Tesla stock struggles to stay the course

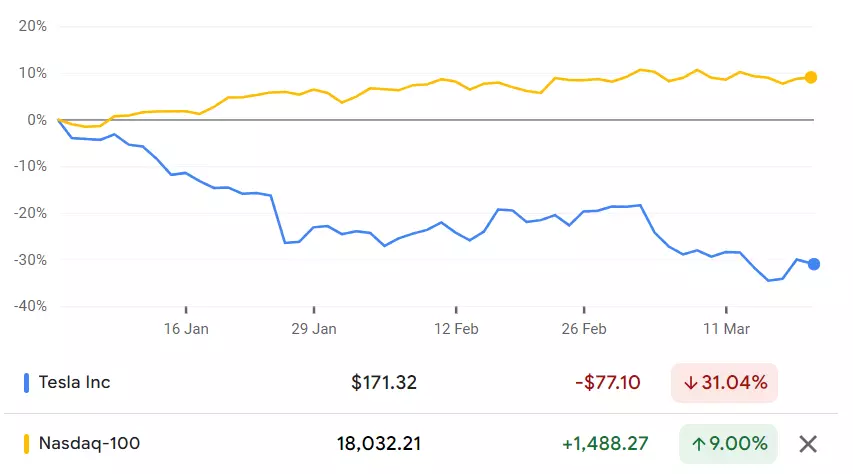

2024 has seen Tesla’s stock price fall sharply even as the Nasdaq 100 hit fresh highs. At present, there seems little sign of a turnaround for the electric car maker.

Tesla faces tough road ahead

Tesla's stock has fallen a staggering 34% year-to-date in 2024, a remarkable underperformance compared to the broader market rally. This decline comes despite Tesla growing its vehicle deliveries to an impressive 1.8 million units in 2023, up from 1.3 million the prior year.

To drive this unit growth, Tesla had to significantly lower prices on its mainstream Model 3 and Model Y vehicles. As a result, revenue growth slowed to just 19% in 2023, while gross profit margins compressed from 25.6% in 2022 down to 18.2% last year.

In its relentless pursuit of scale and market share gains, Tesla has been forced to sacrifice profitability. The company is now at an important crossroads.

New growth plan

Seeking to re-ignite growth, Tesla plans to launch an even more affordable vehicle in 2025 with an expected price point around $25,000. This entry-level offering would open up Tesla's products to a vastly larger pool of potential customers around the world.

However, this new budget vehicle presents its own challenges. If successful, it could certainly boost unit volumes for Tesla. But by dragging down average selling prices even further, it may also cause revenue growth to continue lagging behind any gains in delivery numbers. Investors need to carefully consider this dynamic.

Even in an optimistic scenario where Tesla manages to triple its unit volumes from 2023 levels within three years, aided by the new affordable car. And let's also assume revenue is able to double over that period, helped by operating scale despite the lower pricing.

Profit fails to keep pace with valuation

Tesla's 2023 profit margin of 9.2% - which already reflects the impact of price cuts - implies the company could potentially be earning around $17.8 billion three years out.

That sounds impressive, but the context is important. With Tesla's current market cap around $512 billion, those potential earnings would still leave the stock trading at a price-to-earnings (P/E) ratio of 29. While above-average, that valuation is only modestly higher than the overall market.

From this perspective, Tesla's stock is arguably not cheap, even after the recent 60% plunge from its highs. The company's bold push into lower price points raises concerns about its ability to reignite strong profit growth and justify its historically lofty valuation.

Uncertain future ahead

Unless investors are willing to be extremely bullish on Tesla's growth trajectory over the next several years, the stock could remain under pressure for quite some time. As it relentlessly chases volume at the expense of profitability, Tesla may struggle to deliver the outsize returns shareholders have become accustomed to.

While Tesla's growth story is far from over, the road ahead appears more challenging. The company's path to unlocking its next phase of expansion will require carefully balancing pricing, margins, and profits. Only time will tell if Tesla can pull off that tough feat and reward investors' patience.

Tesla stock price – technical analysis

There has been no let up in the declines for Tesla. The stock price hit a new lower high at the beginning of March, and then slumped to a new lower low, hitting its lowest level since May 2023.

In the short-term, trendline resistance from the late-December high could constrain any upside, and it would need a close above $200 to suggest that a low is in place for the time being.

Short-term support is found around last week’s low at $160.50.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Act on share opportunities today

Go long or short on thousands of international stocks with spread bets and CFDs.

- Get full exposure for a comparatively small deposit

- Trade on spreads from just 0.1%

- Get greater order book visibility with direct market access

See opportunity on a stock?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See opportunity on a stock?

Don’t miss your chance – upgrade to a live account to take advantage.

- Trade a huge range of popular stocks

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See opportunity on a stock?

Don’t miss your chance. Log in to take advantage while conditions prevail.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.