Find out all about the indices that track the UK stock market – including when they were launched, and which companies have been listed for the longest.

Interested in indices trading with IG?

Find out all about the indices that track the UK stock market – including when they were launched, and which companies have been listed for the longest.

Interested in indices trading with IG?

| Markets | Bid | Offer | Change |

|---|---|---|---|

| FTSE 100 |

-

|

-

|

|

| FTSE Mid 250 |

-

|

-

|

-

|

Prices above are subject to our website terms and conditions. Prices are indicative only.

FTSE stands for Financial Times Stock Exchange, representing the two companies that launched the FTSE 100 – the Financial Times and the London Stock Exchange.

The oldest UK stock index that is still in use today is actually the FTSE All-Share, which was launched as the FT Actuaries All-Share in 1962. The index was solely run by the Financial Times until January 1984, when the FTSE 100 was launched.

The FTSE 100 quickly became a popular indicator of UK stock performance, which led to the addition of new indices in October 1992. The most notable of these was the FTSE 250.

A few years after the launch of the FTSE 250, the FT – by now a subsidiary of Pearson publishing – and the LSE formed the FTSE Group to oversee all of the indices under the FTSE banner. Today, the group is solely owned and run by the LSE after Pearson sold its stake in 2011.

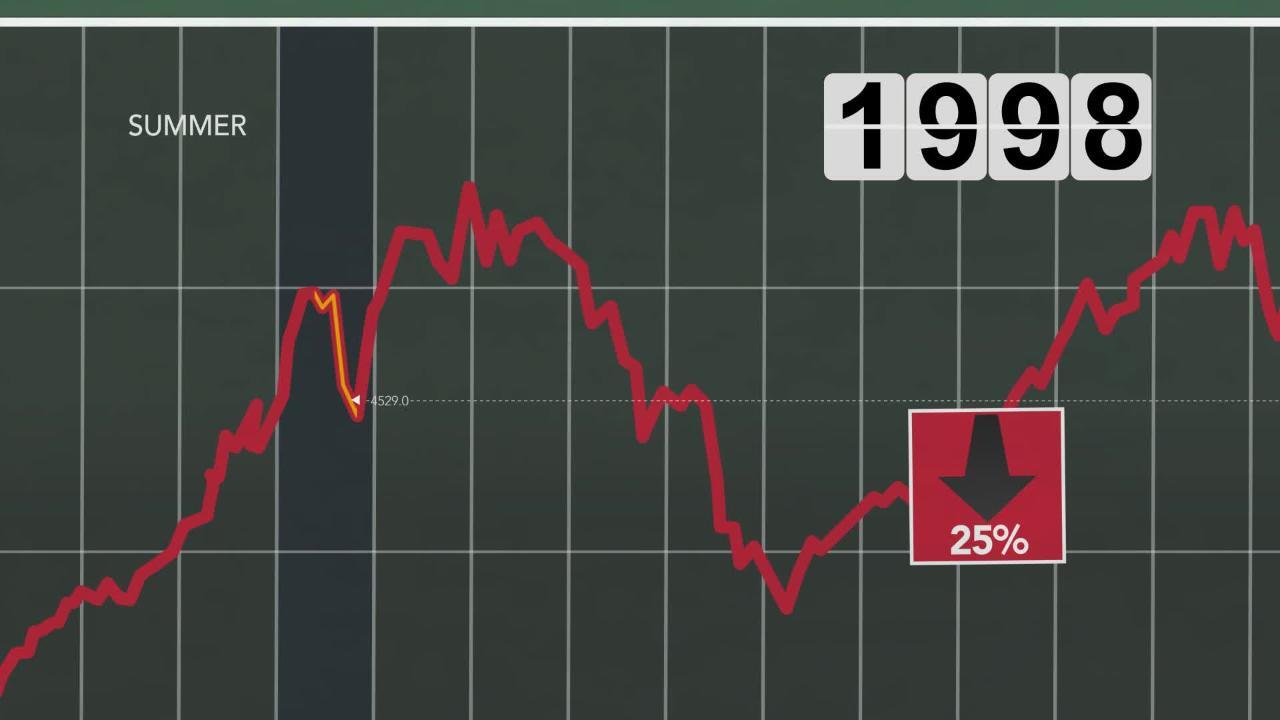

The next few years saw both indices grow rapidly, with the FTSE 100 breaking the 5000-point barrier in August 1997 and the 250 joining it in February 1998. On 20 December 1999, the FTSE 100 peaked at 6930.2 – a record that would stand for the next 15 years.

The highs for both indices were driven mostly by huge gains in telecommunications, media and technology companies. But on the first day of trading in 2000, the dotcom boom began to unravel, sending them back below 4000 by spring 2003.

That would prove to be the last time that the indices were trading within 1000 points of each other. By May 2007 the FTSE 250 was above 12,000. By October 2013 it was above 15,000. The FTSE 100, meanwhile, wouldn’t break 7000 until December 2016.

The UK voted for Brexit on 23 June 2016, in a result that initially hurt UK stocks. At the time, many analysts predicted that the FTSE 250 would feel the effects of the vote the hardest, with a set of companies that relied on the European Union far more than the global-facing FTSE 100.

In the end, the plummeting fortunes of the pound meant that both indices rallied once the dust had settled from the result. In the year after the Brexit result, they both hit record highs.

Who was on the first FTSE 100?

Back in 1984, the FTSE 100 had a very different make up to the one it has today. Here’s a rundown of the original 100 constituents of the index:

Agriculture

Aerospace and defence

Automobiles and parts

Banks

Bevereages

Chemicals

Conglomerate

Construction and materials

Electrical rentals, music distribution and defence

Electricity

Fabrics and chemicals

Fixed line telecommunications

Food and beverages

Food and drug retailers

Food producers

Forestry and paper

Gas, water and utilities

General retailers

Glass manufacturer

Household goods and home construction

Investment trust

Media

Mining

Money broker

Nonlife insurance

Oil and gas producers

Personal goods

Pharmaceuticals and biotechnology

Recruitment

Real estate investment trusts

Tobacco

Transport

Travel and leisure

Overall, there are 29 companies from 1984 that were also featured on the FTSE 100 in September 2017 – these are listed above in bold. However, ten of those 29 companies left the FTSE 100 at some point, and then returned. The 19 companies that were ever-present on the index for all of its first 33 years are

Today, there are several major brands that no longer feature on the FTSE 100 because they no longer exist as listed companies. Boots, for example, was bought out by a private equity firm in 2007, and Cadbury Schweppes demerged in the same year.

There has also been a big shift in the sectors that blue-chip British business operate in. Conglomerates, a key part of the FTSE 100 in 1984, no longer feature. Nowadays, UK businesses tend to specialise more – meaning the days of companies like Thorn EMI, a music distributor that also specialised in consumer electronics and defence, are over.

And, of course, there are the companies that have slipped down into the FTSE 250 and beyond. High street bookmakers like Ladbrokes, who were a mainstay on the FTSE 100 until they dropped out in 2006, haven’t returned since.

Deal on global indices, with more 24-hour markets than any other provider

Learn how trade, or develop your knowledge of the financial markets

Find out all about spread betting with IG – including how to get started