of companies and buying shares in them in the hope that the company will do well in the future. If the company does well while you hold shares, you may receive dividends – a way for a company to share its profits with all the owners on an ongoing basis. Aside from dividend payments, which aren’t guaranteed, you only make money from investing in companies when you sell your shares at a higher price than you bought them for.

It is worth remembering that company share prices and the stock market dip and rise. It’s a normal part of share investing that can feel quite scary if you’re not expecting it. This tendency for prices to change often is called “volatility” and it’s something equity investors must be prepared for on their wealth building journey. In the long-term, the stock market tends to rise in value because these are the companies that produce the things we all rely on.

Alternatives

Alternative investments generally refer to anything outside the mainstream, or anything that isn’t cash, bonds or stocks. This might include hedge funds, art, unregulated assets such as cryptocurrency, commodities such as gold, or private equity investments.

Alternative assets are higher risk by their very nature. They do not always come with the safety net of financial regulation, and they may not have the same track record that the stock market has. However, with high risk comes the opportunity for high returns, and so a lot of ambitious investors can’t resist the temptation of a winning alternative bet.

As a minority holding in a diversified investment portfolio, alternatives can turbo-charge your wealth-building goals by delivering market-beating returns. A minority investment is an amount that won’t affect your long-term wealth building journey if you had to lose the whole amount. There is always the risk of big losses when you invest in alternatives. That is why it is always important to balance your portfolio with a mix of steady wealth-building assets such as bonds, alongside growth stocks and other suitable investments, alongside a small allocation towards higher-risk elements such as alternatives.

You also might be interested in

Financial markets participation

When starting your journey as a financial market participant, there are basics you need to learn. Explore how to actively build your wealth and preserve it.

Ethics in the financial markets

It’s important to understand the role of ethics in financial markets. Explore how to get started with investments that align with your values and passion.