Apple Stock Selloff: Has the Worst Passed?

Apple’s stock dropped in Q1, but the longer-term growth story remains intact.

Steep Slide Erodes Market Value

Apple’s stock has suffered its worst quarterly performance relative to the S&P 500 Index in over a decade, dropping 9% year-to-date. This steep slide has erased more than $300 billion in market value, causing Apple to cede its position as the most valuable US company to Microsoft. The decline was spurred by declining sales in China, regulatory scrutiny of its App store, and mounting concern among investors about its growth outlook.

Short Sellers May Unwind Positions

Short sellers pounced on Apple as peers like Nvidia, Meta, and Amazon kept rallying. Apple is the second-most profitable short position this year at $2.4 billion in paper profits, according to data-analytics firm S3 Partners. That may give them some incentive to unwind the positions, potentially providing some upside for the stock.

Strong Fundamentals and Safe-Haven Appeal

Despite the challenges, Apple's strong cash flows, buybacks, and reputation as a safe-haven stock suggest the downside may be limited from current levels. The company's massive buyback plans mean its shares continue to have upside potential for long-term money managers.

Potential Rotation from Frothy Tech Names

If the AI-driven tech rally fades, some traders expect a rotation back into Apple from frothier tech names like Nvidia. While anxiety is building over how long the artificial intelligence euphoria can last following Nvidia's over 80% surge in 2024, Apple shouldn't be a drag on the S&P 500 unless it breaks its multi-year uptrend from its 2020 lows.

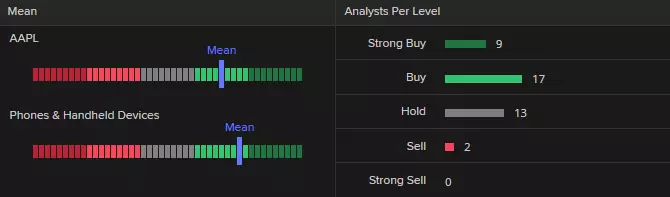

Apple analyst ratings

Fundamental analysts are rating Apple as between a ‘buy’ with LSEG data showing 9 strong buy, 17 buy, 13 hold, and 2 sell - with the mean of estimates suggesting a long-term price target of $200 for the share, roughly 18% above the share’s current price (as of 3 April 2024).

Technical analysis on the Apple share price

The Apple share price topped out in December of last year, having already done so in July, and has been coming off its $196.38 late-January high over the past few months with it slipping towards its October 2023 low at $165.67.

The October low is technically key as a fall through it would form a long-term double top formation which could lead to the 200-week simple moving average (SMA) at $151.21 being reached in the course of this year.

Apple Weekly Candlestick Chart

The risk of such a decline unfolding will remain in play while the January lows and 55-week SMA at $179.25 to $180.39 thwart any upside bounce. In mid-March this key resistance zone already capped the upside and failure there provoked the current descent with the March low at $168.49 being revisited.

Apple Daily Candlestick Chart

A fall through and daily chart close below the $168.49 March low would engage the October 2023 low at $165.67 below which would then beckon the minor psychological $150 region.

Resistance can be seen at last Wednesday’s $173.60 reaction high and along this year’s downtrend line at $174.80. While no rise above $173.60 is seen, downside pressure should prevail.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Act on share opportunities today

Go long or short on thousands of international stocks with spread bets and CFDs.

- Get full exposure for a comparatively small deposit

- Trade on spreads from just 0.1%

- Get greater order book visibility with direct market access

See opportunity on a stock?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See opportunity on a stock?

Don’t miss your chance – upgrade to a live account to take advantage.

- Trade a huge range of popular stocks

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See opportunity on a stock?

Don’t miss your chance. Log in to take advantage while conditions prevail.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.