Will we see any US rate cuts in 2024?

While markets continue to expect US rate cuts this year, it does look like the case for easing policy is becoming weaker.

Stronger data weakens case for US rate ctus

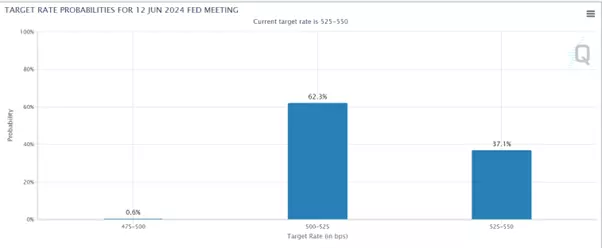

While June is still viewed as a likely point for the Federal Reserve (Fed) to cut rates by 25 basis points (62.1% chance according to the CME FedWatch tool, as of April 3rd), the arguments for continuing to hold rates unchanged remain strong.

The US Personal Consumption Expenditures (PCE) price index, the inflation measure targeted by the Fed, showed an acceleration in recent months after appearing stable late last year. The headline PCE rose 0.3% month-over-month in February, while the core PCE (excluding food and energy) rose 0.3% as well, suggesting annual inflation could move above 4% if repeated.

Fed Chair Jerome Powell downplayed the increase, calling it "along the lines of what we would like to see" and saying the Fed won't overreact, but the bond market sold off in response. Economic data like the S&P Purchasing Managers' Index pointed to strengthening demand and pricing power, contradicting narratives of slowing growth that would justify rate cuts.

The Atlanta Fed revised up its gross domestic product (GDP) growth estimate for first quarter (Q1) 2024 to 2.8%, further distancing the prospects of near-term rate cuts.

Market expectations have shifted, now pricing in the Fed's terminal rate settling around 3.6% by 2027, much higher than the Fed's 2.6% longer-run projection.

The combination of firming inflation and economic resilience makes imminent rate cuts less likely and creates challenges, especially for regions like the eurozone which must contend with weaker economic growth than that seen in the US.

What does this mean for markets?

If the Fed does swerve a rate cut in June, it may be a cause for disappointment for equity markets. A commonly-held view is that the rally from November has been built on hopes of a Fed rate cut, and not much else. This is wrong – the improvement in earnings and the solidity of US economic data has been the real driver here.

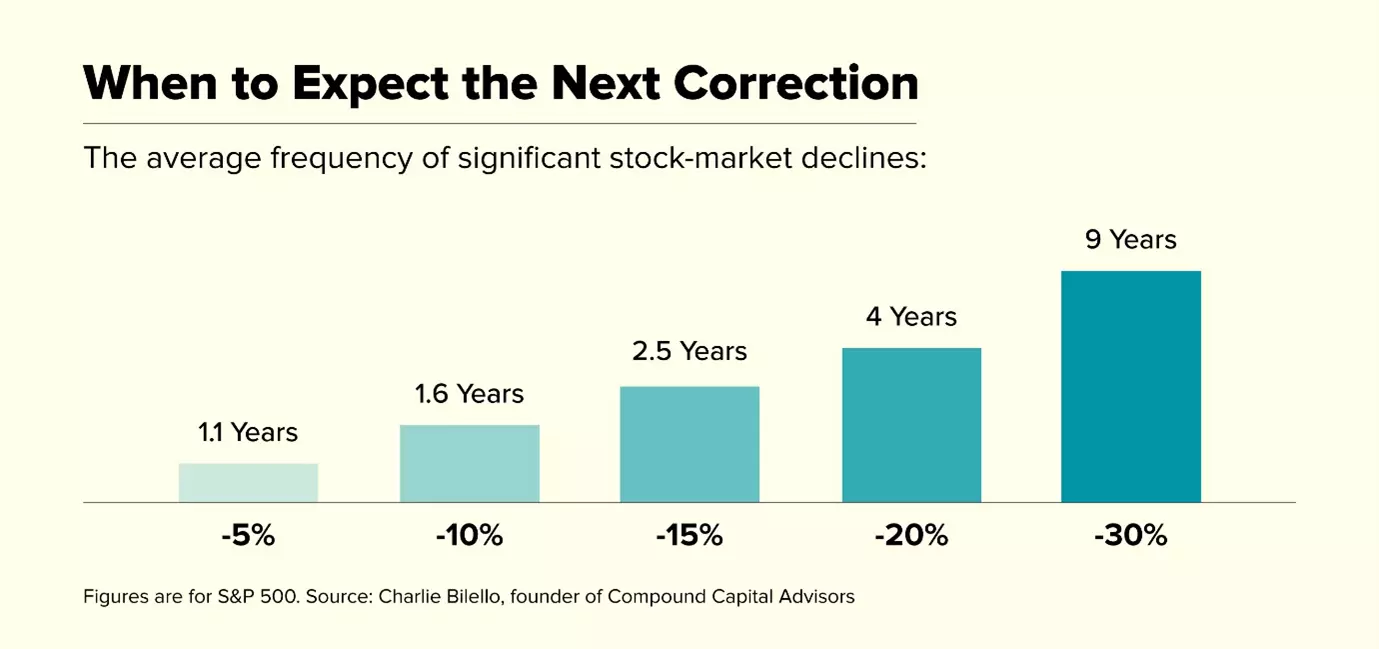

But stocks do remain vulnerable to a short-term sell-off. US indices (and several European ones) have had an astonishingly quiet few months. As an example, the S&P 500 hasn’t had a 2% drop since October. Pullbacks happen, and investors need to remember that markets go up AND down, not up OR down.

A short-term period of weakness in stocks could deliver the kind of dip many are waiting for. It would certainly be ‘healthy’ – markets should correct from time to time.

It would not be surprising to see the VIX and dollar both rise in the aftermath of a ‘hold’ from the Fed, particularly if the commentary around the decision refers to fears of resurgent inflation.

A ‘hold’ in June would not be likely to cause a major market decline – for that we’d need the Fed to declare it was moving to raise rates again, but there could be a decent wobble in stocks if the Fed continues to step away from the idea of rate cuts in 2024. If history is any guide we should continue to see global stock markets make headway, so long as earnings remain supportive.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Keep an eye on FOMC opportunity

Find out how FOMC meetings can affect the markets ahead of the next one on 27-28 July 2021.

- How might the next Fed meeting impact your trading?

- What was decided at the last Fed meeting?

- How does the FOMC announcement usually affect the dollar?

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.