Indices measure the performance of a group of stocks. Discover everything you need to know about stock indices, including how to trade them and which markets are available to you.

What are indices?

Indices are a measurement of the price performance of a group of shares from an exchange. For example, the FTSE 100 tracks the 100 largest companies on the London Stock Exchange (LSE). Trading indices enables you to get exposure to an entire economy or sector at once, while only having to open a single position.

You can speculate on the price of indices rising or falling without taking ownership of the underlying asset with spread bets and CFDs. Indices are a highly liquid market to trade, and with more trading hours than most other markets, you can receive longer exposure to potential opportunities.

How are stock market indices calculated?

Most stock market indices are calculated according to the market capitalisation of their component companies. This method gives greater weighting to larger cap companies, which means their performance will affect an index’s value more than lower cap companies.

However, some popular indices – including the Dow Jones Industrial Average (DJIA) – are price-weighted. This method gives greater weighting to companies with higher share prices, meaning that changes in their values will have a greater effect on the current price of an index.

What are the most traded indices?

- DJIA (Wall Street) – measures the value of the 30 largest blue-chip stocks in the US

- DAX (Germany 40) – tracks the performance of the 30 largest companies listed on the Frankfurt Stock Exchange

- NASDAQ 100 (US Tech 100) – reports the market value of the 100 largest non-financial companies in the US

- FTSE 100 – measures the performance of 100 blue-chip companies listed on the London Stock Exchange

- S&P 500 (US 500) – tracks the value of 500 large cap companies in the US

How to identify what moves an index’s price

An index’s price can be affected by a range of factors, including:

- Economic news – investor sentiment, central bank announcements, payroll reports or other economic events can affect underlying volatility, which can cause an index’s price to move

- Company financial results – individual company profits and losses will cause share prices to increase or decrease, which can affect an index’s price

- Company announcements – changes to company leadership or possible mergers will likely affect share prices, which can have either a positive or negative effect on an index’s price

- Changes to an index’s composition – weighted indices can see their prices shift when companies are added or removed, as traders adjust their positions to account for the new composition

- Commodity prices – various commodities will affect different indices’ prices. For example, 15% of the shares listed on the FTSE 100 are commodity stocks, which means any fluctuations in the commodity market could affect the index’s price

Why trade indices?

By using indices as a trading vehicle, you can:

- Get immediate exposure to an entire index

- Go long or short

- Trade with leverage

- Hedge your existing positions

Get immediate exposure to an entire index

A primary advantage of trading indices using derivatives like spread bets and CFDs is the sheer breadth of market exposure accessed in a single position.

Indices, as a representation of an entire market or industry, measure the overall performance of all stocks included within the index. For example, let’s say a notable event occurs that affects the market as a whole rather than just a few specific companies. By taking a position on an index like the S&P 500, you trade on how the incident will impact a wide cross-section of the most important stocks in an economy or sector.

When you trade an index in this way, you also take your position at the exact price of the market at the time you trade, minus any charges incurred.

To gain a similar level of exposure through traditional investments, you’d have to incur the time and monetary costs of purchasing the individual shares making up the index, or invest in an exchange traded fund (ETF), which would be priced according to the fund's net asset value.

Simply put, indices trading is an immediate and direct way to trade on the movements of the total market at its current price.

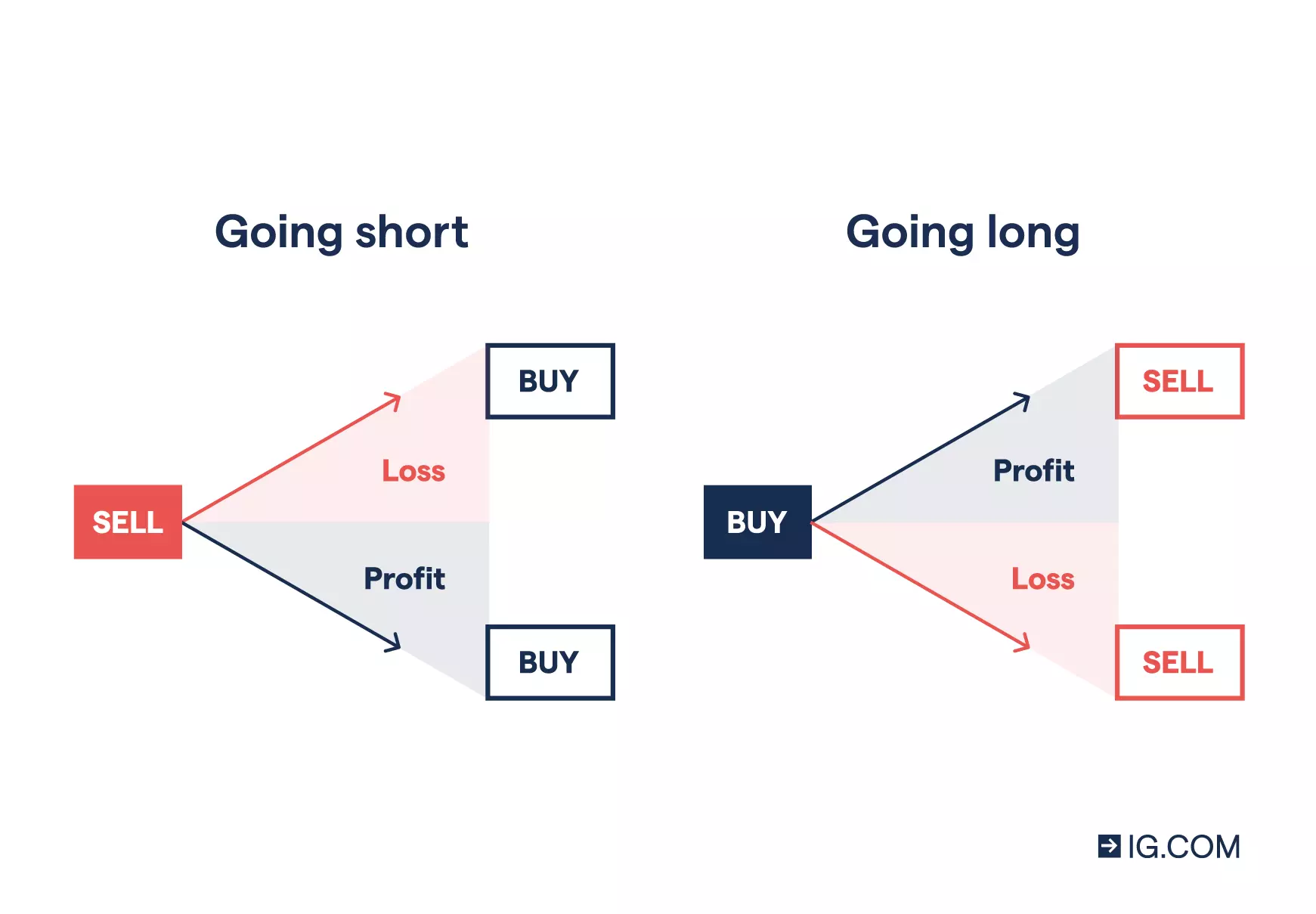

Go long or short on an entire index

When index trading with spread bets and CFDs, you can go both long and short. Going long means you’re buying a market because you expect the price to rise. Going short means you’re selling a market because you expect the price to fall.

This means you can take a position to profit if an index's price decreases in value.

With both spread betting and CFD trading, your profit or loss is determined by the accuracy of your prediction and the overall size of the market movement.

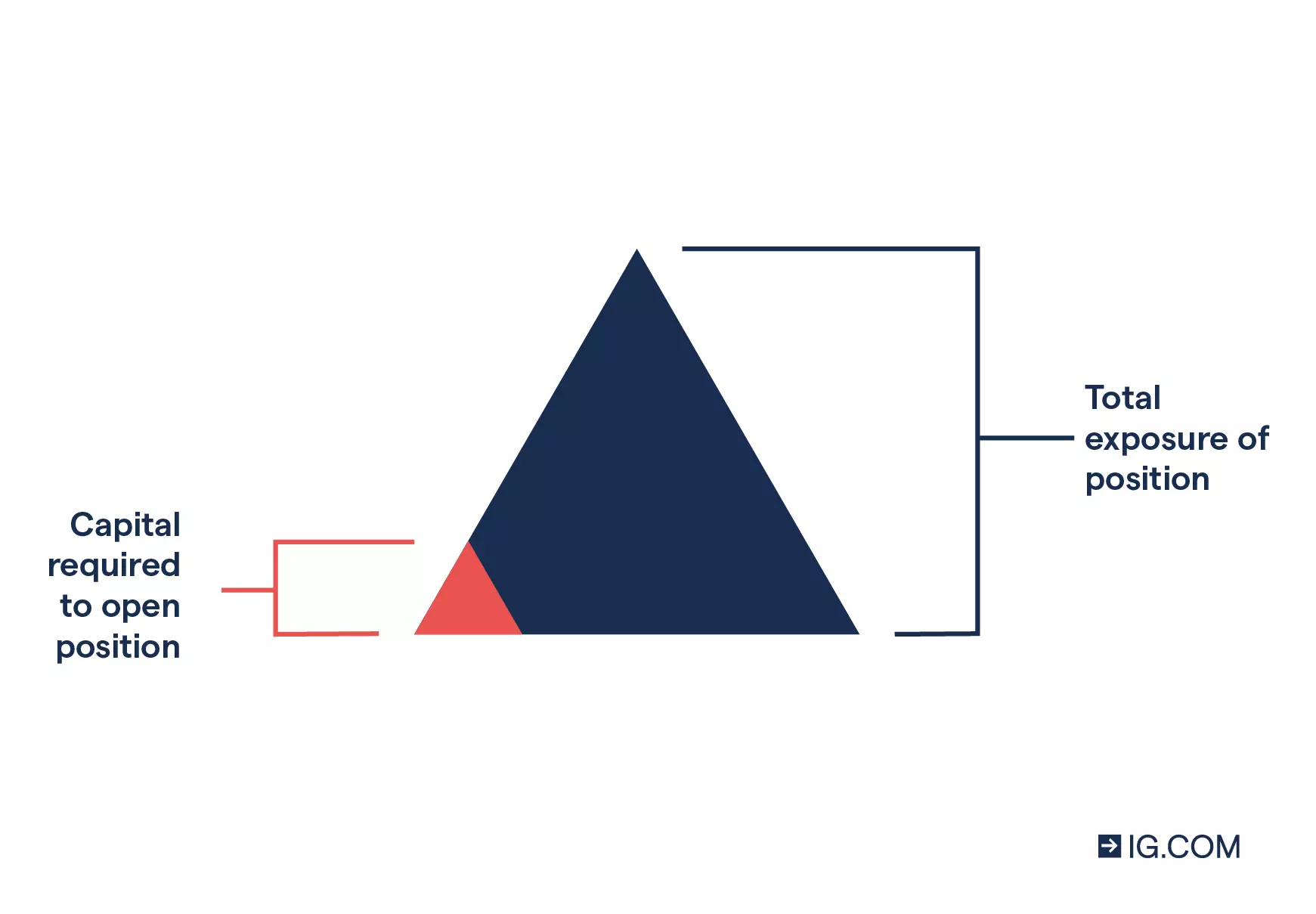

Trade with leverage

Spread bets and CFDs are leveraged products. This means you only need to commit an initial deposit – known as margin – to open a position that gives you much larger market exposure.

When trading with leverage, you should remember that your profit or loss is calculated using the entire position size, not just the initial margin used to open it. This means that while leverage can magnify profits, it can also amplify losses.

Before trading, you should always consider whether you understand how leveraged instruments work and whether you can afford to take the high risk of losing your money.

Hedge your existing positions

An investor with a collection of different shares might short an index to protect themselves from losses in their portfolio. If the market enters a downturn and their shares start to lose value, the short position on the index will increase in value – offsetting the losses from the stocks. However, if the stocks increased in value, the short index position would offset a proportion of the profits made.

If you had a current short position on several individual stocks which feature on an index, you could hedge against the risk of any price increases with a long position on that index. If the index rises, your index position will earn a profit, counteracting a proportion of the losses on your short stock positions.

Choose how to trade indices

With us, you can trade indices via spread bets and CFDs. Both of these products are financial derivatives, which means you can use them to speculate on indices that are rising in value, as well as falling.

We have separate accounts for spread bets and CFDs because the two trading methods differ from one another. You can choose to open accounts for both, or for either. If you decide to open accounts for both, our award-winning platform1 enables you to switch between them quickly and easily.

Spread betting

When you spread bet, you’ll be putting up a certain amount of capital per point of change in the underlying market. Your profit and loss is calculated by multiplying your bet size by the number of points of movement.

For example, you believe that the FTSE 100 is set to rise from its current level of 7000. So, you go long and open your position by ‘buying’ the market – spread betting £10 per point of movement. If the FTSE increases to 7050, you’d earn a profit of £500 – excluding other costs (50 points x £10 per point). But, if the index moved against you, you’d cut a loss in equal measure.

We offer undated, cash spread bets for short-term positions, and futures, forwards and options for longer term views.2

CFDs

A ‘contract for difference’, or CFD, is an agreement to exchange the difference in price of an underlying asset, as measured from the time the contract is opened until the time it’s closed.

For example, you think the FTSE 100 is in an upward trend and will rise from its level of 7100. You buy a FTSE 100 CFD worth £10 per point, and your market forecast turns out to be correct – the index increases to 7200. The difference is 100 points, so your profit is £1000 – excluding other costs. If the market had moved against you, however, and you closed at a level of 7000, your loss would be £1000 – excluding other costs.

We offer undated, cash CFDs for short-term positions, and CFD futures and options for longer term views.2

| Spread bets | CFDs | |

| Main benefits | Go long or short. Cash spread bets have tight spreads while futures, forwards and options don’t incur an overnight fee.2 | Go long or short. Cash CFDs have tight spreads while CFD futures and options don’t incur an overnight fee.2 |

| Tradable in | GBP or other base currency per point of movement | Contracts that mirror the price movements in the underlying market |

| Risks | Leveraging means the trade’s full profit or loss is calculated on the total position size, not the margin amount, so losses could substantially outweigh your margin | Leverage can magnify both your profits and losses as they'll be based on the full exposure of the trade, not just the margin required to open it. Always ensure you're trading within your means. |

| Risk management | Choose an automatic stop-loss level to limit potential losses. Negative balance protection further limits potential losses* | Choose an automatic stop-loss level to limit potential losses. Negative balance protection further limits potential losses* |

| Tax status | No capital gains tax (CGT) or stamp duty3 | No stamp duty, but you do pay CGT. Offset losses against profits for tax purposes3 |

| Expires | Undated, spread bet futures, forwards and options | Undated, CFD futures and options |

| Accesible to | All clients | All clients |

| Commission | Commision-free** | Commision-free** |

| Platforms | Web platform, mobile trading app and MT4 | Web platform, mobile trading app and MT4 |

| Learn more | Learn more |

*Negative balance protection is a regulatory requirement which prevents you from losing more than the funds in your account and is not a product or service of IG

**Other fees may apply

Create an account and log in

To start trading indices with us, open an account. Because spread bets and CFDs differ in the way they work, we have separate accounts for each. This gives you the choice to open accounts for both, or for either. If you decide to open accounts for both, you can switch between them quickly and easily on our award-winning platform.1

We’re a FTSE 250 company with over 45 years’ experience and offer more weekend index markets than any other UK provider. Get exposure to unique trading opportunities on several 24-hour indices, and benefit from our deep liquidity and low spreads.

Decide whether to trade cash indices, futures or options

When you trade with us, there are three main ways to get exposure to an index’s price – via cash indices, index futures or index options. These markets give you access to the performance of an entire index from a single position.

Alternatively, you can also opt to trade or invest in an index-tracking ETF or shares of companies that are included in your chosen stock index.

Cash indices

Cash indices are traded at the spot price of the index, which is the current price of the underlying market. Because they have tighter spreads than index futures, they’re favoured by day traders with a short-term outlook.

Many traders will close their cash indices positions at the end of the trading day and open new positions the following morning to avoid paying overnight funding charges.

Index futures

Trading index futures means you agree to trade the index at a specific price on a specific date. Index futures are popular among longer-term traders because the overnight funding charge is included in the spread – enabling you to hold positions for a long time without this additional cost. When spread betting or trading CFDs, you won’t pay a commission* on index futures

*Other fees may apply

Index options

When you trade options with us, you’ll be using spread bets or CFDs to speculate on an option’s premium – which will fluctuate as the probability of the option being profitable at expiry changes. Owing to their complexity, options trading is often only recommended for experienced traders.

Additionally, please bear in mind that there is substantial risk when selling options. Selling a call, for example, incurs potentially unlimited risk as market prices can keep rising – theoretically, without limit.

- Spread bets

- CFDs

| Min.cash spread | |

| Wall Street | 1.6 |

| Germany 40 | 1 |

| US Tech 100 | 1 |

| FTSE 100 | 1 |

| US 500 | 0.4 |

| Min. futures spread | Min. daily options spread | |

| Wall Street | 6 | 5 |

| Germany 40 | 6 | 4 |

| US Tech 100 | 3 | 4 |

| FTSE 100 | 4 | 3 |

| US 500 | 1 | 0.8 |

ETFs and shares

Aside from cash indices, futures and options, you can also trade index ETFs and individual shares with us. Again, you can open these positions with spread bets and CFDs.

But, if you’d prefer to become an actual shareholder instead of trading on price movements with derivatives, you can invest in index ETFs and constituent companies through our share dealing platform. When investing in ETFs or stocks, you’re taking direct ownership of shares.

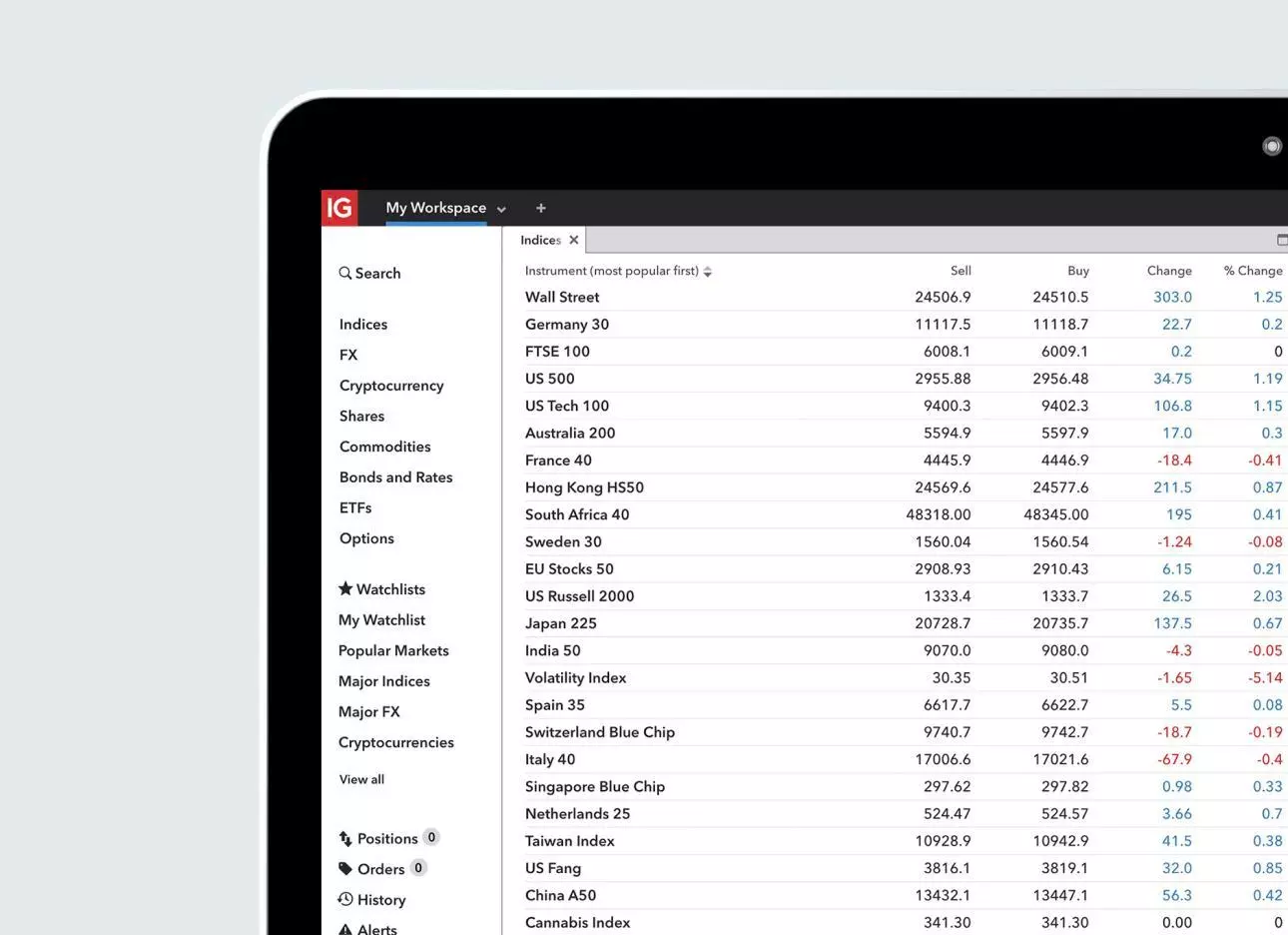

Select the index you want to trade

It’s important to choose an index that’s best-suited to your trading style. This will depend on your individual appetite for risk, available capital and whether you prefer taking short-term or long-term positions.

For example, the Germany 40 (based on the DAX price) is usually a volatile index favoured by traders with high risk appetites and who prefer short-term trading. On the other hand, the US 500 (based on the S&P 500 price) is largely known for its steady returns over time, making it a favourite with traders with lower appetites for risk and a long-term outlook.

We offer 81 major and minor global indices markets for CFD trading, and 69 indices markets for spread betting. We also offer nine indices on our options – meaning that you’re more likely to find a market that fits your individual trading style.

- Major indices

- Minor indices

Decide whether to go long or short

Going long means that you’re speculating on the value of an index increasing, and going short means that you’re speculating on its value decreasing.

If the economic outlook for an economy or sector looks good based on the performance of the companies on an index, a long position could help you realise a profit if the index increased in value. To go long, you’d elect to ‘buy’ when opening your trade.

If the outlook is poor – possibly because large companies on a capitalisation-weighted index are underperforming – you might want to go short on the expectation that the index will fall in value. To go short, you’d elect to ‘sell’ when opening your trade.

Please note, however, that all trading incurs risk and that past results are never a guarantee of future results.

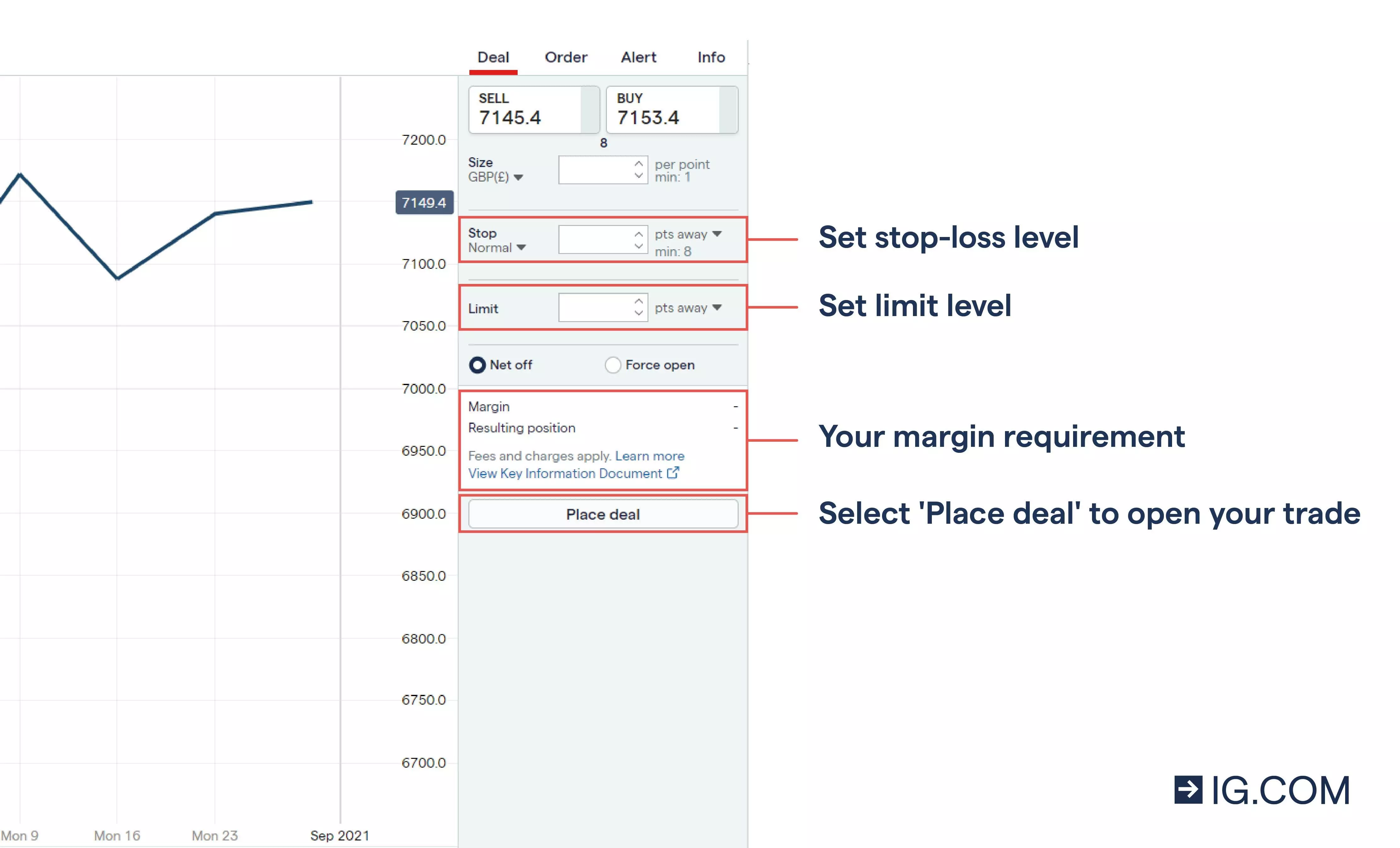

Set your stops and limits

Stops and limits are essential tools for managing your risk while trading indices. A stop order will close your position automatically if it goes to a less favourable level than the current market price, while a limit order will close your position automatically if it goes to a more favourable market price.

Normal stops are free of charge but there is no guaranteed protection against slippage – so your position could be closed out at a worse level if the market gaps. A guaranteed stop will always close out your position at exactly the price you’ve specified, but they do incur a fee if triggered.4

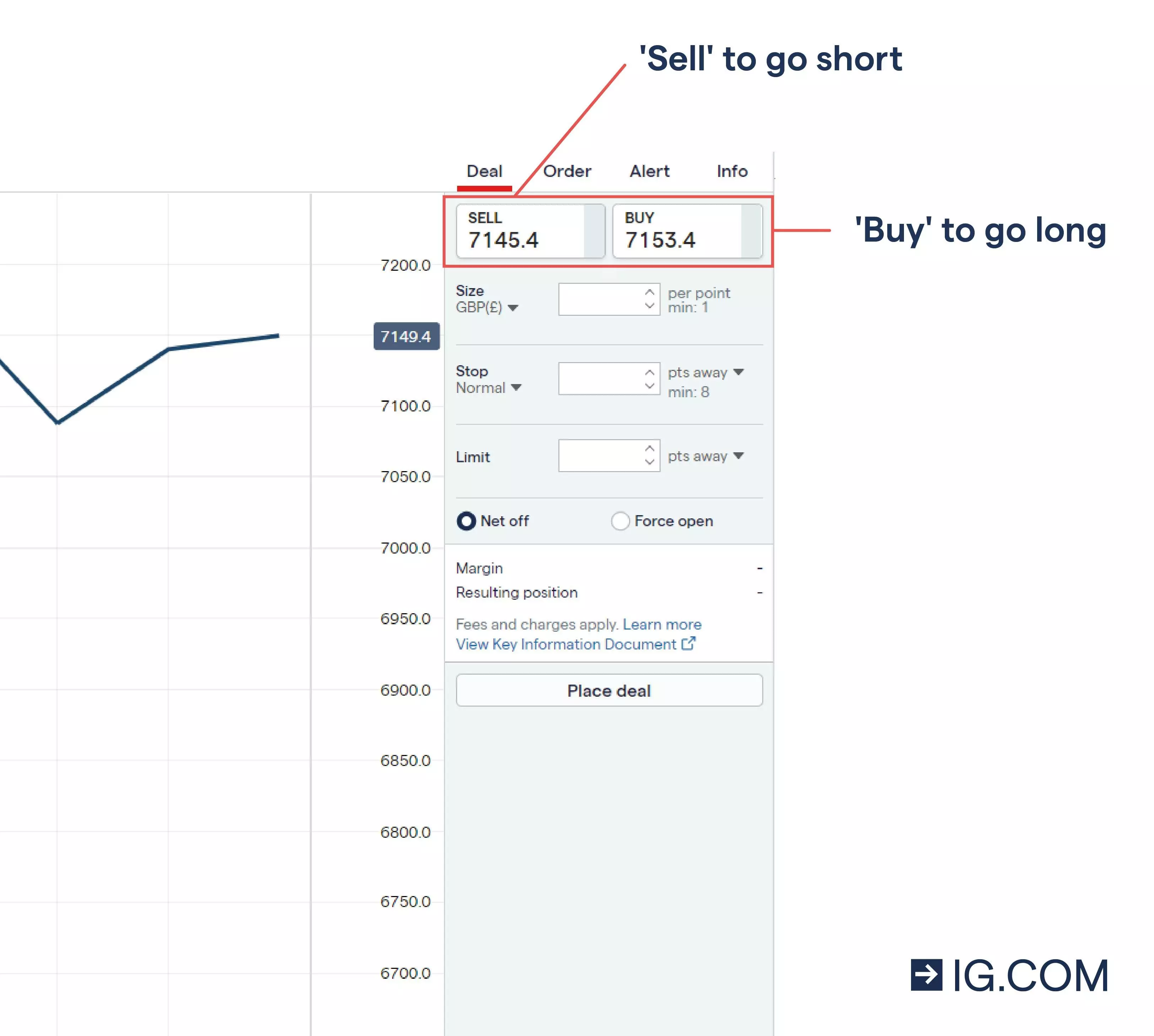

Open and monitor your trade

When you think you’re ready to start indices trading, it’s time to open your position. Log in to our trading platform, choose your way to trade – spread betting or CFD trading – and go to the market you want to take a position on.

Spread bets

Choose to spread bet on our cash, futures or options index markets. For cash and futures, select ‘buy’ if you’re going long or ‘sell’ if you’re going short, and set your spread bet amount per point. Then enter your stop-loss and limit levels, and open your position.

For options, select to buy or sell a call or put at your preferred strike price and expiry date, and set the amount you’d like to spread bet per point. Open your position.

CFDs

Choose between cash, futures and options CFDs. For cash and futures CFDs, pick your favoured contract amount – for example, £2 or £10 per point – and select ‘buy’ if you’re going long or ‘sell’ if you’re going short. Set the number of contracts you’d like to trade, enter a stop-loss and limit, and open your position.

For options CFDs, select to buy or sell a call or put at your preferred strike price and expiry date, and set the number of CFDs you’d like to trade. Open your position.

Monitor your position, and close your trade when you want to take a profit or cut a loss.

FAQs

What does indices trading mean?

Indices trading means that you are taking a position on a stock index – which is measure of the performance of several different companies. Indices trading can be a way to get exposure to an entire sector or economy at once, without having to open positions on lots of different shares.

Can I profit from index trading and what are the risks?

You can profit from index trading by accurately predicting an index’s price movements. For example, if you think the FTSE 100 will rise, you would open a long position. But, if you think it will fall, you would open a short position. Your profit or loss is determined by the extent to which your forecast is correct.

If you decide to trade indices with our products, please note that all leveraged derivatives are complex instruments and come with a high risk of losing money rapidly.

Before trading, you should always consider whether you understand how the instruments work and whether you can afford to take the high risk of losing your money.

What does it mean to buy index futures?

To buy index futures means that you are opening a long position on an index because you think the price will increase. If you are correct in your forecast, you will profit, but if you are incorrect, you will incur a loss.

Are index futures derivatives?

Index futures are a financial derivative. Their price is based on the price in an underlying market, which is influenced by supply, demand and volatility. You can speculate on index futures with spread bets or CFDs, and they will be traded at the futures price – meaning that you won’t incur overnight funding charges. You can also take a long-term position using our options markets.

How can risk be hedged with stock index futures?

You can hedge risk with index futures by taking a position that will turn to profit if one or more of your existing positions starts to lose money. For example, if you held long positions on a selection of US tech stocks, you could open a short position on the US Tech 100 to offset any losses you might incur from the shares declining in value.

Alternatively, if you held short positions on a collection of large-cap German shares, you could open a long position on a Germany 40 index future to protect yourself against any possible increases in the price of the underlying shares.

Can I sell futures before expiry?

You can sell futures before expiry, and many traders will exit their positions before the expiry date arrives. To do so, you can sell your contract outright or purchase an opposing contract which cancels out your current position.

Develop your knowledge of financial markets

Find out more about a range of markets and test yourself with IG Academy’s online courses.

Try these next

Find out how to trade the VIX and speculating on rising or falling volatility

Discover our offering of over 14,500 international shares and ETFs

Learn how to buy and trade shares – including the differences between each

1 Awarded Best Multi-Platform Provider, ADVFN International Financial Awards, 2024

2 Overnight funding is the charge you pay for keeping daily funded bets or cash CFD trades open past 10pm UK time; we‘ll make an interest adjustment to your account, to reflect the cost of funding your position. Learn more about how overnight funding is calculated.

3 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

4 A premium is charged if your guaranteed stop is triggered. The potential premium is displayed on the deal ticket, and can form part of your margin when you attach the stop. Please note that premiums are subject to change, especially going into weekends and during volatile market conditions.