Take advantage of price movements caused by results announcements. Go long or short on the hottest stocks of earnings season with us, including 70 key companies that you can trade out of hours.

Tips for trading earnings season

Tips for trading earnings season

Research the markets and review analyst estimates on given stocks

Monitor your position and set price-change alerts to notify you of any major market movements

Seize opportunities whenever they occur with our 24/5 trading

Develop a risk management strategy to help minimise your losses

What to watch this earnings season

Fourth quarter (Q4) earnings are set to kick off in January with behemoths such as JP Morgan and Wells Fargo reporting early on this earnings season.

For Q4 2024, the estimated (year-on-year) earnings growth rate for the S&P 500 is 11.9%. If this materialises, it will mark the highest (year-on-year) earnings growth reported by the index since Q4 2021.

Use our earnings calendar below to keep an eye out for company earnings’ during this hotly anticipated earnings season.

Earnings season report calendar: key events

Take a look at some of the most anticipated earnings announcements in the table below. You can also keep track of upcoming earnings by using the watchlist on our trading platform.

Breaking news and analysis

Get updates before and after company earnings from our in-house market experts.

-

BP full-year earnings: Can the energy giant balance transition with cash generation?

2026-02-06T12:22:36+0000

Earnings season stocks to watch

- Inflation-beating stocks

- Tech stocks

Although in the UK inflation remains high, it is cooling. That said, its anticipated figure of 5% by the end of the year is significantly above the Bank of England's target of 2%, a percentage they’re not expected to reach until 2025.

Inflation is also coming down in the US and there's an expectation that the Federal Reserve (Fed) will pause interest rate rises later this month with the view of raising them further in the months to come if inflation fails to decrease.

In this high inflationary environment, the spotlight is on inflation-beating stocks for earnings season. Also called ‘defensive stocks’, these are companies known to provide progressive dividends and able to weather inflation.

Here are some defensive stocks to watch, which have inflation-beating reputations.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Whilst tech stocks generally don’t perform well during periods of high inflation, the recent hype around AI has bucked this trend and they continue to succeed despite the inflationary environment.

Companies such as NVDIA and AMD who create the chips needed to implement AI have seen a significant increase in their share price since the beginning of the hype.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Earnings season report calendar: key events

Take a look at some of the most anticipated earnings announcements in the table below. You can also keep track of upcoming earnings by using the watchlist on our trading platform.

What is an earnings season?

An earnings season is a quarterly period in which most public companies release their earnings reports. With these financial results releases instrumental in companies’ share prices, many traders and investors look forward to earnings season as a highlight on the calendar.

Quarterly reports are mandatory in the US. However, a large majority of companies from other countries, like UK, choose to participate in earnings seasons due to the increasingly multinational nature of many sectors.

- When is earnings season

- Why is earnings season important

- Ways to trade earnings seasons

- What is an earnings report and call

- How to trade earnings reports

Earnings seasons occur four times a year and fall in the months of January to February, April to May, July and September to November. These are usually a couple of weeks after the final month of each financial quarter (end of December, March, June and August).

Although it’s not uncommon for companies to report outside of earnings seasons, large companies’ releases tend to fall within a few weeks of each other, leading to four discernible ‘seasons’ every year.

For more specific details, you can look at our earnings calendar to find out the exact date of a company’s earnings announcement.

Earnings announcements are released outside of market hours so that the reports reach as many people as possible and don’t interrupt the trading day. While this usually means you can’t take a position immediately, with us you can trade over 70 US stocks out of hours.

Earnings season gives insights into the outlook of a company and can help you to determine whether to take a position on the stock.

This is why earnings releases are usually accompanied by volatility in a company’s share price, because market sentiment is adjusting to the reports. Even more volatility is expected once CEOs have provided more information in earnings calls.

Market analysts will form estimates of whether a company’s earnings will rise or fall, which can change as it gets closer to the official announcement. If the actual numbers are above analysts’ expectations, the market could rise. But if the figures are below expectations, it’s likely that the market will fall.

It’s worth noting that this isn’t always the case. Sometimes, the market can move in the complete opposite direction – rising when the expectations aren’t met and falling when the earnings exceed expectations.

It’s also important to look at a company’s historical figures for predicted and actual earnings and how the market responded to the reports. This could help you form an educated guess as to how volatility might play out. But be aware that past performance is not a guarantee of future results.

When analysts’ expectations of a company’s earnings per share are in line with pre-released earnings guidance for that quarter, there tends to be little volatility. Just remember, the opposite is also true.

Take a position with spread bets and CFDs

Trade both rising and falling markets with these derivative products. Spread bets and CFDs are also leveraged, so you can open a position for less – just remember, leverage comes with increased risk as your total loss as well as profit is determined by your full position size and can exceed your margin amount.

Find out more about spread bets and CFDs.

Invest via our share dealing service

Take ownership of the shares, paying the full value of the position outright and profiting if they increase in price. You’ll get voting rights and receive dividends if they are paid.

Plus, deal shares commission-free

Find out more about our share dealing service.

Other fees may apply. See our costs and fees.

An earnings report is a document given to shareholders and analysts that details items such as net income, earnings per share (EPS) and net sales.

An earnings call is a conference between the management of a company, analysts, investors and the media to discuss the outcome of an earnings report. This is a chance for questions to be asked about the main details of the reports.

Depending on when a company holds its earnings call, you can use the information to inform their decisions. However, not all companies hold earnings calls, and some will not fall within the earnings period.

- Choose which companies to focus on

It’s impossible to cover every company, so just stick to a few of your favourites. - Do your research and look at analysis

Find out when each company is due to report its earnings, see what analysts expectations are and how the share price normally responds. - Create a trading strategy and stick to it

Choose your goals, methodology for entering and exiting trades, and how you will manage your risk. - Open a trading account and take your first position

You can monitor your trade easily on our platform, or set price alerts to let you know when your targets are met. - Learn from each earnings season

Once you decide to close your trade, it’s important to review your results and perform post-analysis to prepare you for the next earnings season.

Why trade earnings season with us?

Take a position on all session US shares

Trade on announcements with 70+ out-of-hours US stocks

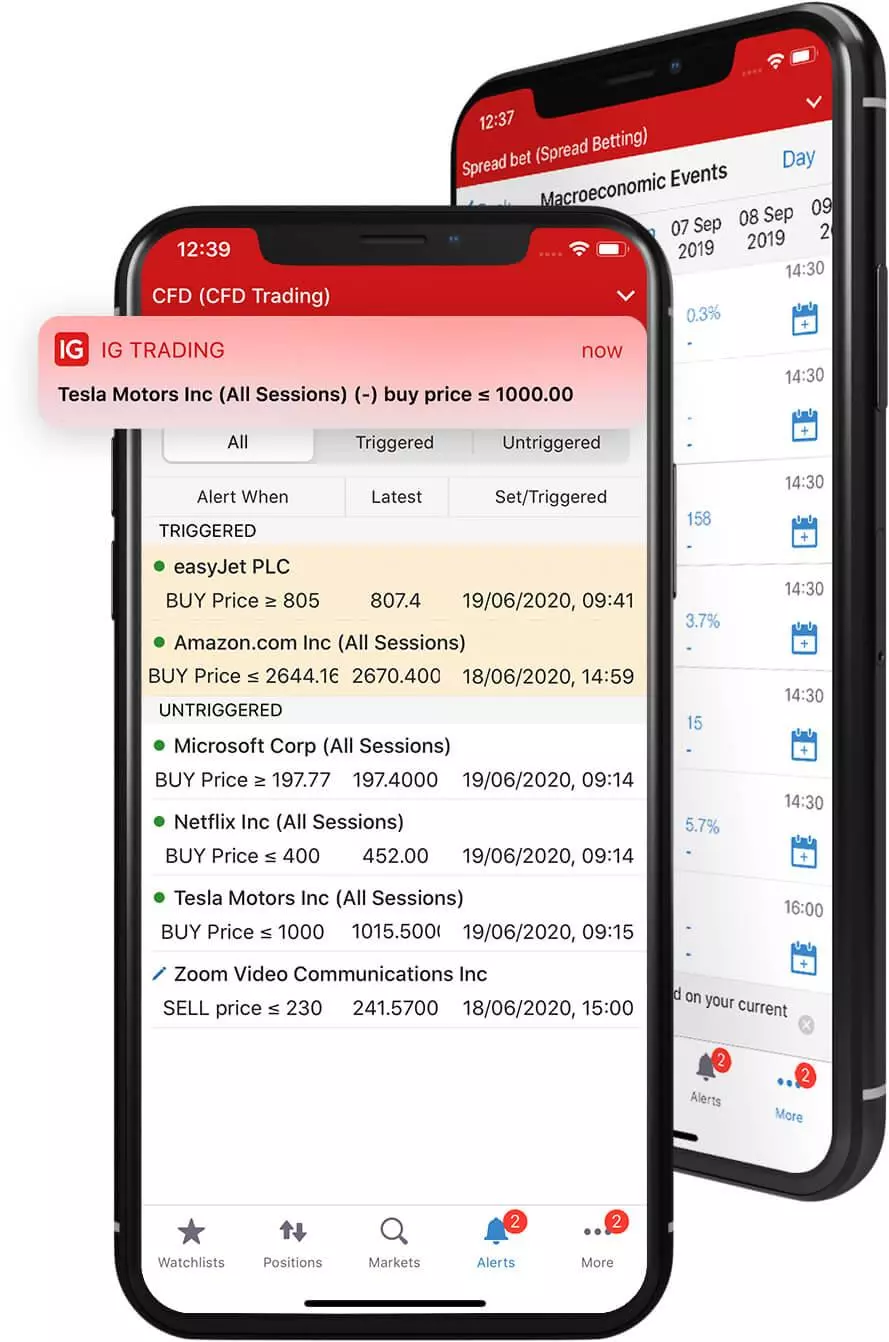

Keep your finger on the pulse

React to breaking news with custom alerts sent by text, email or push notification

Go long or short on a huge range of global stocks

Take advantage of rising and falling prices with CFDs

Stay up to date with expert analysis

Inform your trades with regular insights from our in-house team

Invest in shares commission free*

*Other fees may apply

Get an interactive education

Learn about financial markets and trading with IG Academy’s online courses

Open an account now

*Demo accounts are only available for spread betting and CFD trading.

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

*Demo accounts are only available for spread betting and CFD trading.

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

Keep up to date on earnings reports

Set trading alerts

Never miss out on market movements with our free automated trading alerts.

- Price alerts. Get notified when a market moves by a certain percentage or amount in points

- Technical indicator alerts. Use popular indicators to signal your ideal market conditions

- Economic alerts. Just select your chosen event in our economic calendar to receive an alert

Compare our costs

Buy 17 Tesla shares at $516 with a FX rate of 1.181 (GBP/USD).

Please note, when you buy and sell shares with spread bets and CFDs, you will only be speculating on the underlying market price – not taking ownership of the shares.

You’ll also be charged a currency conversion fee when you trade/ invest in a share which is a different currency from your account’s base currency.

| Spread betting | CFD trading | Share dealing | |

| Cost to open US shares | Spread | $15 | None if you’ve already traded 3+ times in the previous calendar month, otherwise £10 |

| Cost to open UK shares | Spread | £10 | £3 if you’ve already traded 3+ times in the previous calendar month, otherwise £8 |

| Overnight funding | nights held x (market closing price x trade size x (relevant interest rate benchmark * +/- 2.5%)) / 365 | nights held x (market closing price x trade size x (relevant interest rate benchmark * +/- 2.5%)) / 365. | None |

| Currency conversion charge** | Yes | Yes | Yes |

* If you’re long, you pay relevant interest rate benchmark. If you’re short, you receive it.

** When you trade/invest in a currency other than your account’s base currency.

This information is correct as of 03/01/2024 and with the corresponding FX conversion rates.

Trade earnings season on our web platform and app

Seize your next opportunity with one-click dealing, clear price charts, and in-platform news and analysis.

- Web-based platform

- Mobile trading app

Seize your next opportunity with one-click dealing, clear price charts, and in-platform news and analysis.

Take a position wherever you are, and receive trading alerts and signals on the go.

Try these next

Trade or invest in over 12,000+ international shares

Take advantage of rapid market movements and manage your risk

Speculate on rising and falling financial markets with the UK’s No.1 provider2

1 Other fees may apply

2 Based on revenue (published financial statements, 2023).