What are oil options?

Oil options are contracts that grant the holder the right, but not the obligation, to buy or sell oil at a set price if it moves beyond that price within a set timeframe.

A call option grants you the right, but not the obligation, to buy the underlying asset at a predetermined price – referred to as the ‘strike’ – or on set expiry date.

When buying a call option, you have the right, but not the obligation, to buy oil at the strike price at or before the set expiry date. For this right, you’ll pay a premium.

When selling call option, you have the obligation to sell oil at the strike price at or before before the set expiry date if being exercised against. For taking this obligation, you’ll receive a premium.

Alternatively, a put option grants you the right, but not the obligation, to sell oil at the strike price at or before a set expiry date.

When buying a put option, you have the right to sell oil at the strike price at or before the set expiry. For this right, you’ll pay a premium.

When selling a put option, you have the obligation to buy oil at the strike price at or before the set expiry if being exercised against. For taking on this obligation, you’ll receive a premium.

Depending on your trading strategy, you’ll use these methods to get exposure to oil markets by taking a long or short position.

For example, if you expect the price of brent crude oil to rise from $100 to $110 a barrel, you can buy a 1-month call option with a strike of $105, which grants you the right to buy oil at $105 at any time before expiry.

If oil rallies beyond $105, you’ll be able to buy the asset at a lower price. Conversely, if it remains below the strike price of $105, you are not obligated to exercise the option and can let it expire worthless. In this case, you’ll incur a loss of the premium you paid to open your position.

With us, you can trade options on crude oil using derivatives such as CFDs. This means there is no phyiscal exchange of premiums or worry of taking delivery of the underlying asset. Instead, you can simply post margin and speculate the price action of oil options which are all cash-settled.

CFDs give you access to leveraged trading, which enables you to speculate on oil prices rising or falling by using just a fraction of the full value of the position as a deposit. However, not only will your profits be amplified, but so will your losses. You’ll need to take the necessary steps to manage your risk.

Alternatively, you could also take a position on oil futures and the spot oil price (cash market). With oil futures, you’ll enter into a contract to buy the underlying asset at a predetermined price, on a set date.

If you want to buy or sell oil immediately instead of at a future date, you’d opt for the cash market. There, you can trade oil at spot prices that represent how much the underlying asset is worth right now.

Get started trading crude oil options with us by opening a live account.

Why trade options on oil?

- Options are leveraged products. When buying an options contract, you’re essentially gaining exposure to the full value of the market for a premium that’s a fraction of your total exposure.

- When buying an options contract, you set your own level of leverage and maximum risk when choosing the premium you’re willing to pay. For retail clients, a margin benchmark is applicable

- Options on oil can be used to hedge against losses in an existing portfolio. For example, you can buy a put if you expect the value of your shares in an oil producing company to decrease

Ways to trade oil options in Australia

There are different ways to take a position on crude oil options. Here we explain taking a position via CFD trading and via a broker. The example is for comparison purposes only.

CFD trading

Trading through a broker

1. Trade oil options with CFDs

When you trade oil options with CFDs, your prediction mirrors the underlying options market. CFD options are traded in contracts that are worth a selected amount. You can trade fractions of a contract to give you complete control over your deal size.

For example, if you buy a CFD on a call option worth $10 per point, the number of contracts you buy will multiply that amount. So, if you bought five contracts, you’d earn $50 per point the call option’s price moves beyond the strike, minus your margin.

All CFD trades are cash settled, so you never have to deliver, or take delivery of, physical barrels of oil.

2. Trade oil options with a broker

Like oil futures, listed oil options are traded on registered exchanges. You have to meet certain requirements to buy and sell options directly on an exchange, so most retail traders will do so via a broker – which are limited in number.

When you trade with an options broker, you deal on their platform – usually paying commission on each trade – and they execute the order on the actual exchange on your behalf.

With an exchange, if you decide to exercise your options, they’ll be converted to oil futures contracts, which may require physical settlement. By comparison, CFDs are always immediately cash-settled.

1. Understand how oil options work

Options are complex instruments. Before trading with options, ensure that you understand how they work, how they’re priced, and all risks involved.

Find out more about options and see the difference between options and futures.

2. Learn what moves option prices

The value of an options contract will typically fluctuate during its lifespan, depending on the price of its underlying asset, the time left until expiry, and the implied volatility of the market. Other variables like interest rates also influence the option value.

3. Choose to trade using CFDs

With CFDs, you enter into an OTC agreement to exchange the difference in the price of an underlying asset, tracked from the time the contract is opened until it’s closed.

CFDs allow you to speculate on the price action of an underlying asset without ever taking ownership of it.

4. Create a trading account

Applying for a live account takes just minutes. You’ll fill in an online form and once the application is complete, you’ll receive a notification when it’s accepted. Note that there’s no obligation to fund your account once opened, and you can wait until you’re ready to place your first trade.

With us, you can get exposure to 17,000 markets, including shares, forex, commodities, cryptocurrencies and more. We offer competitive spreads and provide opportunities for you to trade what you want, when you want, on an award-winning platform.1

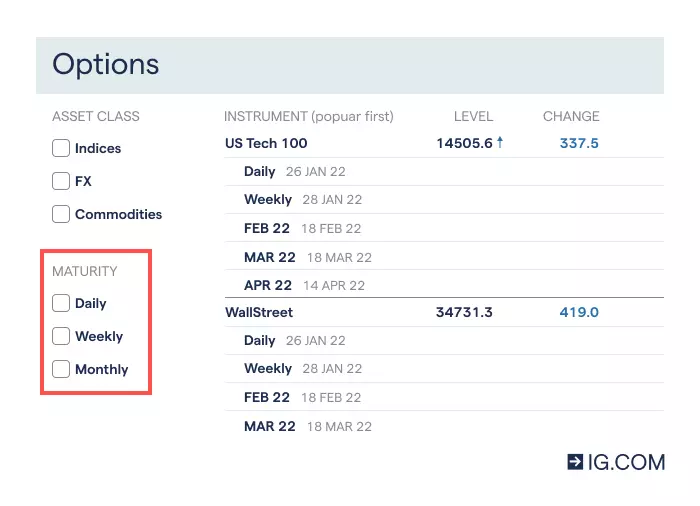

5. Determine your preferred expiry

Longer dated options hold more time value, which results in higher premiums. Knowing how long you want to hold an option for is a fundamental aspect of options trading. This is especially important because the time value of an option decays more quickly as it nears expiry – thereby dropping the premium at an increased pace.

Learn more about daily, weekly and monthly options trading

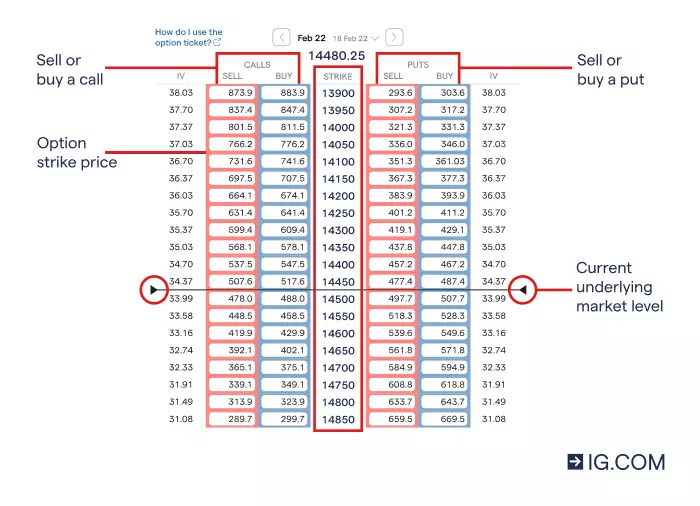

6. Decide whether to buy or sell calls or puts

You can go long in two ways – buy a call or sell a put. Likewise, you can go short in two ways – buy a put or sell a call. Each has its own advantages and risk profile. It’s important that your prediction is supported by sound research, such as technical and fundamental analysis.

You should also ensure you take steps to manage your risk effectively.

7. Open and monitor your position

Once you’re on the platform, select a market you want to get exposure to. Set the timeframe, choosing between daily, weekly and monthly options trading. Then, open a deal ticket and decide between buying or selling a put or call option.

Then, select your strike price, your position size, and place your trade. When your position is opened, you’ll be responsible for monitoring the movement of your trade. Remember to set risk management tools to mitigate losses.

Try these next

Explore future contracts used for buying and selling oil at a later date

Choose from a range of commodities to trade

Learn how to get started with gold trading and investing

1 Best Finance App, Best Multi-Platform Provider, Best Platform for the Active Trader and Best Online Stockbroker as awarded at the ADVFN International Financial Awards 2025.