Is a Labour ‘Supermajority’ ahead, and what does it mean for markets?

The Labour Party seem to be on course for a resounding victory in the UK general election, but how will markets react to such dominance of the UK Parliament?

As the United Kingdom approaches its next general election, the Labour Party, led by Sir Keir Starmer, is showing a strong lead in the polls. Some analysts are even predicting a potential ‘supermajority’ (i.e. a huge lead over their rivals, the Conservative Party) for Labour, a scenario that has sparked discussions about its implications for the country's financial markets and investment landscape.

Markets prefer stability to uncertainty

Despite the magnitude of such a political shift, financial experts suggest that a Labour supermajority is unlikely to cause significant market disruption. This is primarily because the possibility has been anticipated for some time, allowing markets to gradually adjust to the prospect. In fact, market analysts argue that an unexpected outcome, such as a hung parliament or a coalition government, would be more likely to unsettle investors and create market volatility.

Some unexpected help has appeared for Labour in the form of the surprise French elections. Over the other side of the English Channel, investors are faced with political instability as President Macron’s party’s control of the National Assembly is about to give way to large blocs of Far Left and Far Right members. This could result in significant political turmoil, and investors have already begun to react, driving the CAC40 lower and selling French government bonds.

History suggest investors should remain calm

Historical data provides some reassurance for investors. Markets have typically performed well under governments with strong majorities, regardless of their political leaning. This trend suggests that political stability, rather than party ideology, often has a positive influence on market performance.

However, it's crucial to note that other economic factors, particularly inflation, tend to have a more significant impact on market performance than the size of a government's majority. Investors are therefore advised to focus on their long-term financial goals rather than being swayed by short-term political changes.

What sectors might benefit?

Looking ahead, certain sectors could potentially benefit from Labour's proposed policies. Construction, renewable infrastructure, and UK-based investments may see increased attention and support under a Labour government. Additionally, Labour's approach to Brexit, which includes the possibility of closer ties with the European Union, could positively impact some company valuations, particularly those with significant European operations or trade dependencies.

Nevertheless, there are potential areas of concern for investors. Labour's regulatory approach and possible interventionist economic policies could create challenges in certain sectors. Investors will need to carefully monitor policy developments and their potential impacts on different industries.

Labour's stance on Brexit and its potential implications for trade relationships could also have far-reaching effects on the UK economy and specific sectors. While closer ties with the EU might benefit some businesses, it could also lead to regulatory changes that companies would need to adapt to.

Read more of our UK election content:

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

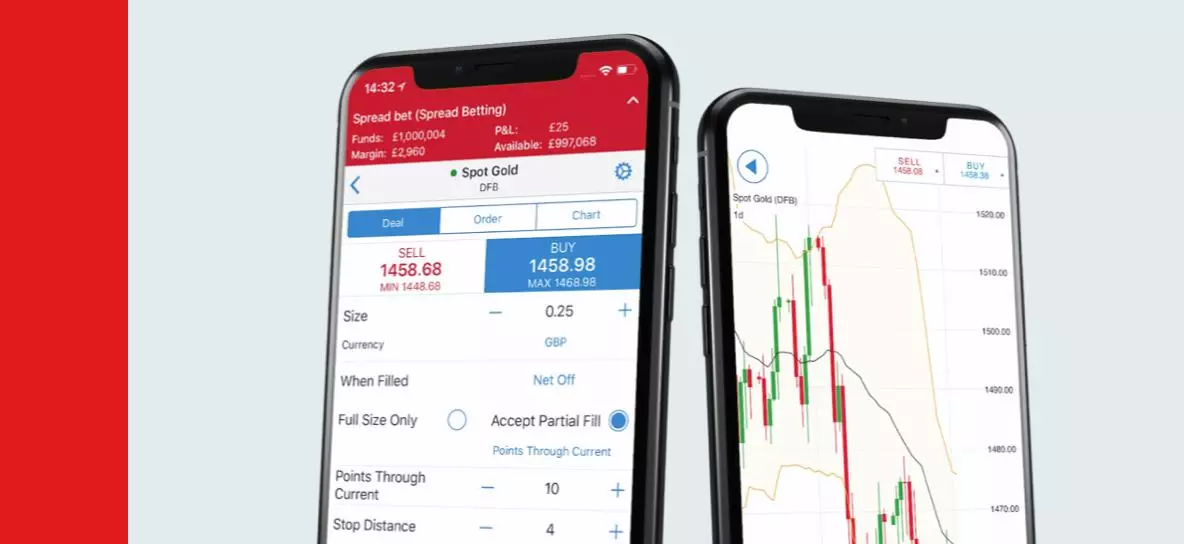

See your opportunity?

Seize it now. Trade over 15,000+ markets on our award-winning platform, with low spreads on indices, shares, commodities and more.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.