Ahead of the game: May 22, 2023

Your weekly financial calendar for market insights and key economic indicators.

Reading time: 4 min 12 sec

US EQUITY MARKETS EXPERIENCED A SURGE as optimism grew regarding an impending resolution to raise the US debt ceiling before the X-date.

President Biden's move to curtail his trip to Asia showcased his dedication to achieving an agreement, while the downsizing of the negotiating team suggests that talks have moved to a more advanced stage.

In Japan, the TOPIX traded to its highest level in 33 years, supported by ultra-easy monetary policy, a very cheap Japanese yen and after Warren Buffett expressed confidence in the Japanese market.

China's recovery faltered with disappointing economic indicators, including weak imports, inflation, lending, industrial production, retail sales, and fixed asset investment. The yuan weakened to a five-month low at 7.03 against the US dollar, erasing post-recovery gains.

For the week of May 22, the market focus remains on updates regarding US debt ceiling negotiations.

- US equity markets surged on optimism for a US debt ceiling deal

- Tesla gained after Elon Musk, who has never used traditional advertising, said that the company would begin advertising its cars

- Mega tech names Nvidia and Meta up over 100% YTD

- The KBW Regional Banking Index soared as Western Alliance Bancorp said deposits had grown by over $US2 billion ($3 billion) since the quarter’s end, easing banking worries

- AU Q1 Wage Price Index data rose by 0.8%, below economics forecasts for a 0.9% rise, easing fears that wage prices are spiralling out of control

- TOPIX hits a 33-year high

- China's economic data sparks recovery concerns

- Gold falls amid a stronger US dollar and optimism for a debt ceiling deal

- The odds of a 25bp rate hike at the Feds June meeting moved closer to 50%

- VIX index drops 5.92% to 16.05.

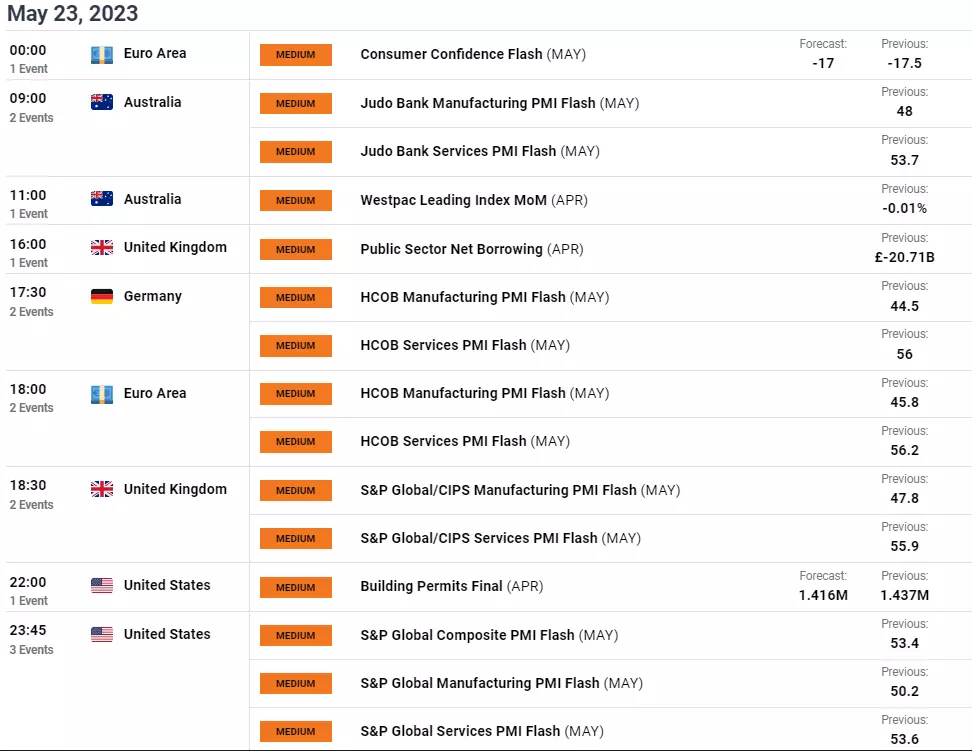

- AU – Judo Bank PMIs (Tuesday, May 23 at 9 am AEST)

- NZ – Retail Sales (Wednesday, May 24 at 8.45 am AEST)

- NZ – RBNZ Interest rate decision (Wednesday, May 24 at 12.00 pm AEST)

- AU – Retail Sales (Friday, May 26 at 11.30 am AEST)

- CN – Loan Prime Rate (Monday, May 22 at 11.15 am AEST)

- US – S&P Flash PMIs (Tuesday, May 23 at 11.45 pm AEST)

- US – FOMC meeting minutes (Thursday, May 25 at 4.00 am AEST)

- US – Core PCE Price Index (Friday, May 26 at 10.30 pm AEST)

- EA – HCOB Flash PMIs (Tuesday, May 23 at 6 pm AEST)

- UK – S&P Flash PMIs (Tuesday, May 23 at 6.30 pm AEST)

- GE – Ifo Business Climate (Wednesday, May 24 at 6 pm AEST)

- UK – Inflation (Wednesday, May 24 at 4.00 pm AEST)

- GE – Consumer Confidence (Thursday, May 25 at 4 pm AEST)

- UK – Retail Sales (Friday, May 26 at 4 pm AEST)

Break down

-

Australia

Retail Sales

Friday, May 26 at 11.30 am AEST

The RBA meeting minutes from the May meeting showed that members discussed two options: holding the cash rate unchanged or increasing the cash rate by 25bp. The decision to raise rates by 25 was a close one.

“In weighing up the two options, members recognised that the arguments were finely balanced but judged it was appropriate to increase interest rates at this meeting.”

The RBA also warned that it could again lift rates as soon as next month, but it would depend on how the economy and inflation evolved.

Wages date and employment data have since come in weaker than expected, easing fears that wage prices are spiralling out of control.

Presuming that next week’s Retail Trade report for April comes in as expected at a subdued 0.4%, it will provide another reason for the RBA to move the sidelines (again) in June.

-

New Zealand

RBNZ Interest Rate Meeting

Wednesday, May 24 at 12.00 pm

The RBNZ was one of the first countries in the world to raise rates during the current round of monetary policy tightening, cutting a path for other central banks to follow.

The RBNZ commenced its rate hiking cycle back in October 2021. It has raised the cash rate on eleven occasions by a cumulative 500bp taking the OCR from 0.25% to 5.25% as it fights to return inflation to its 1-3% target range and to cool a tight labour market.

Last month the annual inflation rate in NZ dropped to 6.7% after reaching a high of 7.3% midway through last year, providing evidence that inflation has peaked. Further falls are expected, with inflation projected to return to the RBNZ’s 1-3% target band by early next year.

In recognition of this, the RBNZ is expected to raise the cash rate by 25bp to 5.5% (a step down from the 50bp hike in April), leaving room for one more 25bp rate hike by August.

The rates market then expects the RBNZ’s next move to be a rate cut into year-end in response to a sharp decline in economic activity.

RBNZ official cash rate chart

-

US

Core PCE price index

Friday, May 26 at 10.30 pm AEST

The Feds preferred measure of inflation, the PCE price index, rose 0.3% in March from the prior month and 4.6% from a year earlier. While the rate is well below the 5.4% high of 2022, the path back to the Fed’s 2% goal is proving to be a slow grind.

The market is expecting more of the same this month, with a 0.3% gain in April, allowing the annual rate a tick lower to 4.5%

Core PCE price index chart

Economics calendar

All times shown in AEST (UTC+10) unless otherwise stated

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.