How to spread bet on shares

Spread betting on shares enables you to speculate on their underlying price without taking ownership of the asset. Learn how to spread bet on stocks in the UK using our comprehensive guide.

What is shares spread betting?

Shares spread betting is a way of speculating on the price of stocks without taking equity ownership of a company. You can go long or short by putting up a certain amount of capital per point of movement on the share price rising or falling.

You’ll earn a profit for correctly predicting market movement or incur a loss if the price moves against your speculation. With us, you can choose from 11,000+ shares to spread bet on.

Spread betting is popular because you won’t pay any tax or commission on your profits.1

For example, let’s say you want to spread bet on Apple shares. If you bet £50 per point, and Apple’s stock price rose 10 points, you’d gain make £500 (10 x £50). If, however, the share price fell by 10 points, you’d lose £500.

Essentials of spread betting on shares

Discover everything you need to know about shares and spread betting before you get started.

Spread betting is leveraged

When spread betting, you can open a trade with only a fraction of the full market value of the position. This is possible through leverage. You’ll only require a small percentage of the full trade value to get exposure to the underlying asset – this is called margin.

The margin for shares is generally 20% of the full value of the position. For example, if you wanted to get exposure to £1000 worth of shares, you might only pay £200 to open the position.

It’s important to remember that, while leverage can amplify your profits based on the exposure to the full value of the trade, your losses will also be amplified. You can lose more than the deposit you used to open your position. That’s why you always need to ensure that you take steps to manage your risk.

You can go long or short with share spread bets

There are two ways of trading shares using spread bets – you can either go long or short. You’ll go long if you’re confident that the price of shares will rise and go short if you think it’ll fall.

Say you wanted to short the share price of an oil company because you believe the price of brent crude oil will fall, you’d open the spread bet deal ticket and click on ‘sell’.

If the share price of the company drops, your prediction will be correct, and you can close the deal and take your profit. Conversely, if the market goes against your short and continues to rise, you stand to lose more than your initial outlay you used to open the position.

Stocks spread betting is commission-free

Spread betting on shares is popular because you’ll never pay commission*, which is different compared to trading share CFDs or buying stock. The only charge is the spread. If you trade on the cash (spot) market, you’ll pay overnight fees if you hold the position after hours. This does not apply if you trade on the forwards market.

Also, you might consider spread bets because they’re tax-free.1 Typically, when you buy shares, you’d be liable to pay stamp duty and capital gains tax on any profits made. However, with spread bets, you won’t have to pay either because you don’t take ownership of the underlying asset. Spread bets are leveraged, so there’s more risk involved than buying shares through a share dealing account.

*Other fees may apply

You can control your position size and currency with share spread bets

Spread bets give you control of your position size by allowing you to choose your bet size.

This is different to CFDs where you can only pick the number of shares (much like with share dealing).

When you open a spread betting account, you can trade any market in pounds, whereas with share dealing or CFD trading you’d need to convert to the local currency.

This means that when you spread bet, you don’t incur forex fees or currency risk.

Spread betting on shares vs other ways to trade stocks

You have three ways to trade shares: via spread betting, CFD trading or US options and futures for American stocks.

You can also invest in shares with share dealing and own stocks. As an owner of an underlying asset, you’d have shareholder rights and receive dividend payments if the company grants them.

One difference between a spread betting and share dealing account is that the former is tax-free while the latter involves paying stamp duty and capital gains tax on profits made.1

Investing in shares is also non-leveraged, which means you’ll pay the full value of the position upfront. You should note that you may lose more money than you initially put down (with both trading and investing). Take careful steps to manage your risk at all times.

Spread betting on stocks: spot vs forwards vs options

Most people spread bet on shares using the cash market – sometimes known as the spot market. This has low spreads, meaning it’s a frequent choice for day traders.

Another alternative can be forwards – sometimes known as futures – which can be kept open longer as they have no overnight fees. Futures are common among traders that use long-term strategies, but you should note that they have larger spreads.

Options give you the right to buy or sell shares before a specific date in the future. You don’t have the obligation to trade, unlike with forwards. So if the market moves against you, you could choose to not execute the trade and only pay the margin on the position.

How to spread bet on stocks

Learn all about spread betting and share trading

It’s important to start your journey by familiarising yourself with spread betting and how it differs from opening a share dealing account.

Start off by getting a firm understanding of what spread betting is and how it works. We offer comprehensive resources on IG Academy that can be useful in learning how to spread bet as well as how to trade or invest in shares.

You can practise everything that you’ve learnt by opening a demo account. You’ll use £10,000 worth of virtual funds to get exposure to different stocks and sharpen your skills before you trade on a live account. Note that once you open a live account, there’ll be charges and fees levied on your trades.

Open and fund your live spread betting account

Once you have a good grasp on the subject matter, you can follow these steps to open a live account:

- Fill in a short form

You’ll complete a form and answer questions about your trading knowledge to ensure you get the best experience - Get verification

All your information will be verified immediately - Fund and start trading

You can deposit funds into your account fast and withdraw your profits for free, at any time

We offer 11,000+ shares and ETFs to trade, plus out-of-hours trading, all on the UK’s best platform.2 You’ll get access to our 24 hour support line if you need any assistance from an industry expert.

Choose the stock you want to trade

We offer 11,000+ shares that you can spread bet on in the UK. Depending on how the stock is performing at a given time, you’ll go long if you believe the price will rise or go short if you think it would drop.

You’ll need to conduct thorough research on the different stocks before you make your choice, by doing thorough fundamental analysis and technical analysis. Your research will enable you to make an informed decision on which stocks to trade.

Decide whether you want to spread bet on the spot market, forwards or options

You can perform real-time trades – in the short term – on the current price of stocks on the spot market. This is known as ‘cash’ on our platform. Alternatively, forwards offer the ability between two parties to agree on the price for an asset in the present, to be exchanged at a later stage.

You could also use options to buy or sell stocks at a predetermined price, on a set expiry date. These are contracts that give the holder the right, but not the obligation, to buy or sell stocks at a set premium, if it moves beyond that price within a set timeframe.

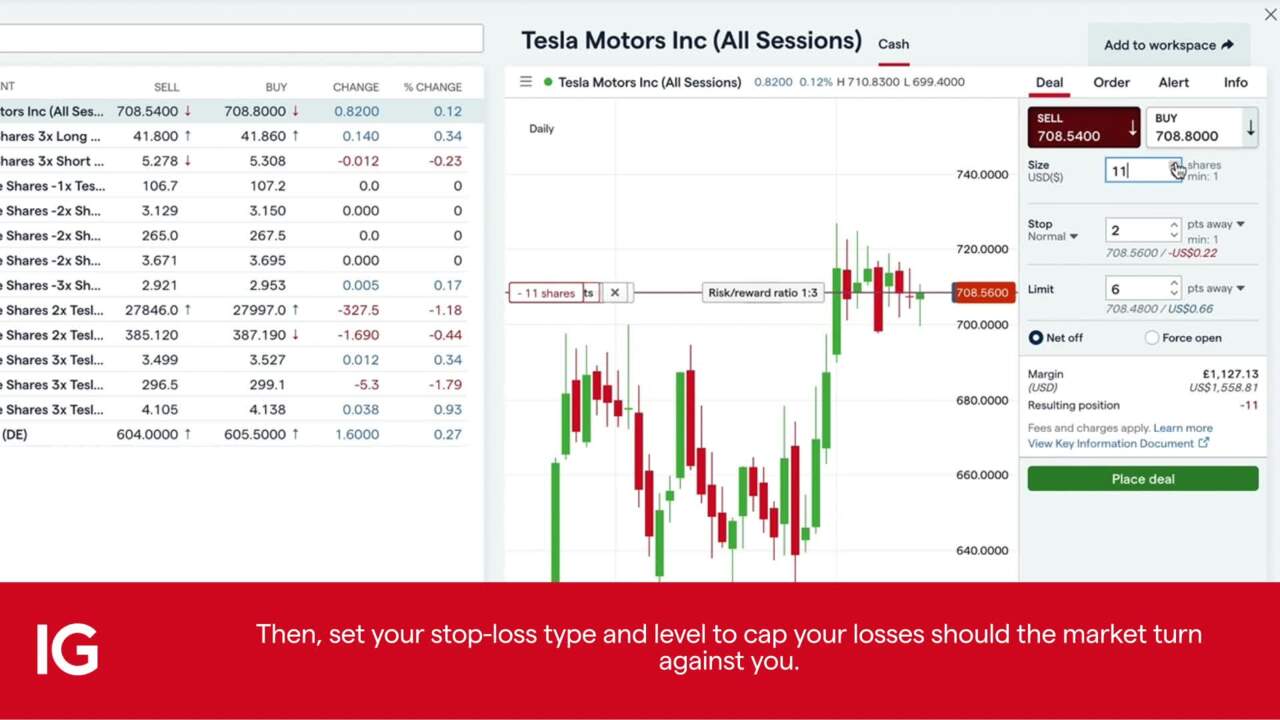

Open your first shares spread bet

You can open your first position once you’ve made your choice on the stock you want to speculate on. A spread betting account lets you choose the currency you want to trade as well as set your position size.

Our platform enables you to observe trade suggestions using trading signals. You can also set up trading alerts that’ll notify you when market events change so that you won’t miss any opportunity.

Remember that you’re responsible for your trades, therefore it’s prudent not to rely solely on alerts but keep an eye on your positions. Also note that signals are provided by third parties and used at your own risk.

Monitor your position

Once your position has been opened on our platform, it’s important to keep an eye on how the market moves. You can do so by keeping up to date with current economic events or changes in the industry on our financial market news page.

You can apply stop order or a limit order on your open trade to help mitigate your exposure to risk. It’s important to remember that market can move very quickly against your position and setting a stop order may not guarantee that your trade may be triggered at the level you set. You have to account for possible slippage on your trade.

FAQs

How can I start spread betting on shares?

You can start spread betting on shares in a risk-free environment by opening a demo account with us. You’ll be credited with £10,000 virtual funds to enable you to practise different trading strategies.

You can expand your knowledge on financial markets by going through IG Academy to supplement your familiarity on spread betting on shares. You can open a live account once you’ve built up enough confidence to spread bet on shares in a real-life environment.

Do you own shares when spread betting?

No, you don’t own shares when spread betting. You can only speculate on price movements of shares. If you want to take ownership of company stocks, you could consider opening a share dealing account.

Do you pay tax when spread betting on stocks?

No, because you don’t take ownership of the underlying asset, spread bets are completely tax free.1 There is no capital gains tax or stamp duty payable if you use spread bets to trade shares.

Try these next

Open a new account to place your first trade

Analyse charts of market movements from live trades for free

Learn how to trade 15,000+ markets with an online account

1 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK. Other fees may apply

2 Best trading platform as awarded at the ADVFN International Financial Awards 2021. Best trading app as awarded at the ADVFN International Financial Awards 2021.