IAG under pressure to catch up as rivals outperform

IAG continues to lag its budget rivals as air travel sees a bumpy recovery from the pandemic.

IAG under pressure to catch up as rivals outperform

IAG continues to lag its budget rivals as air travel sees a bumpy recovery from the pandemic.

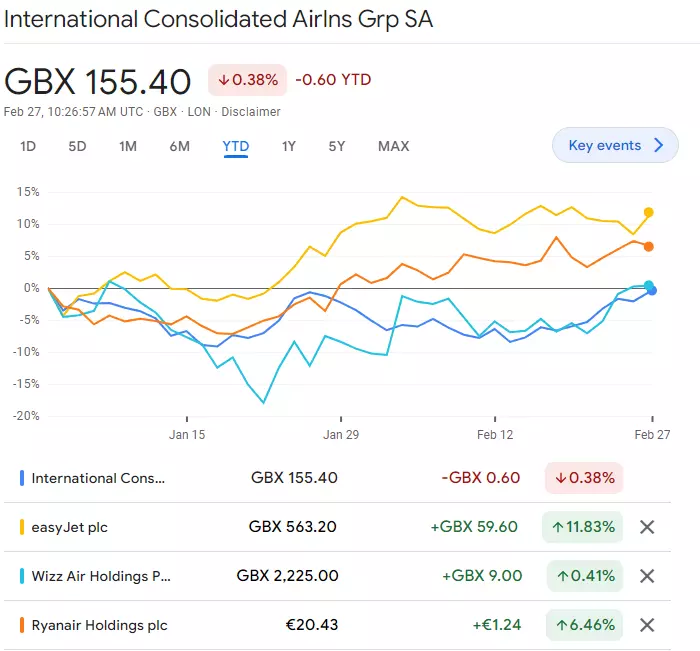

British Airways owner International Airlines Group (IAG) has significantly underperformed rival airlines like easyJet, Wizz Air, and Ryanair since the start of the COVID-19 pandemic. IAG's shares remain in negative territory year-to-date, while rivals have rebounded, some as easyJet and Ryanair strongly.

With full-year results coming on Thursday, pressure is mounting on IAG to turn around its fortunes and close the gap to competitors. The entire airline industry faces headwinds like the Middle East conflict, rising oil prices, and higher labour costs. However, IAG has been particularly weak, calling into question its reliability.

The company does plan to resume London-Tel Aviv flights in April after suspensions due to instability in Israel. Analysts forecast IAG's fourth quarter (Q4) sales will rise 11% to £6 billion and profits will jump 19% to £434 million. For the full financial year, sales are predicted to surge 27% to a record £21 billion, with profits reaching an all-time high of £3 billion.

Investors will closely monitor IAG's capacity compared to pre-pandemic levels as a gauge of its recovery progress. With debt falling, analysts speculate the company could restore shareholder dividends in 2024 for the first time in four years.

But IAG, with a market capitalisation of £7.5 billion, will need to impress on Thursday for its stock to catch up to the performance of its peers. The company has shown repeatedly how unreliable it can be operationally during the pandemic disruptions.

easyJet, Ryanair and Wizz Air have all rebounded faster thanks to their focus on lean, low-cost European point-to-point travel. In contrast, IAG remains weighed down by British Airways' exposure to the more fragmented and competitive North Atlantic and UK domestic markets.

If IAG's full-year results undershoot expectations, or if its capacity outlook disappoints, its underperformance versus its rivals could worsen. But a standout performance could signal a comeback for the airline conglomerate. IAG CEO Luis Gallego will need to demonstrate convincingly that the company has addressed its shortcomings and can compete effectively in the post-pandemic era.

Technical analysis on the IAG share price

IAG’s share price has been oscillating around its 55-week simple moving average (SMA) since October of last year and is trading in an contracting sideways trading range.

IAG Weekly Chart

While the January low at 141.35p isn’t fallen through, the medium-term uptrend will remain in play.

IAG Daily Chart

A rise and daily chart close above the late-January high and the August-to-February downtrend line at 157.45p to 159.15p is needed for a bullish reversal to be confirmed.

If so, the late-November high at 165.45p as well as the August and November peaks at 170.0p to 172.95p would be back in focus.

Analysts recommendations and IG sentiment

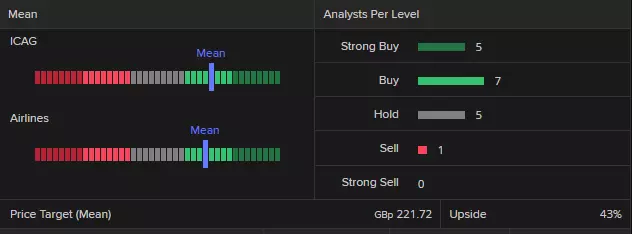

Fundamental analysts are rating IAG as a ‘buy’ with Refinitiv data showing 5 strong buy, 7 buy, 5 hold and 1 sell - with the mean of estimates suggesting a long-term price target of 221.72p pence for the share, roughly 43% above the share’s current price (as of 27 February 2024).

IG sentiment data shows that 98% of clients with open positions on the share (as of 27 February 2024) expect the price to rise over the near term, while only 2% of clients expect the price to fall. Trading activity today shows 83% of buys, but this week 53% and this month 51% of sells.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Act on share opportunities today

Go long or short on thousands of international stocks with spread bets and CFDs.

- Get full exposure for a comparatively small deposit

- Trade on spreads from just 0.1%

- Get greater order book visibility with direct market access

See opportunity on a stock?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See opportunity on a stock?

Don’t miss your chance – upgrade to a live account to take advantage.

- Trade a huge range of popular stocks

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See opportunity on a stock?

Don’t miss your chance. Log in to take advantage while conditions prevail.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.