IG Group Client Sentiment Survey

The Client Sentiment Survey is a bi-annual report from online trading platform IG.com, gathering the latest trader insights globally through understanding their financial goals, market concerns, and future trading intentions.

Introduction and survey methodology

The IG Group Client Sentiment Study is a bi-annual study of IG Group’s core markets, aimed at understanding clients’ sentiment, confidence levels, and concerns, by studying their financial goals, ambitions, financial markets, portfolio performance, and future trading intentions.

The latest survey – the fifth of the series – was carried out between 4 December 2023 and 20 December 2023 with 2,750 IG clients from the UK, Australia, Singapore, Germany, and Japan. In the UK and Australia, the survey was sent to both leverage and share dealing clients. The results were then tabulated based on their preferred accounts.

Key UK highlights from IG Group Client Sentiment Survey

- Geopolitical conflicts and wars (58%) now rank as the primary concern amongst UK respondents, followed by recession (46%), and inflation (43%).

- A majority (67%) of IG UK retail traders and investors are worried about the cost-of-living crisis. Despite that, only 6% of clients said they plan to cut back on trading and 7% plan to cut back on investing.

- While UK clients remained concerned about the state of their economy the level of concern has reduced compared to June last year.

- IG clients are striving for financial freedom across all markets, although the focus for IG traders in the UK is “saving up for retirement” (56%).

- In terms of sectoral outlook, 28% of UK clients believe that “Energy” (28%) will experience the largest growth in the next six months, followed by “Technology Hardware and Equipment” (24%) and “Software and services” (23%).

Are global and economic concerns enough to stop trading?

Two-thirds (67%) of UK survey respondents said that they were worried about the ongoing cost-of-living crisis, owing in large part to rising household, transports, and necessities prices. However, UK clients are less concerned about the cost-of-living crisis compared to June 2023 (71%).

Geopolitical conflicts, recession fears, and inflation are three main areas of concern for clients for investment performance, with 58%, 46%, and 43% of responses, respectively. Since Russia invaded Ukraine in February 2022, war and its consequences have been affecting life in Europe and the UK. Supply shortages and rising energy costs were only some of the economic aftermaths.

Despite slowing down, inflation remains a concern for investment performance.

UK’s Consumer Prices Index came in at 6.7% year-over-year in August 2023, a slight decrease from 6.8% the previous month. By December 2023, the percentage had fallen to 4.2%1. While this steady decline raises hopes, investors remain cautious.

In view of these concerns, 41% of UK traders indicated that they were likely to cut back spending on ‘Luxury items’, with another 26% planning to spend less on ‘Entertainment and socialising’ and 23% intending to lower their spending on ‘Holidays’.

Interestingly, only 6% and 7% of clients said they would scale back on ‘Trading’ and ‘Investing’ respectively.

Surprisingly, 40% have no intentions of cutting back any spending at all, despite external market factors being a concern.

What are UK traders’ top financial goals?

The latest survey also tracked the financial and lifestyle goals that traders are currently working towards.

In the UK, “Saving for/ funding retirement” (56%), “Achieving financial freedom” (43%), and ‘Building a rainy-day fund’ (21%) emerged as the top three goals. These came ahead of “Saving for a holiday / travelling” (13%) and “Paying off mortgage” (12%).

This is perhaps unsurprising, considering that the UK’s average retirement age has increased to 65 years old as of 20212, from around 63 in 1996, on the back of rising costs of retirement and living.

According to the latest Pensions and Lifetime Savings Association’s “Retirement Living Standards” research, the minimum amount of money required for retirees to enjoy a basic standard of living burgeoned by almost 20% in 20223, due to high inflation.

The cost of “a minimum lifestyle” increased from £10,900 in 2021 to £12,800 in 2022 – or 18% – for a single person, and from £16,700 in 2021 to £19,900 in 2022 – or 19% – for a couple, in the UK.

The figures were similar across the entire IG Group, with “Achieving financial freedom” (55%) and “Saving for/ funding retirement” (48%) coming in as the top two financial and lifestyle goals for clients globally.

The results are similar as those from a year ago, with respondents working towards the same financial goals. However, there was a slight increase in the number of clients in the UK who said they were building a rainy-day fund, from 19% in June 2023 to 21% in December 2023.

Promising sectors: Which industries are predicted to experience the highest growth in the next six months?

We asked traders which industries they believe will experience the highest growth in the next six months, and in the UK, Energy was slightly more popular among clients with 28%, followed by Technology Hardware & Equipment (24%), Software and Service (23%), Semiconductors & Equipment (22%) and Pharmaceuticals, Biotechnology and Life Sciences (21%).

Female clients were most optimistic about Energy (32%), followed by Technology Hardware and Equipment (30%) and Pharmaceuticals (27%), while male clients didn’t have a clear front runner and predicted growth amongst Semiconductors and Equipment (26%), Software and Services (26%) and Technology Hardware and Equipment (25%).

Globally, Energy came in first place with 29% of clients naming it the most promising sector. Semiconductors & Equipment was next with 25% and Technology Hardware & Equipment in third place with 24%.

These sectors represent potential opportunities for traders actively looking to capitalise on the latest market trends and developments.

Energising the future: the high-growth energy sector

The Energy sector is the most popular choice (29%) for achieving the highest growth among UK traders and globally.

In 2022, the UK’s energy sector created over 734,000 jobs, while its energy supply chain contributed 190 billion Pounds to the British economy. The UK exports more energy than it imports.4

Climate change is a big topic for the UK’s energy sector. The energy manifesto from March 2023, Powering Up Britain5, targets areas such as offshore wind, hydrogen power, nuclear, and improving energy efficiency. In the second quarter of 2023, the total energy production of oil equivalent fell to 24.3 tonnes, 11 percent less compared to the same time in 2022.6

"Oil prices have surged in recent months, recovering from the lows of the year. This has helped the energy sector, boosting revenues and margins. Demand appears to be holding up well, while supply has not yet increased substantially, suggesting a positive outlook for the year ahead."

Chris Beauchamp, Chief Market Analyst at IG

Two companies to keep an eye on: Tesla & BP

Tesla, launched in 2003, is the largest manufacturer of electric vehicles (EVs) in 2024 and beats the market cap of its nearest competitor 20 times.7 The company also offers stationary battery energy storage devices from home to grid-scale and other sustainable energy solutions, like solar products. Renowned for its innovation in EV technology, its Model S, Model 3, Model X, and Model Y vehicles have reshaped consumer perceptions of electric mobility.

BP, established in 1909, is a global energy giant operating across the oil and gas supply chain in over 70 countries. It's pivoting towards renewable energy, investing in wind, solar, and biofuels while maintaining traditional fossil fuel operations.

Despite challenges, its stock, traded under the ticker symbol BP, has shown resilience, reflecting its adaptability amid shifts in the energy landscape. In the third quarter of 2023, BP reported a profit of £ 4.2 billion and 22.3 net debt.8

Powering progress: the semiconductor sector's rapid expansion

The semiconductor industry plays an essential part in the functionality of everyday devices and will be crucial to future technologies. Science, Innovation, and Technology Secretary Chloe Smith describes semiconductors as: “the beating heart of all electronic devices, from powering our phones and cars to medical equipment and innovative new technologies like quantum and AI.”

While the UK government has identified design and research as the key strengths of the nation, it wants to promote these and support areas lagging, such as infrastructure and international cooperation.

In May 2023, the UK government revealed a 20-year plan with a £1 billion budget to promote its semiconductor sector, with 200 million spent in the next two years.9

The Hiroshima Accord is an example of a new partnership with Japan.10

"2023 has been the year of AI – this promises to revolutionise the sector, both in capacity and demand. While much of the good news appears to have been priced in for the short-term, the sector remains one to watch for the year ahead as companies around the globe boost the use of AI."

Chris Beauchamp, Chief Market Analyst at IG

In 2023, Artificial Intelligence (AI) and the introduction of chatbots like Chat GPT based on large language models have played a transformative role in most industries. However, AI adoption among traders and investors has been low across the IG group. Germany has the highest percentage of usage with 16 % and is therefore 4 % above the global average.

Two companies to keep an eye on: Nvidia & ARM

Nvidia, founded in 1993, stands as a pioneering force in technology, renowned for its GPUs and AI breakthroughs. In the fiscal year of 2022, the company's revenue surged to approximately $26.91 billion in 2022 and climbed to $26.97 billion in 202311, underlining its market dominance. Nvidia’s gross margin fell by 8% from 64,9% in 2022 to 56,9% in 2023.

Its stock listed on the Nasdaq and traded under the ticker symbol NVDA, reflected this success, consistently demonstrating robust growth and a formidable presence in the market.

ARM Holdings, established in 1990, is a pivotal player in semiconductor and software design, dominating the mobile computing landscape. Renowned for its processor architecture, ARM Holdings' technology powers most mobile devices and embedded systems worldwide.

Operating on a licensing model, ARM provides innovative designs to a vast network of manufacturers, enabling customized chip creation. In 2016, SoftBank Group acquired ARM, propelling its expansion into emerging fields like AI and edge computing. ARM Holdings went public in September 2023 on the Nasdaq. Bloomberg congratulated SoftBanks' Masayoshi Son for going public with ARM Holdings12. It was the biggest IPO in 2023, and the American depository shares (ADSs) climbed by 25% on the first day of trading.

The dynamic landscape of the technology hardware and equipment industry

The Technology Hardware and Equipment industry (or IT hardware), which covers information technology (IT) products and devices including personal computers, laptops, servers, storage devices and other computing equipment, had an estimated value of US$111 billion industry in 2022.13 This is expected to grow at a compound annual growth rate (CAGR) of 7.9% to US$177 billion by 2026.

"For big tech, the key driver will be their recurring revenues. Apple and other giants like Microsoft are some of the big winners of the year but are well-placed to keep rising assuming the global economy skirts a recession. While their high valuations do pose a risk in the medium-term, as investments they retain plenty of attractions."

Chris Beauchamp, Chief Market Analyst at IG

Two companies to keep an eye on: Apple Inc and Northamber PLC

Apple is the world’s largest tech hardware company in terms of market capitalisation at US$2.7 trillion. The AAPL stock has grown by nearly 30% in the last decade and over 200% in the last five years. Despite recent underperformance, the company continues to be favoured by top investors like Warren Buffett, who stated that it is ‘a better business than any we own’.

Berkshire Hathaway, Buffett’s multinational holding company, purchased an additional 20.8 million Apple shares in February 2023, thereby growing its overall stake in Apple to 5.8%.

Another example of a thriving tech business is Northamber, the UK-founded and -based company, one of the nation's longest-established independent trade-only IT distributors. Northamber grew its revenue year on year by 4.1% while maintaining gross margins of 13.0% despite challenging market conditions in the last six months of 2022. In June 2023, the company reported a revenue of 67,1 million for the year ended.14

Conclusion

The Client Sentiment Survey has identified three industries IG’s customers believe to have potential: energy, the semiconductor industry and the technology hardware and equipment sector.

Artificial intelligence and climate change are two of the defining topics of 2023. And it is unlikely that their relevance will decrease in 2024.

The three identified industries reflect this and will very likely be interesting to watch in the coming months.

Sources

1 Office for National Statistics

2 Indeed, 2023

3 Retirement Living Standards, 2023

4 Energy UK

5 International Trade Administration, 2023

6 National Statistics, 2023

7 Companies Market Cap

8 bp, 2023

9 GOV.UK, 2023

10 publishing.service.gov.uk

11 NVIDIA Corporation Annual Review, 2023

12 Bloomberg, 2023

13 Mordor Intelligence

14 Northamber Annual Report

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

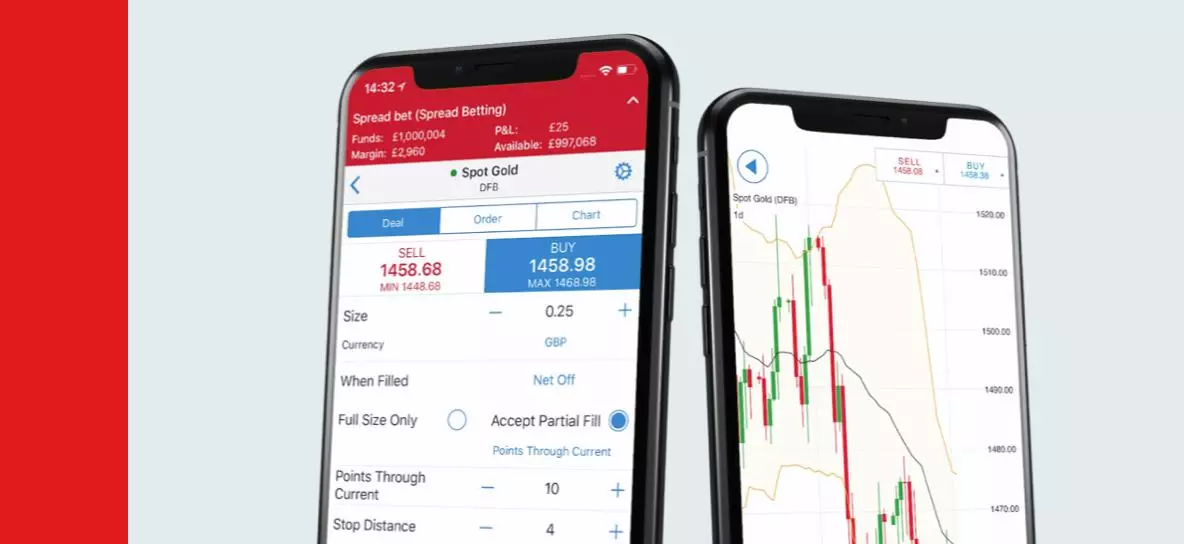

See your opportunity?

Seize it now. Trade over 15,000+ markets on our award-winning platform, with low spreads on indices, shares, commodities and more.