Financial trading is no different to any other form of trading: it’s about buying and selling assets with the aim of making a profit. Discover key concepts, participants and markets involved in financial trading.

What is trading?

Trading is the buying and selling of financial instruments in order to make a profit. These instruments range from a variety of assets that are assigned a financial value that goes up and down – and you can trade on the direction they take.

You may have heard about stocks, shares and funds. But there are thousands of financial markets you can trade, and a variety of products you can use to trade them.

You can get exposure to markets as diverse as the S&P 500, the FTSE 100, global currencies like the US dollar or Japanese yen, or even commodities like lean hog or cattle.

To get started, you’d need to create an account on a platform that offers these markets. Our online trading platform has a variety of financial markets that enable you to speculate whether the price of an asset will rise or fall. Plus, we’ve compiled a trading for beginners guide to assist you in getting familiar with the different markets.

What assets and markets can you trade?

There are more than 15,000 financial assets and markets that you can trade with us.

These include:

Whatever instrument you trade, the intended outcome is always the same: to make a profit. If you buy an instrument for less than you sell it for, you’ll make a profit. But, if you sell it for less, you’ll make a loss.

It’s important to note that trading is inherently risky – and you could lose more than you expected if you don’t take the appropriate risk management steps.

Trading vs investing

The difference between trading and investing lies in the means of making a profit and whether you take ownership of the asset. Traders make profit from buying low and selling high (going long) or selling high and buying low (going short), usually over the short or medium term. They don't own the asset they trade.

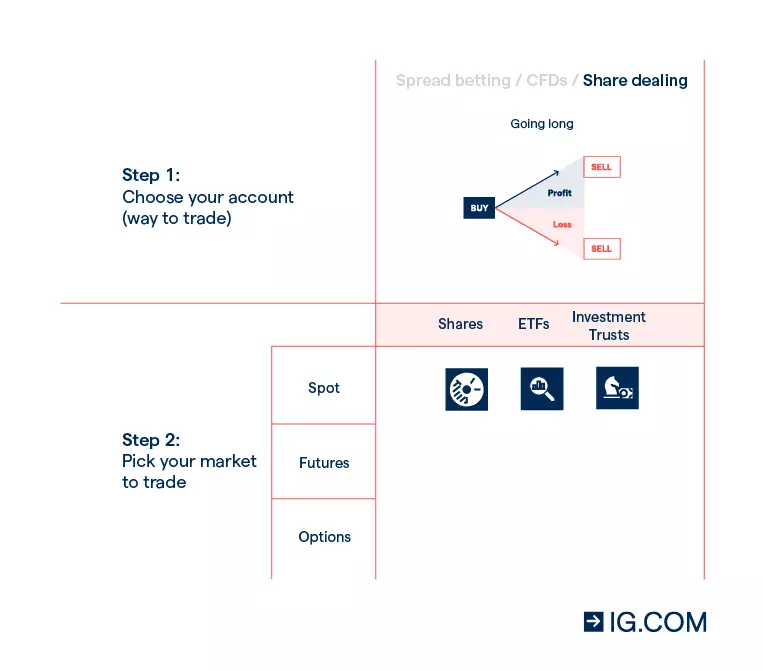

Investors aim to buy shares at a favourable price and take outright ownership of the stock. They make profit from holding the stock and selling it at a higher premium. The hope is that the share price increases over the long-term and they can profit from the movement. Investors could also earn income in the form of dividends if the company grants them. Plus, they’ll have shareholder voting rights.

Who trades and who invests?

Traders, as opposed to investors, are those who’d prefer to make use of leverage and derivatives to go long or short on a range of markets. Investors seek to buy shares or funds and will profit if the price rises.

Individuals (called retail traders or investors), institutions and governments trade and invest. They participate in financial markets by buying and selling assets with the aim of making a profit.

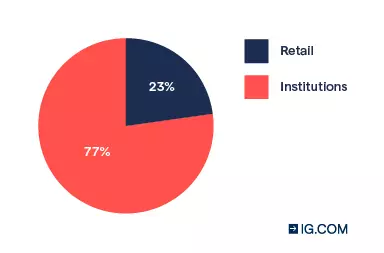

In 2021, retail investors accounted for 23% of all US equity trades, double the amount of 2019, buying more than $1.9 billion in stocks.1, 2 These numbers soared after coronavirus-related volatility hit the market and stock prices fluctuated at an unprecedented rate.

Some financial traders and investors stick to a particular instrument or asset class, while others have more diverse portfolios. Governments and institutions can adapt at a much faster pace, as they often have departments that focus on trading different sectors and industries. Institutions remain the biggest participants in the market, with 77% of trades attributed to them.

For individuals to invest on the stock exchange, they must go through a stockbroker that will execute the order. They’ll do their due diligence, research before placing a trade, read charts, study trends, and the broker will act on their behalf. They trade from their own private accounts, which they fund and bear the full risk of losing their capital.

Institutions that trade and invest include commercial banks, hedge funds, and corporations that have an influence on the liquidity and volatility of stocks in the market. This is because they typically engage in block trades, which comprises of buying or selling at least 10,000 shares or more at a time.3

These entities stand to profit from supply and demand of goods or products, political instability, the availability of currency (including the movement of interest rates), and many other factors.

How does trading work?

When you trade, you profit if the market price of your position moves in the right direction, and you lose money if the price of your position moves in the wrong direction.

The basic premise to remember is supply and demand. When there are more buyers than sellers in the market, demand is greater, and the price goes up.

If there are more sellers than buyers in the market, demand is reduced, and the price goes down.

Getting exposure to assets can only be carried out over the counter (OTC) or directly on an exchange.

Trading OTC involves two parties (trader and broker) reaching an agreement on the price to buy and sell an asset. Whereas an exchange is a highly organised marketplace where you can trade a specific type of instrument directly.

For example, you can invest in UK shares on the London Stock Exchange (LSE), or you might trade listed futures or options through an exchange like the Intercontinental Exchange (ICE).

As you’ll come to realise, most retail traders in the UK trade OTC, using derivatives like spread bets and CFDs, because the assets are more accessible than those listed on a centralised exchange.

Whereas retail investors will use a stockbroker to execute investments on their behalf through a stock exchange.

| OTC | Exchange | |

| Definitions | Trading happens between two parties and often involves a dealer network | Trading happens directly on the order book of the exchange – there’s no middleman |

| Locations | No central, physical location – only a virtual network of participants | Actual, physical location |

| Timings | 24/7 | Specific exchange hours |

| Contracts | Customised | Standardised |

| Risk | Counterparty risk, assets can be more volatile, and since OTC can sometimes be traded on leverage, it means there’s risk of losing more than your deposit | Higher cost, fixed hours, and you can trade on leverage in some cases (options and futures) |

Ways to trade in the UK and how to get started

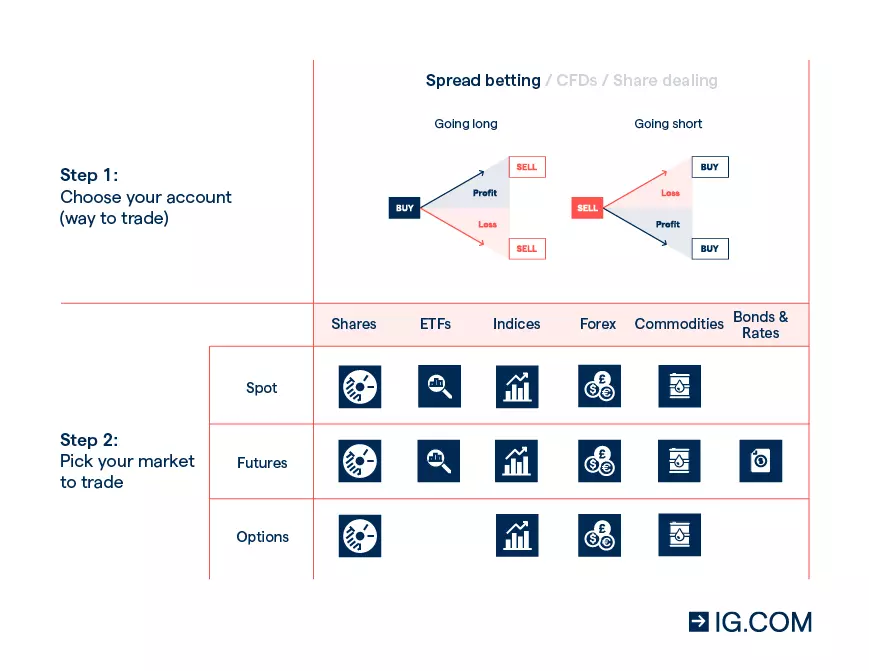

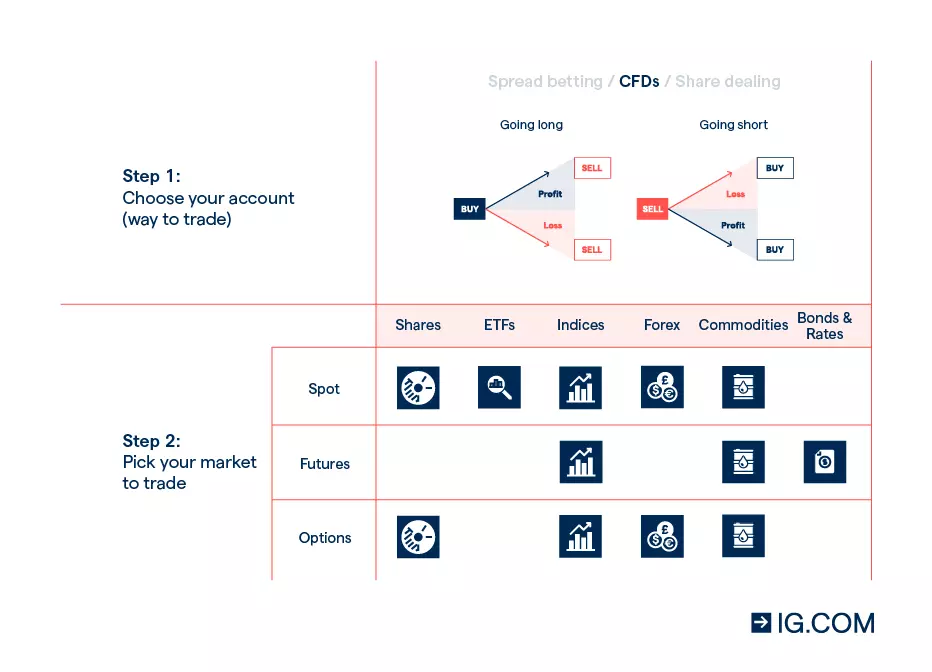

The most popular trading methods in the UK are spread betting and CFD trading (both forms of derivative trading), while investors opt for share dealing. When you trade derivatives, you don’t own the physical asset, but when you deal shares, you own them.

Here are the steps you’ll take to start trading on our platform:

1. Choose your trading account

Choose between a spread betting or CFD trading account. With spread betting, you’d be placing a bet (amount per point of movement) on whether you think the price will rise or fall. When trading CFDs, you’d also speculate on the direction of the asset’s price but your profit or loss will be based on the difference between the opening and the closing price.

You can learn how spread betting and CFD trading works by opening a demo account with us. Your account will be credited with £10,000 in virtual funds that you can use to practise and build your confidence in a risk-free environment.

2. Pick your asset and market

Choose a market that you’re familiar with, or an asset that you can trade based on your experience and risk appetite.

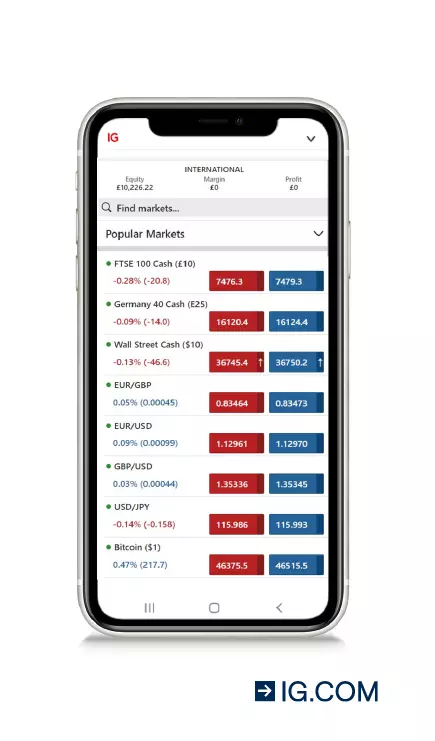

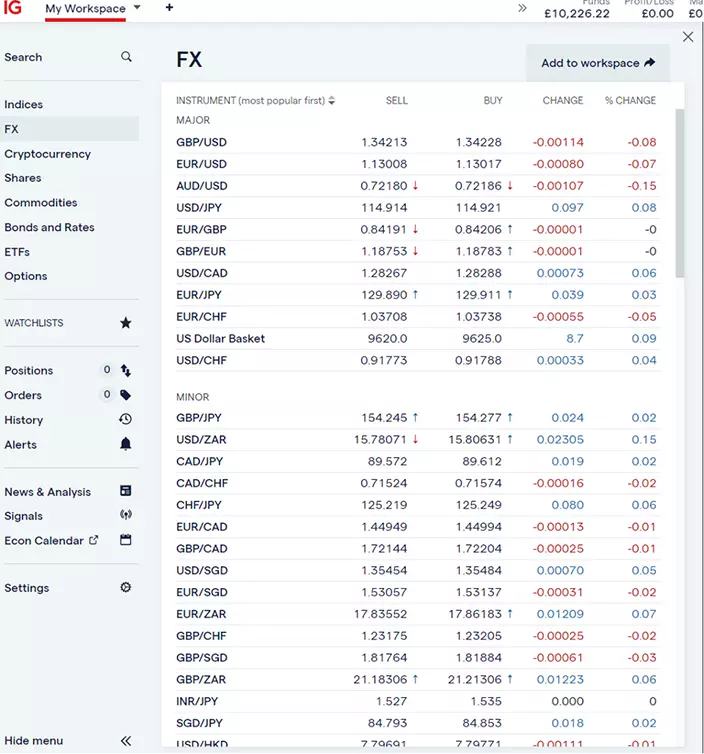

We offer over 15,000 markets to trade like shares, forex, commodities, indices, bonds and more. Our platform features a search bar to help you find the market that interests you, or you can navigate through the most popular markets in the left pane.

You can also access all these features on your mobile device. 50% of our users track their account balances, open positions and view past transactions using the IG trading app.

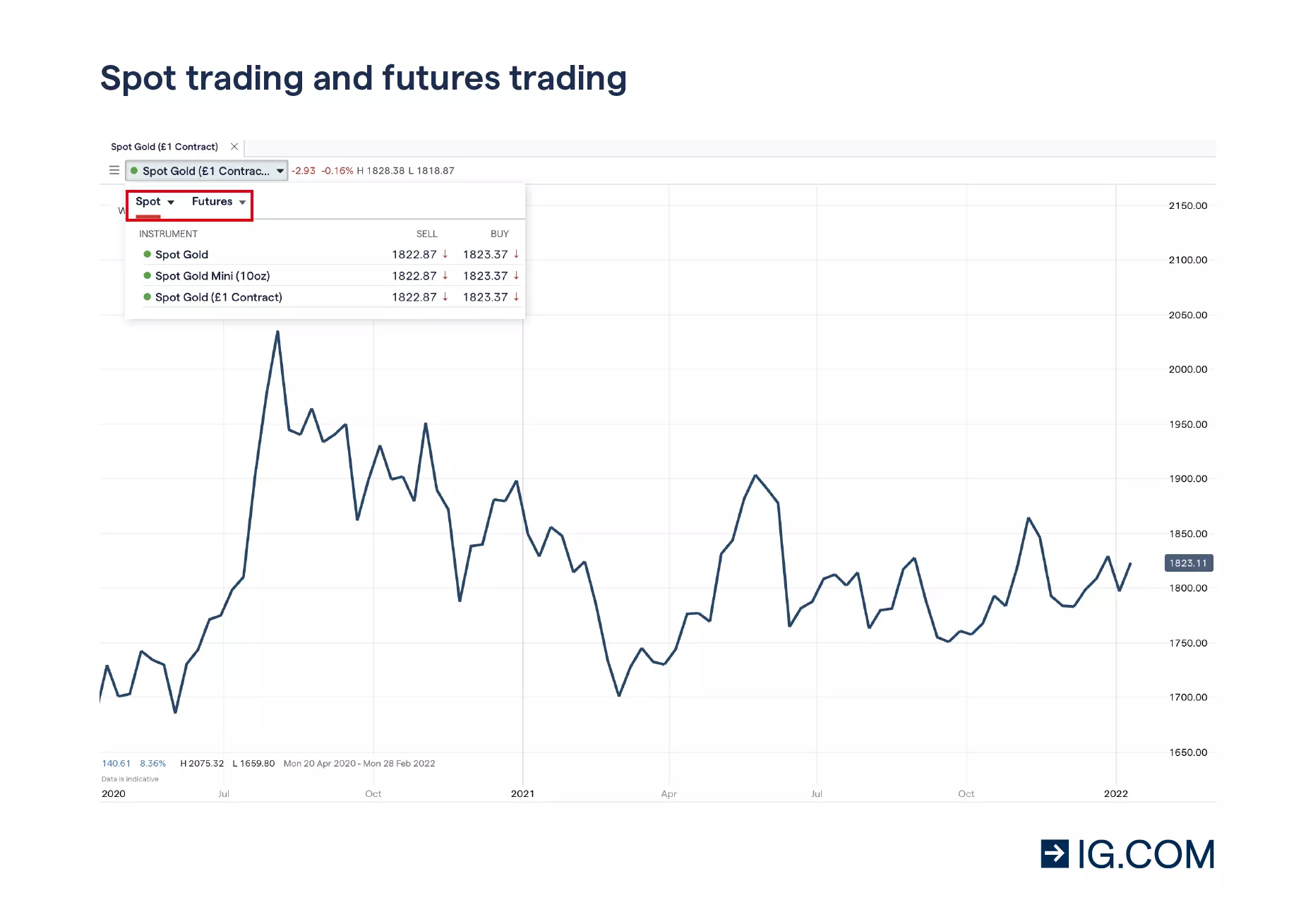

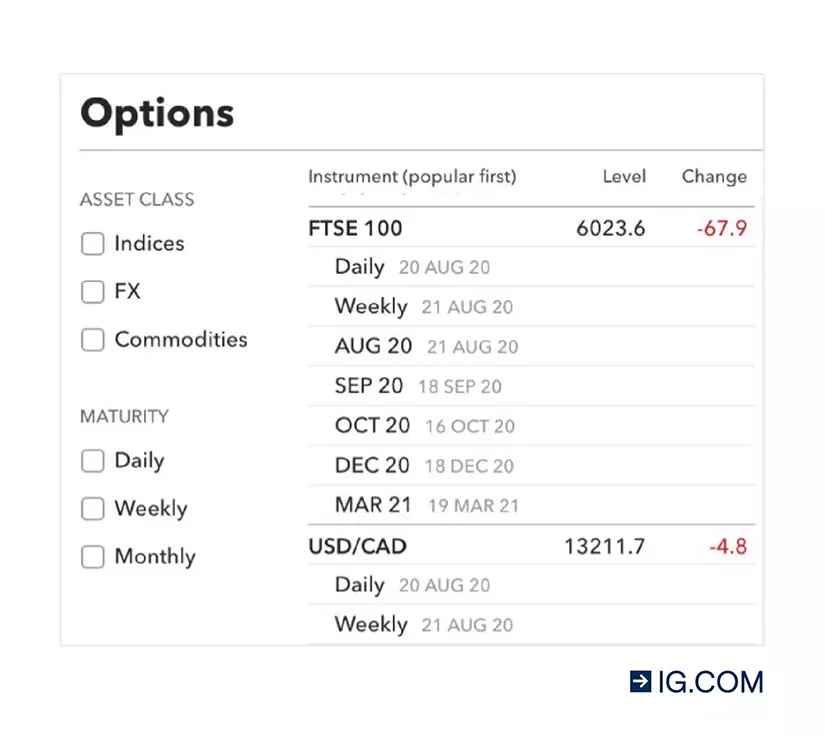

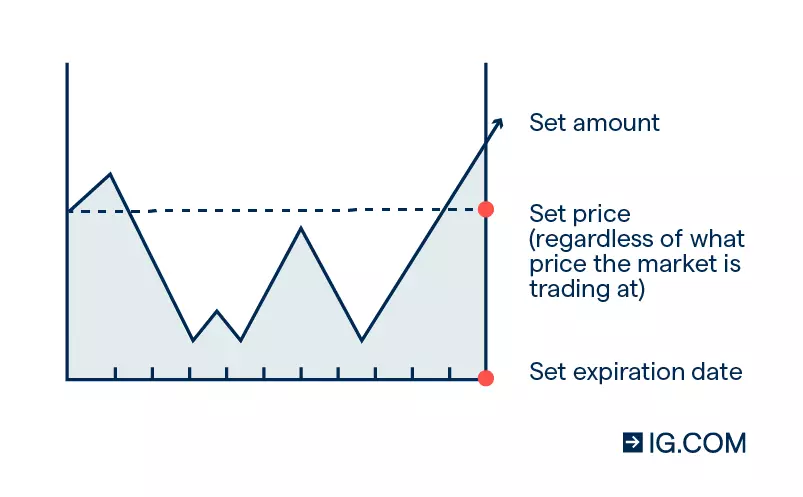

3. Decide whether to trade the spot price, futures, or options

All of our markets are available to trade the spot price (cash). Spot trading means buying and selling assets at the current market rate – known as the spot, or cash, price. It’s preferred by short-term traders the spread is relatively low. There are overnight fees that you need to consider.

You can also trade futures (known as forwards in certain markets). Futures give you the right to buy or sell the underlying asset at a predetermined price by a certain date, before the contract’s expiry. Futures have higher spreads but no overnight fees, and are often favoured by medium- to long-term traders.

Some traders prefer options over futures, because buying them has limited risk. But selling them carries the risk of potentially unlimited losses.

It’s important to remember that, if you want to invest and own an asset, you’ll need to open a share dealing account with us.

4. Place your trade

Once you’ve decided on the market you want exposure to, you can place your trade using spread bets or CFDs. You can speculate on both rising and falling markets. If you think the price will rise, you’ll open a position to ‘buy’, and if you think the price will decline, you’ll open a position to ‘sell’.

Your trading decision should be based on your analysis of the market and your trading strategy. You can trade on a variety of platforms, including our award-winning web platform and mobile app.4 You can also use our powerful charts to find trading opportunities and stay ahead of the curve.

If you still require more information or quick pointers, you can browse our guide on how to get into trading. It’s useful for beginners and seasoned traders that want to learn more about all of the available markets on our platform.

Spread betting

CFD trading

Share dealing

Four trading examples

Check out some examples of financial trading and find out how to get started:

- Trading shares via spread bets

- Trading shares via CFDs

- Trading indices via spread bets

- Trading indices via CFDs

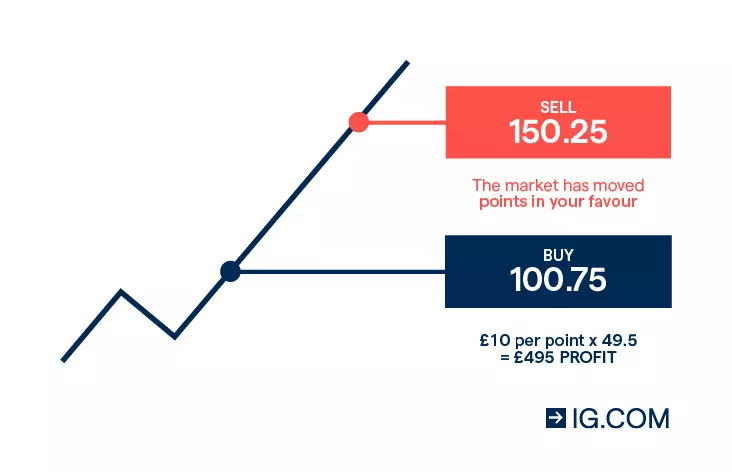

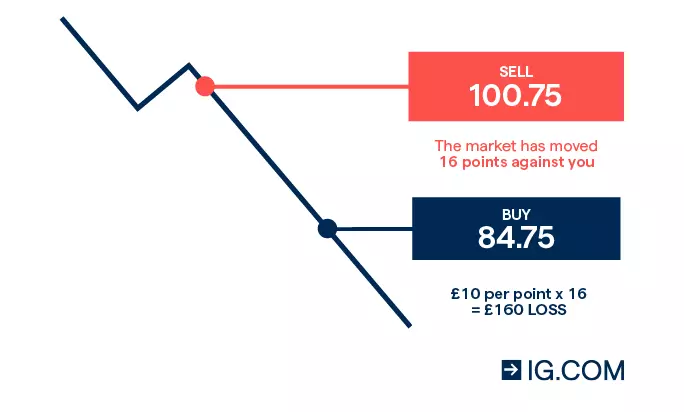

Let’s say you decide to trade Vodafone shares and the current underlying price is 100.25. There’s a 1-point spread, so the buy price is 100.75 and the sell price is 99.75. You think the share price will rise, so you go long on the Vodafone shares, buying them at £10 per point of movement.

If the margin requirement is 20%, you’d need to deposit £201.50 (£10 x 100.75 x 20%) to open the position.

Now, to make a profit, you’d have to sell your position when the market reaches a higher price than 100.75. So, if the Vodafone share price rises to 150.00, with a new buy price of 150.50 and sell price of 149.50, you’d make a profit of £487.50 ([150.25 – 100.75] x £10 per point) if you shorted the stock.

If the underlying share price fell to 85.75 instead and the new sell price is 85.25, you’d make a loss. That means the market moved against you by 16 points and the total loss is £150 ([85.25 – 100.25] x £10), including any additional fees charged.

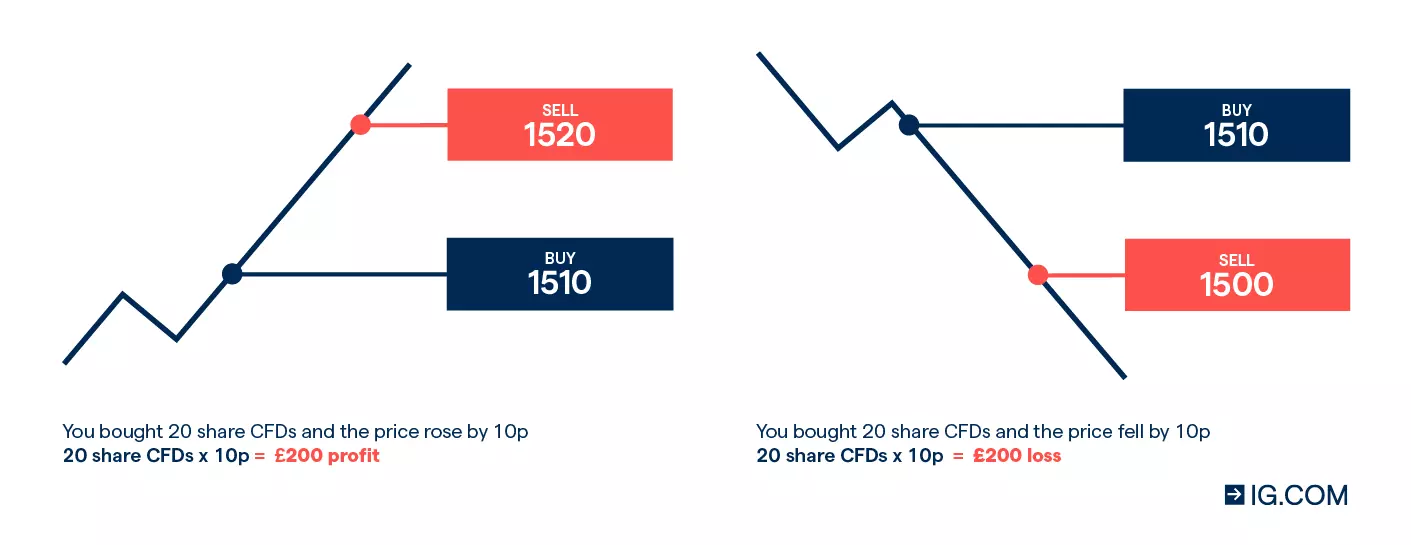

Say Lloyds shares are currently trading at 51.615 with a buy price of 51.630 and a sell price of 51.600. You anticipate that the stock is going to increase in value over the next few days, so you decide to buy 150 share CFDs at 51.630.

If the Lloyds share price did climb and was trading at 52.615 with a new buy price of 52.630 and sell price of 52.600, you’d close your position by reversing your initial trade, selling 150 share CFDs at 52.600.

To calculate your profit, you’d multiply the difference between the closing price and opening price of your trade by its size. In this case, your profit would be £145.50 ([52.600 – 51.630] x 150), excluding any additional costs.

However, if the Lloyds share price had decreased to 50.515 (buy price 50.530 and sell price 50.500) and you closed your position by selling the shares at the new sell price, you’d make a loss. You could calculate this loss as the difference between the closing price and opening price of your trade by its size. In this case, that would be a loss of £169.50 ([51.630 – 50.500] x 150 share CFDs), excluding any additional costs.

You decide to spread bet on the FTSE 100, with an underlying market value of 7114, a buy price of 7114.5 and a sell price of 7113.5.

You predict that the FTSE 100 is going to rise, so you buy at £10 per point at 7114.5. The FTSE 100 has a margin factor of 5%, you’d only need to deposit £3557.30 (£10 x 7114.5 x 5%).

Let’s say your prediction is correct and the FTSE 100 increases in value. You close your position when the market reaches 7150 – at the new sell price of 7149.5.

As the market moved in you favour by 35 points (7149.5 – 7114.5), your profit would be calculated by multiplying this figure by the amount you’ve bet per point. This gives you a profit of £350 (£10 x 35) minus any funding costs.

However, let’s say the FTSE declined in price, instead of rallying. So, you decide to cut your losses when it hits 7078 – with a sell price of 7077.5.

The market has moved against you by 37 points (7077.5 - 7114.5), giving you a loss of £370 (£10 x 37), plus any overnight funding charges if the position was open for more than one day.

Let’s say that you wanted to speculate on the FTSE 100 index going up, above its current price of 6900 (buy 6901.2, sell 6898.8). So, you buy 100 FTSE 100 CFDs at the buy price of 6901.2.

A single FTSE 100 CFD is worth £10, so if you predict correctly and the FTSE 100 price goes up to 6911 (buy 6912.2, sell 6909.8), and you close your position by selling your CFDs at the new sell price of 6909.8, you’d have made a profit of £8600 ([6909.8 – 6901.2] x £10 x 100 CFDs).

If the index moves against you and you decide to close your position, you’d make a loss. For example, if the price drops to 6890 (buy price 6891.2, sell price 6888.8), you’d close your position by selling at the new sell price of 6888.8)

In this case, you’d have made a loss of £12,400 ([6901.2 – 6888.8] x £10 x 100 CFDs).

Get exposure to these markets with us by opening a demo account to start practicing and find your bearings on how our platform works. Our risk-free environment enables you to trade on several financial instruments to learn how they move. Once you’re familiar, open a live account and start trading to make a profit.

FAQs

What is trading in simple terms?

Trading, in simple terms, is the act of buying and selling financial instruments (like shares, forex and indices) without directly owning them, in the hopes of making a profit from changes in their price movements.

How can beginners get started with trading?

To start trading as a beginner, you can use tools and resources such as IG Academy to learn as much as you can about financial trading. Then, you can hone your skills in a risk-free trading environment by using our demo account. You’ll get £10,000 in virtual funds to get you started. Once you’ve built your strategy and your confidence, you could try a live trading account.

What are the ways you can trade?

The two main ways you can trade are via spread bets or CFDs. Both are derivative products, which means you can speculate on the price of an underlying asset rising or falling. When trading derivatives, you don’t own the asset outright, and you can open a position using margin (ie trade using leverage). If you want to own assets, you can choose to invest in them via share dealing.

Note that trading on leverage magnifies your risk, as your profit and loss will be based on the full size of your position, not the deposit used to open it. In other words, you could lose a lot more than your initial outlay. This is why it’s so important to take steps to manage your risk.

What can you trade on?

You can trade on a large variety of financial markets, like shares, ETFs, bonds, themes, global currencies (forex), commodities, indices and more. We offer over 15,000 markets for you to speculate on.

Try these next

Learn about the differences between spread bets and CFDs

Open a trading account with us, fund your live account and get exposure to over 15,000 markets

Discover our powerful trading platforms and mobile app

1 UnitedFinTech, 2021

2 Bloomberg, 2021

3 Yahoo Finance, 2021

4 Best trading platform as awarded at the ADVFN International Financial Awards 2021and Professional Trader Awards 2019. Best trading app as awarded at the

ADVFN International Financial Awards 2021.