Find out everything you need to know about spread betting on forex markets with this one-page guide.

What is forex spread betting?

Forex spread betting is a way to speculate on the upward and downward price movements of currency pairs. When spread betting on a currency pair, you’ll bet an amount of money per point of movement in the underlying market. If the price moves in the same direction that you predicted, you’ll make a profit – but if it moves in the opposite direction, you’d incur a loss.

Let’s say you open a long spread betting position on GBP/USD when the buy price is 13259.1, betting £5 per point of movement. Your prediction is correct and you sell at 13279.1. The market has moved 20 points, so your profit is £100 (£5 x 20), excluding any additional costs like overnight charges.

Spread betting is a derivative product, which means you’re trading via leverage – without taking ownership of any currency outright. Trading on leverage also means you only need to put up a small deposit (called margin) to open a larger position. However, as your total profit or loss is based on the full size of your position, either could significantly outweigh your margin amount. Always take the appropriate risk management steps when spread betting.

Another alternative to trading forex is via CFDs. With spread betting, you have greater control over deal size, while forex CFDs can only be traded in certain deal sizes called lots. Spread betting is also tax-free in the UK.1

Forex and spread betting: the essentials

Before getting started, there are some key things all traders should know about forex as a market and spread betting as a way to trade. Here are the five essentials to know:

What’s the difference between forex and spread betting?

Forex (FX) is a market you can trade with us. Opening a spread betting account is one of the ways you can get exposure to the FX market – and thousands of other markets too – without buying any actual currencies or other assets outright.

FX is traded in currency pairs

When trading forex (via spread betting or any other method), you’re always trading one currency against another – so they are traded in pairs. For example, you wouldn’t just trade the dollar, you’d trade the British pound’s value against that of the US dollar (GBP/USD).

Essentially, you’re buying one currency and selling the other in the pair, based on which currency you think is going to appreciate in value against the other. The currency being bought is known as the base currency (appears on the left), while the other is called the quote currency (appears on the right).

The price of the pair shows how many of the quote currency it’ll cost to buy one of the base. So, if GBP/USD is trading at 1.42000, it means it costs $1.42 to buy £1.

Spread betting is leveraged

Because spread betting is leveraged, you’ll only speculate on currency pair’s price – but you won’t own the physical assets. Plus, you’ll only put up a percentage of the trade size, for example 5%, at the outset of a trade. Leverage can magnify your profits and your losses, because they’re based on the full position size and not just your deposit.

For example, if your total position size is £100 and the margin factor is 5%, you’d only have to deposit £5 to open that trade. However, your total profits or losses for the trade are calculated on the full £100, so losses could outweigh your £5 quickly.

You control your position size with FX spread bets

When spread betting on forex, no restrictions exist on your deal size. But with forex CFDs, you must trade in lots (100,000 units of the base currency is a standard lot). You can spread bet on different forex markets, including spot forex, forwards and options. All three are available to trade with us.

Spread betting on forex: spots vs forwards vs options

Spot (cash) forex trading is the real-time trading of the current price of currencies, while forwards and forex options mean you can buy or sell currency at a predetermined price, on a predetermined expiry date.

Forex forwards are derivatives that give you the obligation to buy or sell FX at a specific price, on a specific date in the future.

Options give you the right, but not the obligation, to buy or sell currency pairs before a specified expiry date. Unlike spot market forex, which work on current prices, you get daily, weekly, monthly and quarterly options.

How to spread bet on forex

Learn all about spread betting and forex trading

The most successful traders of forex spread betting are those with a firm grasp of what forex spread betting is and how to trade forex using spread bets.

Your first step is to learn exactly how both work. Read our introduction: what is spread betting and how does it work? To learn more about forex, read what is forex and how does it work?

Next, visit IG Academy for free resources that explain and educate on forex for every level of experience from beginner to advanced.

Lastly, develop your confidence and hone your skill with our free demo account, which enables you to practise with virtual funds.

Open and fund your live spread betting account

- Fill in a short form

We’ll ask about your trading knowledge to ensure you get the best experience - Get verification

We can usually verify your identity immediately - Fund and start trading

You can also withdraw your money, whenever you like

Not ready to start trading yet? No problem – start off in a practice environment with our free demo account and £10,000 virtual funds, plus get exclusive educational content on IG Academy.

Choose your currency pair to spread bet on

There are plenty of currency pairs to choose from with us, including over 80 major, minor and exotic pairs for spot markets and nine for options.

Before choosing an FX pair to trade, you should carry out fundamental analysis and technical analysis on the two currencies in the pair. This means you should assess how the ‘base’ (the currency on the left) and the ‘quote’ (the currency on the right) move in relation to each other.

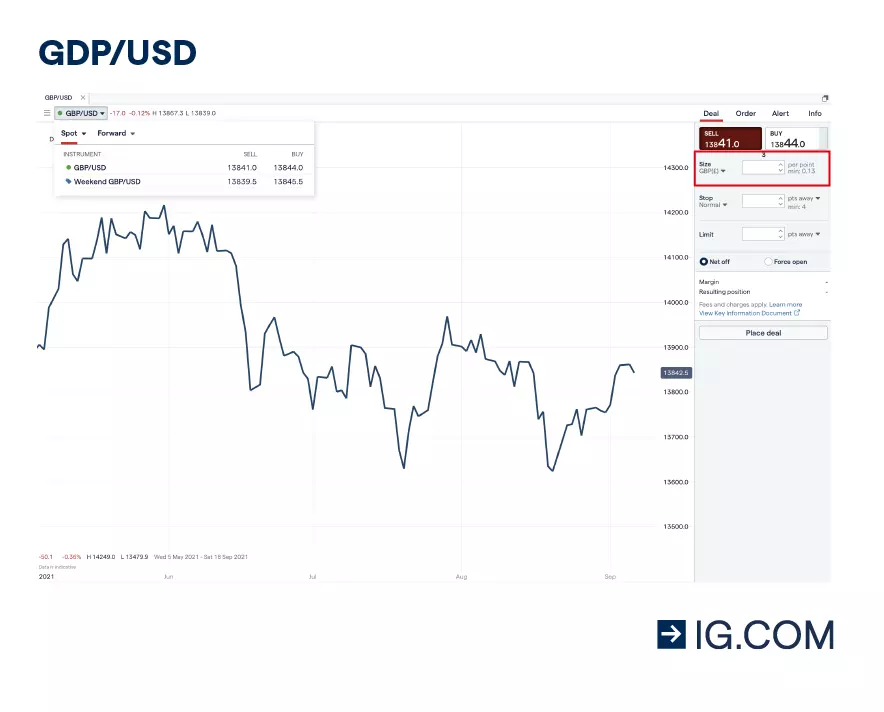

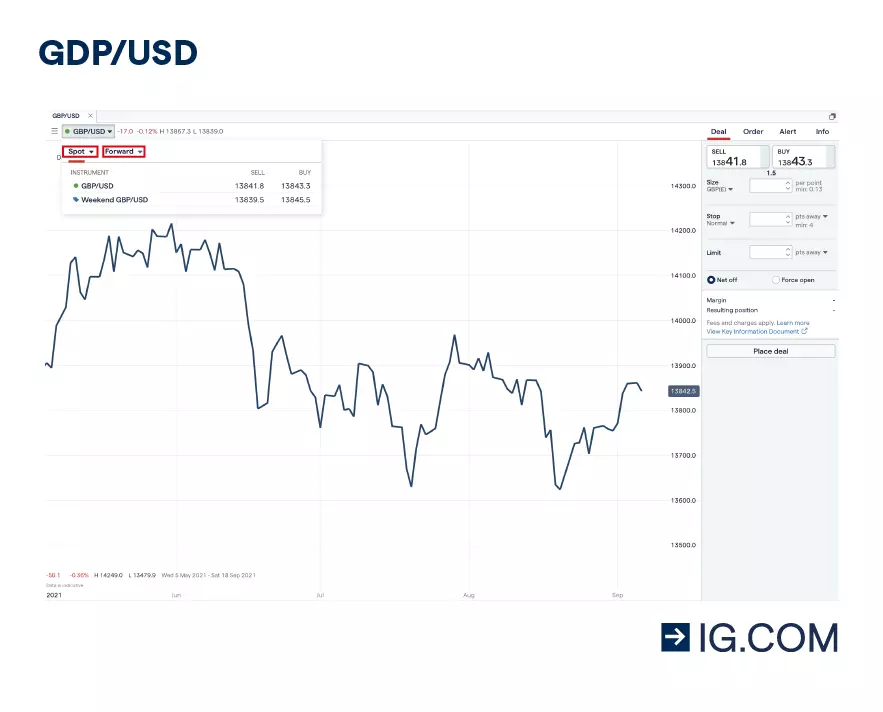

Decide whether you want to spread bet on spot prices, forwards or options

There are various ways to spread bet on forex with us:

- Spot forex trading enables you to trade forex pairs at their current market price with no fixed expiries

- Forex forwards enable you to trade forex pairs at a specified price to be settled at a set date in the future or within a range of future dates

- Forex options give you the right, but not the obligation, to buy or sell a currency pair at a set price, if it moves beyond that price within a set time frame

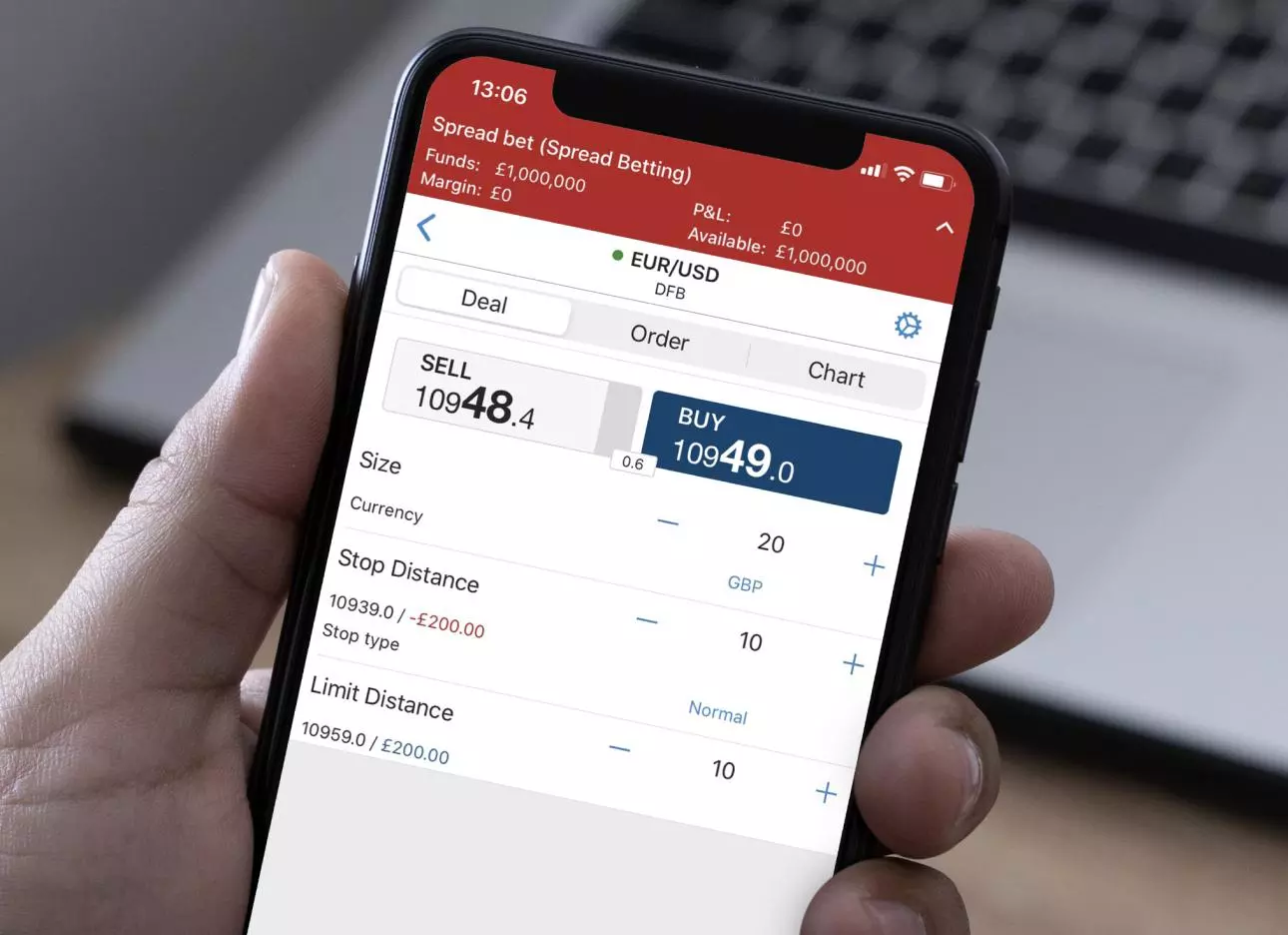

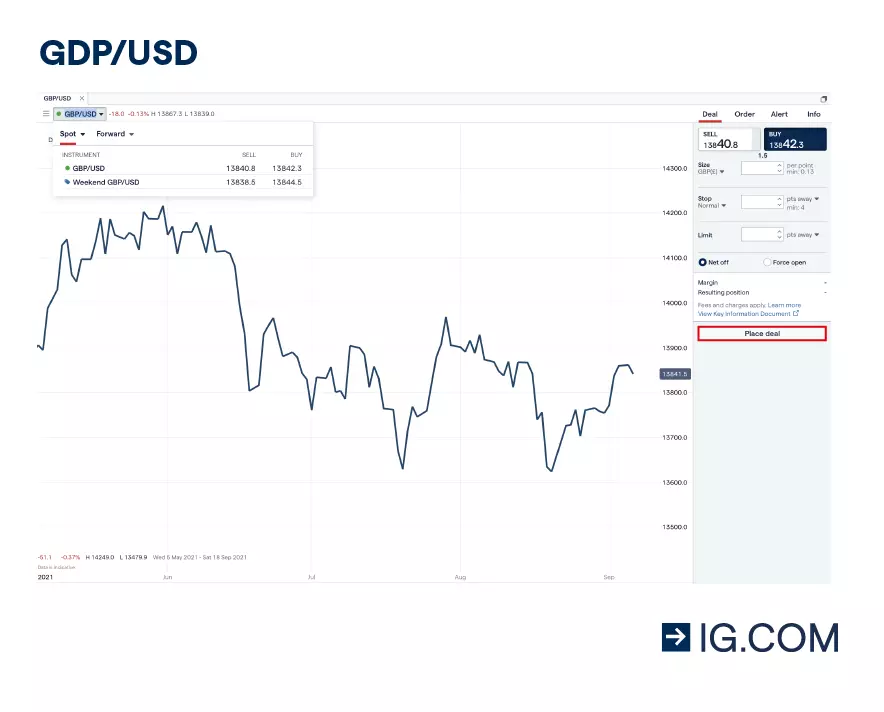

Open your first forex spread bet

Once you’ve opened your live account with us, you’re ready to start spread betting on forex. Head onto our spread betting trading platform and choose whether to buy or sell your chosen currency pair.

You’d buy the pair if you expected the base currency to rise in value against the quote currency. Or, you’d sell if you expected it to do the opposite.

Lastly, set your stops and limits before opening a position. The forex market is particularly volatile, which makes stops and limits vital risk management tools to prevent potential losses you aren’t comfortable with.

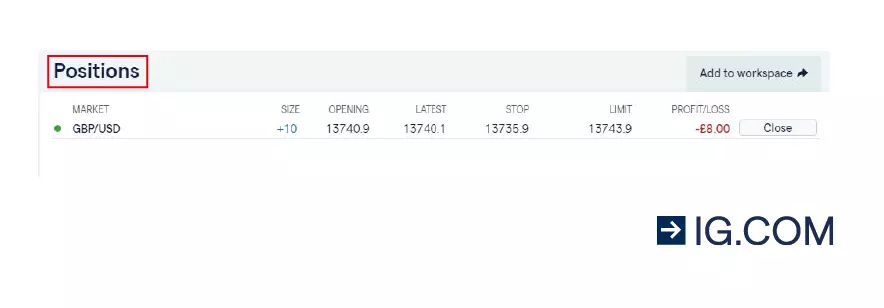

Monitor your position

Once you’ve opened your position, you can monitor your FX spread betting trade in the ‘open positions’ section of the platform. Once your position is open, stay up to date with newsfeeds in our platform, trading signals and trading alerts. You can also set price alerts to receive email, SMS or push notifications when a specified buy or sell percentage or point is reached.

FAQs

Is there a difference between forex spread bets and currency spread bets?

No, there is no difference – ‘currency spread bets’ is another term for forex spread betting, it’s exactly the same thing.

What are the best strategies to spread bet on forex?

For successful spread betting in a market as liquid and volatile as forex, you need a good trading strategy.

While there are numerous strategies out there, each working for a different type of trader, you can get started with our helpful guide: best spread betting strategies and tips

What’s the difference between forex spread betting and CFDs, spot and options?

Spread bets and CFDs and are two different products, or ways to trade the forex market. When spread betting, you’ll stake an amount of money per point of price movement in the underlying forex pair. CFDs are contracts that enable you to speculate on the price of a currency pair – where your profit or loss will be calculated as the difference between the opening and the closing price of your position.

Learn more about the difference between CFDs and spread bets

Meanwhile, spot trading and options are two different markets you can trade currency pairs on. Spot trading is the trading of forex on the cash market in real time, while options trading is contracts called options that give the holder the right, but not the obligation, to buy or sell the underlying forex currency pair by a future expiry date.

Develop your spread betting knowledge with IG

Find out more about spread betting and test yourself with IG Academy’s range of online courses.

Try these next

Discover the differences between spread betting and CFD trading

Learn about risk management tools including stops and limits

Browser-based desktop trading and native apps for all devices

1 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.