CFD trading is one of many ways you can get exposure to share prices. Discover how to trade share CFDs in the UK and how to speculate on price changes in the stock market.

What’s on this page?

What are share CFDs?

Share CFDs are contracts between a broker and client, used when speculating on the price movement of shares in single or multiple companies. With CFDs (contracts for difference), you can get exposure to company shares without taking ownership of the assets outright. Instead, you trade CFDs by buying (going long) if you believe the share price will rise and selling (going short) if you thought it’ll fall.

Traders often use CFDs to speculate on price movements of different stocks because they’re free of stamp duty and you can offset any losses against profits for capital gains tax (CGT) purposes.1

Similarly to dealing (buying and owning) underlying shares, you’ll pay an opening and closing commission. This is in contrast to spread betting on shares, which is commission-free, making it a common alternative for traders opening multiple positions. Note that while there’s no commission for spread betting, there may be a wider spread. Spread betting is only available to UK clients.

Essentials of trading CFDs on shares

We’ve compiled a list of essentials that you need to know about trading share CFDs.

All share CFDs are traded using leverage

Since CFDs are derivative products, you’ll open your position for a small initial deposit, known as margin. This is called trading on leverage. When you trade share CFDs using leverage, you’d only pay a fraction of the full value of the position to open it. For example, let’s say you wanted to go long on 10 share CFDs at £100 each – you might only pay £200 to open the position (20% of the full value of £1000).

Your profit or loss depends on the difference in price from when you opened your position to when you close it. So, if you bought 10 share CFDs at £100, and the share price rose by £5 to £105, you’d make £50 (10 share CFDs x £5).

Note that leverage magnifies both profits and losses, as both are calculated based on the full value of the position, not just the initial deposit. You should always take steps to set a suitable risk management strategy and consider how much capital you can afford to put at risk.

You can go long or short with stock CFDs

To get exposure to the underlying asset, you’ll ‘buy’ (go long) if your trading strategy supports that the stocks will rise or ‘sell’ (go short) if you think it’ll fall. The outcome of your trade will be determined by the direction of the price movement – you’ll incur a loss if the market moves against you and make a profit if your prediction is correct.

You can hedge with share CFDs

Trading share CFDs enables you to hedge your position by going long and short on the same market with the intention of offsetting any losses from the initial position with gains from the other.

This practice is a useful risk management strategy when you discover that the market is moving against your initial prediction. That’s why CFDs are a great tool with which to hedge a shares investment portfolio. If you believe your shares may decline in value, you could open a short CFD position to hedge against losses.

It’s important to note that hedging doesn’t guarantee that no loss will be incurred, as it’s done at a cost of opening a new position and you may only recover a fraction of the losses. However, you may be able to offset any losses against profits for tax purposes.1

Share CFDs vs other ways to trade stocks

CFDs are not the only one way to trade shares. You can also choose to get exposure to shares via spread bets. Both CFDs and spread bets are leveraged derivative products, and you can open both accounts with us.

If you don’t want to trade using leverage, you can open a share dealing account instead to invest and take direct ownership of the asset. It’s important to remember that share dealing is non-leveraged, which means you’ll need to pay the full value of the position upfront.

Stock CFDs: cash vs options

Most people trade cash share CFDs. This uses the real-time trading price of stocks and has lower spreads, making it a popular choice for day traders. Stock options, on the other hand, give you the right to buy or sell shares at a specific date in the future. Options are often the vehicle of choice for traders with a medium- to long-term outlook.

How to trade share CFDs

Traders can choose from 11,000+ international shares that we offer on our platform. We’ve compiled a quick step-by-step guide to help you get started, from opening a trading account to closing a position.

Learn all about CFDs and share trading

CFD trading involves speculating on the underlying price of a financial asset by going long if you think the price will rise, or short if you think it’ll fall. You need to learn how to trade CFDs before you get exposure to different assets. Trading shares is different from investing in them and owning a stake in a company.

Open and fund your live CFD trading account

We offer 11,000+ shares to trade, plus out-of-hours trading, all on the UK’s award-winning platform.2 You can open an account by filling in an online form , and you can deposit funds into your account whenever you’re ready. You can use any bank card, or bank account that’s registered in your name. With us, there’s no minimum deposit for a bank transfer, however, you’d need at least £250 using credit, or debit card.

Choose the stock you want to trade

Get exposure to some of the most popular stocks to watch this year, from UK shares like Lloyds Banking Group and Vodafone Group to top performing US stocks such as Tesla, Uber and Twitter.

Open your first shares trade

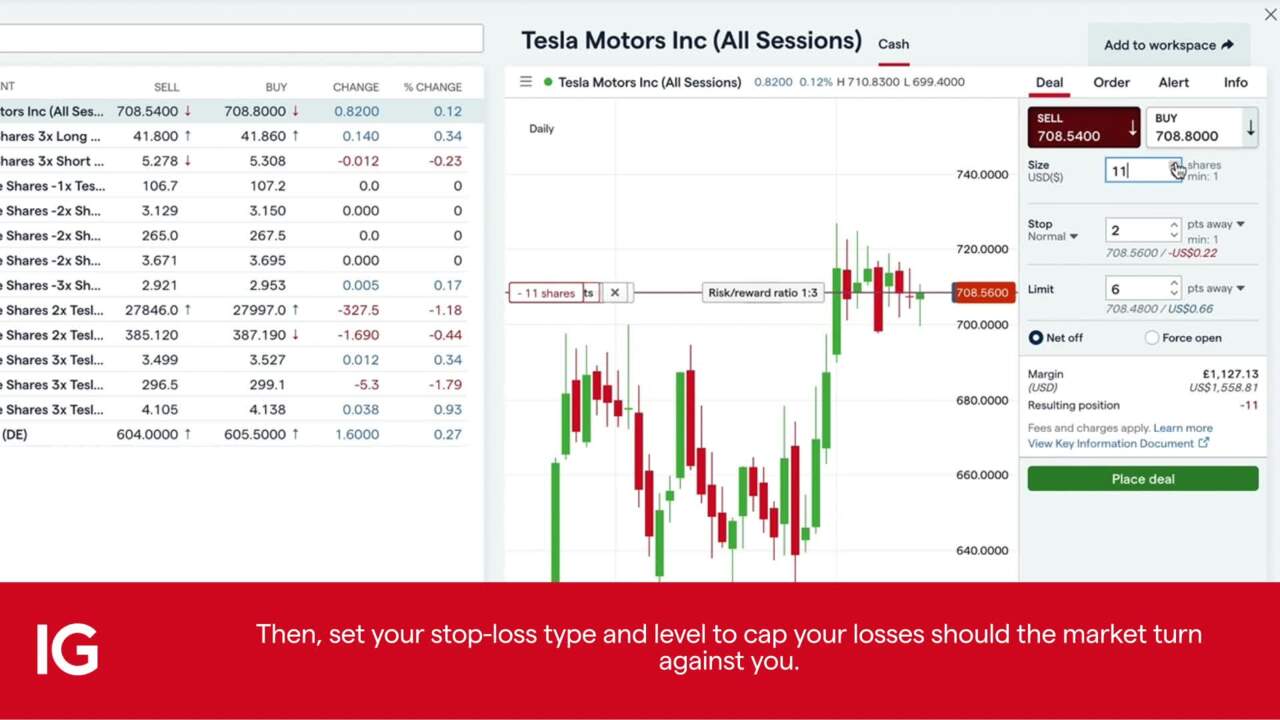

Open your position either by going long or short, based on your trading strategy and risk appetite. You should assess the merits of your trade based on the necessary technical analysis and fundamental analysis before you open your position.

On our platform, you can track trading signals and set up alerts to notify you when there’s market movement in order to reconsider your strategy. It’s important to remember that it’s your responsibility to track your positions and you shouldn’t only rely on alerts.

Monitor your position

Once your position is open, you can track how the market moves by observing economic events or technical conditions.

You can also monitor signals to observe when a certain point is reached and attach stops to your positions to help mitigate your exposure to risk.

Note that even if you set a stop order, there may be sudden movement in the market price that may meant that the trade may not be closed in time and the stop may not be triggered at the level at which it was set. This is called slippage.

FAQs

How can I start to trade share CFDs?

You can start trading share CFDs by creating a demo account to practise in a risk-free environment where you’ll speculate on price movement of stocks using virtual funds.

We provide a comprehensive guide on stock CFDs on IG Academy for you to familiarise yourself with share CFD trading. Once you’ve built up your confidence on the subject matter, you can open a live account to get exposure to different share CFDs on our platform.

Do you own shares when you trade with CFDs?

No, you don’t own shares when you trade CFDs – you only speculate on the share price rising or falling. If you want ownership of stocks, consider creating a share dealing account to invest in 10,000+ shares, funds, and investment trusts.

Do you have tax benefits when you trade share CFDs?

CFDs are free from stamp duty, but you may pay capital gains on your profits. When trading CFDs, your losses can be offset against your profits for capital gains tax purposes. It’s important to note that not all individuals will receive tax benefits – it depends on your tax jurisdiction and personal circumstances.1

Try these next

Take a position on 11,000+ shares with us

Discover how to trade on and invest in themes

Get exposure to the UK equity market via ETFs and funds

1 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK. When trading CFDs, you don’t have to pay stamp duty, but you will be liable for capital gains tax (CGT). When you spread bet, you don’t incur stamp duty and any profits are exempt from capital gains tax.

2 Best trading platform as awarded at the ADVFN International Financial Awards 2021. Best trading app as awarded at the ADVFN International Financial Awards 2021.