Learn how you could profit from market volatility following Brexit – and hedge your share portfolio and exposure to sterling – with the UK’s No. 1 provider.1

Tips for trading Brexit

Tips for trading Brexit

Set price-change alerts to notify you of significant movements

Cap your maximum risk by placing guaranteed stops on your positions

Consider hedging your share portfolio or GBP exposure with tax-free spread bets2

Be ready to go long or short whenever opportunities arise, even at the weekend

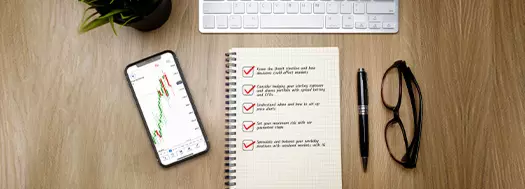

Download our Brexit trading tips, explaining how to:

Why trade Brexit with us?

Deal GBP/USD from just 0.9 points

Go long or short on a range of currency pairs including all major GBP, EUR and USD crosses

Free risk protection

Our guaranteed stops only incur a fee when triggered,3 and are backed thanks to UK regulation by negative balance protection4

Trade exclusive weekend markets

Speculate or hedge 24/7,5 with the only UK provider to offer weekend trading on GBP/USD and the FTSE 100. We also offer EUR/USD and USP/JPY

Choose from a range of price alerts

Stay informed of market movements with percentage and point-based price alerts - exclusive to IG

How to trade Brexit

You can speculate on any Brexit news and the future relationship between the UK and EU or developments by trading financial markets such as shares, forex pairs and indices. The FTSE 100, UK stocks, GBP/USD and gold all likely to experience some movement if relations strengthen or sour in the coming years.

Spread bets and CFDs enable you to speculate on an asset’s price without taking direct ownership. Instead, you’ll take a position on whether you think the price will rise or fall by going long or short. The size of your position and the accuracy of your prediction will determine your profit or loss.

How will Brexit affect GBP?

As the UK and EU were able to secure a deal, stability might be expected to return at least partially to the EUR/GBP currency pair. The deciding factor in the strength or weakness of GBP against EUR in 2021 will undoubtedly be the coronavirus pandemic and how effective the British government is in dealing with it.

For the GBP/USD pair, there were a series of lower highs at the start of January 2021 – indicating USD was strengthening against the GBP, albeit at a slow pace. Possible reasons include the at-the-time upcoming inauguration of Joe Biden as president on 20 January 2021.

How do I hedge Brexit risk?

You can hedge your Brexit risk by opening positions that will turn a profit if the assets you own start to lose money. When you trade with us, you can hedge against:

Weekend movements

We’re the only provider to offer GBP/USD and the FTSE 100 on the weekend, so you can offset your risk whenever volatility arises

Share portfolio risk

We enable you to go short on major indices and over 12,000+ shares, so you can protect your entire portfolio from downside risk

Sterling volatility

We offer forex pairs including GBP/USD, EUR/GBP and GBP/EUR, enabling you to insulate yourself from currency risk

Use our platform tools to stay ahead

Guaranteed stops

Take control with free guaranteed stops, which only incur a fee when triggered3

Price alerts

Set alerts with the only provider to offer percentage and point-based monitoring

Indicators

Stay ahead of volatility with indicators including average true range and Bollinger bands

Open an account today

*Demo accounts are only available for spread betting and CFD trading.

Open an account today

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

*Demo accounts are only available for spread betting and CFD trading.

Open an account today

Open an account today

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

Post-Brexit markets to watch

The table below shows live prices for some of the markets to watch now that the UK has left the EU.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

How will Brexit affect the FTSE 100 and UK shares?

- Indices

- Shares

How will Brexit affect the UK stock market?

The continued impact of Brexit on the UK stock market largely depends on the effectiveness of the trade deal between the UK and EU. Plus, expanding trading relationships with countries outside of the EU – a key talking point of Brexit – could also impact UK indices like the FTSE 100 and FTSE 250.

Get the latest Brexit news

FAQs

Can you make money from Brexit?

You can make money from Brexit even though the process has formally concluded. But, as with all trading, there is a degree of risk in attempting to make money from Brexit – and you should be aware that you could also incur a loss.

Spread bets and CFDs are derivative products that are popular with traders looking to speculate on any underlying market volatility because they enable you to go long or short without taking ownership of any underlying assets.

How can I stay up to date with Brexit's impact on the financial markets?

You can stay up to date with Brexit’s impact on the financial markets through our comprehensive collection of Brexit news, alerts and trade ideas. We also offer live market updates and opinions, an in-platform newsfeed, as well as subscription-based newsletters for the coming week’s trading insights.

Find out more about IG’s news offering

Create an account

Take a position on how Brexit is affecting the FTSE and the pound.

*Demo accounts are only available for spread betting and CFD trading.

Create an account

Take a position on how Brexit is affecting the FTSE and the pound.

*Demo accounts are only available for spread betting and CFD trading.

Create an account

Take a position on how Brexit is affecting the FTSE and the pound.

Create an account

Take a position on how Brexit is affecting the FTSE and the pound.

You might be interested in…

Discover our award-winning web-based platform and natively-designed apps for tablet and mobile

Catch up on latest analysis and insights from our in-house experts.

Learn how to trade the reaction to Brexit across 90 currency pairs

1 Based on revenue (published financial statements, 2023); for forex based on number of primary relationships with FX traders (Investment Trends UK Leveraged Trading Report released July 2024).

2

Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

3 A small premium is payable if a guaranteed stop is triggered.

4 Negative balance protection is a regulatory requirement of all providers and not a product of IG. It’s important to note that negative balance protection applies to trading-related debt only, and is not available to professional traders.

5 Trading is available around the clock, apart from 10pm Friday to 8am Saturday and 20 minutes just before market open on Sunday.