Liabilities definition

What are liabilities in accounting?

Liabilities are the debts and obligations that detract from a company’s total value, which have to be paid over a certain period of time. The form of the debt can vary – common examples include business expenses, loans, unearned revenues or legal obligations.

Discover more about technical analysis

Learn how technical analysis can help you find the right time to enter and exit a trade.

Current vs long-term liabilities

There are two main types of liabilities that will be present on a balance sheet. These are:

- Current liabilities, which must be paid off within one year. These include taxes, monthly accounts and employee salaries

- Long-term liabilities can be paid off over more than one year. These include bonds, vehicle payments, loans, etc.

What is the relationship between liabilities and assets?

The relationship between liabilities and assets is that the former often pays for the latter. A company can either pay for its assets using loans (liabilities), or shareholder investments (equity). This can be explained with a simple accounting equation.

While assets add value to a company, liabilities detract value because they are owed to another party – they can include loans and monthly utilities.

Example of liabilities

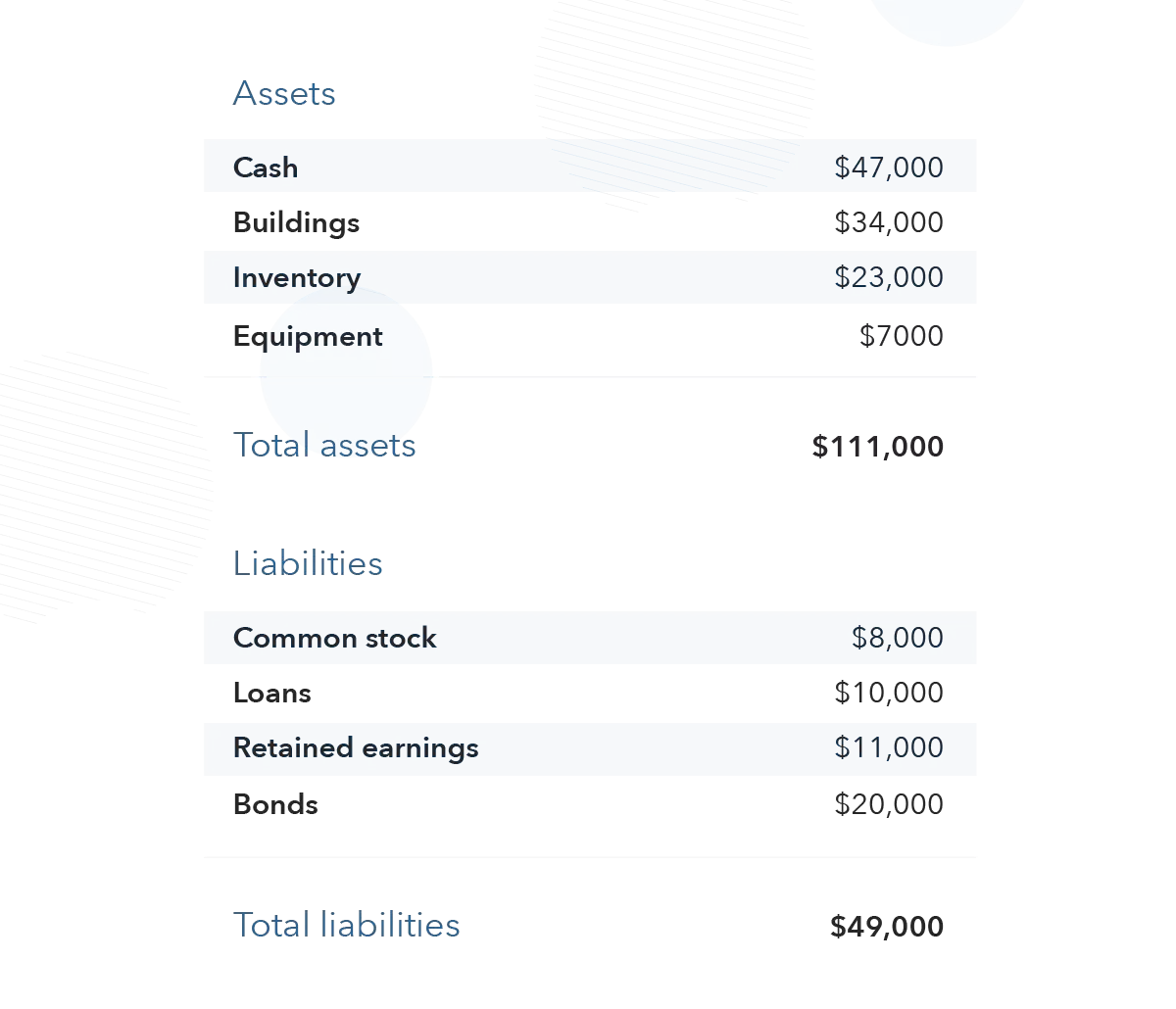

Say a company has a total of $111,000 in assets and $49,000 in liabilities – it will be broken down on a balance sheet as per the example below.

Because the company has more assets than liabilities, it can mean one of two things: either it has enough revenue to pay for the other assets itself, or the assets are funded via shareholder equity.

Build your trading knowledge

Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.