Shares vs bonds rates of return

The calculations for the rate of return for shares and the rate of return for bonds are different because shares yield dividends, while bonds carry interest.

Example rate of return calculation for shares

Let’s say that you own two ABC Limited shares, which you bought for $40 each. This would mean that your initial investment was worth $80.

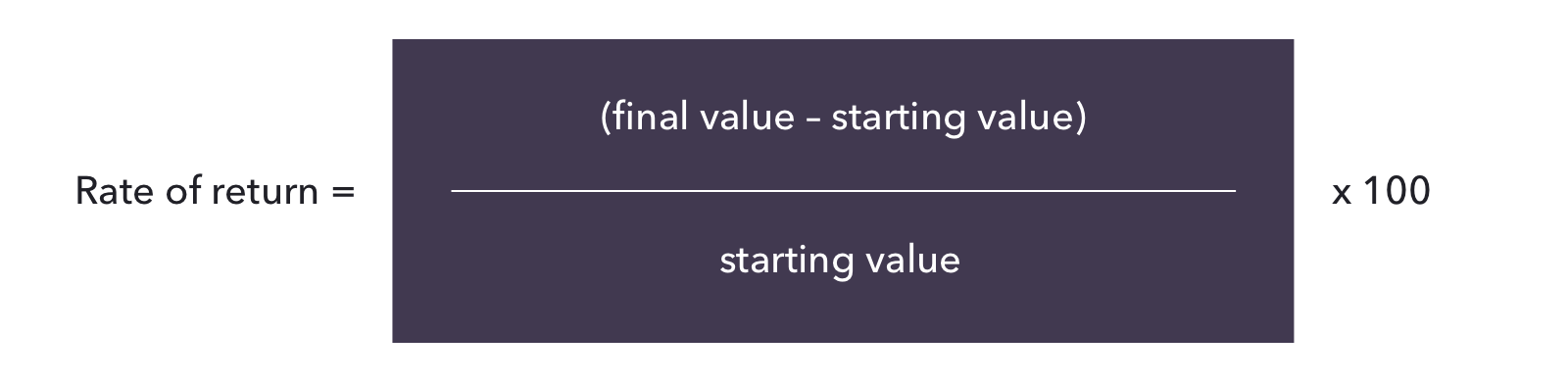

Over the course of one year, ABC Limited pays out dividends of $2 per share – giving you a total of $4 – and the share price goes up to $50. This means that your total investment would be worth $104 (the value of the shares plus dividend payments). You would then subtract the original value of your investment ($80) from the new value ($104) and divide this by $80. To get your rate of return as a percentage, you would multiply this figure by 100. This gives an annual rate of return of 30%.

Examples rate of return calculation for bonds

Alternatively, if you own a $100,000 bond with a 5% interest rate, which reaches maturity after four years, you will earn $5000 income every year (bond value multiplied by interest rate). If you sell the bond for $120,000 after one year, the appreciation – or growth – of the bond is $20,000 (subtract original bond value from new bond value).

The calculation of the rate of return is the interest plus appreciation, divided by original bond price – expressed as a percentage. The rate of return after one year is therefore 25% ($5000 plus $20,000, divided by $100,000, multiplied by 100).