Aggregate supply definition

What is aggregate supply?

Aggregate supply is the total value of goods or services in a market, sector or economy. Aggregate supply is used to show the amount of goods that can be produced at different price levels in a given time period – usually one year.

Visit our news and trade ideas section

Get the latest news and market analysis from our in-house experts.

Short-run aggregate supply and long-run aggregate supply

Aggregate supply can be split into short-run aggregate supply and long-run aggregate supply.

Short-run aggregate supply (SRAS) is the relationship between real gross domestic product (GDP) and current price levels. It shows the output an economy can manage in the short term at varying price levels.

SRAS assumes that capital levels are inflexible because of fixed costs such as wage contracts, rent agreements and regulated prices – to name a few.

Long-run aggregate supply (LRAS) refers to the theoretical output of an economy if it had a net unemployment of zero – meaning that its workforce is operating at maximum capacity.

LRAS states that aggregate supply is not determined by current price levels or by aggregate demand, but instead is determined by the factors of production including capital, labour and manufacturing technology.

Differences between SRAS and LRAS

The primary difference between SRAS and LRAS is the effect that aggregate demand has on each. In SRAS, capital is fixed, which mean any changes in aggregate demand will affect what a manufacturer can realistically produce in the short-term. As a result, output is unlikely to change drastically.

In LRAS, the assumption is that changes in aggregate demand do not have a lasting impact on the economy’s total output. The only factors which can affect an economy’s output in LRAS are capital, labour and manufacturing technology – because everything else in the economy is taken to be at maximum efficiency.

What causes aggregate supply to change?

Different factors cause aggregate supply to change, depending on whether we are looking at short-run or long-run. Changes to short-run aggregate supply are often unpredictable and unexpected, while changes to long-run aggregate supply can often be forecast, or are the result of a concerted effort within the economy or sector in question.

SRAS can be affected by any changes in aggregate demand, or other factors such as supply shocks – which could include anything from crop failures to oil shortages.

LRAS can shift if productivity in a sector or economy changes. Productivity could be affected by an increase in all factors of production, including the availability or scarcity of raw materials, the overall quality of these materials, wages or the land which is available for production.

Scarce resources could become more accessible if there is population growth – either organically or through migration – and the quality of resources could improve if the workforce is better educated or receives more training.

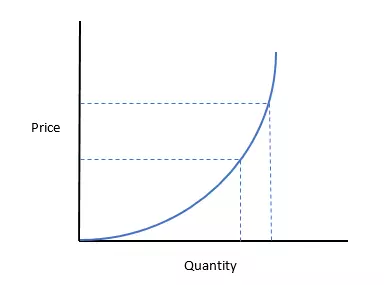

What is a supply curve?

The term ‘supply curve’ is only used to refer to the short-run aggregate supply, and the curve is upward sloping because the quantity of goods supplied increases as the price increases. An example of a short-run supply curve can be seen below.

How to calculate aggregate supply

The short-term aggregate supply calculation is as follows:

Y = Y* + a(P-Pe)

Where:

Y = the production of the economy

Y* = the natural level of production of the economy

a = the coefficient, which is always greater than 0

P = the price level

Pe = the expected price level from consumers

Build your trading knowledge

Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.