Learn how to spread bet

Spread betting is a way to speculate on the future direction of a market’s price. If you expect an asset’s price to rise, you’d open a position to ‘buy’ and if you expect an asset’s price to fall, you’d opt to ‘sell’.

Learn more about what spread betting is

When you spread bet, you’ll be putting up a certain amount of capital per point of movement in the underlying market. Your profit and loss would then be multiplied by this amount to get your final sum.

For example, you thought a stock was going to increase in price so you opened a spread bet for £10 per point. If the stock increases in price by 10 points, you’d have made £100 (10 x 10), but if it decreased by 5 points, you’d lose £50 (50 x 100).

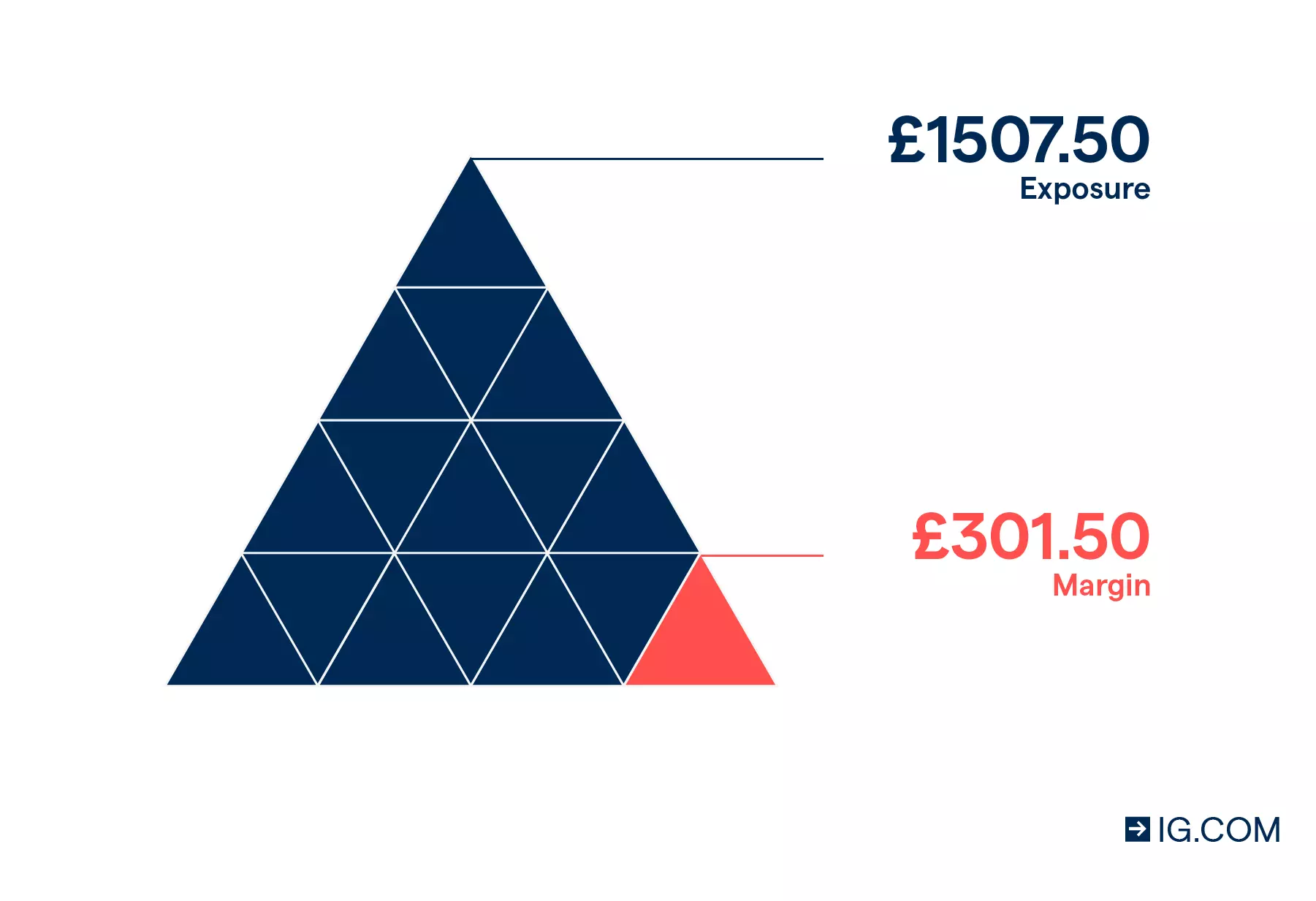

Spread betting is also leveraged, which means you’ll only need to put down a small initial deposit to open a trade. Your end total is then calculated using your full exposure – meaning your profits and losses could be magnified.

Discover the benefits of spread betting

Create and fund an account

Open a live account via our online form – you could be ready to trade in minutes, and there’s no obligation to add funds until you want to place a trade.

Alternatively, you can practise trading first in our risk-free demo account.

Build a trading plan

A trading plan outlines your motivation, time commitment, goals, attitude to risk, available capital, markets to trade and preferred strategies. Creating one is particularly important if you’re new to the markets as it can help you take the emotion out of your decision making. It will also provide some structure for when you open and close your positions.

Find an opportunity

Once you're logged in to our platform or app, you can choose from 15,000+ markets, including:

Discover the benefits of spread betting.

Of course, with so many markets to choose from, it can be difficult to know where to start. That's why we offer a range of tools and resources to help you analyse markets and identify opportunities:

Expert analysis

Get technical and fundamental analysis straight from our in-house team

Trading alerts

Keep your finger on the pulse with unique price and economic data alerts

Trading signals

Get actionable ‘buy’ and ‘sell’ suggestions based on analysis

Technical indicators

Discover price trends using popular indicators such as MACD and Bollinger bands

Economic calendar

See a full schedule of macroeconomic events and company announcements

Market screener

Narrow down your choice of share by fundamentals, location, index and industry sector

Market data

Access unique insights including the day's recent activity and client sentiment

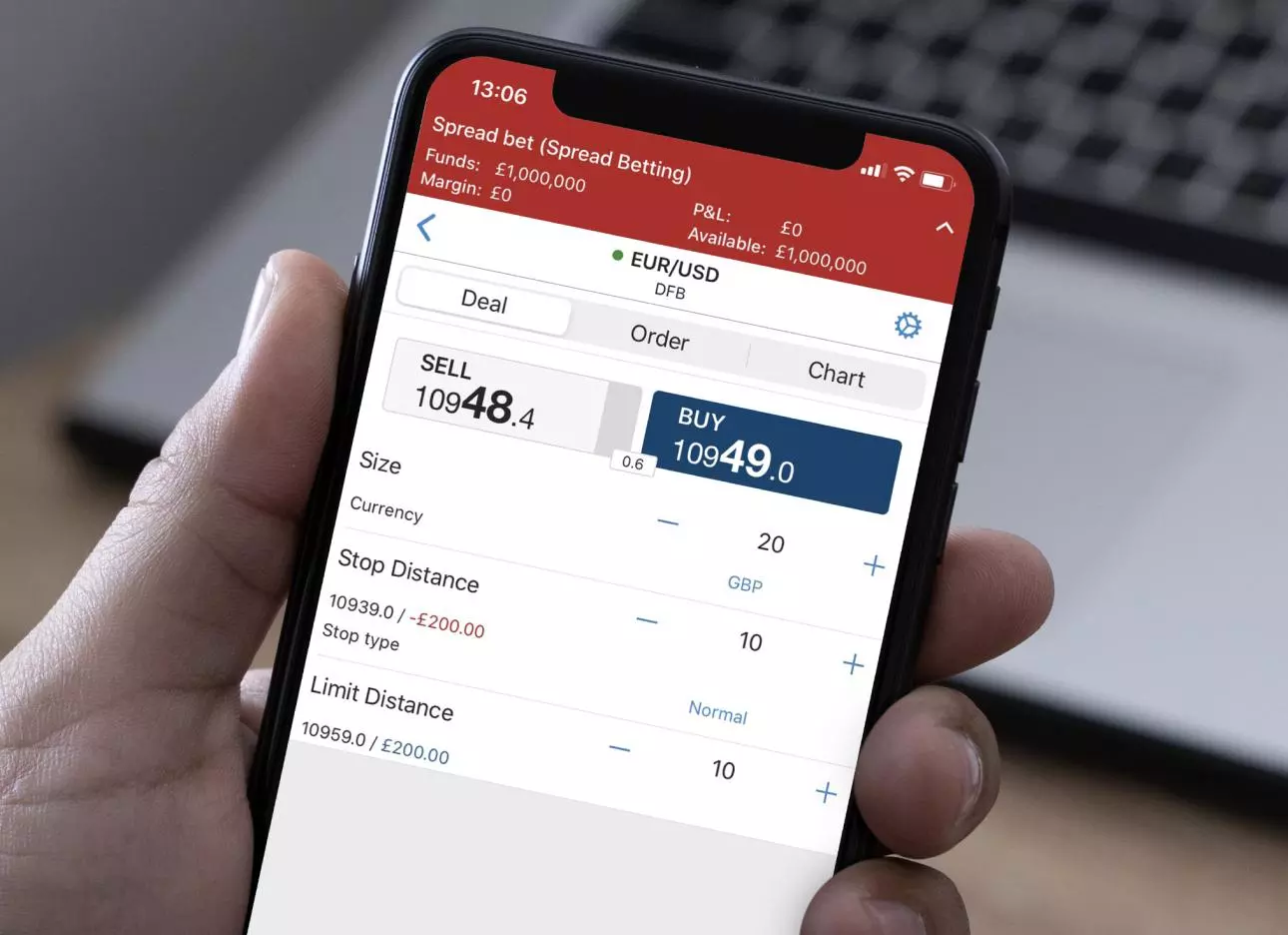

Choose your spread betting platform

Start spread betting on our award-winning suite of platforms, including:

- Our web-based platform

- Mobile trading apps

- MetaTrader 4

- Advanced platforms

These can all be tailored to suit your trading style and preferences, with personalised alerts, interactive charts and risk management tools.

Find out more about our trading platforms

Open, monitor and close your first position

When you open your platform, you’ll be able to search for a market in the top left corner or browse through each asset class.

After you’ve opened the deal ticket for your chosen market, you’ll need to choose whether to buy or sell the market – depending on whether you think the asset will rise or fall in price. You’ll also need to decide on your bet size, which will determine the margin you pay.

Finally, before you enter the market, it’s important to consider how you’ll manage your risk. Attaching stops or limits to your position will automatically close your trade once it hits a certain level – a stop-loss order can minimise your potential loss, while a limit-close order can help lock in any profits.

Once you’re ready, it’s time to open your trade. You can then monitor the profit or loss of your position in the ‘open positions’ section of the dealing platform.

When you decide it’s time to close your position, you just click ‘close’ to realise your profit or loss.

Spread betting examples and calculator

Whichever market you’re interested in, it’s important to understand how much capital you’re putting at risk. For spread betting, the calculation for this is:

Capital at risk = bet size x market price (in points)

When you spread bet, the market price will be displayed in points. For example, if you were trading a forex pair, instead of a price of ‘1.12980’ you would see a price of ‘11298.0’. So, a trade worth £10 per point of movement, would mean you’re putting a total of £112,980 at risk (11298.0 x 10).

As spread betting is a leveraged product, you will only need to cover the margin as opposed to the full value of the trade. The spread betting calculation for margin is:

Margin = margin factor x total exposure.

For the above example, if the margin factor was 3.33%, you would only have to put down £3762.23 (3.33% x £112,980) to open the trade. Leverage could potentially magnify your profit and loss, as they’re calculated using the full size of your trade – in this case, £112,980 – not just the margin.

See how spread bet trades are calculated with our spread betting calculator

How to spread bet on shares example

You decide to spread bet on Barclays stock, which is currently trading at 150.25. If there was a one-point spread, you would be presented with a buy price of 150.75 and a sell price of 149.75.

You open a long spread bet position on Barclays, buying at £10 per point of movement at 150.75. If Barclays shares had a margin requirement of 20%, you’d need to deposit £301.50 (£10 x 150.75 x 20%).

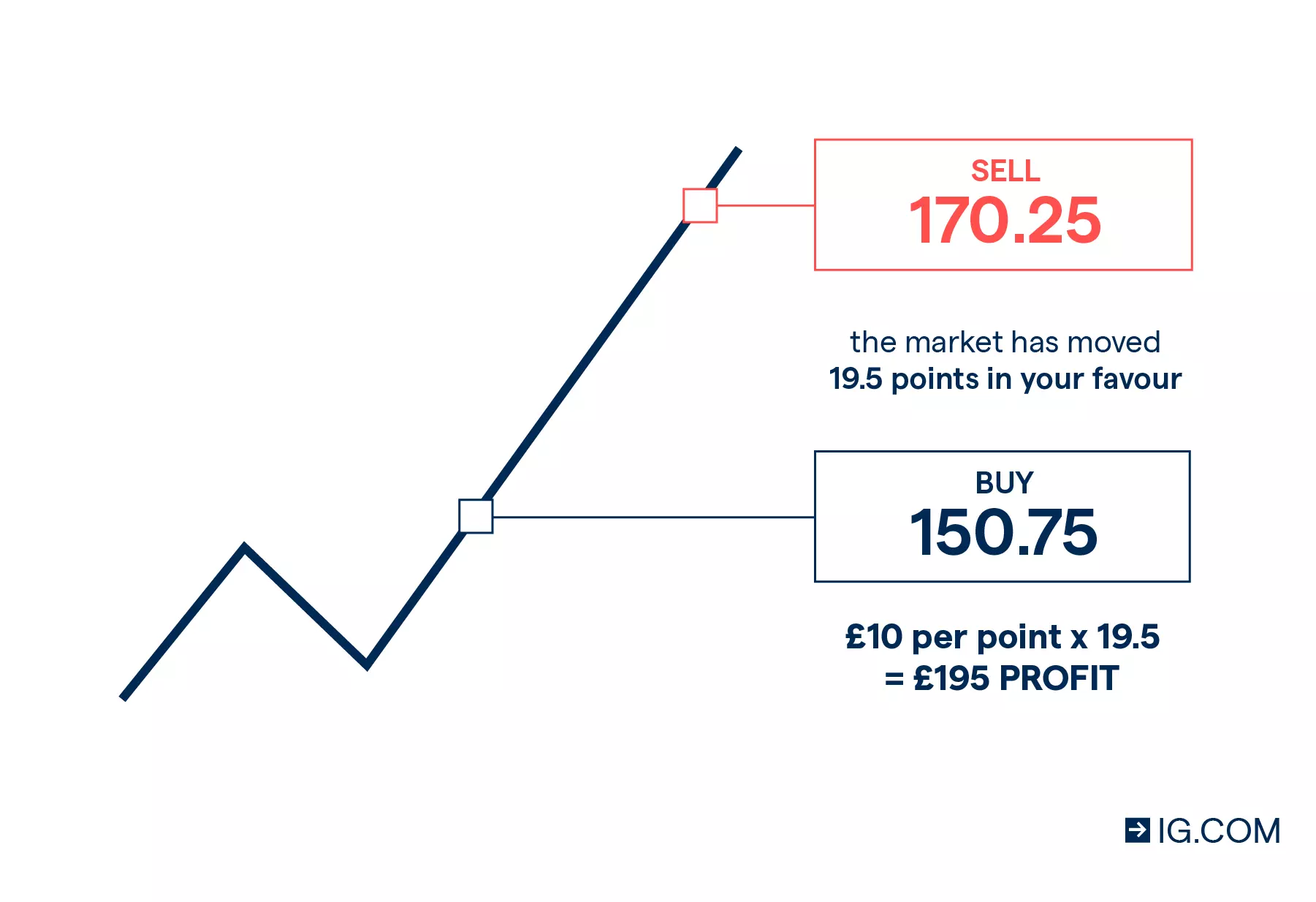

If your shares spread bet was correct

Let’s say Barclays shares increased to 170.75, you might decide to close your position to take your profit.

You’d close the spread bet position at the new sell price of 170.25. As the market has moved in your favour by 19.5 points (170.25 - 150.75), your profit would be £195 (19.5 x £10). You won’t pay any tax on your profits. However, you would have to pay funding charges to keep your position open overnight.

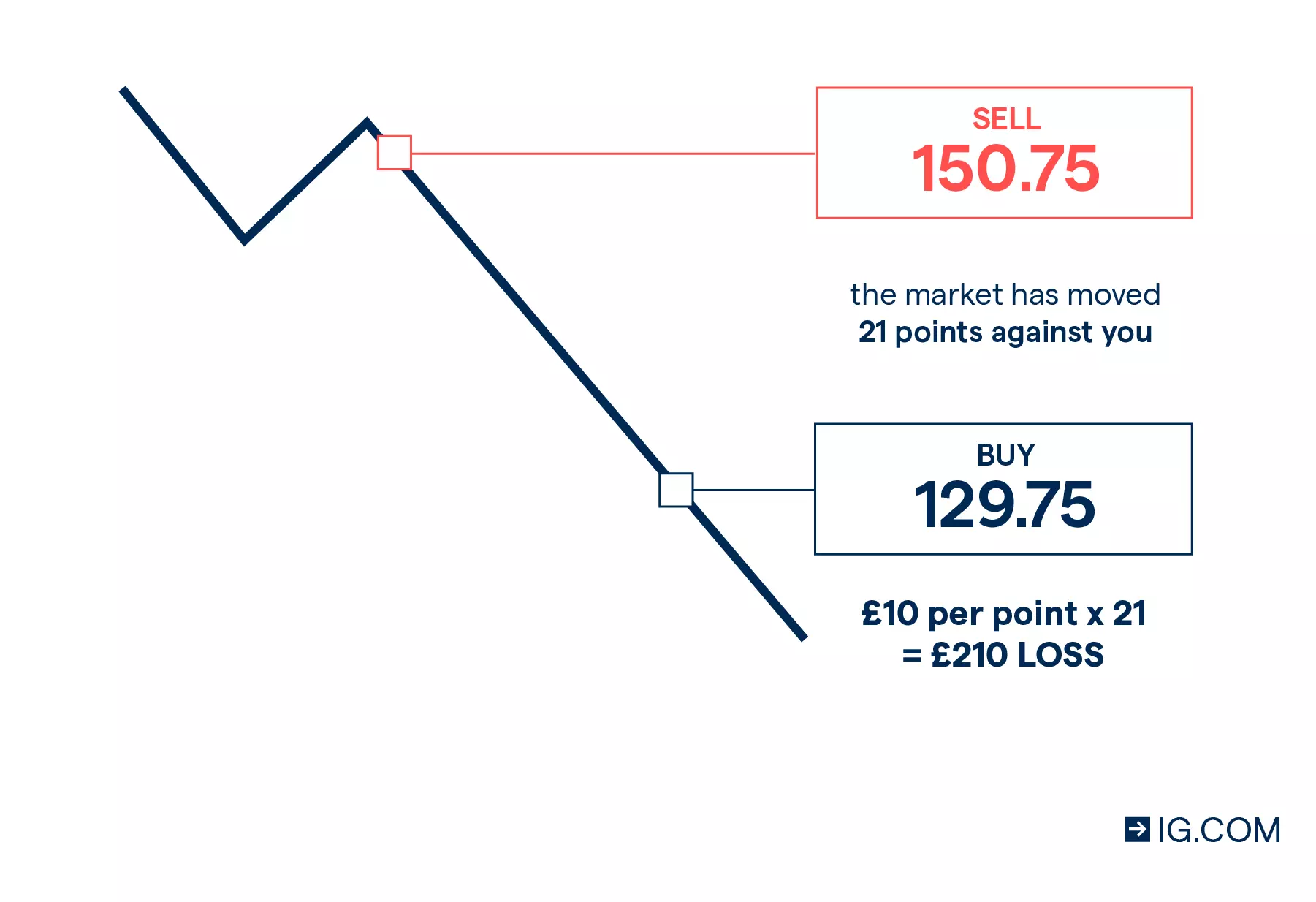

If your shares spread bet was incorrect

However, let’s say shares of Barclays fell instead, down to 130.25, there would be a new sell price of 129.75. As the market has moved against you by 21 points (129.75 - 150.75), you’d be looking at a loss of £210 (210 x £10), plus any additional funding charges.

Discover the differences between spread betting and share dealing.

How to spread bet on forex example

You decide to spread bet on forex on EUR/USD, which is trading at £1.19129. You think that the dollar is going to rise against the euro, so you decide to sell the currency pair.

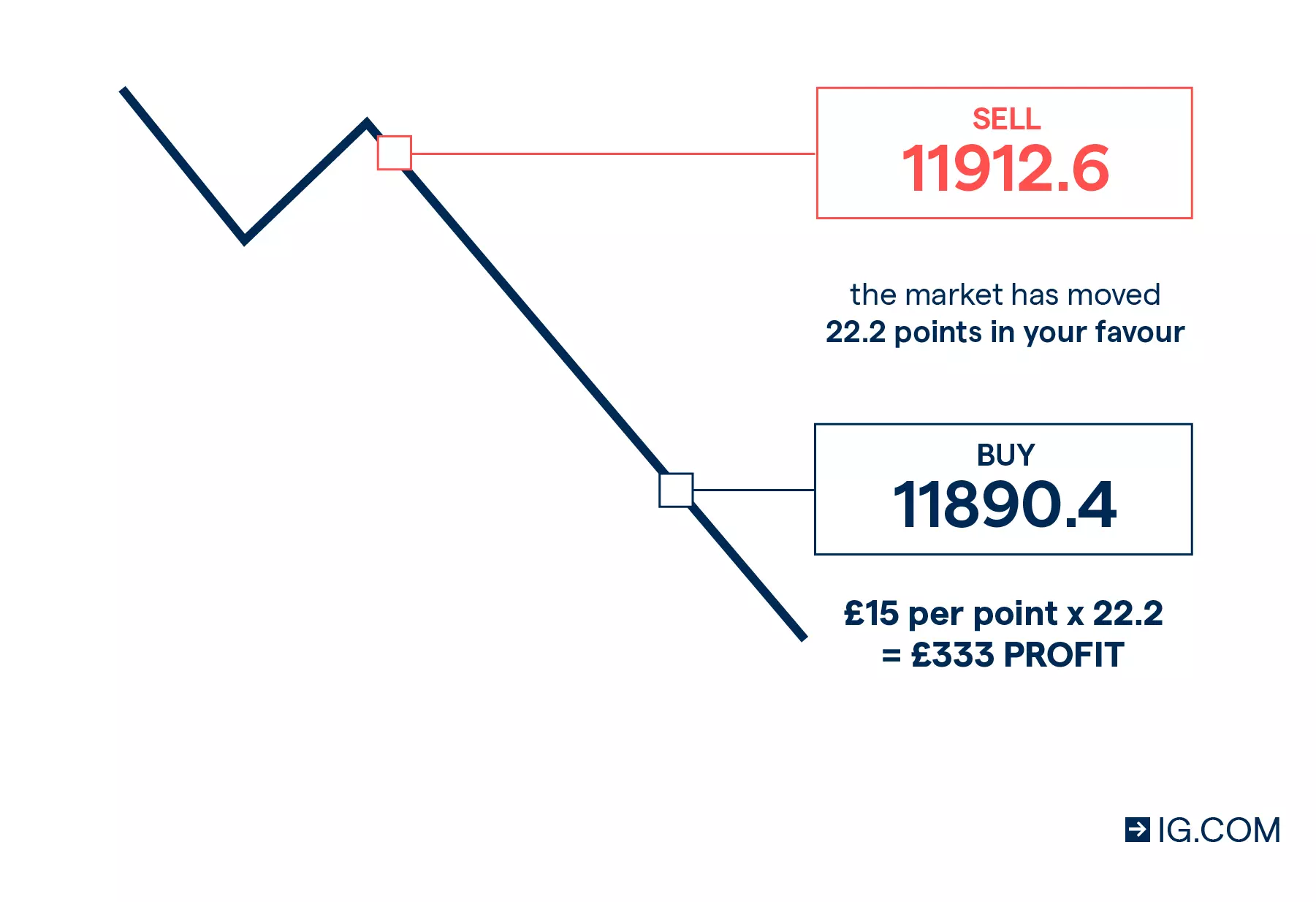

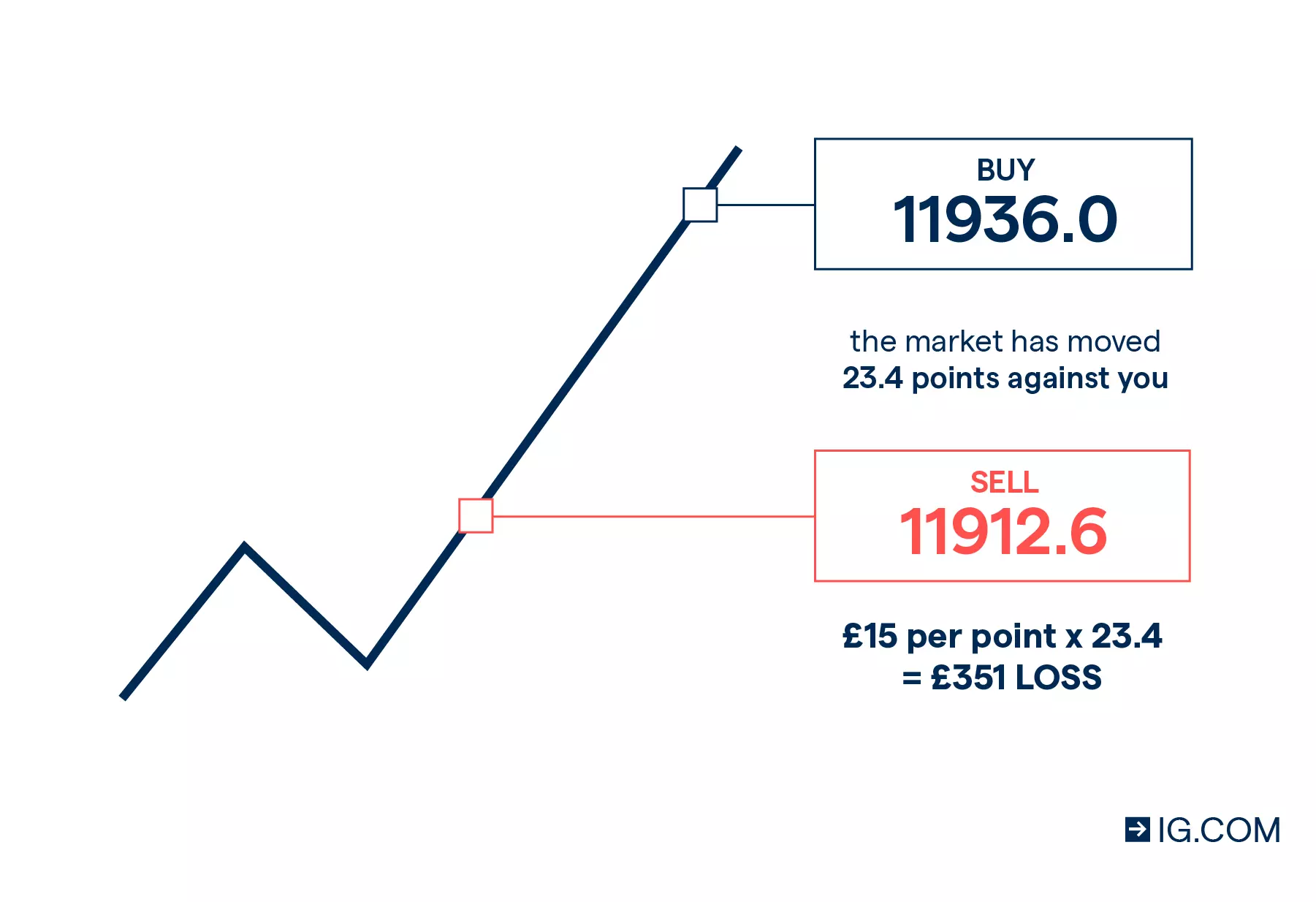

As spread betting markets are listed in points, when you enter the platform you would see a market price of 11912.9. And, because of the spread, you would see a sell price of 11912.6 and a buy price of 11913.2.

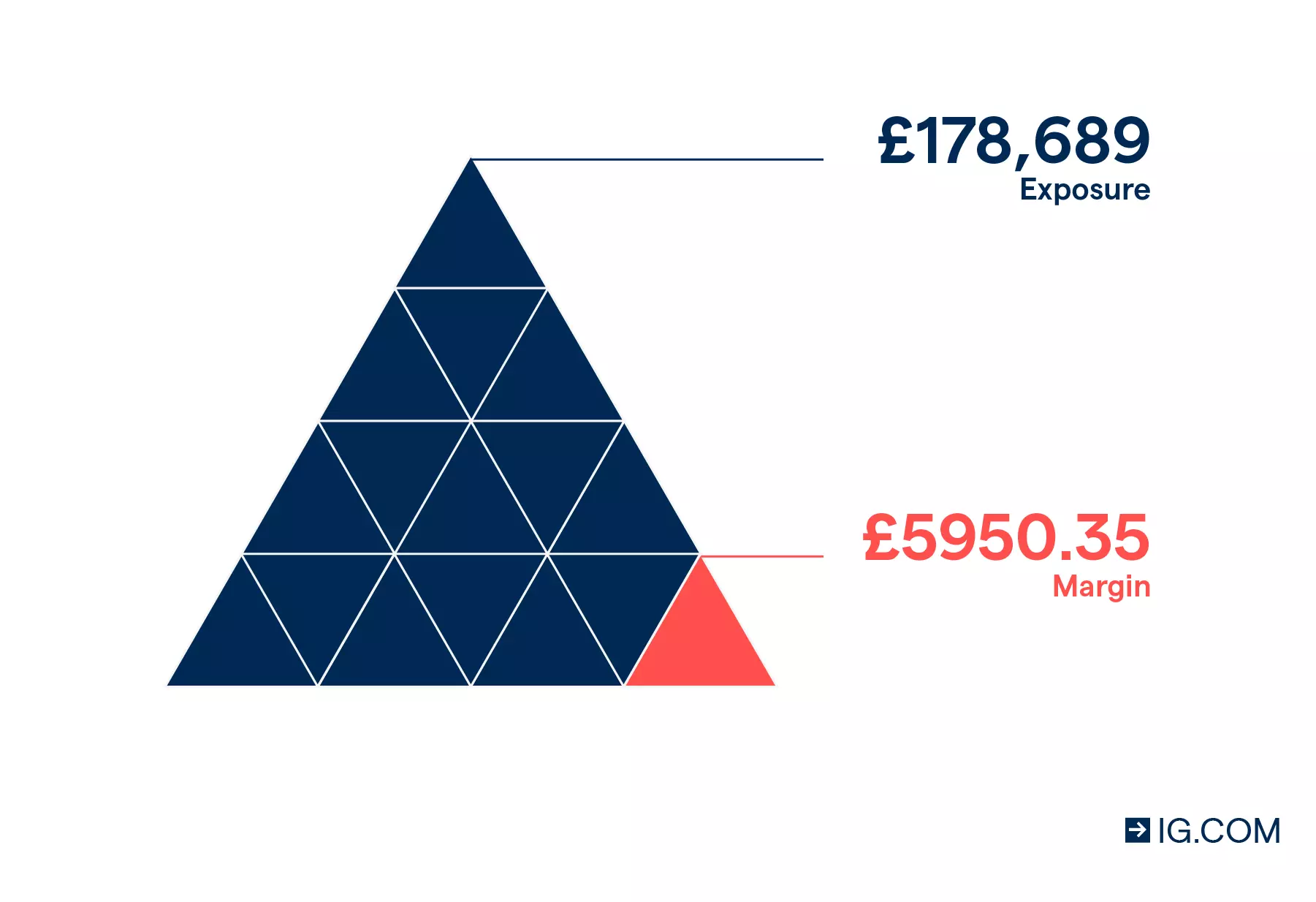

You open the trade for £15 per point at 11912.6 and as EUR/USD has a margin factor of 3.33%, you’d need to deposit £5950.35 (£15 x 11912.6 x 3.33%).

If your forex spread bet was correct

Say EUR/USD fell to 11890.1, with a buy price of 11890.4 and a sell price of 11889.8. As the market has moved by 22.2 points (11912.6 - 11890.4), you’d have a total profit of £333 (£15 x 22.2). Remember, if you’d kept this position open overnight then your total profit would be lower because of funding charges.

If your forex spread bet was incorrect

However, let’s say EUR/USD rises instead. So, you’d close your position at the new buy price of 11936.0. As the price has moved against you by 23.4 points (11912.6 - 11936.0), you would have made a loss of £351 (£15 x 23.4), plus any funding charges.

Learn more about how to spread bet on FX

How to spread bet on indices example

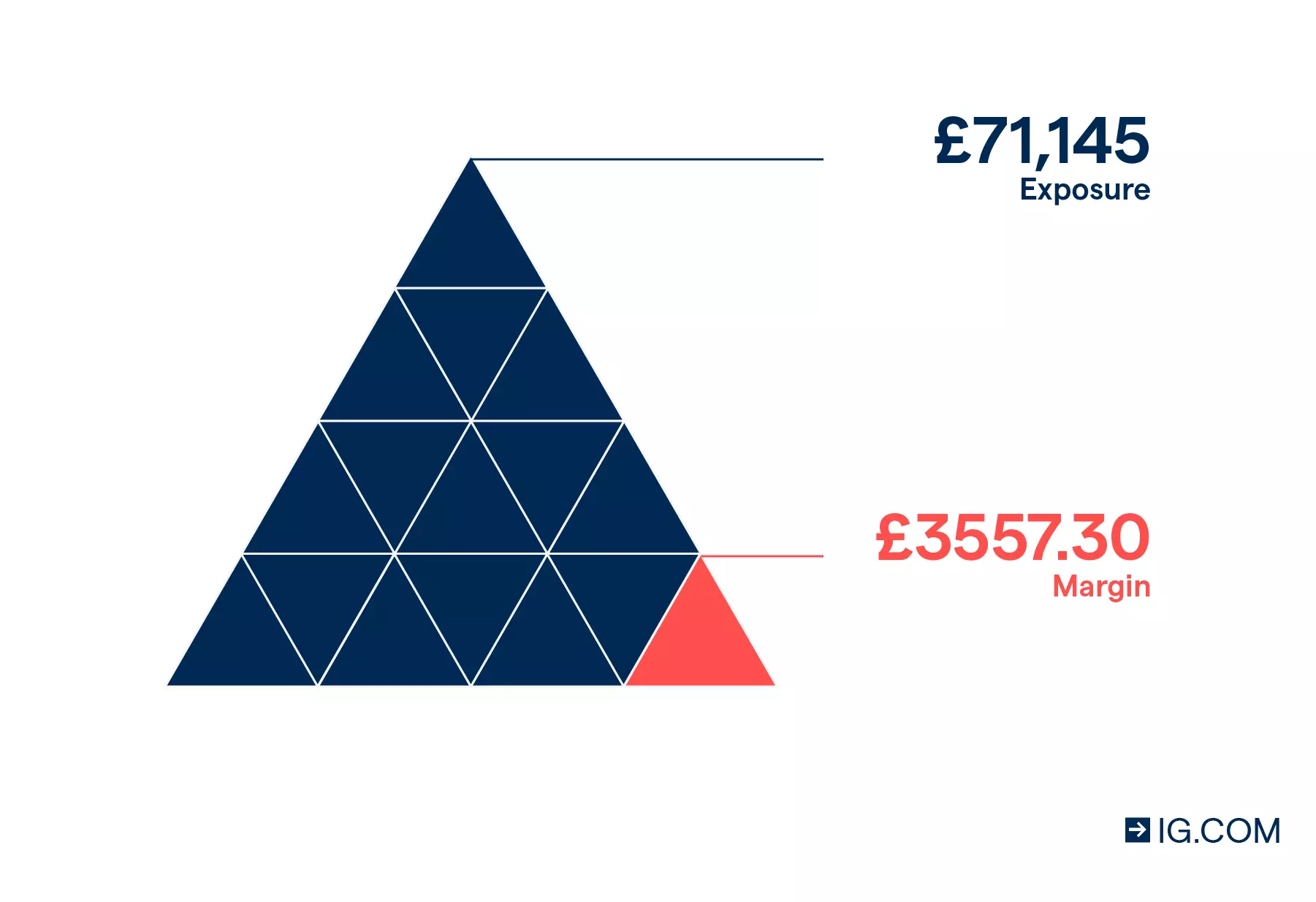

You want to spread bet on the FTSE 100, which has an underlying market value of 7114. We’ll apply a one-point spread, so you can sell it at 7113.5 or buy at 7114.5.

As you anticipate that the FTSE 100 is going to rise, you opt to buy at £10 per point at 7114.5. The FTSE 100 has a margin factor of 5%, you’d only need to deposit £3557.30 (£10 x 7114.5 x 5%).

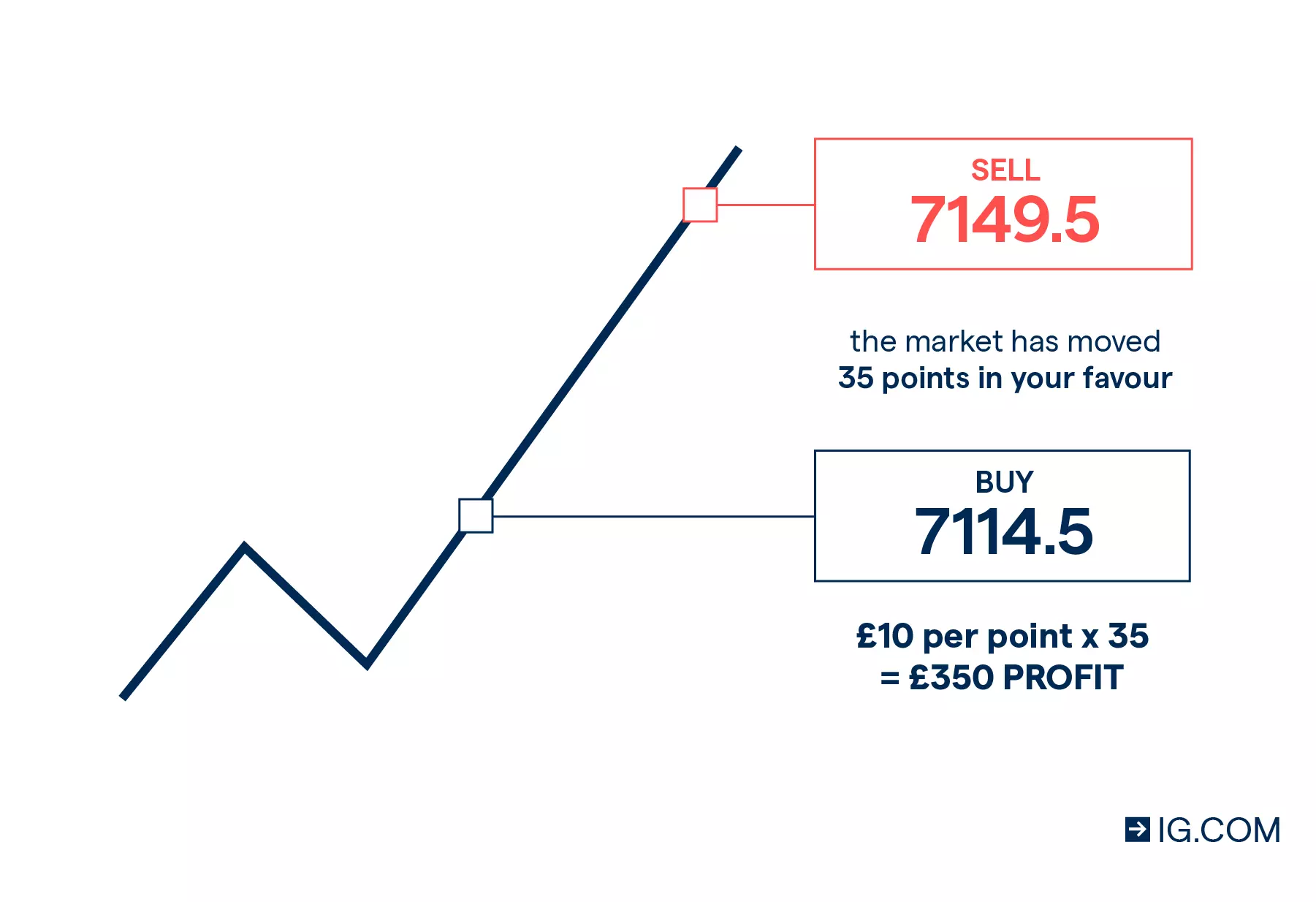

If your indices spread bet was correct

Let’s say your prediction is correct and the FTSE 100 increases in value. You close your position when the market reaches 7150 – at the new sell price of 7149.5.

As the market moved in you favour by 35 points (7149.5 – 7114.5), your profit would be calculated by multiplying this figure by the amount you’ve bet per point. This gives you a profit of £350 (£10 x 35) minus any funding costs.

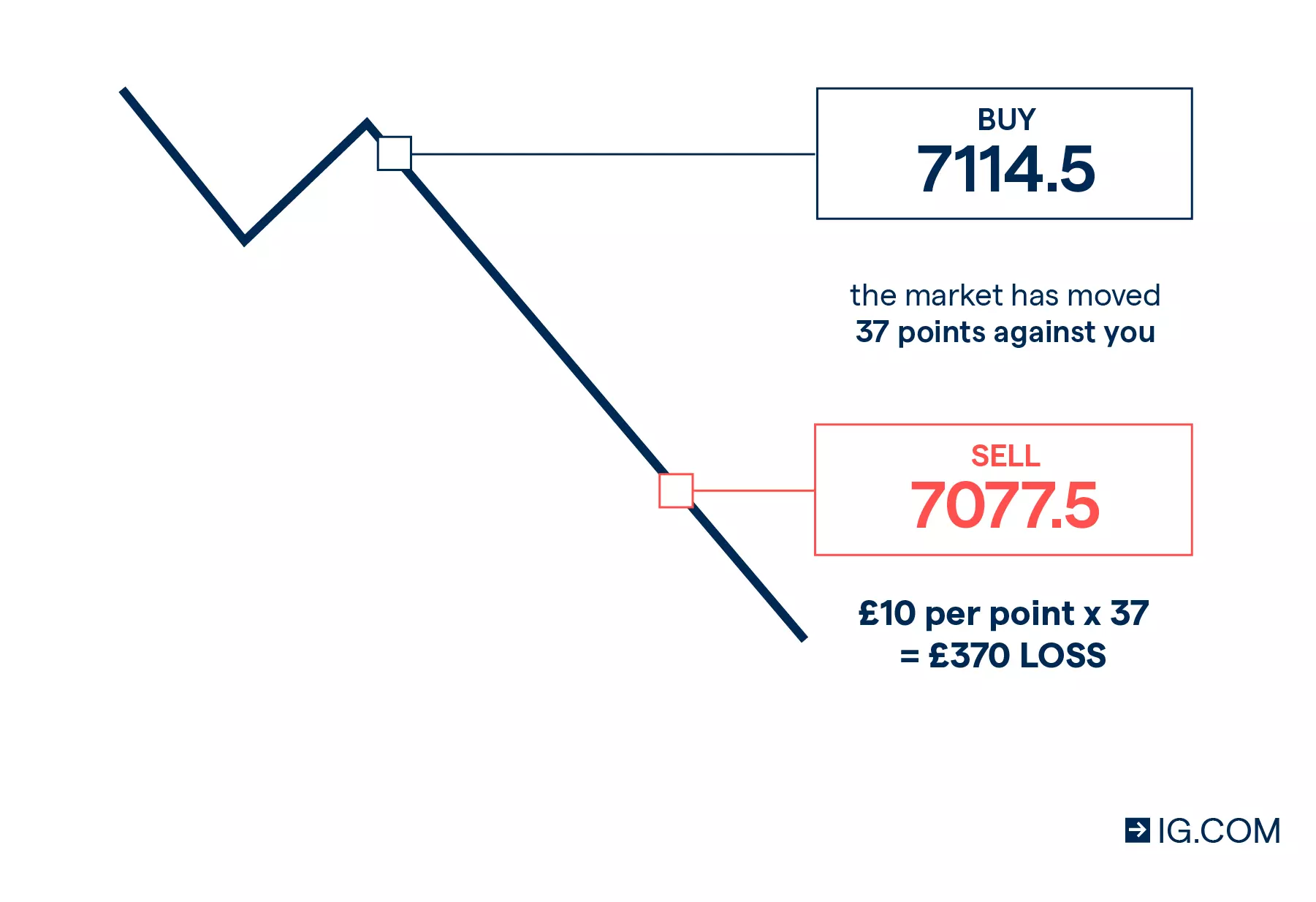

If your indices spread bet was incorrect

However, let’s say the FTSE declined in price, instead of rallying. So, you decide to cut your losses when it hits 7078 – with a sell price of 7077.5.

The market has moved against you by 37 points (7077.5 - 7114.5), giving you a loss of £370 (£10 x 37), plus any overnight funding charges if the position was open for more than one day.

How to spread bet on commodities example

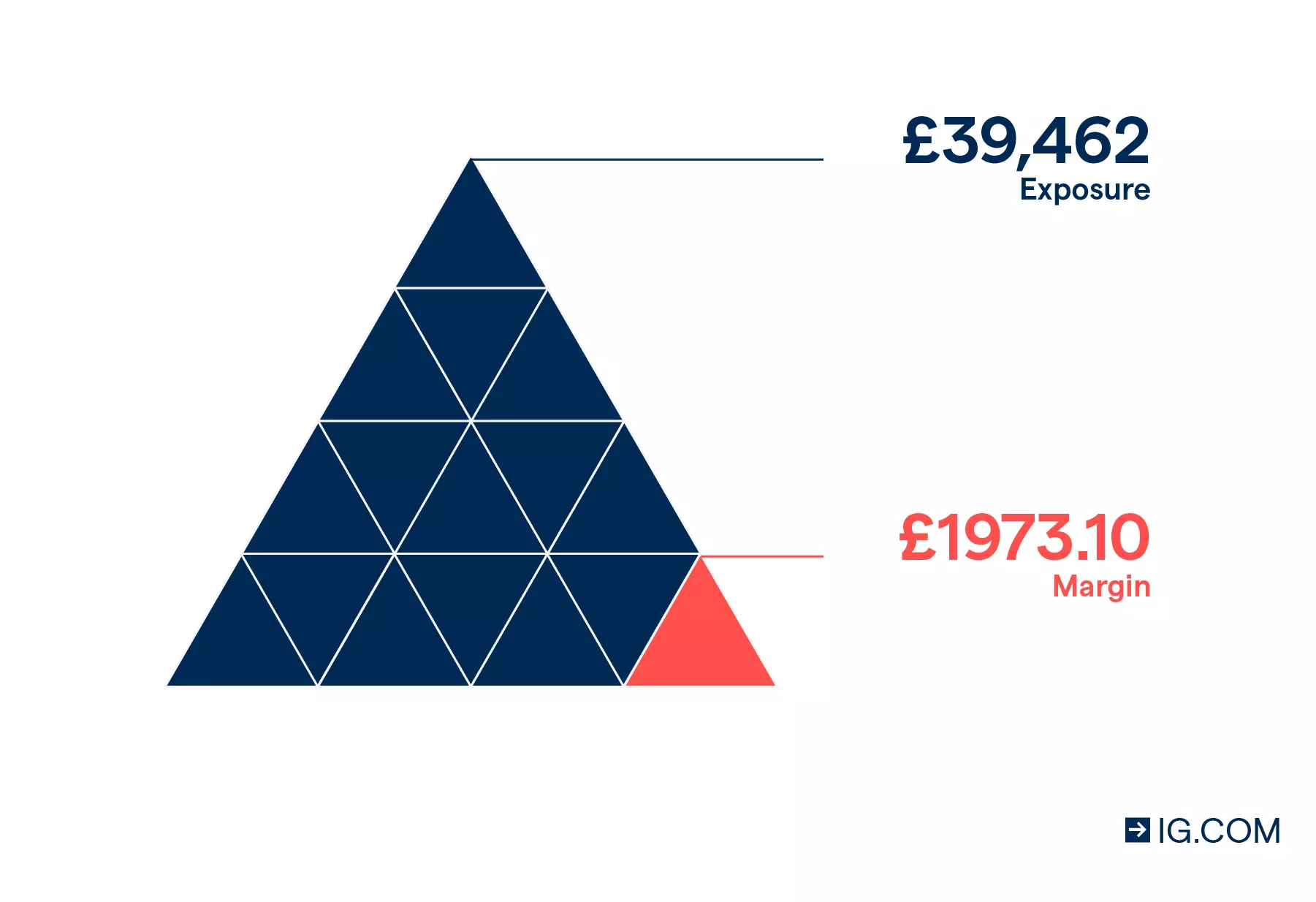

You decide to spread bet on gold, which is currently trading at 1315.70, with a buy price of 1316.00 and a sell price of 1315.40. As you believe the price of gold is due to decline, you open a spread bet to sell the commodity for £30 per point of movement.

Gold has a margin factor of 5%, so you would need to put down £1973.10 (£30 x 1315.40 x 5%) to open the position.

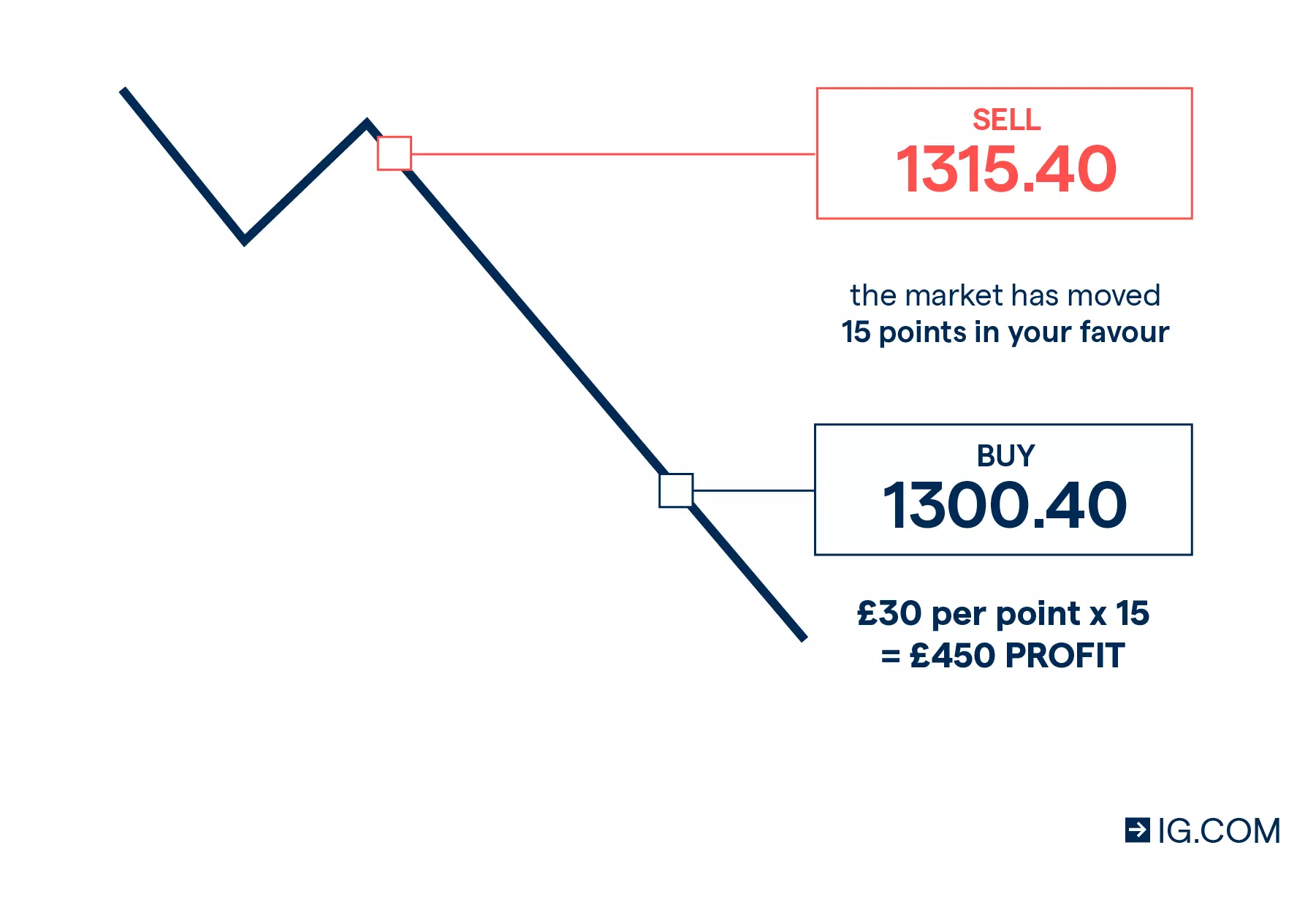

If your commodities spread bet was correct

Let’s say the price of gold did fall, down to a new price of 1300.10. You close your position at the new buy price of 1300.40.

As the market has moved in your favour by 15 points (1315.40 - 1300.40), you would be taking a profit of £450 (15 x £30). If you had kept your position open overnight, you would also have funding charges to pay.

If your commodities spread bet was incorrect

However, if you were incorrect and the market price of gold rose instead, to 1335.70, you would have made a loss. You’d close your position, at the new buy price of 1335.40.

As the market has moved against you by 20 points (1315.40 - 1335.40), your total loss for the commodity spread bet would be £600 (20 x £30), plus any funding charges.

FAQs

If you’re a retail trader, you can spread bet on over 15,000+ markets including forex, shares, indices and commodities.

Who can spread bet?

Spread betting is available to anyone who has sufficient knowledge and experience of trading. This will be assessed during the application process for an account with us.

Spread betting can be a useful tool for anyone who wants a range of asset classes, tax-free trading, and the opportunity to speculate on markets that are rising and falling in price. However, if you don’t feel ready to start trading live markets, you can start by building your knowledge with IG Academy’s range of online courses, or trading in a risk-free environment with an IG demo account.

How much does spread betting cost?

The cost of spread betting depends on the bet size that you choose, how much capital you are willing to put up, and how long you keep your trade open for. Before you start to spread bet, it is important to establish what your parameters for trading are, and how much capital you can afford to risk.

Find out more about IG’s spread betting charges.

To open a new spread betting account with us, you just need to fill out a simple form so that we can establish your previous experience and available funds. This way we can ensure that you get the best trading experience possible.

Our mobile trading apps, state-of-the-art technology and free educational tools make the process of switching your account to us an effortless experience. So, you can be signed up and ready to trade within minutes.

Is online trading safe?

Your security while trading online is ultimately in the hands of your provider. 256-bit SSL (secure sockets layer) encryption – used by IG – is the current industry standard for online financial transactions. Some providers also offer two-factor authentication for added account security.

Develop your spread betting knowledge with IG

Find out more about spread betting and test yourself with IG Academy’s range of online courses.

Try these next…

Discover the differences between spread betting and CFD trading

Learn about risk management tools including stops and limits

Browser-based desktop trading and native apps for all devices