The huge fluctuations in the global supply and demand of oil makes this market quite volatile and popular to trade. Discover what oil spread betting is and how to trade this commodity using the UK’s No.1 online trading provider.1

What’s on this page?

What is oil spread betting?

Oil spread betting is the act of speculating on the price of the underlying market (oil) by betting an amount of money per point of movement. Spread betting enables you to get exposure to the oil market without having to buy and own the commodity. You can either go long (‘buy’) if you think the oil price will rise, or short (‘sell’) If you think it’ll fall.

When you spread bet on oil, you only pay our spread and not commissions. And, unlike CFDs, you won't be liable to pay capital gains tax.2

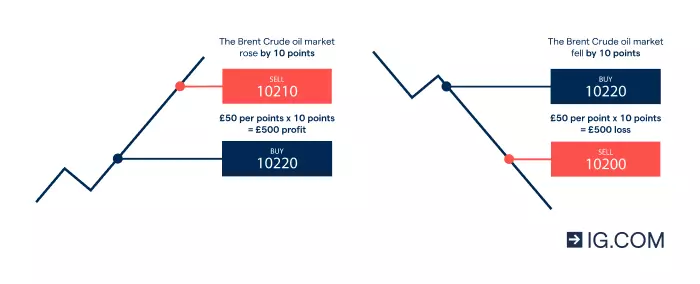

Let’s say you believe there’d be an increase in the oil market price and then decide to spread bet on Brent Crude oil. Your expectation is that the oil price will rise above 10,250 per barrel in the coming days. You log into the platform, and you see that the buy price is 10,220 and the sell price is 10,210.

You then open a spread bet to go long on the market at £50 per point of movement. Note that every point of movement in the underlying oil market is now worth £50 to you, so if the oil market price increases by 10 points to 10,230, you’ll make £500 (£50 x 20 points) in profit. If the oil market price falls by 10 points to 10,210, you’ll make a loss of £500 (£50 x 10 points).

Oil and spread betting: the essentials

1. Spread betting is leveraged

Spread bets are a leveraged derivative product, which means you only use a deposit (margin) to open your position. While this could decrease your price of entry, it amplifies both profit and losses.

When you open a position using leverage, you still get exposure to the full value of the position. For example, if the trade is worth £5000, you may only have to put down £500 to open it (depending on the margin rate), but your profit or loss will be based on the full £5000. Be sure to manage your risk carefully.

2. You can go long or short with oil spread bets

When you spread bet on oil, you speculate on the price movement of the asset. You’ll go long (‘buy’) if you believe the oil price will increase and go short (‘sell’) if you think it’ll fall.

3. Oil spread betting is commission-free

You won’t pay a commission when you spread bet on the oil market with us. The only charge is the spread and the overnight fees that apply only when you trade on the ‘undated’ spot market. Spread bets are also tax free.2

4. You can control your position size with oil spread bets

When you spread bet oil, you can control the size of your position. You can open your oil spread bet position at a minimum trade size of 50p per point of movement. Oil CFDs have a pre-determined contract value, whereas with spread bets you can choose your bet size. This means that the leverage ratio will be the same on spread bets and CFDs. Since you can bet 50p per point on spread bets, your deposit could be much lower than with an oil CFD, where the minimum contract size is £1.

5. Oil spread betting vs other trading alternatives

Spread betting is one way to trade oil markets. Another alternative is trading oil CFDs. The difference between spread bets and CFDs is the way in which they’re traded and how they work.

Spread betting stakes an amount of money per point of movement in the underlying asset. CFD trading, on the other hand, exchanges the difference in price from the point at which the contract is opened to when it’s closed.

Both spread bets and CFD trading accounts are leveraged products, meaning you’ll only need to pay margin to open a position that’ll increase your exposure to the oil market.

Remember that when trading with leverage, your profit or loss is calculated using the whole position size and not just margin. While leverage can amplify your profits, it will magnify your losses. Carefully manage your position by making use of our risk management tools.

Keep in mind that leveraged products are complex, so ensure you understand how they work before you start trading them. Also determine if you can afford to risk losing your money.

If you don’t want to trade with leverage, you can invest and own oil exchange traded funds (ETFs) or stocks through share dealing. Investing involves buying and holding the oil ETFs or stocks until they appreciate in price so you can sell them for a profit. Unlike spread betting, which uses leverage, you’ll have to pay the full value of your position upfront.

6. Spread betting on oil: undated (spot) vs futures vs options

Like most traders, you can spread bet on oil using the spot market – also known as the undated or cash market. This market uses the real-time trading price of oil and has lower spreads, making it an option favoured by day traders.

On the other hand, you can keep oil futures open for longer periods since they don’t have overnight fees, but note that they do come with larger spreads. Oil futures are financial contracts in which a buyer and a seller agree to trade a specified number of barrels of oil at a fixed price set for a future date. Contracts are cash settled, you don’t have to take possession of physical barrels of oil.

With us, you can speculate on the price of oil futures using spread bets and CFDs, which don’t require you to take ownership of the underlying asset.

Oil options give you the right to buy or sell the asset before the specified expiry date in the future. Unlike futures, with options you won’t have an obligation to buy or sell the oil market.

1. Learn all about spread betting and oil trading

When spread betting in this instance, oil trading will involve tracking the rise and fall of the market price of the underlying asset. With us, you don’t have to take ownership of the underlying oil market, meaning you won’t have to worry about taking delivery of the physical asset.

You can increase your knowledge on how to trade via spread bets by visiting IG Academy and enrolling for a course – for free.

2. Open and fund your live spread betting account

With us you can get access to over-the-counter trading using the UK’s best platform with spread bets on the oil spot market, futures and options.1 When you open a spread betting account with us, you can deposit any amount you want to and also make fast withdrawals without being charged penalty fees.

We’ve got deep liquidity and our platform offers fast execution with orders being filled on average in 0.014 seconds.3 We also offer 24/7 support via telephone, email and social media platforms like Twitter.

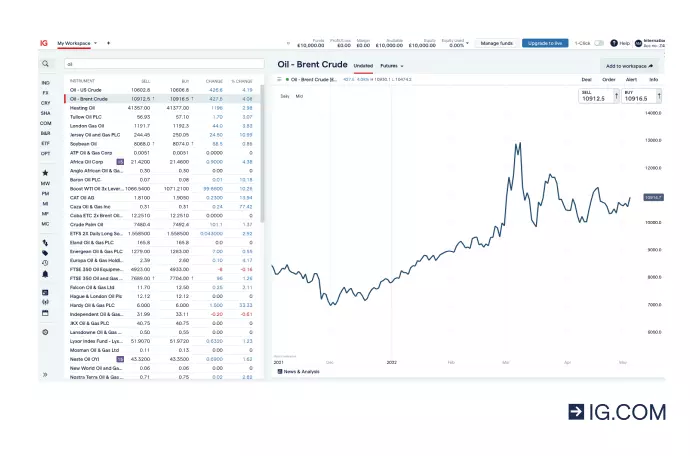

3. Choose the oil market you want to trade

Like most people interested in trading this commodity, you might decide to spread bet on two dominant oil markets – Brent Crude and West Texas Intermediary (WTI) known as US Crude. Brent crude is mined in oil fields in the European North Sea, while WTI is extracted in Texas, North America.

Brent crude is mostly used as an international benchmark when trading oil contracts, futures and derivatives, while North America does the same with WTI.

Note that the price between these oil markets will differ based on their property variation. Both oils are easy to be refined and processed by petrol producers due to their light nature.

4. Decide whether you want to spread bet on oil spot, futures or options markets

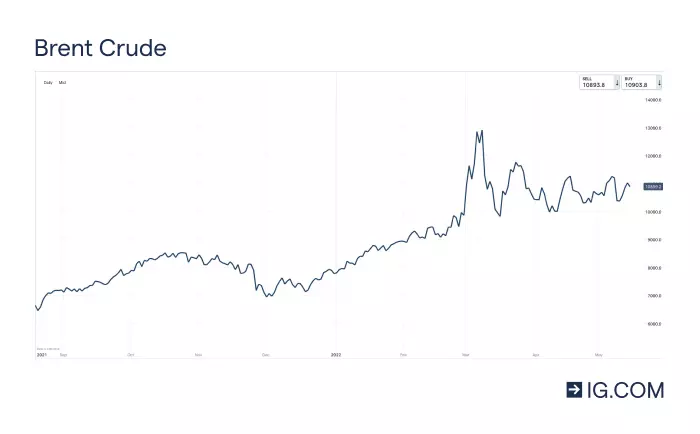

When trading the oil markets, you can choose whether to spread bet on the oil spot price, futures or options. Spread betting on the oil spot market is common among day traders since in offers low spreads. You can also take advantage of continuous or historical charting. Note that past performance does not guarantee future success.

If you don’t want overnight funding fees to apply, you could consider opening longer-term positions on the underlying oil market by trading futures or options.

5. Open your first oil spread bet

To open your first oil spread bet with us, open our platform and click on ‘Commodities’ in the top left toolbar and a list of financial instruments that fall within the sector will appear. Alternatively, you can search for oil and then choose the market you’d like to trade.

Once you’ve made your choice, open the deal ticket and buy or sell your chosen oil market. You’ll go long if you think the oil market price will rise and short if you believe it’ll fall.

On your deal ticket, you can set the size of the bet you'd like to place. This’ll determine the amount you’ll have to pay for the margin to get exposure to the underlying oil market.

You can get trading alerts when the oil market price moves certain percentages above or below your set level. Note that, while we’ll do our best to ensure you receive notifications when your set levels are met, it’s your responsibility to monitor your position. Remember to make use of our risk management tools.

You can set ‘sell’ trading signals by clicking on ‘Signals’ in the bottom left toolbar of our platform. This’ll open a list of markets with ‘buy’ and ‘sell’ suggestions based on emerging chart patterns and key levels that’ve been reached.4

It's important to do your own technical and fundamental analysis instead of solely relying on third-party generated chart patterns to make your trading decisions.

6. Monitor your position

Once you've opened your spread bet position, and set your trading signals and alerts, you should monitor your position. You’ll see your running profits and losses on the platform for the duration of the trade.

What affects the price of oil?

The demand and supply of oil, including various macroeconomic factors, are main drivers that affect the price of the commodity. Day traders often like to spread bet oil due to the market’s high volatility so that they can take advantage of increased fluctuations in the price movement. Here's what affects the price of oil:

- Limiting competition in the global supply of oil. Five countries generate about 50% of the world’s total oil production, giving them increased power and sovereignty to control the commodity’s global supply. Therefore, there’s a direct impact on the cost of oil, as the countries could reduce or increase production to manipulate prices

- Growing economies to drive global oil demand. Positive macroeconomic trends tend to increase global oil demand. Exponential growth of powerful global economies is likely to increase the price of oil. On the other hand, a weakening global economy decreases oil demand, thus suppressing its price

- Waging of geopolitical conflicts. When an oil-producing region goes through a war or conflict, this is likely to negatively impact the amount of black gold extracted. This’ll then increase the volatility of the oil market and its global price

Try these next

Seize the opportunity to trade on our easy-to-use platforms and apps

Watch market developments in real-time using charts generated by fast cutting-edge technology

Learn how to trade online and access key markets using our award-winning platform1

1 Best trading platform as awarded at the ADVFN International Financial Awards 2021. Best trading app as awarded at the ADVFN International Financial Awards 2021.

2 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK. Other fees may apply

3 Based on IG Group's OTC data for October 2019