Are the Bank of England’s rate cut hopes fading?

UK wage growth remained strong in the three months to April as a rise in the minimum wage boosted pay packets, despite a slowing jobs market.

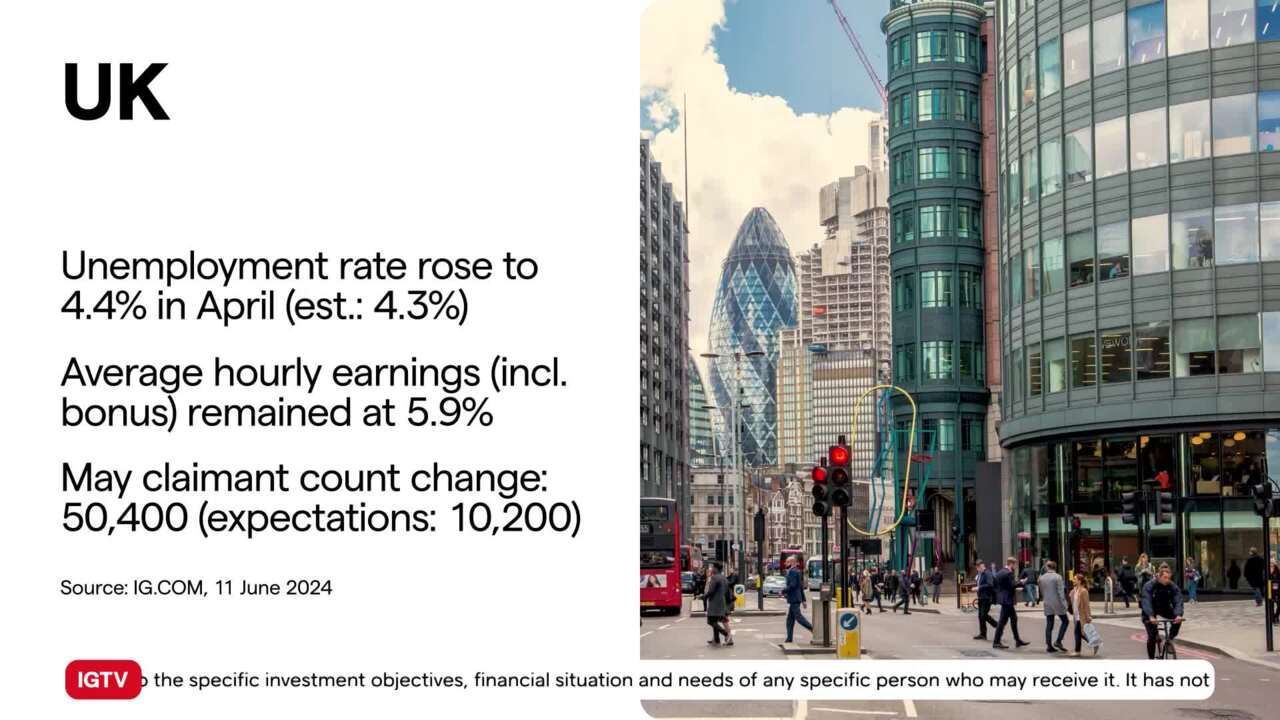

While UK unemployment rate unexpectedly rose to 4.4% in April, from 4.3% the fact that people continue to see unacceptably high wage increases will be of concern to the Bank of England (BoE). Average earnings remain high - excluding bonus payments wage increases remain at 6%, way above the recent 2.3% rise in consumer prices. Including bonuses pay remained at 5.9%, it had been expected to drop to 5.7% year-on-year. The figures are likely to reinforce the majority view on the BoE's monetary policy committee that more evidence of inflationary pressures easing is needed before cutting interest rates. One positive for rates is that there were signs of the labour market cooling, with a slight decline in the number of vacancies and in the number of payrolled employees and an uptick in claims for jobless benefits.

(AI Video Summary)

The Bank of England faces a dilemma on interest rate cuts scheduled for their August meeting, influenced by stronger-than-expected wage growth and a slight increase in the UK unemployment rate to 4.4%. Wage statistics, reflecting a minimum wage hike amidst a cooling labor market, present persistent inflationary pressures. The recent financial news has led to a significant drop in sterling against the US dollar. These factors suggest a cautious approach towards rate cuts pending further inflation data, affecting strategy in upcoming Monetary Policy Committee meetings.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Start trading forex today

Find opportunity on the world’s most-traded – and most-volatile – financial market.

- Trade spreads from just 0.6 points on EUR/USD

- Analyse with clear, fast charts

- Speculate wherever you are with our intuitive mobile apps

See an FX opportunity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See an FX opportunity?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from just 0.6 points on popular pairs

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See an FX opportunity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.