Time decay (theta) definition

What is time decay?

Time decay – also called theta – is a measure of the value of an options contract as it nears its expiry date. An option’s value will decrease the closer it gets to the expiry date while being out of the money, and theta measures this decline.

Discover how to trade options

Learn more about options trading and how to get started.

Time decay example

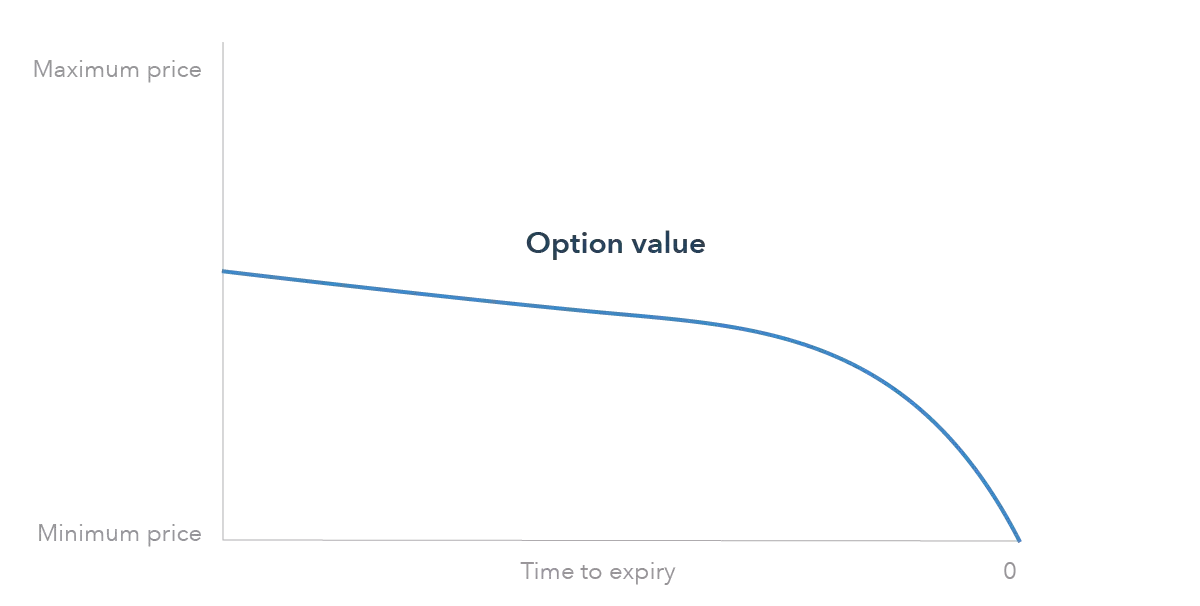

As an example of time decay, let’s look at the graph below. This shows how the value of an option – represented by the curved line – declines as the expiry date gets closer. The nearer an option gets to the expiry date while being out of the money, the faster the option’s value will drop. This is because the likelihood of the option expiring out of the money increases.

Time decay vs time value: what’s the difference?

Time decay is different to time value, which is the premium that a buyer has paid for the option minus the option’s intrinsic value. An option’s intrinsic value relates to the price of the underlying market – it does not diminish with the passage of time, but instead is tied to any shifts in the price of the underlying. The measure of change in an option’s price respective to any changes in the price of the underlying asset is referred to as delta.

How moneyness affects time decay

Moneyness refers to whether an option is in the money, at the money or out of the money. In the money options will generally retain their value as the expiry date approaches, because their intrinsic value is above zero and so the option is profitable.

However, at the money and out of the money options are more susceptible to time decay. This is because, as the expiry date approaches, the likelihood of the option expiring in the money gets smaller.

That being said, time decay only begins to affect the price of an options contract the closer that it is to expiry while being out of the money. As a result, it generally has a small effect on an option’s price until the expiry date is approaching.

This means that while the expiry date is a decent amount of time away, a trader can sell an option and still receive a good price on their initial investment. This is also true for the effect that time decay has on an option’s premium, which could help a trader decide whether or not to open a position on an options contract.

Build your trading knowledge

Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.